Introduction

DeoBioSciences (DBS) is a stealth mode, R&D stage, virtual biotech developing a cancer drug, based on a naturally occurring compound, that selectively kills both early and advanced stage cancer cells from humans and, potentially, dogs and cats as well.

We are reverse engineering the drug from anecdotal data and reports of human efficacy and safety from bioprospecting sources and also corroborating studies involving molecular homologues in humans and animals that further affirmed safety and efficacy projections. So far, our pre-clinical lab results have corroborated and met all our predictions for safety and performance.

Deal Highlights

- Major biotechs and pharmas have confirmed, in writing, their interest in pursuing in-licensing or partnerships, upon the presentation of more positive data

- Top Ivy League scientists, among others, are anxious to continue working with us to take our research to the next level

- We're not a “one trick pony”-- our stealth tech has other potential applications that we will pursue to maximize our chances of success

Problem

Human Cancer Market

In the U.S. alone, over 1.8 million new cancer cases are diagnosed annually. It is the second leading cause of death. Over 606,000 Americans die of cancer annually, more than 1600 each day in America. (American Cancer Society).

The International Agency for Research on Cancer (IARC) roughly estimates that seventeen million (17,000,000) new cases were diagnosed globally in 2020. By 2030, the global burden is expected to grow to 21.7 million new cancer cases and 13 million cancer deaths as a result of growth and aging of the population. (American Cancer Society, “Global Cancer Facts & Figures.”)

Pet Cancer Market

Canine cancer is a leading killer of companion dogs in the U.S. According to the Pet Food Institute, the U.S. has over 67 million pet dogs, and the lifetime incidence of canine cancer is approximately 1 in 3, about the same as humans. According to the Comparative Oncology Program of the U.S. National Cancer Institute, approximately 6 million new cancer diagnoses are made in dogs and the same number made in cats each year.

Solution

DeoBioSciences has developed an experimental cancer drug (DBX-31) that is a powerful natural compound against cancer.

The main goals of this offering are to (1) synthesize a “man-made” version of DBX-31 for clinical use and (2) test our next set of projections. If our next experiment goes like our prior tests, at a minimum, we’ll have a 90% accurate probability that we’re on course to eliminate four (4) of the deadliest cancer types, regardless of stage. And, if validated, it should be safer, more effective, and less expensive than other cancer drugs on the market today. Our research to-date, under lab conditions, supports our development goals.

Business Model

We have several paths for monetizing this discovery depending on future research results. The earliest revenue stream could result from licensing fees and royalties from a partnership with a veterinary drug developer. This would also help finance the human drug development path with non-dilutive capital.

The next anticipated source of revenue would stem from sales following regulatory approval of DBX-31 as a human therapeutic for one or more cancer types (indications). This could include other commercial uses. Sales could result from licensing/royalty revenue, or directly from in-house manufacturing and distribution.

We define “success” as generating profitable revenue through at least one of the following applications of DBX-31:

- Human cancer drug

- Veterinary cancer drug

- Diagnostic agent

- Therapeutic transport/delivery molecule.

“Success” does not require that we “cure” cancer. Even if DBX-31 ”only” leads to a marginal therapeutic benefit, there are numerous ways to profitably monetize a drug that does not fully eliminate cancer from the body and/or is limited to one type of cancer, particularly a rare cancer. The key to obtaining FDA approval is that the drug candidate helps a segment of the patient population in a better or different way than a currently approved drug.

Market

Human Cancer Market

By 2030, the global burden from cancer is expected to grow to 21.7 million new cancer cases and 13 million cancer deaths as a result of growth and aging of the population. (American Cancer Society, “Global Cancer Facts & Figures.”) IARC estimates, globally, approximately 27.5 million (27,500,000) new cases will arise annually by 2040, simply based on population aging.

Analyst firms vary in their assessments and future growth projections for global oncology (cancer) drug sales. They range from sales of USD$77.3 billion in 2018 (Coherent Market Insights) to a CAGR of 7.6% from 2018 to 2025 leading to global sales of USD$176.5 billion by 2025 (Allied Market Research). Regardless of the correct estimate, DBS’s portion of this market size would depend on the range of malignancies impacted by DBX-31 but if our projections are validated, the share would be substantial.

