Introduction

PennyFly is a 21st century record label and entertainment company, with an emphasis on Web3 projects. We have demonstrated expertise in multiple entertainment sectors, particularly in the music industry and with blockchain/NFT driven initiatives. As an independent by-artists-for-artists platform, our simple 50/50 artist profit splits, flexible deal terms, and access to critical music industry channels that are typically exclusive to major labels, allows us to offer services that an artist typically expects from a major label deal, but with significantly greater profit opportunity and control over their career.

Problem

Pain Points - The Reality of Signing with a Traditional Major Label

- Major labels can take upwards of 75-85% of artist profits, owning the artist’s brand & likeness

- Major labels monopolize distribution networks to further capitalize on additional artist revenue streams

- Artists have limited creative control and ownership over their music

- Artists may be contractually bound to on-demand and constant touring, recording appearances, interviews, and dictation of day-to-day life at the will of the label

- Collaboration amongst artists is difficult due to licensing negotiations and politics from label management

- Receiving payout is hardly guaranteed due to clever contracts – many have been left in debt while the label collects money; trust is gone after decades of mistreatment

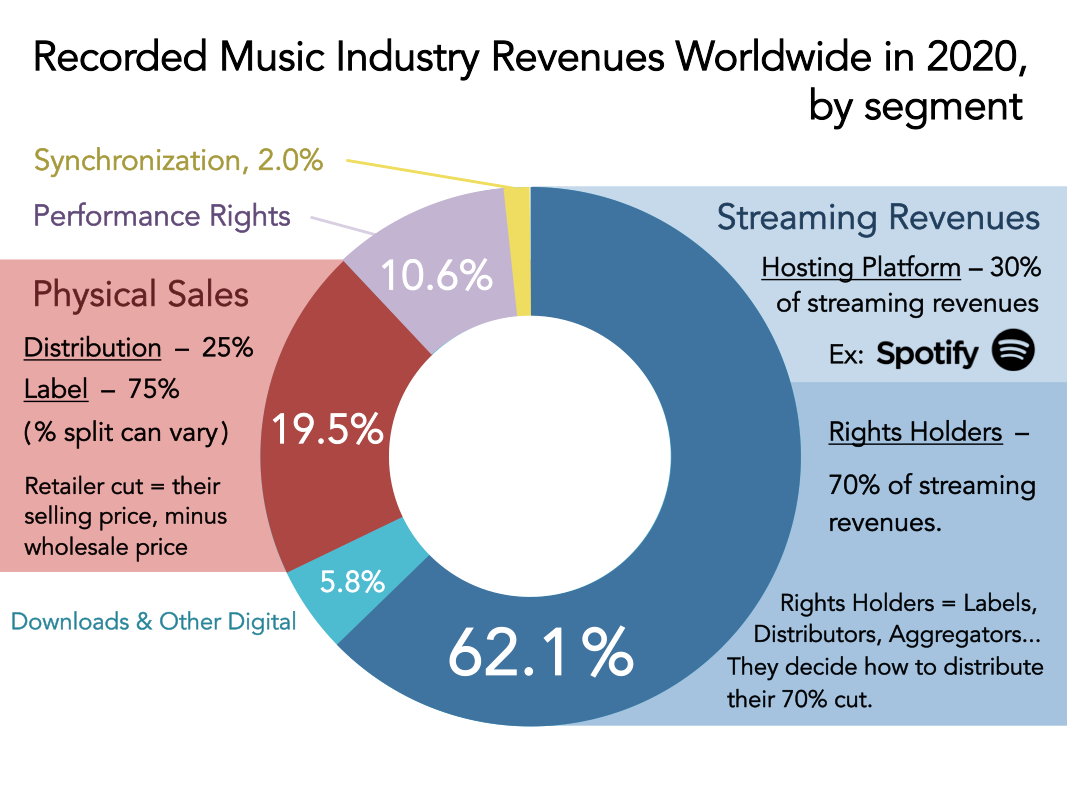

Streaming provides a good example of how the fate of most artists is left at the mercy of the record label. While streaming makes up 62.1% of industry revenues, typically 30% of these revenues are kept by the hosting platform (Ex: Spotify, Apple Music), who typically does NOT pay the artist directly.

