Introduction

Raveler is action marketing for specialty food companies. We help small businesses get credit for the amazing work they do.

“I believe in [the Raveler] team. I have a lot of faith in their ability to execute, their intuition about marketing, how the product should feel and look, and about what the customer needs.”

“Having big piles of coffee-stained papers is not the best way to keep records. Digitally archiving batches [with Raveler] has been a game-changer.”

Problem

Specialty food is a tough business. Margins are slim, compliance regulations are strict, and competition is fierce. Artisanal food companies are constantly trying to prove why their product is special and worth the price.

Showcasing their artisanal, unique, and often hand-crafted products could be their full-time job, but that is not how food business operators spend their time. When they are not actively making and selling products, they are keeping up with a host of tasks like production scheduling, inventory management and batch tracking. All of this is done with a messy spreadsheet and notebooks, and the result is often very frustrating. This burns out small business operators, and makes it harder for them to prosper and grow their companies.

Specialty food transcends cultural borders, strengthens the local economy, and enriches lives everywhere. We believe these small specialty businesses deserve better tools that showcase their unique products.

Solution

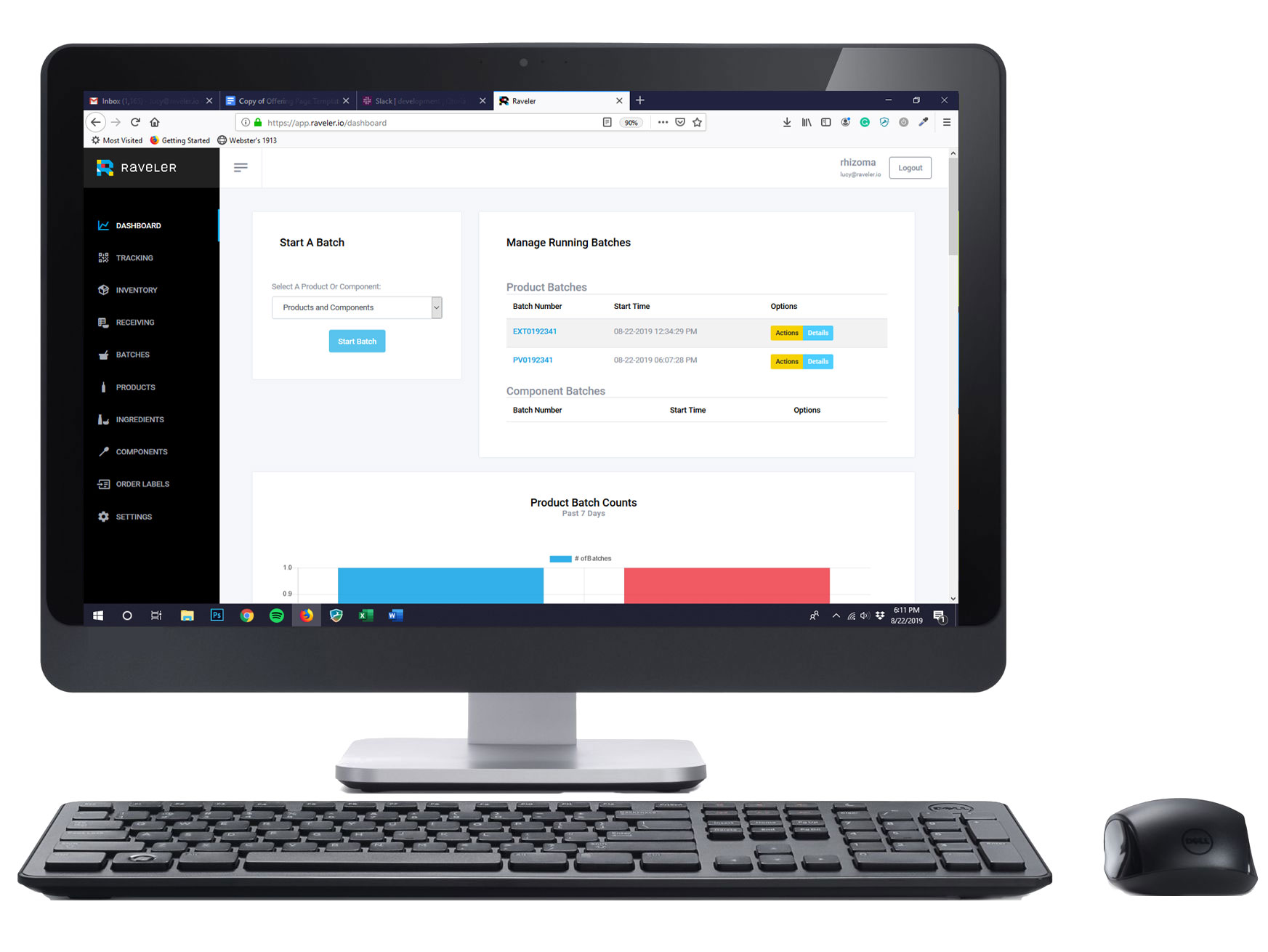

Raveler is a web-based app that streamlines operational headaches such as inventory, batch information management for the FDA, and keg/container tracking. These tools are currently in use by beta customers, and are ready for a broad market release.

