Introduction

Quants Compete is a robo-advisor that invests and manages client funds in the stock market, regardless of account size. Here’s how it works…Clients register with our app, answer a few helpful questions and set up a brokerage account with Interactive Brokers LLC (IBKR). The process is similar to opening a bank savings account. Quants Compete invests these client funds and actively manages them over time. The bottom line… we are providing people with a better alternative to Do-It-Yourself (DIY) investing.

Quants Compete appeals to a wide audience made of multiple segments, each of which has the potential to grow our Assets Under Management (AUM) in a big way. Note: while we still regard ourselves to be pre-revenue (i.e., we have not yet engaged in a formal branding & marketing campaign), our fee structure has been designed such that our revenue will grow proportionally with AUM. In other words, appealing to a large volume of small accounts has the potential to be incredibly lucrative. Specifically, we are positioned to gain traction in the following segments:

- Small Cash Accounts— we offer people a better alternative to bank savings accounts, which returns little on their investment. AND, we offer people a better alternative to DIY brokerage apps, which have negatively impacted many novice investors. This segment is absolutely huge and is wildly underserved, and we intend to capitalize on it!

- Rollovers— we provide a rollover option for anyone who has an unmanaged retirement account from a previous employer (e.g., 401k, 403b, Roths). People are getting crushed by high-inflation and a down-market. People in this segment are highly motivated to find a solution.

- Inheritance— we expect that a certain percentage of our clients will inherit money from the older Silent generation and/or Baby Boomer generation. We believe that our clients are more likely to entrust us with these inherited funds if we are already doing a good job managing their smaller accounts.

Deal Highlights

- We are already gaining traction and growing our Assets Under Management (AUM) ahead of a formal branding/marketing campaign.

- Amazon Web Services (AWS) has recently joined our team, bringing with them tremendous resources and support.

- Version 3.x of the Mobile app has been deployed to the App Store and Google Play. This version has better UI/UX in order to streamline client registration and improve conversion ratio.

- Quants Compete is federally registered with the Securities and Exchange Commission (SEC) as a Registered Investment Advisor (RIA)

- Founder & CEO earned a B.S. & M.S. in Mechanical Engineering,a Ph.D. in Physics, holds a graduate certificate in Project Management, and a Series 65 financial license.

Problem

Very few people have access to wealth management tools. A big reason for this is that many people simply lack the net wealth to gain access to a traditional investment advisor (Note: many traditional investment advisors place a high minimum wealth requirement for new client accounts).

As a result, many Gen Z’ers, millennials and Gen X’ers adopt a Do-It-Yourself (DIY) approach to investing, registering with an online brokerage app. Unfortunately, many DIY’ers have learned the hard way that investing is a full-time job.

At this point, it’s important to talk strategy. Currently, “the greatest transfer of wealth in history has begun” with [Gen Z’ers,] millennials and Gen X’ers poised to be the beneficiaries (WSJ). We can capitalize on this transfer of wealth if we demonstrate to our clients that we are good stewards with their smaller accounts. So, just how big is this transfer of wealth?

- At the end of this year’s first quarter, Americans aged 70 and above had a net worth of nearly $35 trillion, according to Federal Reserve data.

- Older generations will hand down some $70 trillion between 2018 and 2042, according to research and consulting firm Cerulli Associates.

- Roughly $61 trillion will go to heirs—increasingly Generation Z'ers, millennials and Generation Xers.

- The average inheritance in 2019 was $212,854, up 45% from an inflation-adjusted $146,844 in 1998, according to an analysis of Fed data by economists at a unit of Capital One Financial Corp (WSJ).

However, not all this wealth is being transferred by way of inheritance. Older generations have begun to give, taking advantage of the “gift-tax exemption [which] rose again in 2018 and today is $11.7 million for individuals and $23.4 million for couples” (WSJ).

All this is forcing younger generations to figure out how to manage their newfound wealth. According to Broadridge Financial Solutions, “76% of millennials familiar with, but not currently using robo-advisors, (are) likely to begin using (a robo-advisor) in the next 12 months” (FTF).

