Introduction

The three-tiered system prevents wineries from selling directly to consumers, increasing wine prices and gouging sales returns. Yahyn bypasses that by allowing the global wine community to buy directly from vineyards and wine producers, cutting out the middleman.

Yahyn’s BTC marketplace also integrates seamlessly with vineyard and wine producer’s current inventory systems to display their catalog of wines for our community. This business model means that vineyards can sell to a larger audience with a much higher margin and consumers can find a far broader selection that is on average +20% cheaper per bottle.

Problem

Consumers are faced with endless wine choices (vintage, type, region, etc.), inaccurate recommendations, and wildly different prices. This creates an environment where most wine drinkers just decide on a bottle of wine by the looks of it and not by the taste. Yahyn simplifies and guides our community with AI science to make personalized recommendations on every bottle of wine.

For vineyards, the current three-tiered system is costly, with razor-thin margins and high-volume requirements. Since each state has varying regulatory hurdles, wine selections tend to be identical in stores. Yahyn changes this dynamic by providing wine producers with the ability to sell their products to anyone through Yahyn’s online sales platform. Our platform makes it extremely easy for wine producers to sell online directly to consumers.

Solution

Yahyn’s Wine-Tech disrupts $100b industry

Yahyn is disrupting the way wine is purchased, distributed, and consumed. For consumers, you can now purchase from the world’s largest inventory of wine with Amazon-like convenience and have it shipped right to your door.

For sellers, Yahyn provides a quick and simple way to legally sell wine that is fully compliant and integrated into an ecommerce experience: Think Amazon (when it sold only books), if it were built specifically for the heavily regulated wine industry. Yahyn’s platform serves as an inexpensive line of distribution that most sellers would not have access to on their own.

In today’s regulatory environment, many sellers simply do not have the expertise, time, or funding to understand the nuances of shipping wine throughout the fifty states; Yahyn has worked with its legal team to codify these rules into our technology so that buyers are only able to see producers and distributors who are able to sell to them under each state’s law. Tax collection, reporting, remittance, compliant shipping logistics, age verification, and payment processing are all handled by Yahyn’s proprietary technology.

