Introduction

Deal Highlights

- Our team has over 100 years of combined industry experience. This is not your average startup.

- As stewards of capital, we invest alongside our crowd of investors for economic alignment.

- COVID-19 created an unprecedented entry point for investors wanting to buy at a low price.

- A record number of companies and investors are moving online to access investments options.

Problem

Through extensive time spent in the oil and gas industry, our team noticed the recent shifts in the capital markets that make accessing capital difficult for smaller oil and gas companies. Potential investors have no easy way to access these investment opportunities.

- Archaic dealings for oil and gas investing are outdated.

- No easy way for investors to access tailored products targeting the oil and gas market.

- With crowdfunding booming, oil and gas does not have a premier platform.

Solution

PetroFunders - Oil and Gas Crowdfunding Platform

We put together a powerful team to bring equity crowdfunding into the oil and gas sector with a disruptive business model. Our platform synchronizes fintech, crowdfunding, and deep industry experience.

Online Platform

- An online platform built to scale that can handle 100,000+ investors, simultaneous offerings, with investment products for accredited, nonaccredited, and institutional investors.

Simplified Investing

- Investors new to oil and gas don’t have to understand specifics about the industry.

- By leveraging our team experience, investors can select an investment product with defined targets

- Asset Classes (Example: Royalties)

- Lower relative risk profile

- Target Investment Returns (IRR / ROI)

- We make it simple: Explore, select, invest, and collect checks.

Experienced Team

- Our startup has over 100 years of experience with oil and gas expertise in fundraising, accounting, and SEC law, designed to provide the leverage needed to invest with confidence.

- PetroFunders invests alongside investors who bring economic alignment and incentive to place capital in vetted opportunities.

ESG Standards

- We develop environmental, social, and governance standards to ensure that investors on our platform benefit from the responsible placement of capital and overall company culture that fosters an inclusive environment.

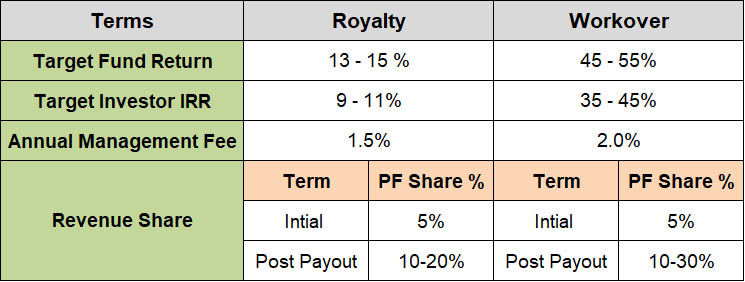

Business Model

PetroFunders will generate revenue through each investment product that is funded through the platform.

- Annual Management Fee

- Revenue Share - Carried Interest

Each investment product will have a management fee and carried interest structure based on the complexity and ongoing oversight required.