Pet Cancer Market

The pet cancer therapeutics market size was valued at USD $178.0 million in 2018 and is expected to witness approximately 10.8% CAGR from 2019 to 2025 and is, thus, forecasted to grow somewhere between USD $343.9 million and $359.4 million by 2025. (Global Market Insights; “GMI”)

Success To Date

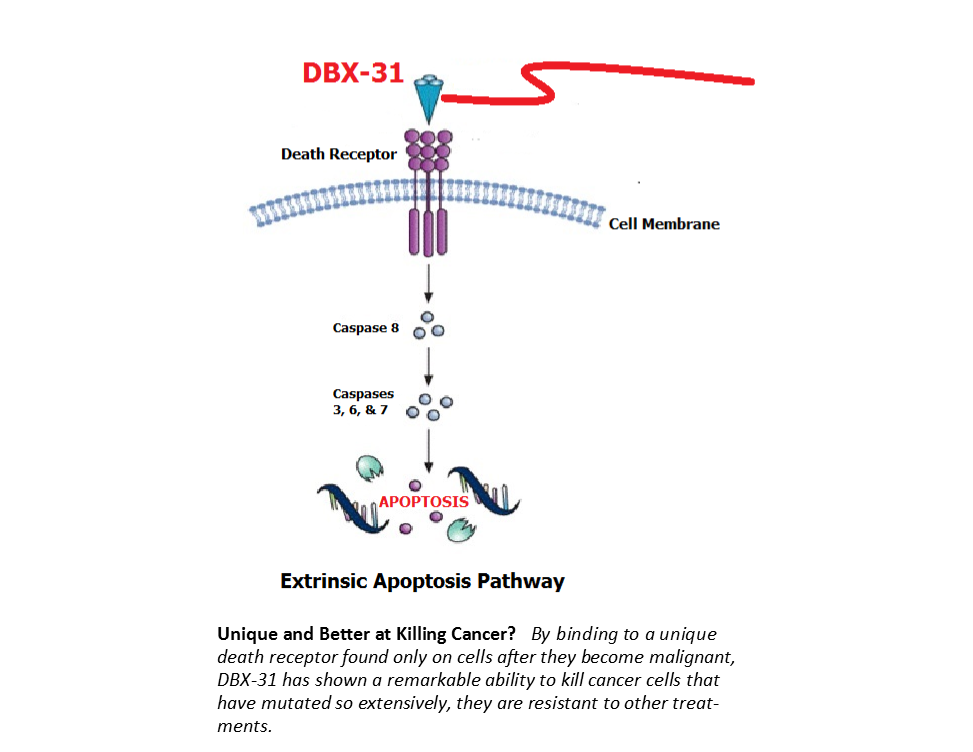

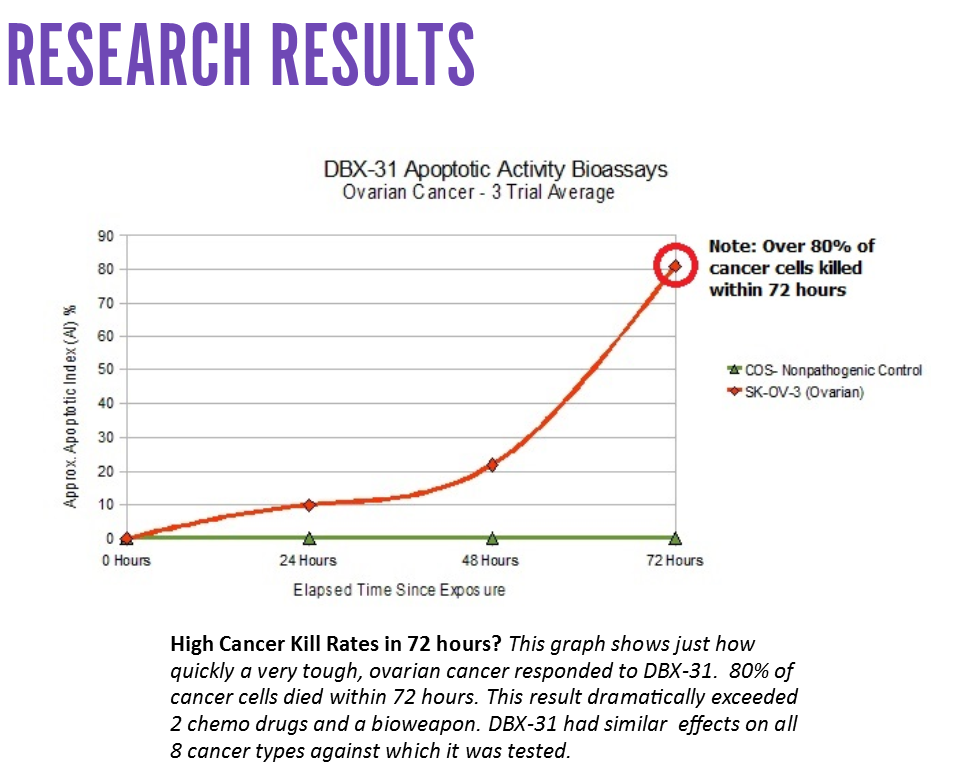

On behalf of DBS, Cornell tested eight (8) different cancer cell lines in bioassays to see if DBX-31 could kill them via external (receptor-mediated) apoptosis. They included the following tissue categories:

- Skin cancer (metastatic-originated from uterus)

- Several types of breast cancer (triple negative, hormone+, HER2+)

- Ovarian carcinoma

- Colorectal (colon) adenocarcinoma;

- Small cell lung carcinoma

All of these cancer tissues were advanced stage and/or metastatic, and very hard to kill. These are the types of malignancies that do not respond to conventional cancer treatments or internal apoptosis. Within 24 hours all of them had positive responses to DBX-31.

Team

Validating Relationships

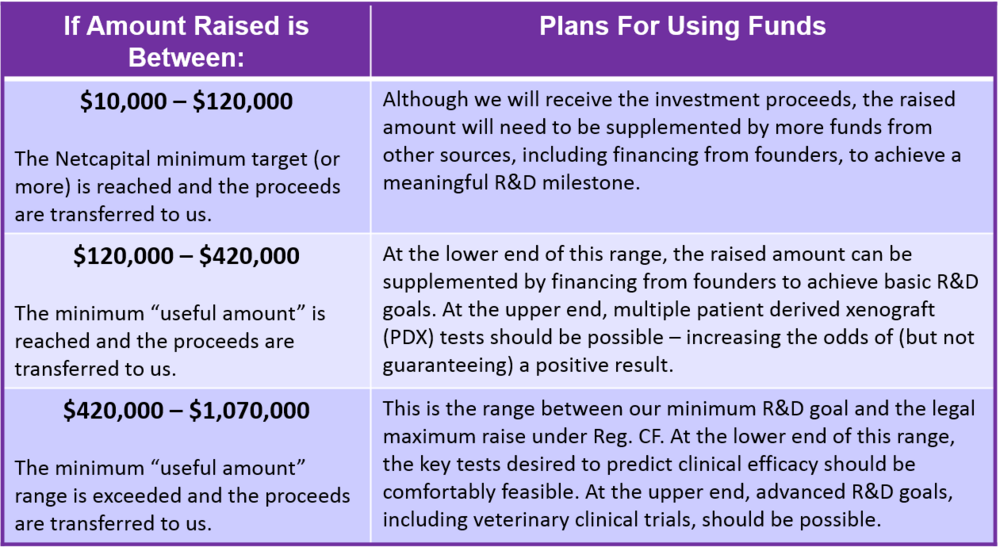

Use of Proceeds

If the offering's maximum amount of $1,070,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Pre-Clinical Drug Manufacturing | $290,000 | 27.1% |