Business Model

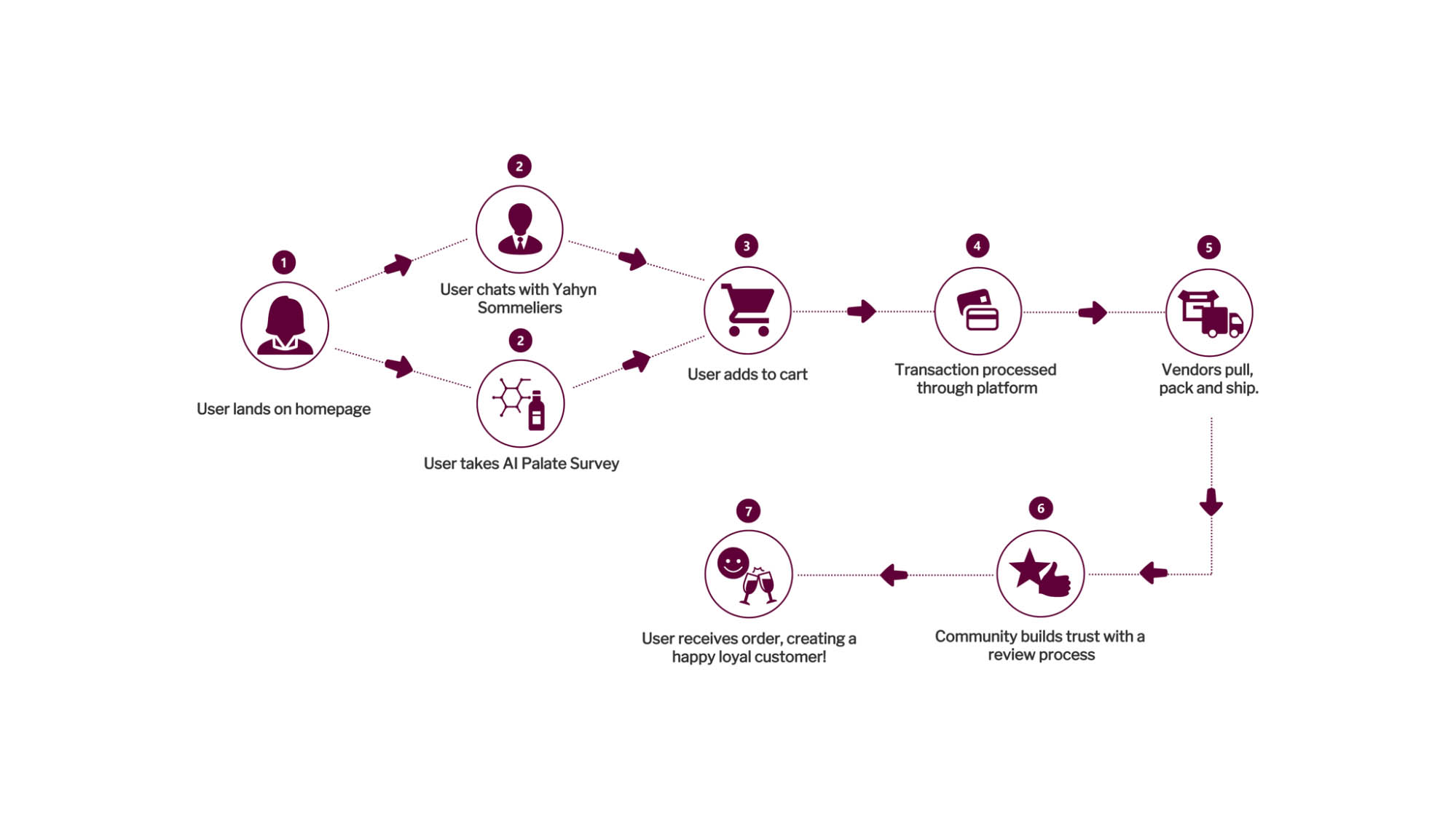

Yahyn brings retailers, distributors, and producers onto our platform via an API connection directly into their inventory management system. We then upload that inventory to our platform under that merchant’s profile. When a customer makes a purchase, Yahyn processes the transaction, takes a platform fee of 12% from the Seller and a 2% fee from the Buyer, and notifies the Seller(s) of the sale.

We plan to generate additional revenue through a variety of listing enhancements offered to sellers to provide better visibility for their listings.

Upon completion of the transaction, both the Buyer and the Seller are able to rate and review their counterparty in an open and transparent review/honor tracking system.

Onboarding fees do apply to certain vineyards under specific conditions. This is mainly for foreigen wine producers looking to sell within the US.

