Introduction

OmniValley has cultivated a social community, designed for the venture capital industry and for those seeking to better connect into under-ventured and unfamiliar markets. Our platform and engagement tools provide transparency and access into entrepreneurial ecosystems, regardless of geography or market size, and enables our Members to create new and impactful relationships across the globe.

Why You Should Invest

WHY YOU, WHY NOW...

Because you’ve taken the time to support us, the OmniValley team is pleased to return the favor to our early investors:

- For our Investor Members or those planning to join the network, an investment of any amount here will grant you a free profile and extended membership for at least an entire year! Once you and your organization are noted as a supporter of OmniValley, your subscription will be free – including complete access to a growing network of now more than 750 investor members!

- For our Service Providers and Ecosystem Builders: we’re offering your organization premiere placement on our Benefits & Partners page (see snapshot below)! For an investment of $3,000, we’ll place you at the top of our listings and in front of our growing member base of over 750 accelerators, venture capital firms, and larger institutions. Our current providers have revenue sharing agreements with us – for you, we’ll remove that for at least one year too! Look to your marketing and sponsorship budgets – as our platform grows, we want you listed for them to see. And launching soon... we have a rapidly expanding base of member portfolio companies that currently include upwards of 15,000 (venture backed) startups. These startup companies gain immediate access and exposure to your service offerings. If our investors or companies need your services – we can highlight what you’re doing for them in big ways – join us!

For larger amounts invested into OmniValley today, we’ll be working closely with those groups on targeted placement of their choosing, investor level access and complete profiles, and waived event sponsorship opportunities — all attainable through your increased support with us today!

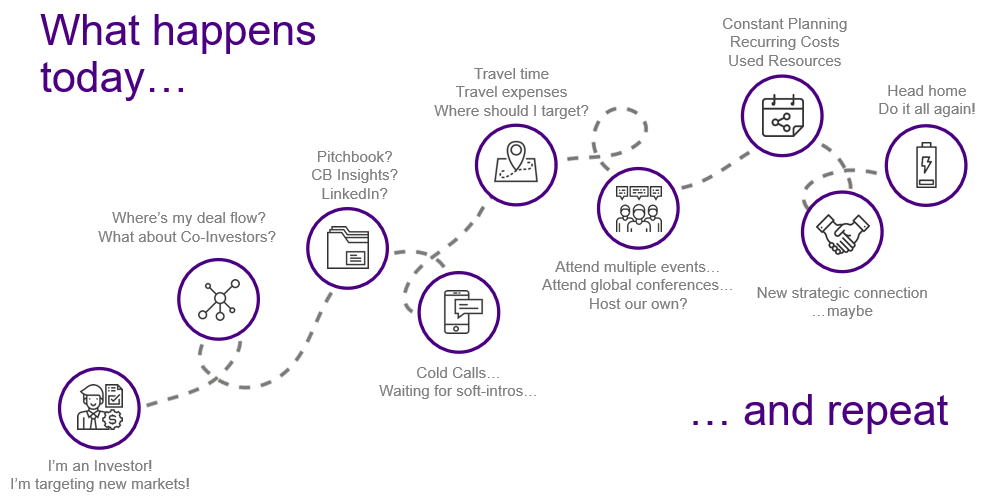

Problem

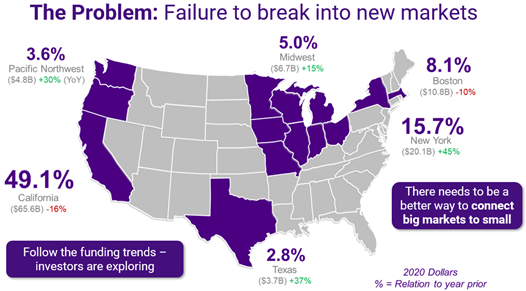

The new market conditions of remote work have brought forth challenges to many businesses, but have created significant opportunities for the venture capital industry. The data and trends on investment dollars spent elsewhere had already begun to point to the Midwest and other, once peripheral markets before the pandemic took over; however, we are now operating without geographical advantages/disadvantages, leading to an increasing need to connect into untapped regions and discover new investor connections and promising startup companies.

