Introduction

FinTron is a digital brokerage / banking provider that offers all of the latest investment tools to new investors, featuring commission free, unlimited fractional share trading with $5 order minimums, banking that pays you and passive budgeting products. FinTron focuses on tech savvy new investors, ages 18-35 (we call them the mobile generation)

Testimonials

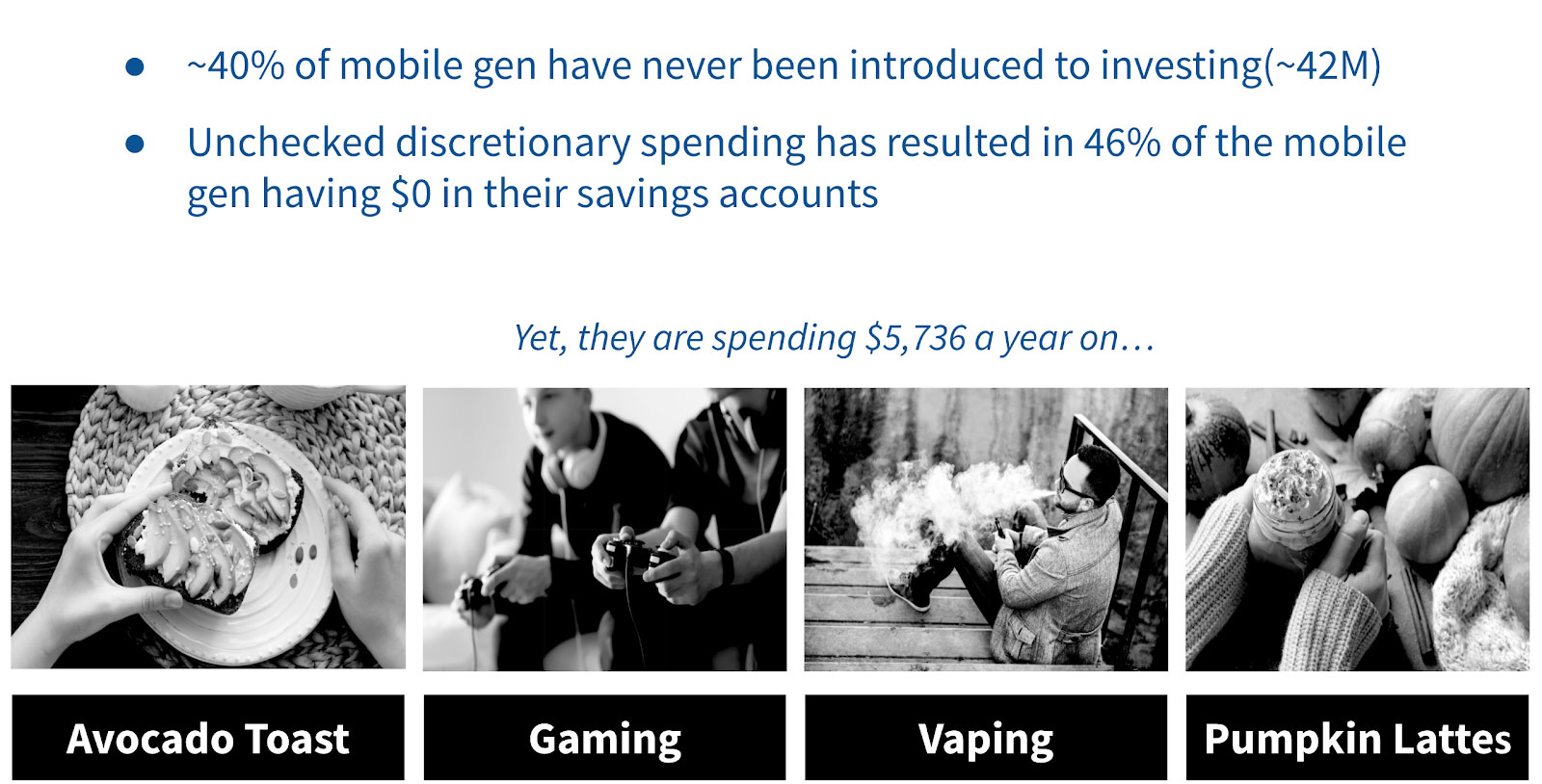

Problem

The current problem in the 18-39YO segment of the population: Gen Y(Millennials) - Gen Z

- 66% of people aged 18 to 29 (and 65 % of those 30 to 39) say investing in the stock market is scary or intimidating.

- 77% of millennials prefer cash to investing.

- 40% of millennials have never had investment exposure.

- Tuition debt has delayed new potential investors.

- Major financial institutions have difficulties acquiring millennial users.

