Introduction

Straight Teeth Solution’s Simple aligners provides consumers with doctor supervised US manufactured clear aligner treatment, producing enhanced results at lower prices than most DIY internet alternatives. We also provide marketing for dentists by providing pre-qualified patients and financing.

Deal Highlights

- US Patent Pending, Application #17/369,779

- Over 70 Affiliate Dentists in network in 17 states and growing

- Patients are seeing their insurance cover up to 100% of the cost

- Initial Seed Investment of $490,000 in Jan. 2020 and $660,000 in 2021

- Continued growth during Covid pandemic with doctors having limited access to patients

Problem

On average the typical dentist, local orthodontic provider, and “brand names” may charge upwards of $5,500 for clear aligner treatment, according to The Consumer Guide to Dentistry. However, the average consumer most likely cannot afford at that price point. Consumers are faced with a major problem, where can they get high-quality aligner treatment at an affordable price?

The dilemma becomes even more complex when you factor in several other desired criteria:

- Doctor supervised

- Fair and affordable pricing

- Proven, high quality results

- High quality treatment

Solution

Made in the USA and successfully treated over 500,000 patients

Through our US patent pending business model we provide consumers with doctor supervised clear aligner treatment, at a more affordable price than most existing DIY clear aligner companies and typical orthodontic providers.

For our affiliate dentists:

- We provide the marketing

- We send pre qualified patients

- Confirmed financing/ability to pay

We also offer dentist aligner packages for their existing patients at a competitive price and faster turn around than most competitors to help increase their bottom line.

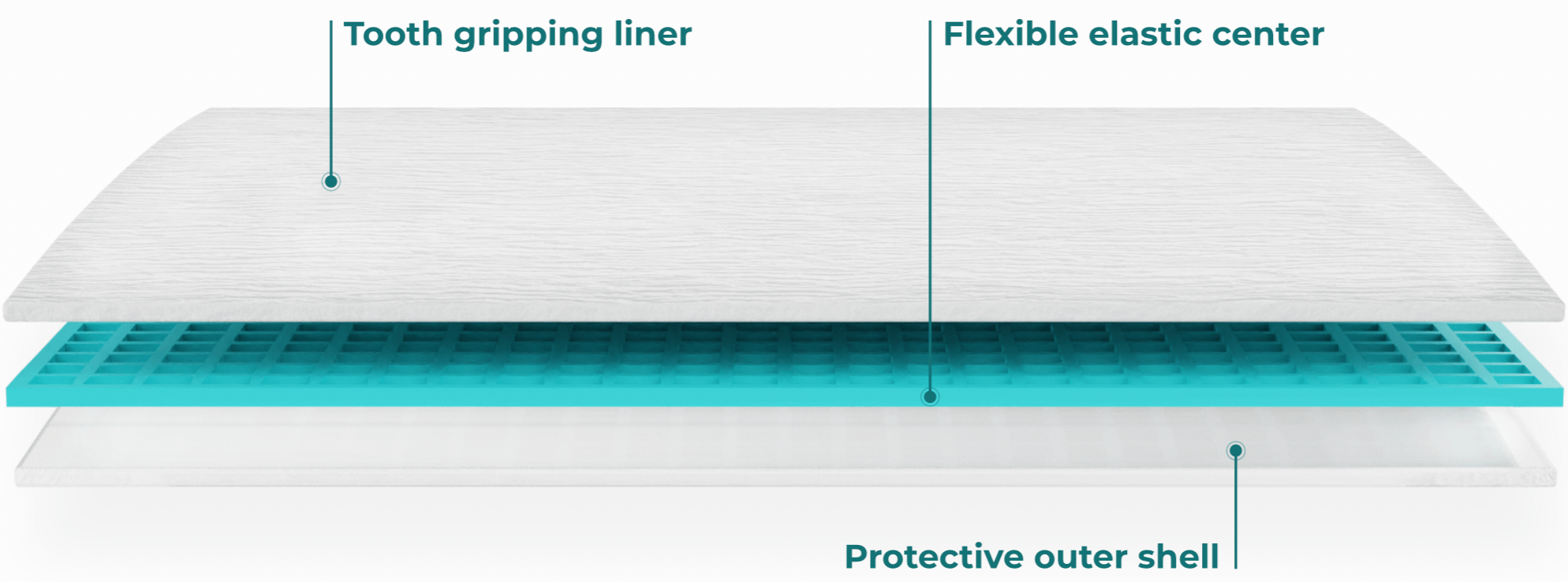

Oh so comfy...

Our tri-layer engineered material makes for increased flexibility and comfort, with a less noticeable fit.

Tooth gripping liner

The inner layer creates a better grab on the teeth to move them into place without the need of added support.

Flexible elastic center

The hyper-elastic center is engineered for flexibility and strength that gives the aligner its perfect fit.

Protective outer shell

A barrier against stains, and impact not only protects the aligner, but also your pearly whites.

How It Works

Happy Provider Partners and Users

Business Model

We offer various different plans for those with:

- Dental Insurance

- Ortho Insurance

- No Insurance

Doctor Membership Fees

Doctors pay a 12 month membership fee of $750 per month to join the STS local provider network. The monthly fee is used to pay for their local marketing and customer support.