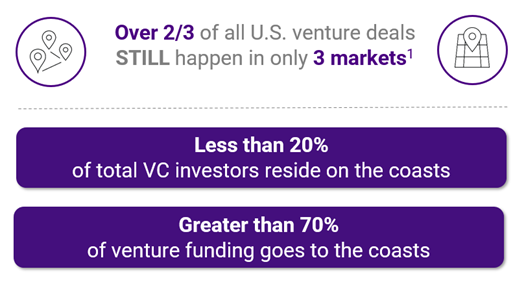

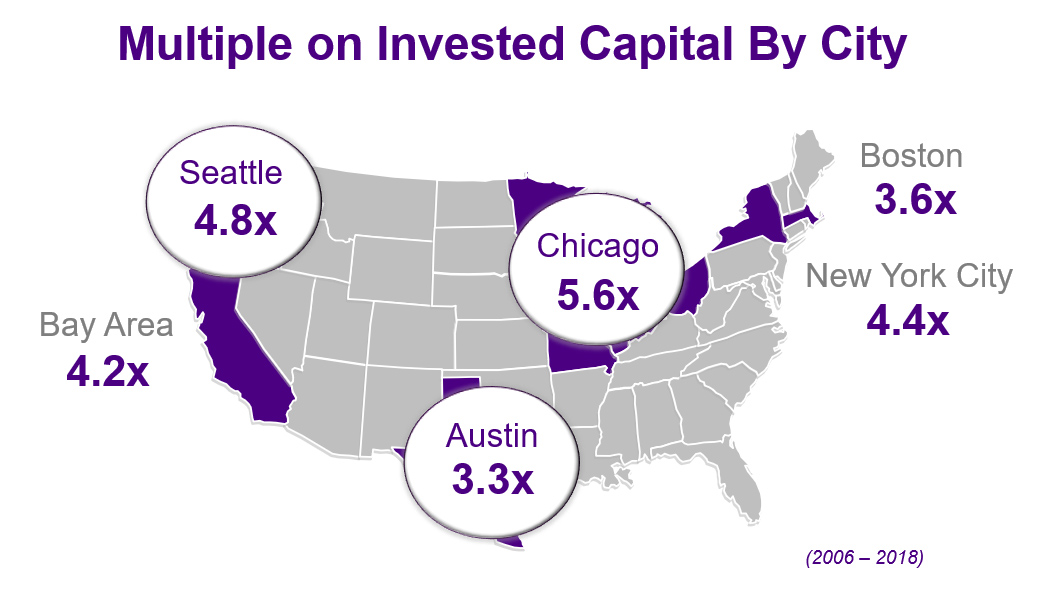

Entrepreneurship and startup activities exist in all regions and societies around the world, yet institutional and venture capital investments remain extremely concentrated to a few areas. These epicenters include the greater San Francisco area, Boston, and New York City markets where startup companies receive close to 80% of all venture investment year over year [1].

The return on capital provided to investors does not justify the disproportionate sum of funding given to these centralized locations. Some of the largest investors have begun to notice this trend in relative performance and have started to shift their way of thinking. Throughout 2016, 1,192 institutions and VC firms made at least 1 startup-related investment outside of SF, Boston, and NYC. The number of investors jumped in 2017 to 1,344; over a 12% increase in new investors in one year [2].

Today, most understand that entrepreneurs can build something innovative and succeed from anywhere. Still, it continues to be difficult for investors to navigate and cover these unfamiliar areas.

According to one OmniValley member, Unshackled Ventures, “It is far too much work to assess these outside markets. Before OmniValley, we previously had few connections into these places so they continued to go overlooked. With this platform, I can directly interact with these market participants and make important connections for my firm.”

Furthermore, Bobby Franklin, President of the National Venture Capital Association stated that, “To work with the broader entrepreneurial ecosystem, investors as a whole are increasingly engaging with accelerators and startup founders.” Meaning, everywhere they may be.

This outlines the problems that OmniValley addresses within this flawed market. The reason investors don’t source more deals elsewhere is not because they only have an interest in coastal startups, but because they do not have an efficient way of being introduced to peripheral, unknown markets. Investors attempting to enter new startup ecosystems are unfamiliar with the local markets and uncomfortable with the lack of transparency. They simply need connections there.

OmniValley’s inherent value lies in connecting local communities to experienced Investor Members who are interested in discovering new ecosystems. Startup accelerators offer this first connection point into emerging regions. These are the local boots-on-the-ground operators who also struggle to attract new investors and showcase their companies to a broader audience. While data providers and other relationship-matching networks exist, none of them seem to understand that the creation of entrepreneurial ecosystems and the fostering of startup communities begins at the very early, granular, and local levels.

- Source: The Martin Prosperity Institute - 2019

- Source: Pitchbook Data - 2018

“We’re now seeing these pockets of technology companies spring up all over outside of Silicon Valley. While we may not have the density of the Silicon Valley, we’ve found that all the talent we need is right here in Michigan. Investors are coming to me.”