| Pre-Clinical animal trials/studies | $245,000 | 22.9% |

| Payroll & Benefits (20 mo./3 ees) | $336,000 | 31.4% |

| R&D consultants/contractors | $88,000 | 8.2% |

| Admin. Operations, Rent, IP & Legal, Miscellaneous | $58,570 | 5.5% |

| Intermediary fees | $52,430 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock , under registration exemption 4(a)(6), in DeoBioSciences, Inc.. This offering must reach its target of at least $10,000 by its offering deadline of March 15, 2022 at 10:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Feb 29, 20244th Quarter 2023 Investor Update Dear DBS...

- Jul 19, 2023Mid -Year 2023 Investor Update Dear...

- Jan 9, 2023January 2023 Investor Update Dear...

- Mar 16, 2022Primary offering finalized, selling shares

- Mar 15, 2022Dear Investors: This is our last announcement...

- Mar 10, 2022Dear Investors (& Followers) : This is an...

- Jan 21, 2022Dear Investors (& Followers) : Here's an...

- Jan 18, 2022Dear Investors (& Followers): Happy 2022 to...

- Dec 7, 2021Dear Investors (& Followers) : Here's an...

- Oct 25, 2021Dear Investors (& Followers): As "early...

- Jul 22, 2021Dear Investors: First, a deep and sincere...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.