Today’s food business operators walk around with a clipboard to record this information and input it into several multi-tabbed spreadsheets to make sense of it. It takes a lot of time and headspace to set up and maintain these systems, and it is easy for things to fall through the cracks. Raveler will allow them to record the information on a tablet or phone, and to access that data from anywhere.

Our next software build is a content management module which will integrate with our operational tools. Today, marketing content such as images of farms, ingredients, and producers are typically spread across dropbox files and within emails. These images, and the descriptive language about the product and how it’s made, are reserved for outdated sell sheets and company website, and never touch operational reality. Often employees do not even know why their products are special, and unless the company owner is present to tell the story, customers do not have the opportunity to learn.

Raveler will allow business owners to keep product information up to date by connecting images of ingredients and their sources (farms/producers) with each batch of product made. This exciting development will give specialty businesses the opportunity to integrate more authentic storytelling and image content into their marketing channels. It will allow them to instantly create materials that reflect batch-level specificity, thereby leveraging scarcity into a value-add.

Market

The companies we serve are smaller specialty businesses - small batch producers of unique, curated products. Between food retail, wholesale, foodservice and agriculture businesses, there are about 1.1 million companies that fit our target demographic. Small businesses spend an average of 6.9% of their annual revenue on information technology, leading to a total addressable market of over $40 billion. Our specific initial targets are coffee shops, consumer packaged goods (CPG’s), bakeries, and breweries.