Solution

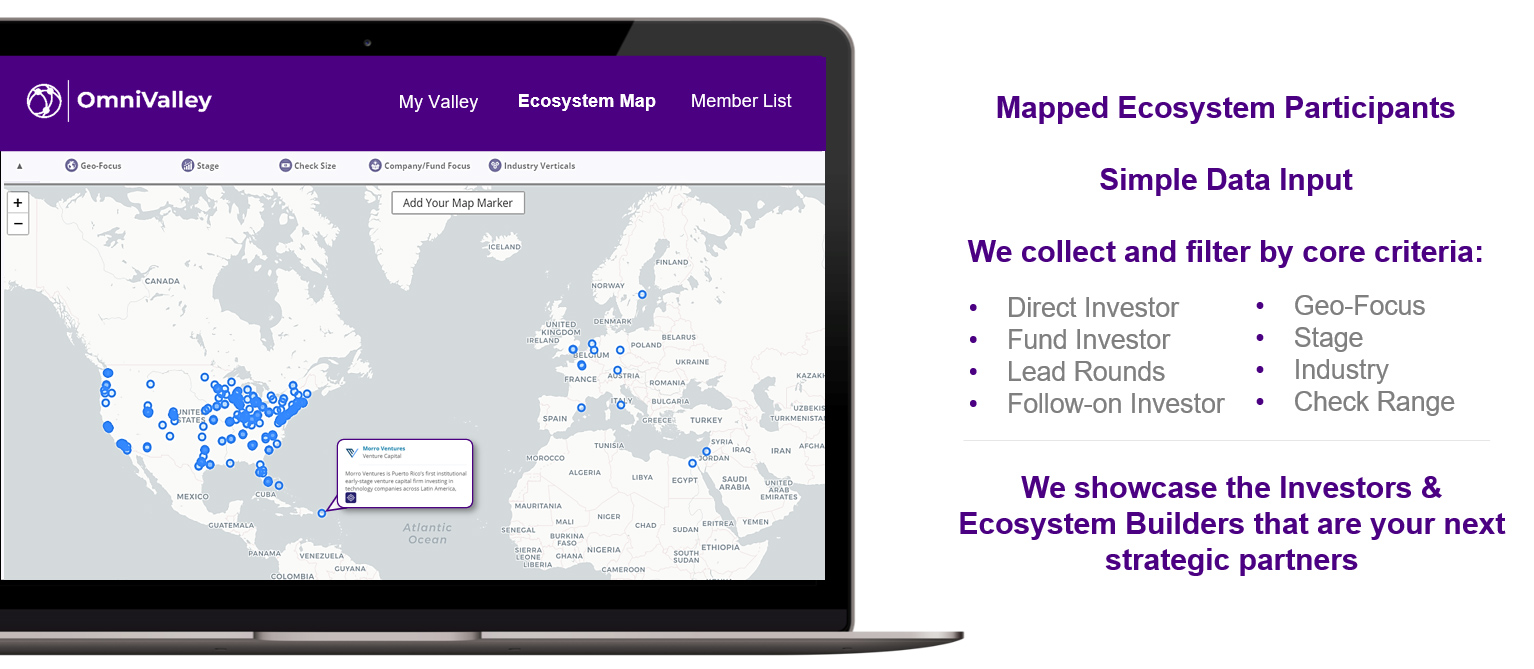

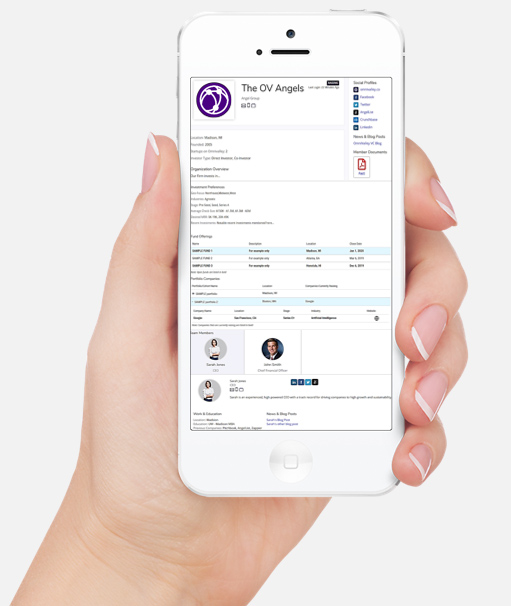

OmniValley focuses on how to better connect entrepreneurial ecosystems and solves the existing problems within a market ripe for disruption. The platform utilizes Member-driven data to create an experience for its community that is both simple to use and increasingly valuable. Because we seek to accelerate the exchange of the most critical, relationship-forming information, we don’t ask our Members to fill out endless questionnaires or gather past data to populate a newsfeed. From our Investor Members, we only collect high-level and defining criteria that are very descriptive and rarely changing. This allows our Members to better showcase themselves, highlight their portfolios, and to form more curated connections based on what matters most to them.