Solution

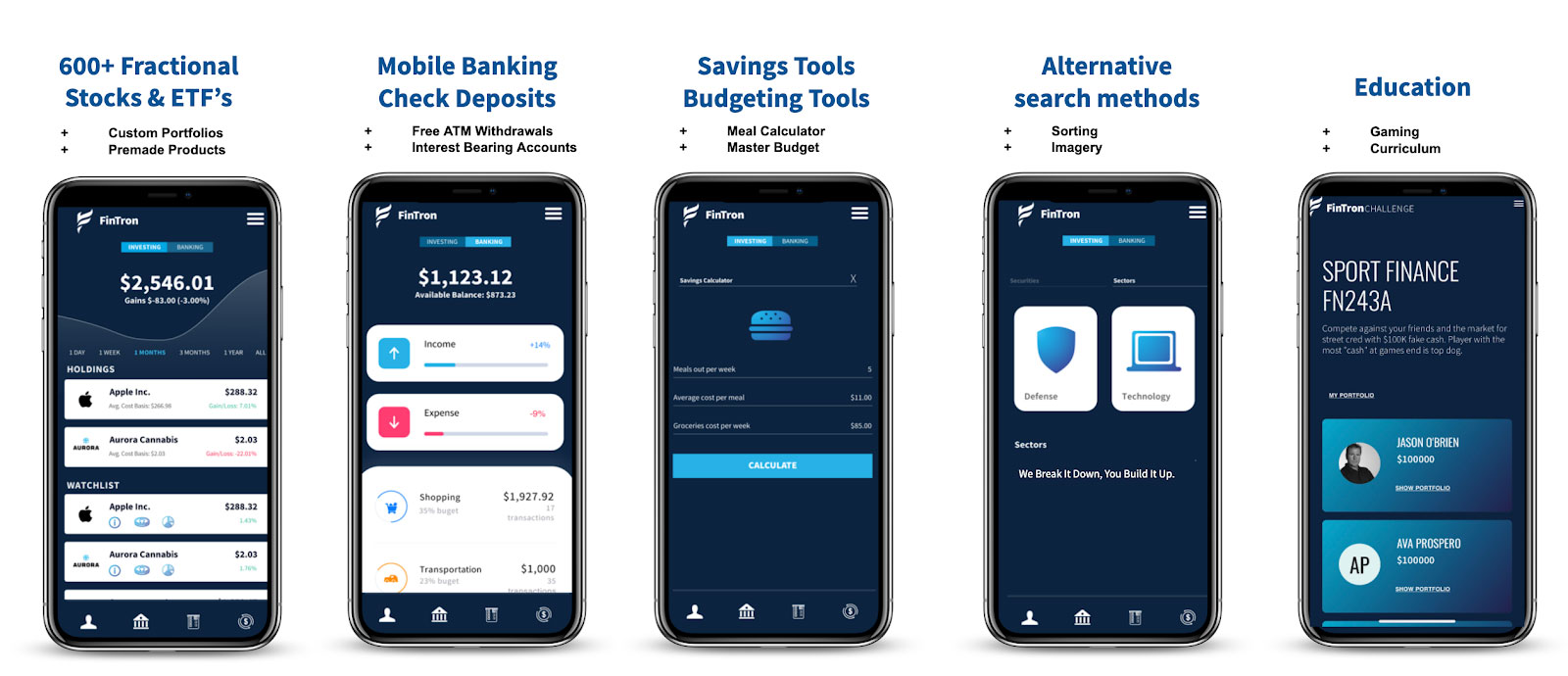

Our Solution: FinTron Invest - a digital Broker-Dealer / Banking application. We provide premium investing / banking products with an emphasis on education.

For just $2 per month we offer:

- Interest-bearing accounts (.5% per annum)

- Globally reimbursed ATM withdraws

- Unlimited Trading in 600+ fractional securities (stocks/ETFs & ETNs)

- Invest in big names like Apple for as little as $5

- Recurring investments in 3 levels of risk

- A master budgeting tool

- Meal calculating tools

- Mock trading

In addition to our brokerage and banking products, we offer educational services. Our simulated trading game, fully equipped with lesson plans, quizzes and competitive game-play reinforces financial literacy and funnel newly educated investors to our paid platform.