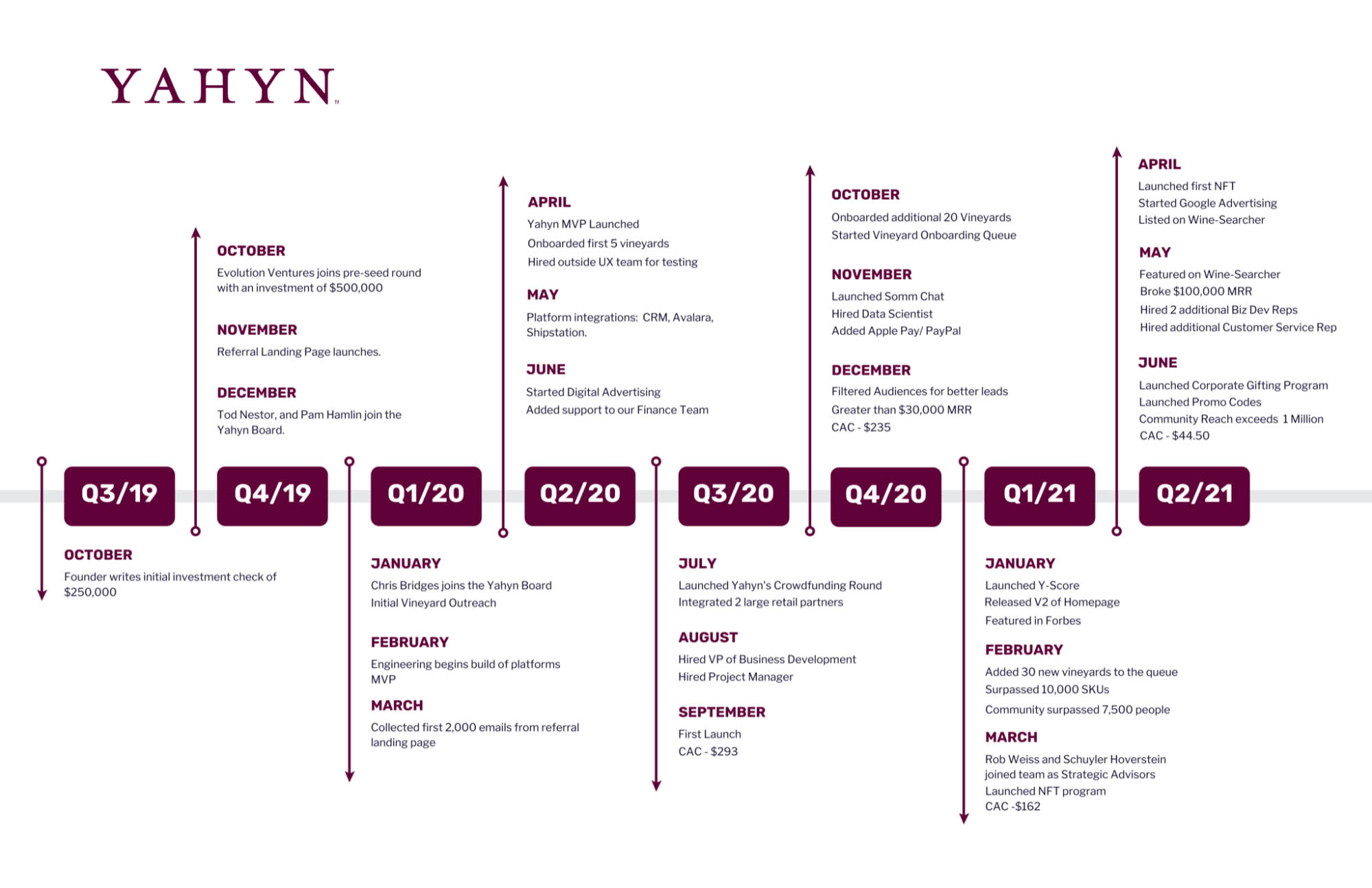

Timeline

Market

A total addressable market of close to $100B in 2019 in just the US alone and growing significantly year over year[1]. Due to COVID-19, the wine DTC market grew 350% in 2020 and continues to accelerate in 2021.

The vast majority of brick & mortar retail stores and distributors have ZERO online presence. There is no true “Shopify” or “Kayak” style platform for the wine market and only one which allows a limited offering of 3rd party sellers. As a result:

- Most sales for premium wines and alcohols are generally either through local, brick & mortar shops with limited supply or online through only a handful of major e-commerce retailers.

- Online sales for premium alcohol is currently growing at a 5 year compound rate of 11.6%, versus in store purchase growth for the same period of 2.7% as consumers move towards more digital transactions.

- 78% of wines are purchased based on the label and name. With thousands of brands, consumer confusion is common.

- Consumers of premium wines are typically a highly retargetable market base as demonstrated by significant brand loyalty in the luxury space.