It is critical that we scale up ASAP to capitalize on this “greatest transfer of wealth!” If we establish brand loyalty with a large number of small clients, then we will increase our chances that inherited money will get re-invested with us.

Solution

We developed Quants Compete to accommodate a large volume of accounts, casting a wide net in an effort to gain maximum market share. Our focus is to provide our clients with exceptional service, and to build brand loyalty around:

- Integrity

- Intelligence

- Focus

Quants Compete is committed to acting in the best interest of its clients. It’s simple - when they succeed, we succeed. This is why we provide a very competitive fee structure including a free trial for clients with fewer than $5,000 in AUM (see company website for details).

Over the past few years, retail investing has become increasingly popular. For example, [r]etail Investors make up over 20% of US equity trades (double that of the previous year) and the brokerage industry has added more than 10M new accounts in 2020 (NASDAQ).

Quants Compete combines low fees with an exceptional user experience to attract a large volume of clients. But, Quants Compete goes a step further. While we recognize the tremendous potential that exists in gaining traction with a large group of smaller investors, we are also positioned to appeal to investors with larger accounts.

How Does Quants Compete work?

Our mobile app guides clients through a step-by-step process:

1. Register with Quants Compete

- Our mobile app (iOS & Android) can be downloaded on the App Store and Google Play.

2. Complete our Questionnaire

- Clients provide information that helps us define their financial goals, risk-tolerance and time-horizon.

3. Review our Recommendation

- Based on their response to our questionnaire, we make a recommendation to the client that he/she can either accept or customize.

4. Create/Fund a New Interactive Brokers (IBKR)¹ Account

- Clients are directed to create a brokerage account where their investment monies and securities will reside. Once funded, Quants Compete will begin to make discretionary trades on behalf of the client.