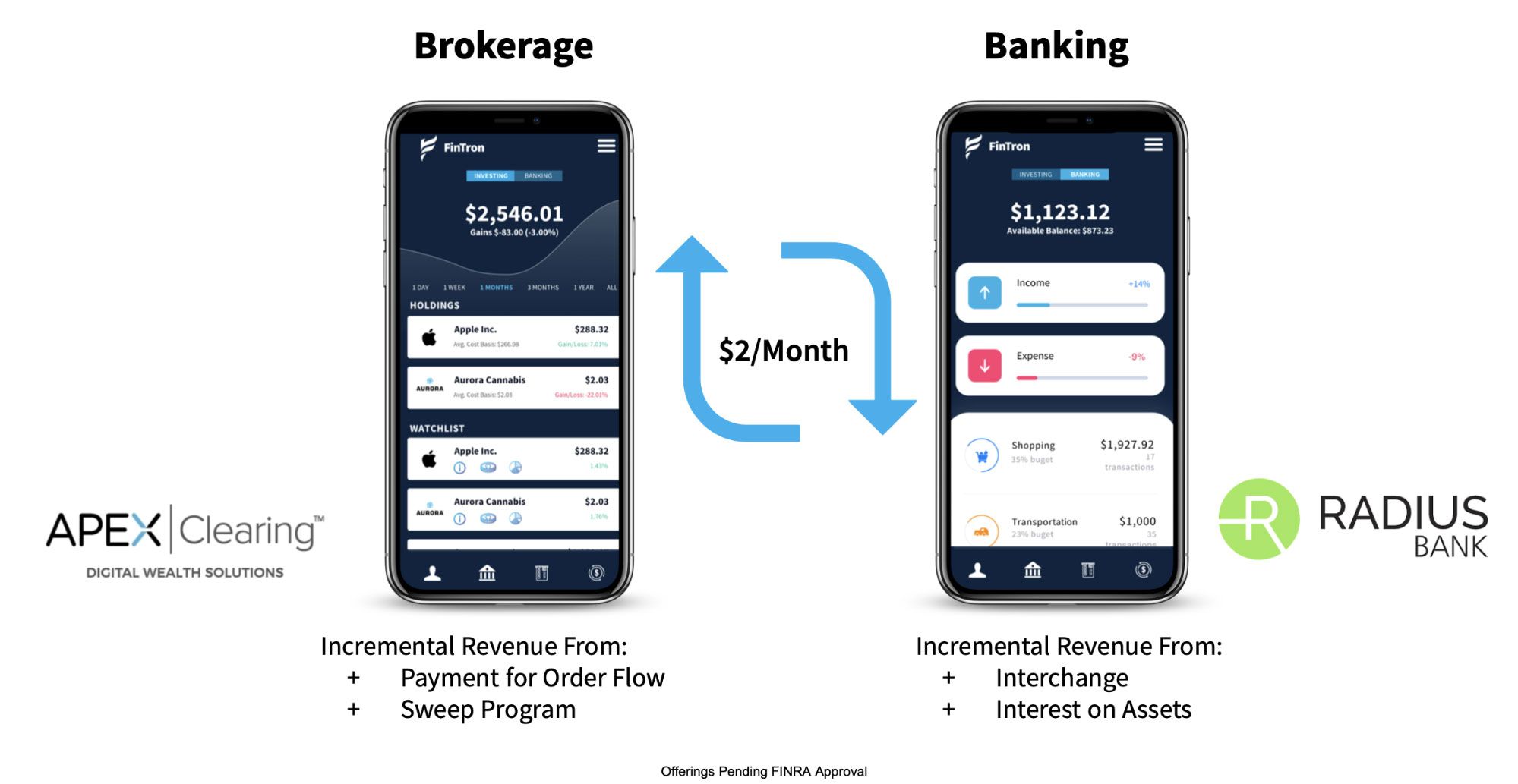

We are currently an unregulated broker-dealer in-formation. We are in the broker-dealer registration process with FINRA (Financial Industry Regulatory Authority, Inc.). We anticipate our licensing approval/denial decision in June/July 2020. We will provide mobile banking through Radius Bank, an FDIC insured bank.

Business Model

FinTron has 5 distinct revenue streams. We plan for our greatest source of revenue to come from our $2 monthly recurring subscription fee.

As our users deposit funds and grow their accounts we begin earning greater and greater revenue on assets under management. We earn about 1% on all cash balances held in our brokerage accounts and about half of 1% on all cash held in our bank accounts. When your extra cash sits in your bank or brokerage account, our partners take this cash and reinvest it or lend it out and we earn a bit of what they make on these investing activities.

We also plan to generate revenues called “interchange” when our clients make banking transactions from their debit cards. Ever encounter a minimum card purchase amount at a gas station or convenience store? Well, the owner of the gas station or convenience shop is charged a transaction fee every time a customer makes a purchase using a card. These fees can be minimum fees of 50 cents to a dollar or a percentage of the transaction total… Our partner bank makes cash from these fees and we earn a bit off the top.