[1] Statista, 2019 Market Reports (Wine & Whiskey), Forbes 2018 Report

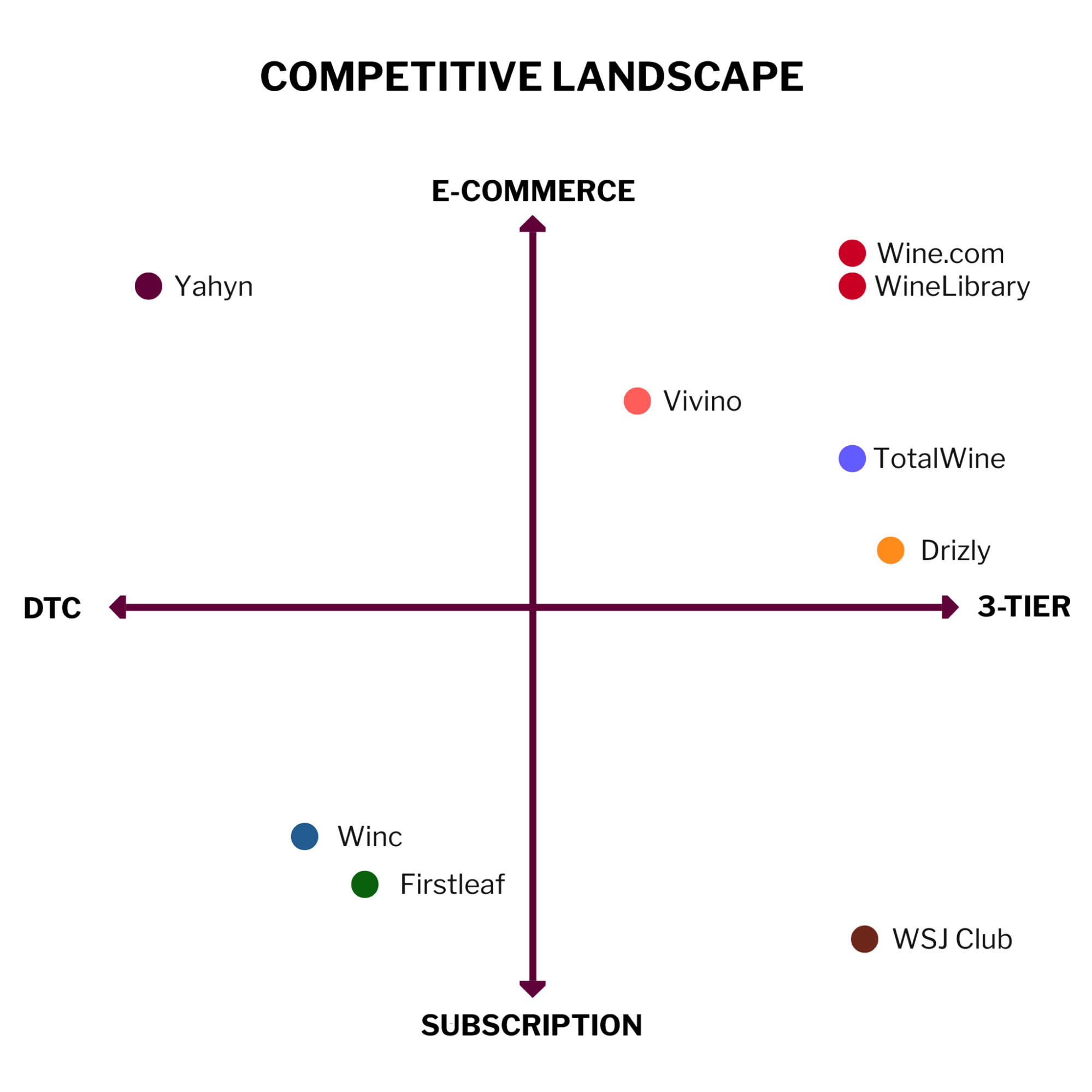

Competitive Landscape

Currently, the online wine sales space is dominated by a couple major e-commerce merchants such as Wine.com, Winelibrary.com; otherwise, independent producers and distributors struggle for online market access.

There is only one significant, direct competitor (Vivino.com) who recently updated their platform to offer sales from a very limited seller base alongside their review platform.

Yahyn is a “vineyard-first” company that focuses on increasing their sales to a vastly larger digital audience. For users, they are able to purchase wines that they otherwise would not have access to. Due to the built-in efficiencies of our model, our users save ~5% - 30% per bottle. The by-product of the DTC model is that the carbon footprint per bottle is far lower. Our software is also different because ours is designed to be user friendly, functional, and mimic the benefits of having a wine expert in your pocket.