12 month member fees:

- STS: $9000 - paid monthly

- STExpress: $1000

STS B2C Packages

Mild Solution: up to 16 Aligners + one retainer set

- Price: $1,895

- Doctor paid: $800

Moderate Solution: 17-26 Aligners

- Price: $2,550 + one retainer set

- Doctor paid: $1,200

Complex Solution: 27-52 Aligners + unlimited revisions & 2 sets of retainers

- Price: $3,950

- Doctor paid: $2,000

Our weighted average margin per sale is 31%

STExpress B2B Packages

Flex

- $149 per treatment plan

- $30 per aligners and

Unlimited

Up to 52 aligners + unlimited revisions and 2 sets of retainers - $1,249

- Flex weighted average margin per sale is 36%

- Unlimited weighted average margin per sale is 83%

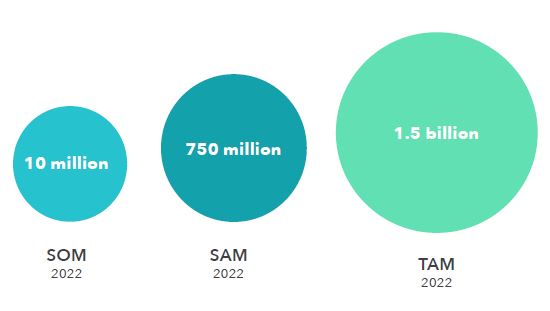

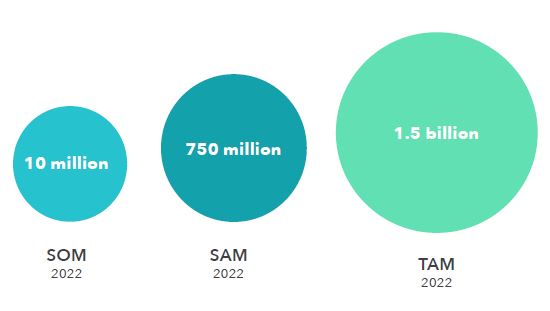

Market

Target Market & Opportunity

The 2020 US market for orthodontic aligners was valued at approximately $1.82 billion and is projected to reach $6.17 billion by 2028 [1].

According to Align Technology, 60% of the worldwide population suffer from problems of malocclusion or misalignment of teeth. Over 300 million people could benefit from straightening their teeth.

Team

34 years of in-field sales experience in the orthodontic/dental industry. 24 years sales experience with GAC/Dentsply, 3 years with TP Orthodontics and 4 years with ClearCorrect aligners. dExtensive knowledge of orthodontic clear aligner industry.

Accomplished and Award-winning Professional with over thirty years of Executive Leadership, Sales, Sales Leadership, Operations, Product development, and Business Development experience in Dental-Orthodontic Devices, as well as Healthcare, Dental, and Business services, both with Fortune 500 companies plus eight different startups. Fifteen years of sales and operations leadership experience with orthodontic aligners.

40 years of accounting and financial management experience. 20 years of experience in the role of Controller. Extensive experience in several different industries such as manufacturing, property management, and construction.

34 years international legal and executive experience, served as General Counsel and leadership roles in private international and US companies and startups, regularly advised startups from inception, launch and expansion.

With a background in marketing, engineering and operations for over a dozen Fortune 500 companies, Josh Bolinger has spent the last 10 years consulting and working on countless startups, including clear aligner and dental companies, with exits from those startups in the hundreds of millions of dollars.

Dr. Molina has been in the practice of General and Cosmetic Dentistry since 1988. He is a graduate of The Dawson Academy as well as an active member of the American Dental Association, the Academy of General Dentistry and the South Florida Dental Association. He is one of South Florida’s leading cosmetic and implant dentists. The Consumers Research Council of America selected him as one of “America’s Top Dentists.”

Dr. Nakhla has been a practicing Dentist and Owner of Nakhla Dental Group since 2016. He is a graduate of University of the Pacific, Arthur A. Dugoni School of Dentistry.

Footnotes

Use of Proceeds

If the offering's maximum amount of $1,069,999 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Marketing | $600,366 | 56.1% |

| Unallocated Funds | $0 | less than 0.1% |

| Employee Salaries | $305,271 | 28.5% |

| Loan Payments | $101,757 | 9.5% |

| App Development | $10,175 | 1.0% |

| Intermediary fees | $52,430 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Class B Common Stock, under registration exemption 4(a)(6), in Straight Teeth Solutions, Inc.. This offering must reach its target of at least $10,000 by its offering deadline of April 28, 2023 at 8:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Apr 29, 2023Primary offering finalized, selling shares

- Nov 28, 2022YTD we have more than doubled our number of...

- Jul 26, 2022An update from our Chief Revenue Officer on...

- May 17, 2022Our rapid growth continues!! We now have over...

- May 10, 2022We have a lot going on! In February Simple...

- Feb 11, 2022Simple has expanded its doctor network by 250%...

- Jan 24, 2022On January 14, 2022 Simple’s patent application...

- Jan 19, 2022Simple expands its doctor network by 10% in the...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.