We also earn cash for order flow, wherein we receive payment for directing orders to another brokerage. Payment for Order Flow is a complex concept so we’ve attached a link if you’d like to do a bit of research https://www.investopedia.com/terms/p/paymentoforderflow.asp

Investing Revenue Streams:

- Payment for order flow (Apex Clearing Firm)

- Sweep program

Banking Revenue Streams:

- Interchange

- Interest on AUM

Subscription revenue stream:

- $2.00 a month recurring

Market

Our target market: Gen Y - Gen Z(Ages 18 - 39). Comprising a total addressable market of 90 million potential clients. We estimate only 22% of this addressable market has been penetrated by our major competitors (The likes of Robinhood, Stash, SoFi, Acorns, etc). This leaves an addressable target market of ~70 million millennials and Gen Z’s.

Our target market includes:

- Urban areas with high concentrations of Millennials

- Millennials freshly out of college with 2 - 3 years working experience

- Mature Millennials preparing for "Adulthood"

- Newly married, first time parents and/or new homeowners

- Those who have accumulated small to moderate amounts of savings and eager to begin investing for the future.

- The 75M individuals 18-34 earning on avg: $800/week

- New Investors

- Low Net Worth Investors

- Do it yourselfers

- E-bankers

Example:

Mellisa, a 27 y/o millennial nursing student is sharing a rental house with 3. She is living comfortably, but looking for opportunities to tuck cash away to budget, save and invest.

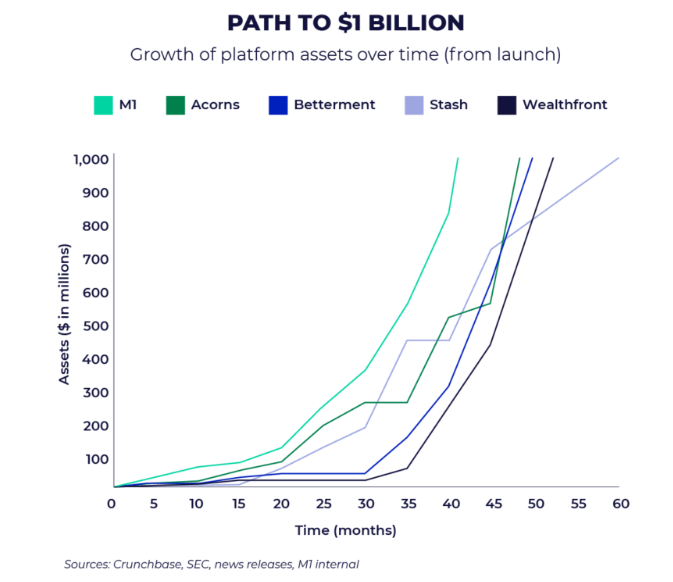

Competitive Landscape

The digital investing / banking revolution began in 2014 with major competitors Robinhood, Acorns and Stash Invest. In just over 5 years, these three major players have signed on over 14 million investors, bankers and savers with an average user age of 31. FinTron provides many of the features the big 3 offer with the addition of our own proprietary products and the added benefit of philanthropic initiatives. We estimate that there are almost 70 million customers still available in our target market segment. With our product suite, our scalable backend and our digital marketing campaign, we believe we can replicate the success of our major competitors and make our way to the hundred million dollar valuations seen across the industry.

Stash:

- Seed round funding: $3MM

- Series A funding: $9.25MM - 2016

- Users 12 months post-launch: 200,000

- Current Users: 3+ million

Investment app Stash aims to make the process of finding and selecting investments — specifically exchange-traded funds and individual stocks — more accessible and approachable for beginners. The service repackages existing funds into easy-to-understand themes based on risk tolerance, goals, interests, and values, plus offers access to individual stocks. Stash doesn't manage investor accounts directly, but rather helps guide investors through the process of building an ETF portfolio. The service requires $5 to start investing and charges $1 a month for account balances under $5,000 ($2 per month for retirement accounts under $5,000) and a 0.25% annual fee for accounts with $5,000 or more. Stash waives its fee on retirement accounts for anyone under age 25. Stash also offers an online bank account and cash-back debit card, with rewards available at about 7,000 merchants nationwide. The user's account has no minimum balance requirement or overdraft fees.

Acorns:

- Seed Round funding: $300K - 2012

- Series A funding: $2.5MM - 2013

- Users 10 months post launch: 650,000

- Current Users: 4+ million

Acorns has modernized the practice of saving an individual's change, merging the Robo-advisor model with an automated savings tool. The app rounds up your purchases on linked credit or debit cards, then sweeps the leftover change into a computer-managed investment portfolio. That approach is certainly a useful tool to save more — especially with the launch of retirement accounts, called Acorns Later. Acorns is free for four years for college students with a valid ".edu" email address. Other investors pay $1 a month for a taxable investment account, $2 a month to add on an individual retirement account on Acorns, or $3 a month for an Acorns checking account — called Acorns Spend. Acorns Spend also includes investment and retirement accounts.