Yahyn’s goal is to find each user their perfect bottle of wine for every occasion. We do that with:

- Sommelier chat services that help you find exactly what you’re looking for. Each user has an on-demand expert to ask questions.

- Utilizing Yahyn’s sensory science AI to award each user with a custom “Y-Score”. This is expressed by a number that delegates all recommendations given to a wine enthusiast across Yahyn’s website.

Progress

Sales are high! Cheers to that!

Our development team has created the most advanced platform in the wine space. Yahyn is custom built with our in-house development team. Since going live on September 1, 2020, the platform has exceeded our expectations and we roll out new features and enhancements weekly. Most recently, we crossed $100k MRR.

The technical engine and business model are proven, with successful sales and daily transactions across the platform. The next step is to build up to SCALE.

Currently, we have strong relationships with industry leaders like BevMax, Star Wines, All Star Wines, and an extensive list of vineyards and a massive queue ready to onboard. This makes Yahyn the single largest wine store in the world.

Partnerships include Outshinery, Worth Ave Yachts, Wine Direct, Studio Beverage Group

Users:

- Reduced customer acquisition costs by more than 60% over the last 6 months. Our conversion rate of 5% is nearly triple the industry average

- Current CAC of $44.50 dropping 15% m/m

- Membership acquisition was $1.56 Dec 1st Now $0.54 (66% reduction in cost)

- Marketing costs on a per user basis continue to trend downward, growth remains robust at +35% MoM growth

- Rapidly growing community size of 400,000+

iOS App Development: Yahyn is on schedule to launch our app Q4 2021. We are working on an innovative app that creates the “network effect”. We tap into two primal consumer behaviors; wine is the most shared product in human history & gamification of competing. This provides tremendous value to users while also the potential for generating exponential user growth.

Deal Highlights

- Highly experienced founding team

- $1,600,000+ raised from private investors

- Community reach of over 400,000

- Growing at nearly 23.1% M/M

- 50+ merchants currently selling, 10k + SKUs available

- 3 month Goal: 200 merchants, 20k + SKUs online

- Makes us the globe’s largest online retailer

- $100B TAM in just the US alone[2]

- Wine is the fastest growing category for online alcohol sales. +350% in the last 18 months alone

- Due to COVID-19, the cost of customer acquisition for “Merchants” (vineyards & retailers) has dropped to zero due to a seismic shift in how the vineyards approach sales and distribution. A sudden shift away from stores and tasting rooms and a rush to digital has put Yahyn in an amazing position.

- Yahyn currently has 1700 Merchants in the queue

- Hired 4 Business Development team members including 1st international hire

- Yahyn iOS App Q4 2021

[2] Statista, 2019 Market Reports (Wine & Whiskey), Forbes 2018 Report

Press

- How This DTC Wine Platform Is Engaging Sommeliers And Educating Consumers to Revolutionize The Way We Buy Wine - Forbes

- NFTs Join the Fight Against Wine Fraud - Wine-Searcher

- Mixing old-world taste and new-world tech, digital wine sommelier Yahyn prepares for its debut - NY Headline

- Yahyn is at the Helm of Wine Experiences with Worth Avenue Yachts Partnership - Yahoo Finance

- Yahyn Wine ecommerce startup launches first NFT wine allocation - Unlock

- Yahyn Partners with Sensory Science Company, Tastry - Business Wire

Team

The Yahyn team is a group of unique and diverse entrepreneurs and professionals that not only have had multiple exits but have also had to learn through trial and error. Between our deep operational experience and history of scaling businesses, we are well prepared to scale Yahyn. With experts in multiple fields, our team has a burning desire to be successful.

Youngest SVP at Columbia Management (Asset Management arm Bank of America) before airlifting sales and distribution team to Prudential Asset Manager. Rogers is a serial entrepreneur, having started and/or sat as a board advisor on 4 previous companies with Head of Business Development, Intermediary Distribution, and Alternative Asset manager prior to founding PuroTrader.