OmniValley continues to work with its Members to implement the desired tools to make data gathering easier and to foster strategically-filtered and curated relationships:

- Market Transparency

— Due to the investment duration and competition worries, VC fund and startup company investments have been historically challenging to monitor. OmniValley’s platform data is inputted, maintained, and updated by each individual profile owner, thereby offering needed transparency for all Members active in startup company and venture fund investing.

- Curated, Private Community

— OmniValley platform Members must meet current eligibility requirements in order to maintain and grow a community of well-curated peers. In doing so, the platform’s Members are given a trusted place to share otherwise sensitive data and information to only like-minded, operationally similar peers. By focusing on exclusivity on the investor side, the network becomes inherently more attractive to future Members.

- Meaningful and Fast Connections

— OmniValley Members are given contact information (investor-to-investor). They also can quickly sort through the filters and/or match their profile inputs to firms and funds who are thinking similarly in other areas.

— Startup companies (living separately on this network) now have the ability to request introductions to our Investor Members. These opt-in requests come directly from OmniValley and give investors the information they need to take the introduction or to pass at that time. Startup companies either connect instantly or are given more introduction requests - all at the discretion of the Investor Members.

— The platform elicits faster, more strategic connections based on filtered data sent in real-time. While providers and other industry networks exist, data collection has been the core focus behind connecting startup ecosystems. OmniValley differs in that we are intently focused on building the relationship tools to create stronger, faster relationships.

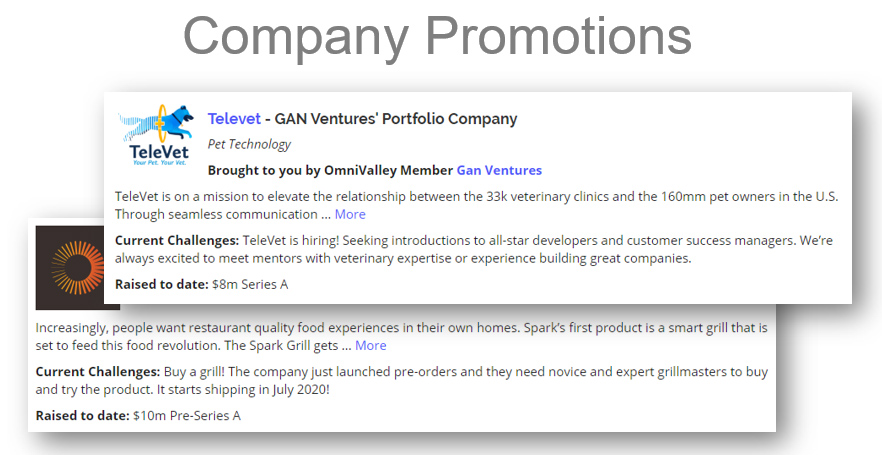

- Portfolio and Startup Company Exposure

— Given the present need in today's world and having heard from our Members, we have JUST LAUNCHED the startup company side to this network. This now enables current Members to showcase their portfolios and startup companies they are working with to the rest of the investor community on OmniValley. It also allows for the companies themselves to create profiles – all visible to the investor network.

- OmniValley Intelligence

— Future plans include extrapolating Member-inputted data and to launch a co-investor mapping and portfolio company tracking visualization tool. Providing investors and Startup Members with the ability to plug in their portfolios and company to have a curated list of potential co-investors and connections based on specifics and past data matching their own investment preferences. As well as Members having the ability to connect with one another through past and present portfolio company information.

Business Model

Since inception, OmniValley has been cultivating a strong and collaborative network of investment firms, funds, and individuals. We've been intently focused on building the tools and functionalities for the platform to make it conducive for all Members involved. We have planned out freemium to premium subscription offerings to enable profitability while continuing to rapidly scale our Member base.