The remaining 70% goes to the Rights Holder, i.e. typically a Record Label, Distributor, Aggregator or Collecting Society. They determine how they want to distribute their 70%.

Solution

Don’t waste time and money experimenting on your brand. PennyFly offers services that artists typically expect from a major label deal:

- Management — PennyFly fights for artist rights while introducing artists to trusted partners within our network. Our job is to find artists opportunities that translate into real revenue and brand awareness.

- Production — Work with a top producer at a world-class studio, or remotely from anywhere on the planet to create a truly major-label caliber product. Development deals are available for select artists who qualify.

- Marketing — An integral aspect of any successful project, PennyFly plans to assemble a bespoke marketing team unique to the artist or brand’s needs and stage of development.

Don't pay a premium!

- We believe PennyFly has the relationships, access, and staffing that major labels have

- Instead of 360 deals, PennyFly Artists are signed to a simple 50/50 profit split structure and allowed much more control over their rights and career

- Artists aren’t forced to create music untrue to their vision, or tour and record endlessly on a relentless schedule only to receive 15-20% of profits

Our model keeps artists happy, fans happy, and promotes artist longevity. This helps everyone’s bottom line.

More importantly, we care about the artist. We offer established relationships with some of the best in the industry and provide carefully constructed roadmaps, while the artist always retains the majority of their revenues, rights, and creative freedom.

Market

Total Industry Revenue & Growth:

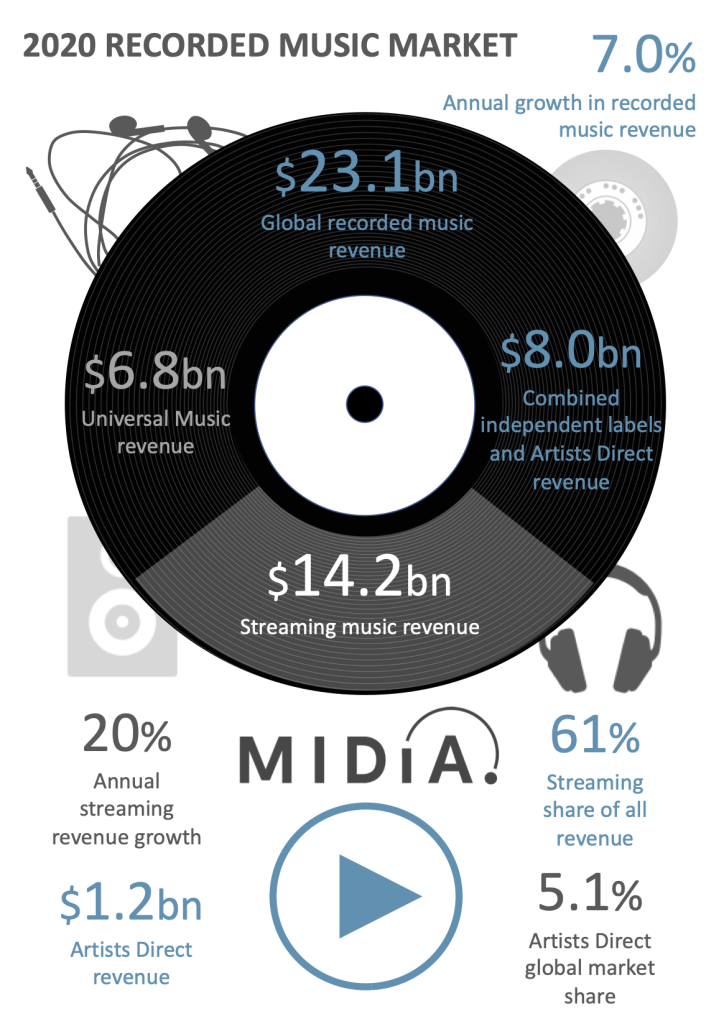

MIdia Research reported:

- Recorded music market revenues GREW by $1.5 Billion (+7%) in 2020 in spite of COVID-19, to reach $23.1 Billion in record label trade revenue terms.