Business Model

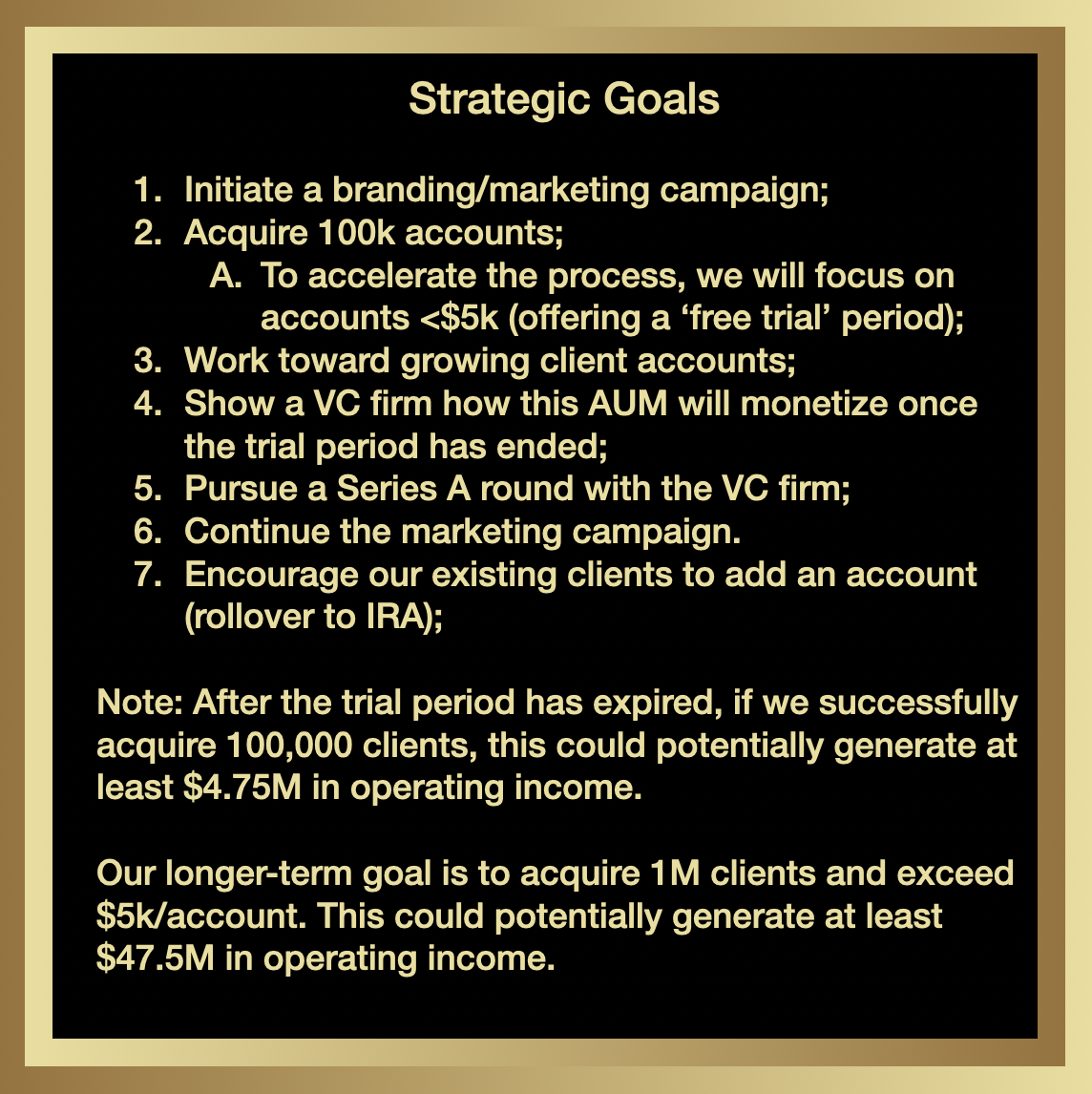

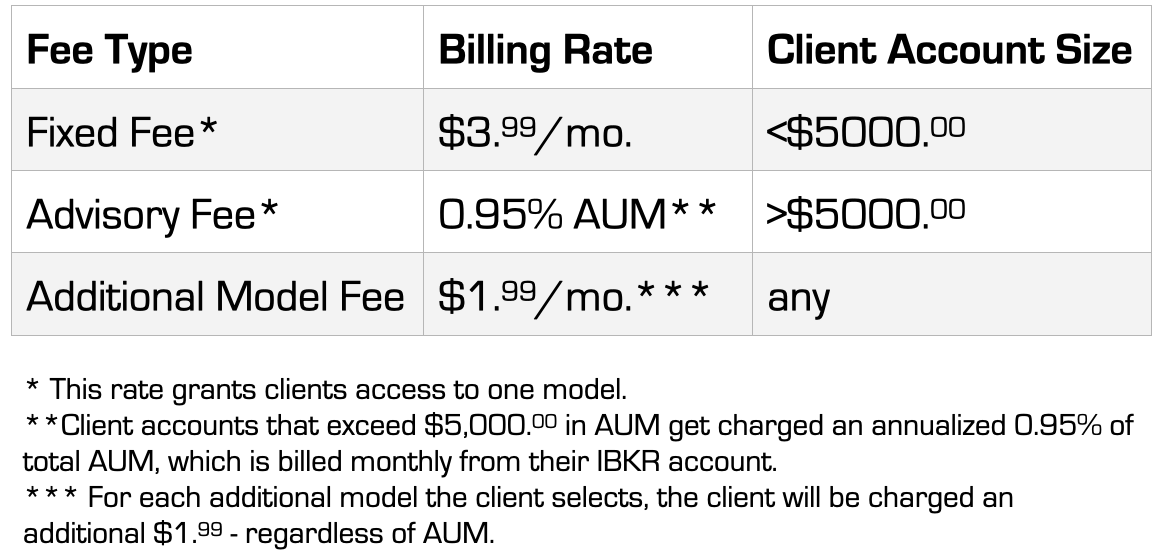

Quants Compete has the opportunity to make money through three different fee structures (Table 1).

- Clients can enjoy a free trial period, so long as their account is under $5000.

- Once a client’s account size exceeds $5000, we promptly congratulate them on reaching a financial milestone. Additionally, we inform them that their free trial has expired, and their next month’s bill reflects our Advisory Fee. Similarly, if the trial period elapses before the account has reached $5000, the client will switch over to our Advisory Fee. See table below for details.