Recently launched, Startup Company Members now have the ability to create profiles for FREE exposure to the growing network of Investor Members. Premium access gives the ability for individual companies and those supporting the Startup Members to request a limited number of introductions to the Investor Members of their choosing. OmniValley greatly limits the number of requests that can be sent to Investor Members. This is on purpose to better train these young companies to do their research – all accessible on the OmniValley platform – and to not allow our Investor Members to be spammed by the endless emails from those seeking funding today.

Our Investor Members can utilize OmniValley as an outsourced investor relations arm for their portfolio companies. Our Startup Members can gain exposure to global investors from wherever they’re building their company.

We project additional streams of revenue over the next year coming from service provider placement on our benefits and partners page, as well as small subscription fees paid to OmniValley by the startup company profile side.

In order to ramp up our membership numbers to target revenue faster, we intend to create sustainable network effects through content positioning and brand awareness, increase our advertising spend, and continue to funnel our technology roadmap through to execution and launch.

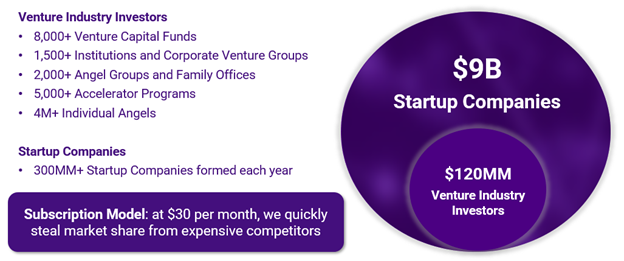

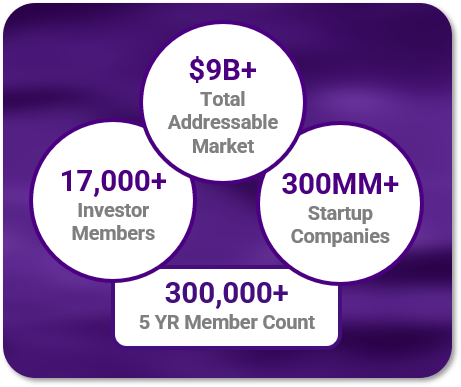

Market

Less than 20% of our total market resides where nearly 80% of venture funding happens – leaving so many needing the exhibition and access points that OmniValley can provide. OmniValley has an addressable market of more than 17k targeted organizations, groups, and 4M angel targeted investor profile Members. And these numbers are both growing.

Online platforms and databases focused on startup investments are controlled by a number of players, two of which are AngelList and PitchBook Data. AngelList has a network of individual accredited investors looking to directly invest into startup companies. It is open source and allows 2,700+ accredited investors to form groups and/or individually reach out to all startups on their network. PitchBook utilizes its 600 employees to populate widely sourced data on companies to be provided to its subscribing customers. While each competitor has positively grown over the years, AngelList’s user base is overcrowded and lacks direction and PitchBook relies on previously disclosed data and is controlled by the PitchBook team. By allowing all types of investors on their network, AngelList has become a group think-tank where one syndicate can lead others to certain startup investments. In doing so, users are investing alongside those still focused on the usual, larger markets. PitchBook, however, only consolidates the data on these groups and companies, giving their subscribers extensive filters to sift through scraped information.

Investors are becoming conscious as to whether the stale data and often incorrect contact information being provided justifies their hefty subscription fees. What these competitors lack by way of a well-curated, relationship-focused network and trusted data shared in real-time are what OmniValley sees as market-changing opportunities.

OmniValley serves this targeted market as an online platform centered on connecting small-scale entrepreneurial regions to large, strategic, and new investors. Unlike our competitors, OmniValley offers Member-inputted information provided in real-time to a select, interested network. Institutions, corporations, and VC firms can relate to accelerators and the building of smaller ecosystems as they too often have altruistically like-minded missions to foster growth in their own communities.

The platform is a trusted peer network where information and interactions are based on each Member’s own discretion. Outdated or stale data is not being scraped nor inputted from other sources. OmniValley’s platform focuses on fostering introductions and creating otherwise nonexistent relationships based on the most important qualitative and quantitative Member inputs.

Progress

Since our formation in 2018:

- We’ve conducted interviews with over 300 targeted Members and continue to speak with new referrals on a daily basis. From those asked to register on the OmniValley platform, the adoption rate exceeds 90%.