- The bulk of revenue increases were driven by streaming, with streaming growth itself being DRIVEN BY INDEPENDENTS (labels and artists).

- According to Goldman Sachs', the general music industry revenue worldwide figure is $77B. USD.

- Growth in all of the world's regions. US +7.3% growth in 2020 [1].

- Strong growth outlook for industry further evidenced by Tencent's 10% stake in Universal Music Group (UMG), and their decision to double their position to 20% just a few months later in spite of COVID-19.

[1] https://www.ifpi.org/ifpi-issues-annual-global-music-report-2021/

Independent Label Market Share & Growth:

MIdia Research reported:

- Independent labels are still expected to GROW their absolute percentage share of industry revenue (currently 34.5% of a $23B.+ market)

- Independent labels and artists strongly over-performed the market in 2020, collectively growing at 27% and increasing their combined streaming market share to 31.5%.

Business Model

- “Label for Hire” Services: Production, Mixing, Mastering, Sync Licensing, Representation, Career Development

- Signed Artist Revenues: Merchandise, Streaming, Touring, Sales, Sponsorships

- RockAgainstTrafficking.org: Partnership Revenues

- Rock Against is a non-profit which uses the power of music to raise financial resources for organizations which combat human trafficking.

- Starcrowd.com: Partnership Revenues

- StarCrowd is a joint collaborative project with multi Grammy winner and main Justin Bieber collaborator, Poo Bear

- Contracted by StarCrowd for artists’ marketing services

- Other Projects

- Strategic growth across entertainment and technology sectors by empowering artists with new revenue streams utilizing NFTs and the metaverse

- Engaged to provide marketing and creative development services for blockchain-based NFT game “DashLeague” since its inception. The “DashLeague” presale sold out at 200 / 200 Ethereum (worth $500,000+) in minted items, verifiable on OpenSea. The full game is set to release later this year.

Success To Date

- Over $650,000 in revenue across all projects

- Signed deals with Sony Orchard, RockAgainstTrafficking.org (Malibu's Top NonProfit 2018 + 2020), StarCrowd.com (project of multiple Grammy winner & main Justin Bieber collaborator Poo Bear), and more!

- Two state-of-the-art music studios; one in Malibu, CA and another in Miami, FL

- These locations offer bi-coastal revenue generating opportunities through production, mixing, and mastering services.

- The debut EP release of Jett Prescott (one of PennyFly's artists)

- Generated $135,000+ in gross profit, a 697% ROI

- Jett was named Top Solo Artist in Los Angeles (XO Group) + was named #2 among the Top 25 New Artists of the Year (Music Connection)

Press

- Tyler 'Jett' Prescott - Rolling Stone | Culture Council

- Hidden Gems: Meet Jett Prescott of PennyFly Entertainment - VoyageLA

- 15 Culture Leaders Share Their Tips for Developing a Great Business Concept - Rolling Stone | Culture Council

- My Thoughts on How NFTs Are Redefining Our Cultural Mentality Around Value - Rolling Stone | Culture Council

Team

Prescott has run a highly successful full-service digital advertising company for over 8 years. Tyler’s experience coordinating high quality promotional services for businesses across multiple industries proved integral to PennyFly’s early development. He graduated from Penn State with a B.S. in Cyber Security while focusing heavily on project management, business management, and music. An artist himself, Tyler was named #2 among the top 25 new artists of the year in Music Connection Magazine as “Jett Prescott”, turning down offers from Epic and Sony in order to found PennyFly and create a legitimate alternative to major label deals.

Michael's career in the music industry spans 30+ years, beginning with Polydor Records in the mid 80’s where he worked with such artists as Freddie Mercury, Siouxsie, and the Banshees and The Cure. Michael soon became the Head of Media Relations at Virgin Records, and for a decade looked after media for everyone from Phil Collins/Genesis, Lenny Kravitz and Madness to Massive Attack, Dr Dre, and Daft Punk.