Quants Compete Fee Structure

NOTE: We plan to offer a free-trial period to clients starting with less than $5000. (See Corporate Website for Details)

Market

Taking into account our diverse library of automatic trading models and our user-friendly mobile app, Quants Compete casts a wide net across the entire Robo Advisor market.

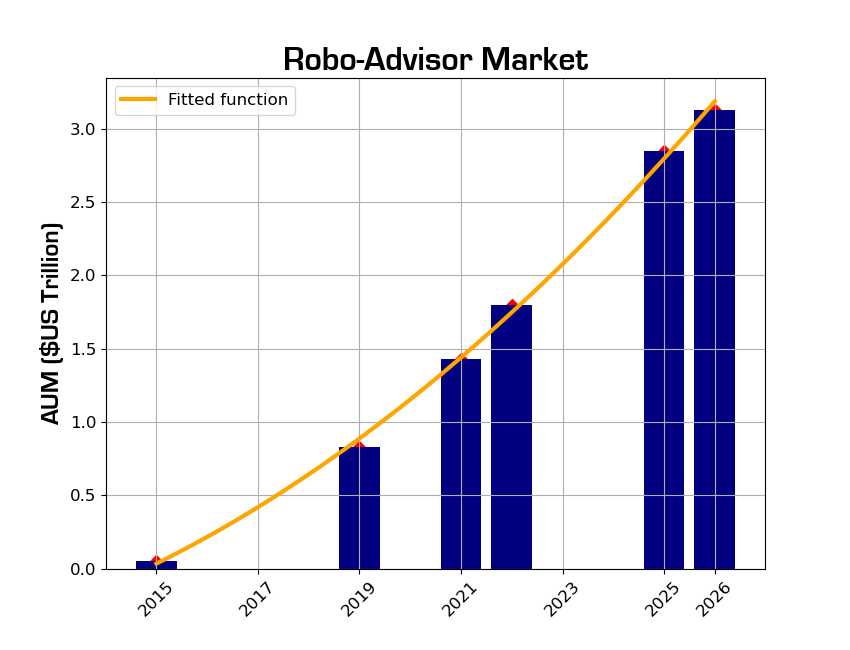

The current size of the Robo Advisor market has grown from $1.4 trillion to $1.8 trillion according to Statista. Deloitte reported that some believe this market will hit a “mind-boggling $16 trillion AUM by 2025”. However, we are a bit more conservative, using figures that tie-in well with historical data. Specifically, we consider the following:

- In 2015, the robo advisor market hit $55 billion in AUM (KPMG, Altus).

- A few years later in 2019, the market size had grown to $827 billion AUM.

- By 2021, AUM in the Robo Advisors segment is projected to reach $1.43 trillion.

Given a projected annual growth rate (CAGR 2022-2026) of 14.99% the market could hit $3.13T by 2026 (Statista).

If Quants Compete is able to acquire 0.1% of this projected market, this could potentially lead to $3.13 billion assets under management, with a projected gross revenue of $30 million. We believe our goals are reasonable and achievable, especially as we consider a top retail brokerage firm that has amassed 30M clients with an average account size of $220k (CNBC). Note: their past performance is not a promise of our future returns.

Success To Date

- Quants Compete is actively taking on new clients and gaining traction.

- Amazon Web Services (AWS) has joined us as a team member, bringing in top-tier resources and mitigating risk.

- The Quants Compete platform includes:

- Front End:

- — Version 3.x of the mobile app (iOS & Android) available on App Store and Google Play

- — SEO Website

- Back End:

- — Automatic Trading Platform - extensive code that leverages IBKR’s API, automatically executing trades on behalf of clients.

- — Library of Models - Models have been designed to cater to a range of risk tolerance, financial goal and time-horizon.

- — Backtesting Platform - used to test and qualify new Models for inclusion in our library.

- Front End:

- Quants Compete is registered with the Securities and Exchange Commission (SEC) as a Registered Investment Advisor (RIA).

- Quants Compete selected Interactive Brokers LLC (IBKR) as the custodian of client funds.