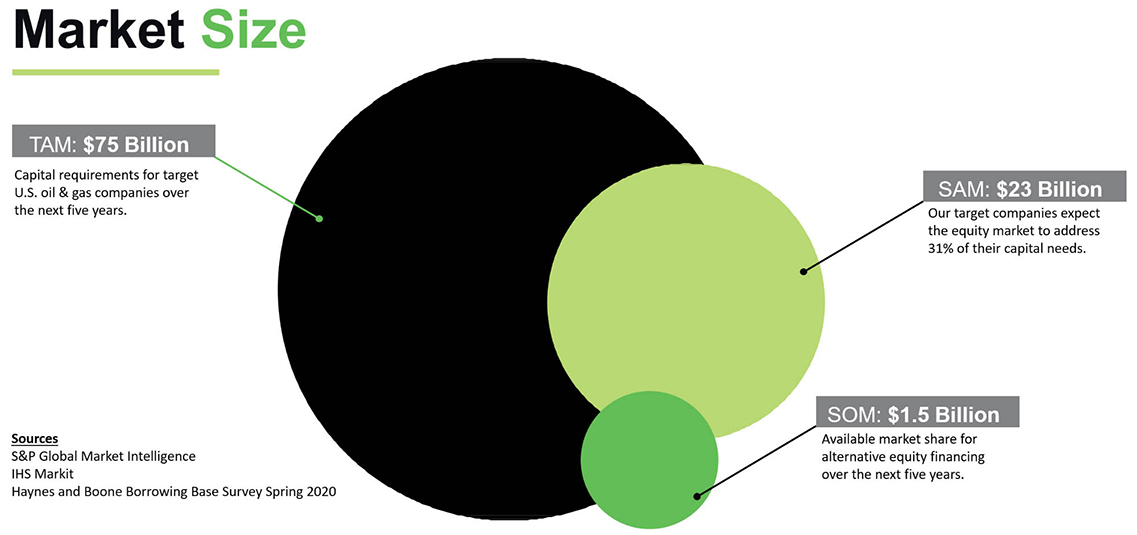

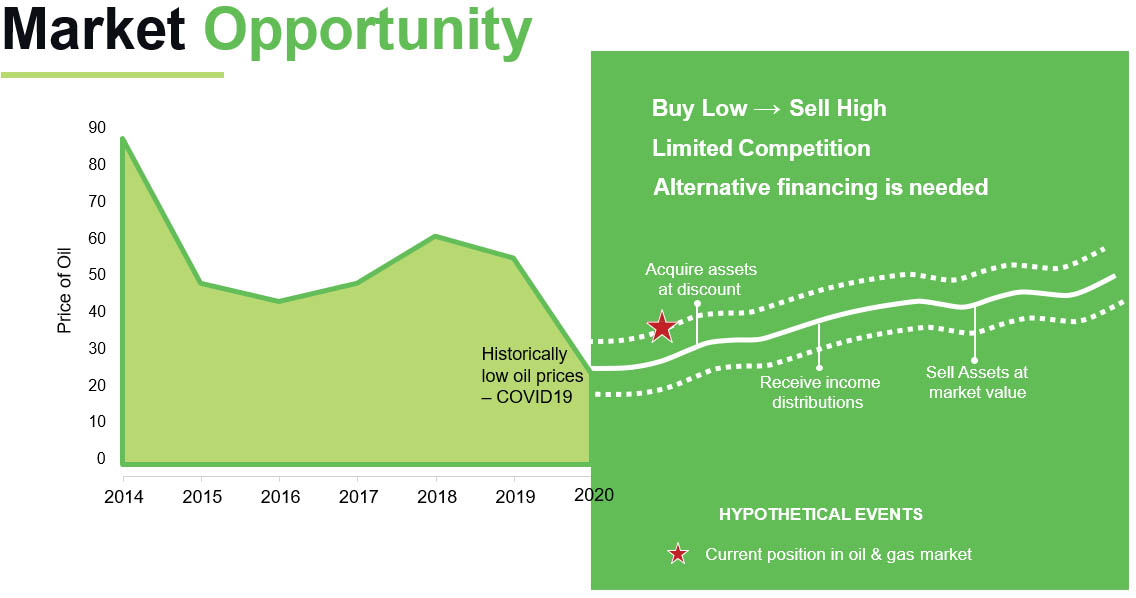

Market

Capital markets retreated from oil and gas investments amid the historically low global energy demand caused by COVID19. This created a unique opening for alternative financing options for smaller oil and gas companies that no longer had access to capital markets. Companies need to sell discounted assets to survive. With commodity prices pressured by suppressed global demand, it is the time for investors to enter the market with a simple buy low, sell high strategy. For the crowdfunding market, offerings in July (typically the second slowest month) was the highest month of new offerings since the industry started with 128 new offerings. This was 74 more offerings than July 2019: a 137% increase.

Historically, capital providers looked for oil and gas deals. Today, oil and gas deals are looking for capital. This creates a buyers market that our community of investors will be able to access.

Progress

- Online crowdfunding platform built

- Corporate structure finalized with 5 entities

- 6 Core team members + 3 advisors

- First offering on platform (Reg D)

- Raised $1.91 million for first offering

- 15 Investors

Team

We built a world-class team with industry expertise and a track record of creating value, navigating crowdfunding, and leveraging fintech. The combination of our skill sets and backgrounds make us the right team to create, maintain,and dominate the online marketplace for oil and gas investing while utilizing a disruptive business model.