Robinhood:

- Seed round funding $3MM

- Series A funding: $13MM - 2014

- Current users: 6 million

Mobile brokerage app provider Robinhood has made investing in over 1,000 securities free. The app provides a simple interface that offers securities trading, options trading, and cryptocurrencies.

Although financial services are highly competitive, we believe we offer many advantages:

- We plan to provide our investors the broadest range of fractional shares of securities in which they can invest, including all of the stocks in the S&P 500, DOW 30, and NASDAQ 100.

- For a broad range of sector funds and all of the securities we offer, we plan to provide investors with the opportunity to benchmark their investments against three levels of risk.

- We plan to provide college graduates givebacks to help them pay off their student debt.

- We plan to offer different financial planning tools to help our users budget and save, and to reach their financial goals.

- We plan to offer FinTron Learn, which serves to teach and educate our users on financial terminology and concepts.

- Our free paper trading platform that allows clients to use our real trading portal and familiarize themselves with the investing process in a safe environment.

- We plan to offer banking features on our website/app, which will include checking/savings accounts earning .5% per annum, check deposits, bill pay, globally reimbursed ATM withdrawals and transfers.

- We seamlessly integrate our user's financials on one platform. We anticipate adding IRA and jointly managed account functions in year 2.

- A majority of our executive staff have agreed to deferred compensation. Deferred compensation, coupled with the leveraging of technology, has culminated in what we believe to be one of, if not the lowest operating costs in the industry.

- Our C-suite and board of advisors include highly seasoned professionals from both the buy and the sell side. Between our staff and advisory board at FinTron, we collectively have over 100 years of industry experience.

Each staff and advisory board member brings their own unique skill set to the company allowing for a very well rounded and competent working atmosphere. Our current staff and advisory board 's wide age range allows helpful insight for our target market (millennial's) and older generations. With a young development team attuned to the demands of the market we believe this diversification gives us a competitive advantage over others.

Progress

Our founder, Wilder Rumpf, launched started what is now FinTron in his attic with one macbook. Since these humble beginnings, we’ve built:

- a broker-dealer in-formation with 5 fully licensed, registered representatives,

- a team of 15 current interns (60+ total) and 8 dedicated devices

- signed two 3 year contracts with major industry players, Radius Bank and APEX Clearing (Fully FDIC and SIPC insured)

To date we’ve raised over $430,000 to build the latest investing / banking / budgeting app on the market, and now we’d like you to join us on this journey.

While the investment product awaits licensing approval (Anticipated June 2020), we have partnered with digital marketing firm, Digital Surgeons(DS) - the agency that helped SoFi acquire over 25,000 users. We’ve hired DS to develop and roll out our go-to-market strategy. Testing ad sets and content delivery, testing against metrics and optimizing our digital advertising funnel primarily focused on Facebook, Instagram and Snap.

Meanwhile, our educational product has gained traction with multiple school districts and is continuing to grow in popularity at a rapid pace. In 2019, we set out to turn an old industry on its head by leveraging technology, in 2020 we will bring investing to the 99%.

Press

- Suite Talk: Wilder Rumpf, CEO of FinTron Invest – Westfair online

- Fairfield grant enables new fin-tech start-up – Fairfield Citizen

- From Living in a Tent to Student Entrepreneur | Wilder Rumpf '19 | FinTron Invest CEO – Sacred Heart University

- Millennials Missing Out on Long Term Growth Opportunities; Fairfield Start-up Sees Generations It Can Help – CT By the Numbers

- SHU Student Receives Grant for Investment Startup – Hamlet Hub

Team

- Our C-suite and board of advisors include highly seasoned professionals from both the buy and the sell side of financial markets.

- Between our staff and advisory board at FinTron, we collectively have over 100 years of industry experience.

- Each staff and advisory board member brings their own unique skill set to the company allowing for a very well rounded and competent working atmosphere.

- Our current staff and advisory board 's wide age range allows helpful insight for our target market (Millennial's) and older generations. With a young development team attuned to demands of the market, we believe this diversification gives us a competitive advantage over others.

- NY Regional Manager, Preferred Pool Management, LLC: 2015 - 2019

Wilder founded FinTron LLC (Formerly AKO Capital Management LLC) in 2017 and has been acting CEO ever since. As CEO and Founder, Wilder has been crucially involved in every aspect of FinTron’s development. With a background in management Wilder has led the firm in scaling the software, size of the company, valuation, marketing and capital raising efforts. He has also developed most all of the algorithmic and technological aspects of the firm, including frontend and backend web design and software development. Wilder holds 3 years in full stack technical management experience, 3 years experience in asset management, and 3 years experience in business compliance and algorithmic development. Wilder launched FinTron, built the entire product suite, closed on major industry partners Radius Bank and APEX Clearing, raised over $400,000 and passed the relevant principal FINRA exams all while attending Sacred Heart University for a dual bachelor's degree in Finance and Economics, and working to pay for living expenses. Prior to FinTron, Wilder was the regional manager of NY operations for a large property management company based in New Jersey. Wilder has 4 years experience recruiting, hiring, training and maintaining over 100 staff at 15 locations spread across 5 counties and 2 states. Wilder also has 3 years experience in compliance with various county health and permit departments.