Leavitt is a serial entrepreneur who most recently served as SVP of finance and operations in the development of Alumni Ventures Groups back end systems, facilitating its hyper growth phase. Previously he served as a lead auditor and tax accountant for Rowley and Associates, a mid-market corporate CPA firm and Corporate Analyst for Performance Sports Group.

With over 20 years of experience in the wine business, Stu leads Yahyn’s business efforts. After a successful career with internet advertising giant DoubleClick, Bossom went to work in the wine industry. He initially joined a leading South American importing company, spending the next eight years learning all he could about wine and the highly regulated import and distribution process involved in bringing a product to market. He then branched out to form his own importing company, bringing South American and European wines to the U.S., later venturing into the spirits market. Wine is not just a part of Bossom’s career, it is his passion. He avidly collects wines from all over the world, with a focus on California, Burgundy, and Northern Rhone. He otherwise enjoys sports, and most of all spending time with his family and two Weimaraners.

Bousquet was the lead developer behind SaaS company Appfolio.com, now a publicly traded company. Robert developed Procore, a project management software company founded in 2003. Procore had revenues of $289.2 million, and 1.3 million users in 2019. Senior Developer for Lookout.com, with a $1B+ valuation, Lookout is deployed on over 180 million mobile devices. With 155 patents and analysis of over 100 million mobile applications. He was the first employee at Groupsite.com.

Advisors and Investors

Cooper is our principal investor, serial entrepreneur with 20+ years of experience. Most recently, he was the Founder and CEO of Ebbu, LLC having completed a successful exit through the acquisition of Ebbu by Canopy Growth Corporation.

Nestor is the former CFO at Bacardi who integrated the acquisition of Grey Goose Vodka. Senior Treasury Analyst and Finance Manager PepsiCo. Former CFO of Fairway Market large scale Grocery chain.

Hamlin is currently the President of York Creative Collective, where she leads the strategy and operations of York Creative Collective. Former Global CEO of Arnold Global Network. Prior to Arnold, Pam was the Managing Partner and Director of Client Services at Leonard/Monahan. She currently serves on the boards of the Cambridge Trust Company, Netra, Inc. and the Massachusetts Women’s Forum.

Ludacris is the founder of his own record label, “Disturbing the Peace”, an imprint 3distorted by Def Jam Recordings. He is the co-owner of Conjure Cognac liquor. Owner of “Chicken N Beer” restaurant in Atlanta. Founder and creator of Karma’s World.

President at Dynamic Ticketing Partners and Chief Revenue Officer at LiveXLive, a publicly-traded global digital media company dedicated to music and live entertainment. He holds advisory roles at MilkMoney, SevenRooms, Nightout, and other startups. Schuyler stated that Yahyn's platform is "simply a better way to serve the consumer with their purchase journey, and I look forward to helping Yahyn become the leader in this massive space!"

Weiss is a television and film producer, screenwriter, actor, and director who is best known for his film adaptations of Entourage, American Psycho, Ballers and Amongst Friends. Rob brings deep entertainment insights and knowledge in successfully growing a lifestyle brand, having partnered with Davidoff to launch signature cigar line, BG Meyer Cigar Co.

Use of Proceeds

If the offering's maximum amount of $301,258 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Marketing | $199,289 | 66.2% |

| Engineering | $60,000 | 19.9% |

| Back end infrastructure | $27,207 | 9.0% |

| Intermediary fees | $14,762 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Puro Trader, Inc. dba Yahyn. This offering must reach its target of at least $10,000 by its offering deadline of February 14, 2022 at 10:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

Yahyn’s official name is Puro Trader, Inc., so that’s the name that appears in the statements below.

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Feb 15, 2022Primary offering finalized, selling shares

- Oct 22, 2021Hello Everyone! We wanted to share this great...

- Sep 20, 2021Neil Patel from Angels and Entrepreneurs makes...

- Jan 30, 2021Primary offering finalized, selling shares

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.