Mr. Dukes co-founded PetroFunders in 2019. Previously held corporate reservoir engineering positions for a Caerus Oil & Gas, a private equity backed E&P company. At Caerus he was instrumental in maintaining and increasing the enterprise value exceeding $1 billion. He has expert technical and A&D experience with oil and gas assets in Texas, Louisiana, North Dakota, Wyoming, Colorado, and Utah. He has shown expertise in bringing forth material high value projects that meet or exceed acceptable market hurdle rates. During his time at QEP Resources, he launched an industry leading refrac program in Haynesville and oversaw a $35 million non operated budget. He holds a B.S. in Petroleum Engineering from University of Oklahoma.

Mr. Sotiros has 36 years of experience in accounting. He has spent the past 15 years as a member of the accounting firm of Sotiros & Sotiros, LLC, Certified Public Accountants, which includes clients in the oil and gas industry. As a CPA, he has been part of M&A activity with various clients, aggregating $50 million in deals. He was responsible for annual payments in excess of $500 million for film and television participating interests. In 1996, Warner Bros. merged with Turner Entertainment and he was involved in the logistics of coordinating merged departments. Mr. Sotiros has a Bachelor’s Degree in business from the University of Colorado, Boulder.

Mr. Tate is a nationally recognized securities, finance, and fintech attorney. He counsels clients throughout the U.S. and internationally on structured finance, private and public securities offerings, fintech, initial coin offerings and tokens sales, SEC reporting, real estate financings, venture capital and angel financings, fund formation and compliance, business formation and corporate governance. Marty also represents several entrepreneurs, small and large companies, as well as private investors, finance companies, national and regional banks, investment banks and venture capital and private equity firms. In working with such clients, he regularly advises on various transactions, financings, contracts and agreements in an array of matters. Throughout his career, he has provided counsel in association with over $500 million in debt and equity financings.

Advisors and Investors

Mr. Banister brings extensive leadership and international experience. Most recently he has been elected to the Board of Directors of Dow. He also currently serves as Lead Independent Director for Tyson Foods. From 2007 to 2015, he was the President and CEO of Aera Energy, LLC. Banister began his career with Shell in 1980. Banister has worked in California, Louisiana, Texas, and Singapore. In addition to his experience in global exploration and production, he worked in strategic planning, information technology and acquisitions. Active in the public and private sectors, Banister is a Director for the Harwood Institute for Public Innovation. Banister served on the Boards of the California Chamber of Commerce and United Way of Kern County. Banister is also a member of the Board of Trustees of South Dakota School of Mines and Technology. Banister holds a bachelor’s degree in Metallurgical Engineering from the South Dakota School of Mines. Banister also received an Honorary Doctorate degree from Fort Valley State University in Georgia.

FAQs

- earned more than $200,000 annually for the past two years,

- or earned more than $300,000 annually, combined with their spouse, for the past two years,

- or has a net worth of at least $1 million (solo or combined with their spouse) excluding their home.

Use of Proceeds

If the offering's maximum amount of $1,067,192 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Staffing | $125,000 | 11.7% |

| Marketing & Growth | $118,500 | 11.1% |

| Tech Support | $77,500 | 7.3% |

| Insurance | $32,000 | 3.0% |

| 3rd Party Expenses | $244,500 | 22.9% |

| Advisory and Legal Services | $347,000 | 32.5% |

| Other expenses | $70,400 | 6.6% |

| Intermediary fees | $52,292 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Preferred Stock, under registration exemption 4(a)(6), in PetroFunders Inc.. This offering must reach its target of at least $10,000 by its offering deadline of February 26, 2021 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Dec 1, 2025As the end of 2025 approaches, we have focused...

- Feb 28, 2025Starting off 2025, we have seen renewed...

- Nov 8, 2024During the latter half of 2024, we have...

- Jul 2, 2024During the first half of 2024, we have been...

- Feb 1, 2024Company Update: During Q4 2023 PetroFunders...

- Aug 31, 2023Company Update: PetroFunders continues to...

- Mar 31, 2023Company Update: PetroFunders has entered the...

- Jul 5, 2021Investors, We are happy to provide an update...

- Feb 27, 2021Primary offering finalized, selling shares

- Feb 27, 2021Two years ago, we were furious with the limited...

- Feb 25, 2021PetroFunders Investors! We want to thank you...

- Jan 15, 2021Dear PetroFunders Investors, We want to wish...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.