- SIE

- Series 63

- Series 7

- Series 24

- Office Assistance, Monroe Family & Reconstructive Dentistry: 2011 - Present

Matthew Fatse has 2 years of experience in starting a Broker / Dealer and has had an integral role in FinTron’s business development, all while successfully completing his Bachelor's degree in business management from Sacred Heart University with a GPA of 3.65. Matthew started off as an intern and climbed up the ladder to Director of Operations. Matthew has had an integral role in the business’ development and has been involved in major collaborative efforts with the CEO in the initial algorithmic development of FinTrons online investing platform. Matthew’s main responsibilities include upper level management, strategic planning/management, and product/project management. Matthew has managed the last 3 intern cohorts totaling 45 individuals. Matthew also has taken an active role in FinTrons marketing, as he is well versed in photography and video production. Matthew has been partly responsible for filing all necessary FINRA applications and SEC filings, such as the Form BD, Form NMA and our Regulation D offering.

- SIE

- Series 63

- Series 7

- Series 24

Director of Sales (May 2019 - August 2019)

- Sales Representative, Cutco Vector Marketing Corp: 2019 - 2019

- Window & Patio Door Installer (Assistant), Anderson Corp: 2018- 2018

- Painting Assistant, Painting By Gregory: June - August (2015, 2016, 2017)

Adam has 1.5 Years of experience as Director of HR (Processed over 60 interns during the product development phase - ran interview process/directed intern training). He has obtained his General Securities Solicitations License and is currently pursuing his Series 7 & Series 24 Principle License. He implements Human Resources policies in compliance with FINRA regulations and has recruited and took part in the vetting process of new staff. Adam also has experience in database management (mySQL) and has demonstrated proficiency in Excel. He graduated with a Finance Bachelors at Sacred Heart University

- SIE

- Series 63

- Pursuing 7

- Pursuing 24

- Adjunct Professor, Sacred Heart University: 2018 - Present

- Self Employed Investment and Fiduciary Consultant, Roger Williams, LLC: 2019 - Present

- Senior Vice President, Segal Marco Advisors: 1998 - 2019

We brought on Roger Williams as our Chief Operating Officer in May 2019 and appointed him Vice President. With over 30 years of experience in the financial industry, a CFA and CAIA designation, Roger has ensured best practices and ethical behaviors for a number of pension funds and asset management companies. Roger will also; Review and approve accounts, perform AML procedures, submit SARs reports, mentor current and incoming staff and act as treasurer - ensuring timely reports, sound accounting and best practices.

Roger has over forty years experience in helping plan sponsors, foundations, hospitals and financial intermediaries achieve their investment objectives. Roger began his career at Stauffer Chemical Company as Manager of Pensions and Investments; later, he held similar roles at GTE Investment Management and the Olin Corporation. Before founding his own consulting firm, Roger was a Senior Vice President at Segal Marco advisors. In this role, he led a team which consulted corporate and public pension funds, endowments and financial advisers, concerning implementation of successful investment programs and strategies. Roger graduated with a BS in Finance from Bryant College and an MBA from Pace University. Roger is also a Chartered Financial Analyst(CFA) and a Chartered Alternative Investment Analyst. More recently Roger has passed his Series 63 and Series 7 exams and is currently pursuing his Series 24.

- SIE

- Series 63

- Series 7

- Series 24(Pursuing)

- CFA

- CAIA

- Head of Sales and Marketing, Aptus Partners: 2019 - Present

- Chief Connector, Saltbridge: 2019 - Present

- Adjunct Professor of Marketing, Sacred Heart University: 2013 - Present

- Chief Operating Officer, MillerSmith: 2014 - 2017

We hired Ian Smith to fill our Chief Marketing Officer position in September 2019. As a strategic, entrepreneurial and goal oriented senior business executive with 30 years of demonstrated success leading cross-functional teams, Ian has led our Paid, Owned, and Earned digital media marketing strategies through all platforms. Ian has also helped in the contracting of our marketing agency Digital Surgeons; the digital marketing agency that has worked with major financial firms SoFi, Forbes, and SunTrust Bank. With over 25 years of experience in digital media marketing, Ian will direct our go-to digital marketing media campaign.