A well-respected and trusted industry veteran, Foley is one of the top executives in the business with a vast array of A-list promotional experience including: U2, Dave Matthews, Bruce Springsteen, Santana, Billy Joel, Bon Jovi, and many more. Gene has won several "Best In The Biz" Awards from the N.A.R.I.P.

Previous experience includes acting as the Public Relations Marketing and Social Media Director for New Ocean Media, a full–service media firm that offers various management services for its world renowned clients including Capitol Records, Def Jam Recordings, and Warner Music Group.

James has worked for 8 years both in business development and as an entrepreneur. His skill set includes project management, pitch decks, industry analysis/research, and financial modeling. He took the lead on the intensive diligence process required by Pepperdine's "Most Fundable Companies" competition, resulting in PennyFly's Semi-Finalist placement. To date PennyFly is the only record company to be recognized in this capacity.

Adonis is an experienced licensing specialist with a demonstrated history of working in the music industry. Skilled in music licensing, composing, arranging, and music production. Adonis has composed music for TV’s 'CSI:NY', ‘Guiding Light’, ‘All My Children’, ‘NCIS’, and numerous reality shows on the E Network, and A&E Network.

Josh has acted as a public relations & marketing consultant for artists and musicians alike, creating engaging new campaigns with an expert creative eye and a history in DIY culture. His sponsorship work has found him connecting with partners like Red Bull, C3 Productions, LiveNation, Fender, and many more.

Lynn has been featured on major networks including Bravo, Fox, Lifetime, CBS, and VH1. Lynn is an expert relationship builder with a vast network of high-level contacts across the entertainment industry.

Tyler began his career with Sony Music, working on marketing strategies for Childish Gambino, Frank Ocean, and Tyler the Creator among others. As a marketing/branding strategist, Tyler has overseen campaigns for Fireball Whiskey, Xbox, Microsoft, and more in addition to serving as a consultant for Sonicbids, Tunecore, and A3C.

Dr. Harry J. Malinski possesses an in-depth knowledge of blockchain technology, charting analysis, and margin trading. His responsibilities at PennyFly include researching new ways that artists can monetize via blockchain initiatives, as well as recommending and integrating internal tools to improve communication, productivity, and overall workflow across our team.

Swartz is a seasoned attorney with a broad range of experience in the entertainment industry and other areas of law. He has represented major film studios and music companies, as well as Oscar, Emmy and Grammy winning talent and icons such as Muhammad Ali, Farrah Fawcett, and Irving Berlin.

Use of Proceeds

If the offering's maximum amount of $1,069,992 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Total Payroll | $188,000 | 17.6% |

| Contract CFO | $52,000 | 4.9% |

| Legal | $28,000 | 2.6% |

| Unallocated Funds | $1 | less than 0.1% |

| Insurance (E&O, D&O, EPLI) | $13,570 | 1.3% |

| Hosting, Email, SSL, CDN, etc. | $2,400 | 0.2% |

| Travel (Car allowance) | $3,600 | 0.3% |

| Travel (Air, Hotel, Meals, etc) | $9,600 | 0.9% |

| Conferences & Seminars | $6,000 | 0.6% |

| New Equipment | $9,600 | 0.9% |

| Telecommunications | $2,400 | 0.2% |

| Office Expenses / Supplies | $2,392 | 0.2% |

| Marketing of Partnered Projects | $475,000 | 44.4% |

| Marketing of PennyFly / Services | $225,000 | 21.0% |

| Intermediary fees | $52,430 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Class A units, under registration exemption 4(a)(6), in PennyFly Publishing LLC dba PennyFly Entertainment. This offering must reach its target of at least $10,000 by its offering deadline of April 29, 2022 at 10:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

PennyFly Entertainment’s official name is PennyFly Publishing LLC, so that’s the name that appears in the statements below.

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Apr 30, 2022Primary offering finalized, selling units

- Apr 28, 2022Hi everyone! We're excited to announce our...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.