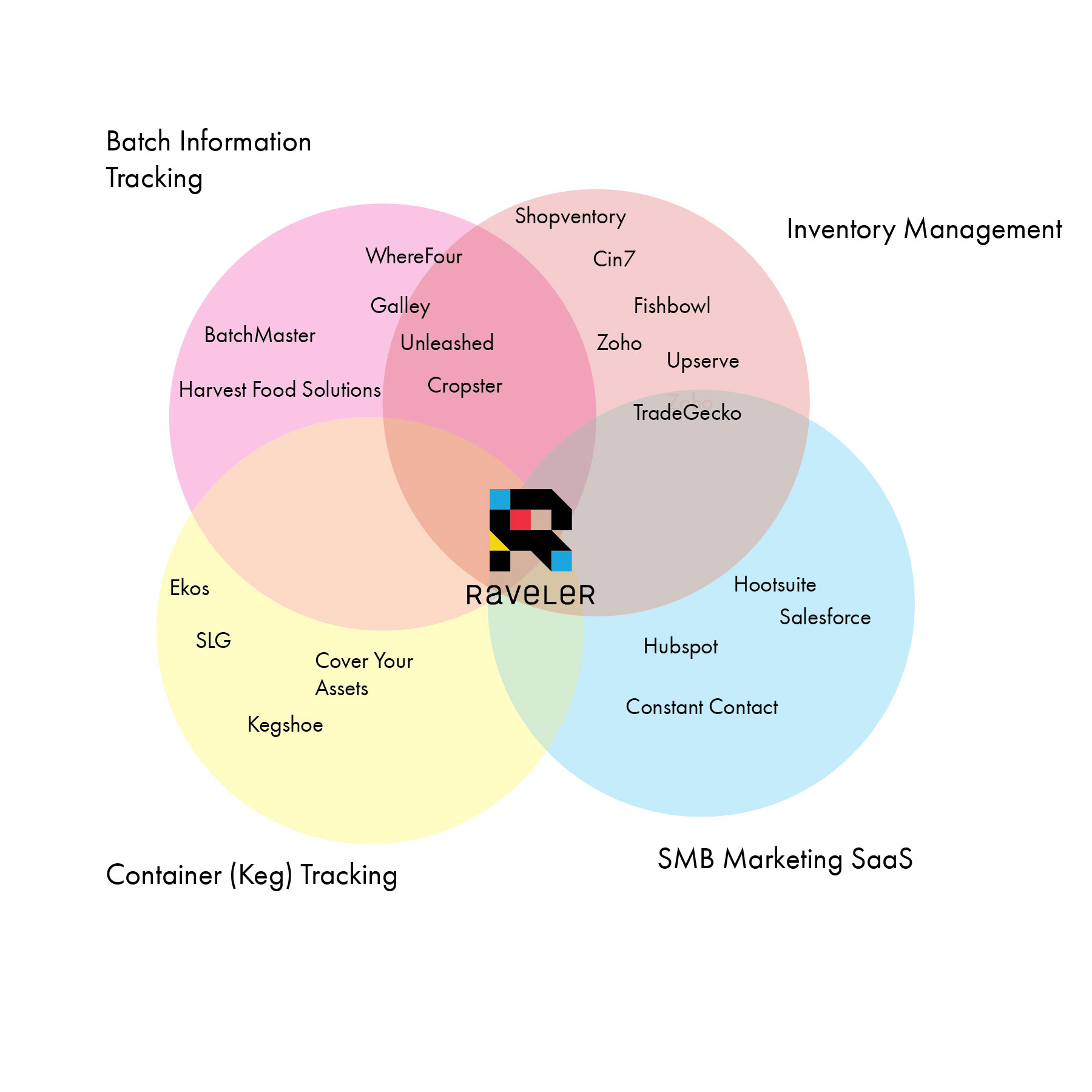

Competitive Landscape

Business Model

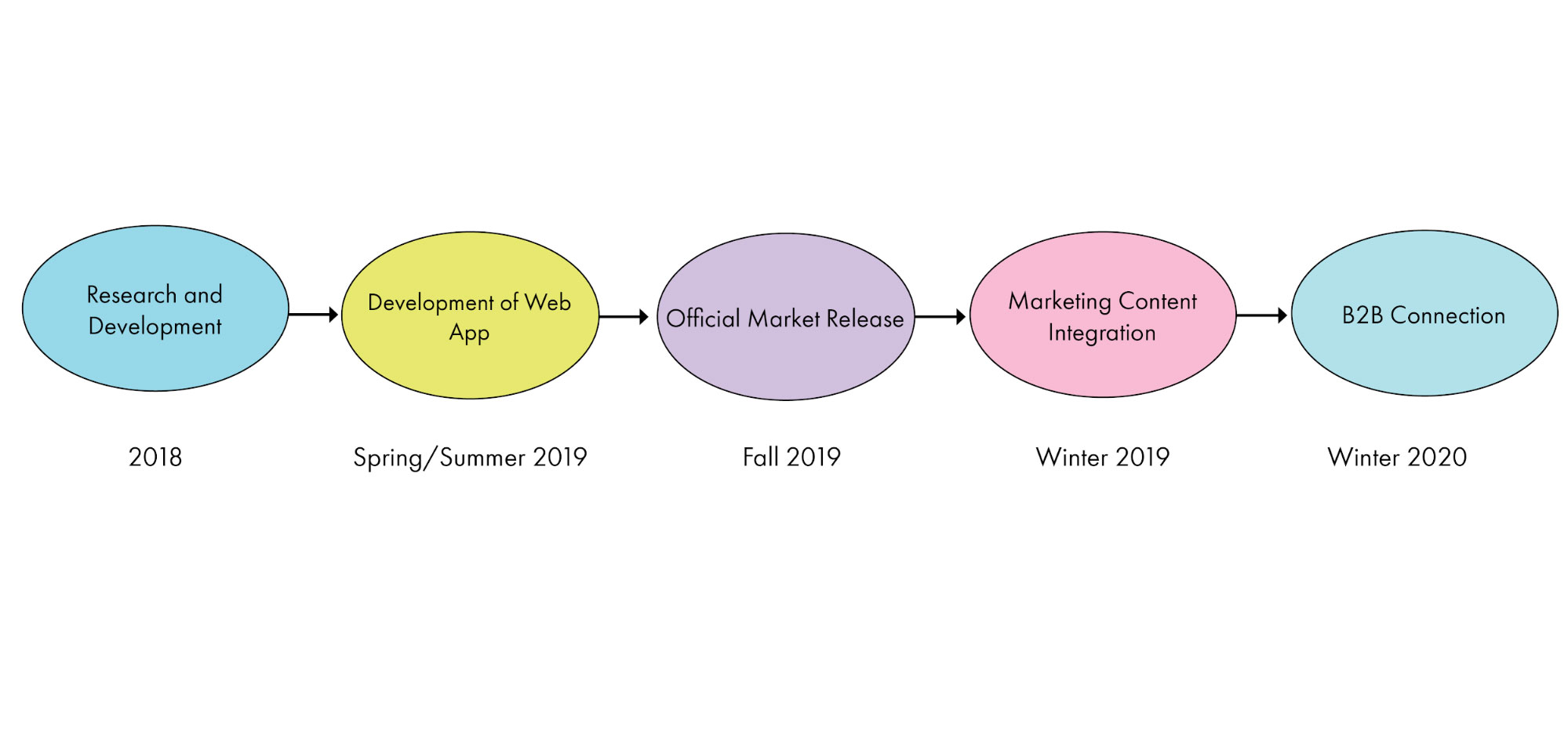

Progress

Success

Our new, revamped website recently launched in preparation for our official product market release, and it is absolutely beautiful. We also recently brought veteran SaaS Customer Success expert Rob Zierten onto our team. The success of our customers is our primary objective as a company, and we are excited to bring emphasis to that part of our business in this early stage.

Press Mentions

Team

We have assembled a team of amazing people to solve highly specific problems for an underserved population.Our team is uniquely qualified to tackle these problems. We have deep experience in the food business in wholesale, retail and foodservice verticals.

Lucy Valena is the former owner of Voltage Coffee & Art, a venture-backed coffeehouse and gallery in Cambridge, MA. She studies food and narrative, and holds a Masters in Gastronomy. Valena works with open-book management consultancy Rethink Restaurants, and proudly heads the arts initiative Bait/Switch.

Jaime van Schyndel has a decade of specialized experience in sourcing coffee through 'direct trade'. He founded Barismo Inc in '08 and became one of the early companies leading the charge that would become a wave redefining modern specialty coffee. As an inventor with brewing patents through his other company Draft Coffee Solutions, he is an entrepreneur that thrives on solving problems. Jaime has also been a blogger, consultant, culinary coffee instructor, and at times a panelist or presenter.

Chris utilizes his experience in IT, software development, cloud architecture and project management to deliver Raveler's surprisingly-less-frustrating software solutions (SLFSS). Outside of work, Chris enjoys spending his time biking, learning guitar and searching for the best burger Boston has to offer.

Benjamin Osowiecki is a full stack developer who recently graduated from Keene State College. He enjoys traveling, learning new things, and biking in his spare time. Ben's favorite programming languages are Swift and Matlab.

Use of Proceeds

- Regional launch of the Inventory, Batch Management, and Container Tracking app

- Development of the Content Management Module

- Onboard enough customers to create traction for a 2M raise in Spring 2020

If the offering's maximum amount of $100,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Development | $40,000 | 40.0% |

| Operations/Customer Success | $20,000 | 20.0% |

| Sales & Marketing | $30,000 | 30.0% |

| G&A | $5,100 | 5.1% |

| Intermediary fees | $4,900 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Raveler Inc. This offering must reach its target of at least $10,000 by its offering deadline of December 18, 2019 at 12:00pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Dec 18, 2019Primary offering finalized, selling shares

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.