Ian is a strategic, entrepreneurial and goal oriented senior business executive with over 30 years of demonstrated success leading cross-functional teams. Following school, Ian started a 19 year career at Kraft Foods working his way up through a series of sales, marketing and operations assignments to C-suite level positions. Ian held positions as Head of Global Digital Marketing and Head of Digital Innovation. After leaving Kraft, Ian worked as a Marketing Consultant for several large Fortune 500 brands, built and sold a Digital Marketing agency, and acted as an advisor/investor to multiple start-ups in the technology/education space. Ian is also an Adjunct Instructor of the MBA program at Sacred Heart University.

- Managing Director, Exemplar Capital: 2019 - Present

- Adjunct Professor, The Business, Finance and Management School of New York: 2019 - Present

- Managing Director, Greenwich Financial Management: 2003 - Present

Andy has been our Chief Compliance Officer since September 2019. He has helped maintain legal and regulatory compliance and assisted in the filing of our NMA. When we open our doors, Andy will also; Review and approve accounts, perform AML procedures, submit SARs reports, mentor current and incoming staff and act as a fiduciary - ensuring timely reports, sound accounting and best practices.

Andrew, better known as Andy, has served over 25 years in investment banking and capital markets positions. He began his career on Wall Street at Lehman Brothers in their Fixed Income Division, dealing primarily with mortgage-backed securities. Following Lehman, Andrew moved on to Kidder, Peabody & Co, working his way up to Senior Vice President on a variety of fixed income teams including high yield trading. Before moving away from Wall Street and starting his own financial management company, Andrew was an Executive Director at UBS on their Emerging Markets Trading Desk. He holds a Masters Degree from Harvard University, a JD in Law from Yale Law School and is a Chartered Financial Analyst.

- SIE

- Series 66

- Series 63

- Series 79

- Series 7

- Series 3

- Series 24

- Founder, Seir Hill: 2020 - Present

- Founding Partner, Creative Director, MillerSmith: 2014 - 2020

We are excited to have Brian Miller join as our Creative Director. He has enhanced the overall FinTron brand, established credibility through look and feel, and has delivered an engaging, personalized experience through his redesign. Brian will continue to maintain and clearly articulate user experience & brand propositions to increase conversions.

Brian Miller is a successful entrepreneur and creative director. He worked at Gartner Inc. as a global creative director and was responsible for corporate brand development. He then founded Brian Miller Design Group in 2005 and worked as a trusted partner with Rockstar Games, NBC UNiversal, NBC New York, A&E Television and more on delivering strategically-sound design solutions. He has also successfully founded MillerSmith, a digital design company that was acquired in 2017. Brian is a Best-Selling author of digital design book, Above the Fold.

- Executive in Residence, Welch College of Business: 2016 - Present

Mark joined our Advisory Board in February 2019. With over 25 years in the financial industry and previous executive roles on Wall Street, Mark helps to provide industry insight.

Mark Ritter was the Chief Compliance Officer of Global Credit Trading at Deutsche Bank from 2006 - 2009. During his career at Deutsche Bank, Mark managed a multi-billion dollar derivatives portfolio and over 1,000 reporting staff.

Prior to his esteemed career at Deutsche Bank, Mark served numerous positions including; Head of Commodities at UBS Investment Bank where he was awarded risk manager of the year by Risk Magazine in 2003. More recently, Mark served as Director of CipherPoint Software, Inc up until 2017. Mark now spends his days as an Executive in Residence at Sacred Heart University and teaches multiple finance courses.

- Product Owner, HotHoods: 2019 - Present

- Head of Product management, Cometa Group: 2019 - Present

- Board of Directors, Stamford Innovation: 2018 - Present

- Senior Vice President, Chilton & Chadwick: 2018 - Present

- Product Manager, SWARM.: 2018 - 2019

- IT Product manager, Fidelity: 2010 - 2018

We took on Aleksandr Tropp in February 2020 for our System Automation and user journey buildout. As an accomplished product manager, Aleks is responsible for the design of the FinTron Web/App client support system. He has also managed the development and integration of the FinTron User UI/UX. Aleks will continue with the client onboarding process and buildout as we approach launch.

Aleksandr Tropp is an accomplished Product Manager who made his professional career advising institutional clients in finance how to leverage technology in their practice. He led the charge at Fidelity Investments with product innovations for client onboarding solutions to create scale and efficiency while taking the guesswork out of regulatory compliance.

"Since I was a child I have enjoyed taking things apart to see how they work and have carried that passion into my professional career. I seek to uncover opportunities, influence positive change and challenge convention."

Aleksandr volunteers his free time as a member of the leadership board for Stamford Innovation Week. An organization whose mission is to promote awareness, collaboration and innovation among business leaders and entrepreneurs for the betterment of Stamford and the surrounding areas.

When Aleksandr is not promoting creative revolutions he is exploring mountain bike trails and new travel destinations to feed his passion for photography.