Team

Dr. Matthew Jones is a registered investment advisor, and the founder & CEO of Quants Compete. His quantitative approach to finance is supported by his background in mathematics and science. He earned both his bachelor’s degree and master’s degree in mechanical engineering at Clemson University, and went on to earn a Ph.D. in physics at Auburn University.

When Dr. Jones noticed how the larger financial brokerages reduced or even eliminated their commission fees on stock and option trades, he saw it as an incredible opportunity for people with smaller accounts to participate in the stock market.

This inspired Dr. Jones to found Quants Compete - a robo advisor that is capable of managing accounts for the masses. By bringing investment advising to people with smaller accounts, Quants Compete can manage a large amount of assets, resulting in a strong top line of operating income. Dr. Jones is excited to help people achieve their financial goals as quickly and efficiently as possible. Most of all, he wants to level the playing field by offering cutting-edge financial products to everyone.

Recently, Amazon Web Services (AWS) joined the Quants Compete team. They share our enthusiasm for our business model and have made it clear they want us to succeed. They see Quants Compete’s ability to scale rapidly and are actively helping us achieve this goal. In fact, AWS is helping us in a number of important ways. First, AWS has consulted with us in terms of strategy. Specifically, they are connecting us to their top-tier affiliates, where they can serve as strategic partners moving forward. This is particularly exciting since these affiliates are able to add significant value to Quants Compete, helping us accelerate our growth. Second,, AWS is helping us financially. Already, we have received credits toward AWS’ services while we grow. Additionally, AWS is offering Quants Compete subsidies that will offset costs from partner services. Finally, AWS has offered their assistance in sourcing us a VC firm if/when it’s time for a Series A round of funding. In summary, we are thrilled to have AWS as a team member!

About our Independent Contractors

Currently Quants Compete is leveraging incredible talent from a number of independent contractors. Their contributions include but are not limited to: legal counsel, CPA services, frontend & backend development, and cloud-based services. Quants Compete intends to bring this talent in-house if and when it is appropriate to do so.

Use of Proceeds

If the offering's maximum amount of $700,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $25,000 | 3.6% |

| Branding/Marketing | $180,000 | 25.7% |

| Website/Mobile App Development | $65,000 | 9.3% |

| Legal | $20,000 | 2.9% |

| Recruitment (additional analysts) | $75,000 | 10.7% |

| Advertising | $170,700 | 24.4% |

| Backend Development (Coding) | $65,000 | 9.3% |

| Overhead/Indirect Costs | $65,000 | 9.3% |

| Intermediary fees | $34,300 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Class B Common Stock, under registration exemption 4(a)(6), in RocketTrader Inc. dba Quants Compete. This offering must reach its target of at least $10,000 by its offering deadline of October 31, 2022 at 1:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

Quants Compete’s official name is RocketTrader Inc., so that’s the name that appears in the statements below.

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jan 8, 2025A new announcement about Quants Compete is...

- Apr 9, 2024Investors in Quants Compete, please see our...

- Apr 18, 2023A new announcement about Quants Compete has...

- Nov 12, 2022A brief message to our NetCapital investors...

- Oct 31, 2022Primary offering finalized, selling shares

- Sep 21, 2022Hey guys, I started a podcast. Click the link...

- Jul 19, 2022BIG ANNOUNCEMENT! • We just updated our listing...

- Jul 17, 2022I encourage you to check out our video pitch...

- Jun 17, 2022Amazon Web Services (AWS) has decided to become...

- Jun 3, 2022VIDEO ANNOUNCEMENT! Founder and CEO Matt Jones...

- May 2, 2022RocketTrader Inc. dba Quants Compete has made a...

- Mar 18, 2022Quants Compete has made a new announcement....

- Feb 25, 2022Quants Compete has made a new announcement....

- Feb 4, 2022Quants Compete has made an announcement. Please...

- Dec 30, 2021UPDATE: Branding and Marketing We are...

- Dec 8, 2021ANNOUNCEMENT: APP UPDATE - v1.1.1 We just...

- Nov 15, 2021Thank you for your interest in Quants Compete....

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.