- Chief Technology Officer, Droit: 2019 - Present

- Founder, Voicenik Inc.: 2013 - Present

Patrick May has been with FinTron since January 2020 and has aided in the development and implementation of the firm's database, network, and back-end security protocols / programs. He is slated to develop and implement our front-end, client-facing security protocols and programs following the completion of programming. Through the development process, Patrick frequently reviews the speed, functionality and security of the product suite. Patrick will also manage our testing team and the scaling of products.

Patrick has filled roles ranging from Principal Technical Architect to VP of Engineering to Chief Technology Officer, working with numerous organizations to build teams, bridge the gap between the commercial and technical branches of the organization, and achieve large-scale, mission-critical objectives. His 25 plus years of industry experience have focused on the design and development of adaptive, distributed systems in the advertising, financial services, and telecommunications industries. He has worked at Amazon, Yahoo!, Tibco, Aviva, and several startups.

Patrick holds a Bachelor of Science in Chemical Engineering from the Massachusetts Institute of Technology in Cambridge, Massachusetts.

- Senior Developer, Gong Ming Technologies: 2015 - Present

After receiving his diploma in computer science from Northeastern University, located in Shenyang China, Lin Hui began his career as a full-stack developer, focusing mainly on back-end build-outs. His early work consisted of admin panel development for insurance companies and POS systems. As Lin Hui progressed through his career he began developing full-stack components including a reporting dashboard for a food distribution company and management portals for European companies. Bored with the monotonous programming of admin portals and management systems, Lin Hui grew an appetite for complex logic which would inevitably lead him to a career in algorithmic development. He began picking up work in geo-spatial scripting, machine learning, algorithmic bot detection for online casinos, and general algorithmic development. His proficiency in algorithmic development led him to FinTron in 2018 where he first began developing complex trading algorithms. Following months of successful algo development for FinTron, Lin Hui worked his way up to the position of Chief Developer. Lin Hui is now responsible for our database management, product development, and oversight of our development team.

Lin Hui is proficient in; Python, Django, Flask, Java Spring, Springboot, Ruby, Rails, Node js, Express js, React js, Angular js, Vue js, D3 js, AWS, GCP, and Devops.

In his free time, Lin Hui loves to play soccer and eat out with friends.

- Senior Executive in Residence, Sacred Heart University: (Present)

John Gerlach joined FinTron’s Board of Directors in May 2019. With over 30 years in the financial industry John Gerlach has helped to advise the CEO and C-suite level executives on strategic management, business development, general oversight, and capital raising.

Upon graduation from the Wharton School John Gerlach joined the consulting firm of Booz, Allen and Hamilton. He then went on to become the Vice President of Corporate Development at General Mills, where he was responsible for the acquisition of 43 companies in the United States and twelve foreign countries. He left General Mills to start a venture capital firm that made investments in 19 companies, the most successful of which was American Woodmark, with a market value over $500 million. Mr. Gerlach was then elected President and Chief Operating Officer of the Horn & Hardart Company, a restaurant and direct marketing company listed on the American Stock Exchange. He then accepted a position in corporate finance with Bear Stearns where he worked on a number of acquisitions and refinancings.

During the course of his business career, Mr. Gerlach has been elected to serve on the Board of Directors of eight public companies in the United States, one public company in France and several private companies. As part of his service on these boards he has been the chair of several audit, executive and personnel committees. He has also served on the Board of Directors of four non-profit organizations including the Guthrie Theater in Minneapolis, St, John's University and the Merton House in Bridgeport, where he is also a volunteer.

- PR at Microsoft, Yes Agency

- MPS, Georgetown University

We have onboarded Myja to create an earned media public relations strategy, complete PR planning, and begin media outreach for Fintron to help the company establish a strong public identity, fulfill its PR goals and drive the company vision.

Use of Proceeds

If the offering's maximum amount of $249,999 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for Managers | $24,000 | 9.6% |

| Fixed-Operating Costs | $50,000 | 20.0% |

| User Acquisition | $118,750 | 47.5% |

| Technology | $44,999 | 18.0% |

| Intermediary fees | $12,250 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Units, under registration exemption 4(a)(6), in FinTron LLC. This offering must reach its target of at least $10,000 by its offering deadline of December 4, 2020 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

COVID Relief:

This offering is being conducted on an expedited basis due to circumstances relating to COVID-19 and pursuant to the SEC’s temporary COVID-19 regulatory relief set out in Regulation Crowdfunding §227.201(z).

Offering maximum:

In reliance on this relief, financial information certified by the principal executive officer of the issuer has been provided instead of financial statements reviewed by a public accountant that is independent of the issuer, in setting the offering maximum of $250,000.

Pitch Deck

Financials

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Nov 23, 2021It is with great excitement that we announce...

- Dec 5, 2020Primary offering finalized, selling units

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.