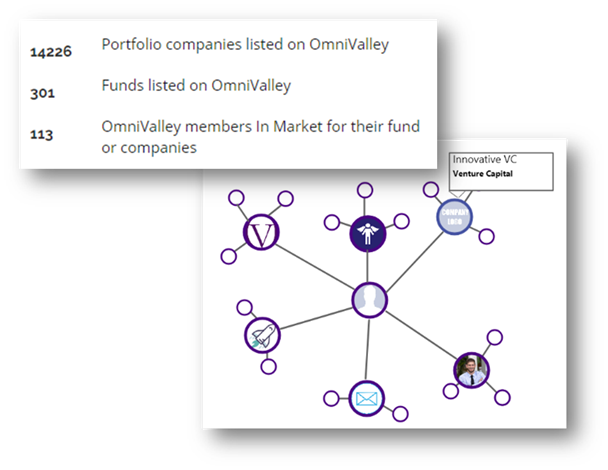

- The platform opened with 25 members on March 1, 2018 and has since grown to 800 Investor Members and organization profile in 2021.

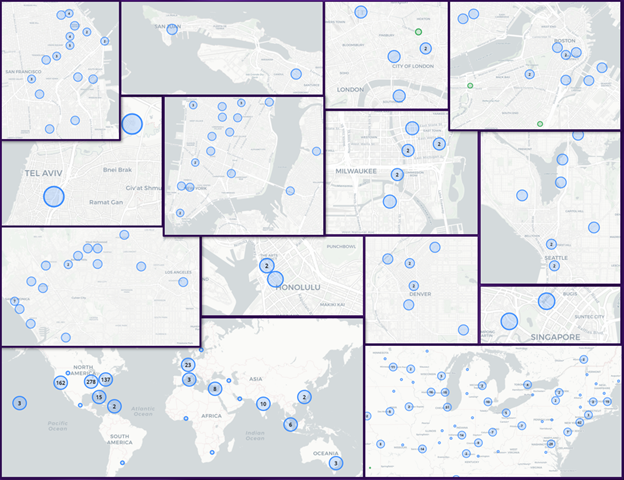

- 200+ unique ecosystems/markets

- 6 continents represented

- 100+ new investor-to-investor connections sourced

- Proudly aligned with the Global Accelerator Network. Their team has been tremendously supportive and helpful in introducing us to their growing network of accelerator organizations as well as promoting OmniValley to their distribution.

- October 2021 – launch of Startup Company Members

- October 2021 – Revenue generation from Members turned on

The team is confident given the growth in Member rates and the overwhelmingly positive support provided by current and future Members, that OmniValley has the ability to meet its targeted benchmarks and provide increased economic benefits to local communities.

Snapshot of the platform and network today:

Press

Team

The OmniValley team is led by 3 individuals with the appreciated support of those within the industry and groups around the world. Our founder, Grady Buchanan has spent the bulk of his corporate career within the institutional investment world investing in both accelerator and venture capital funds. John Bruehler, our team’s technical expert, has done a fantastic job in building out the platform you see today and we're happy to say that we’ve been able to develop and keep this in house. Zack Genthe comes from the engineering and consulting world, focused on process improvements and operational setup. Zack also brings a UW-Madison MBA degrees to our growing team.

On the advisory side, Henry Chi and Paul Plakut work alongside the OmniValley core team. As the once portfolio manager for St. Louis-based accelerator, Capital Innovators, Henry managed the growing portfolio of over 120 companies. His responsibilities included sourcing new investments, due diligence, legal negotiations and investor relations. He's now a Director at Manhattan West. Henry works directly with OmniValley on legal and compliance adherence as well as providing guidance on fundraising, business development and talent recruitment for OmniValley. As a serial entrepreneur and our technical advisor, Paul Plakut works in concert with John Bruehler and the OmniValley team in structuring and planning the technical product roadmap, new build and feature initiatives, and divisional setup planning for team expansion and onboarding. OmniValley holds formal monthly advisory board meetings in addition to their open communication with these individuals.

Grady Buchanan is an institutional and risk-based asset allocation professional. His focuses include venture capital fund investments as well connecting startup ecosystems across the globe. Seeing a need for an online social community to foster entrepreneurial ecosystem growth, Grady co-founded OmniValley. OmniValley is a network of institutional investors, venture capital firms, accelerators and ecosystem supporters, to connect under-ventured entrepreneurial ecosystems to sophisticated, strategic, and interested investors, sponsors, and mentors. Grady received a Bachelor of Science degree in Economics from the University of Wisconsin-Madison.

Zack Genthe is the co-founder and COO at OmniValley. Zack manages the day-to-day internal operations of the company alongside collaborative efforts in strategic planning with OmniValley’s CEO and core team. He is a dynamic leader and decision maker capable of managing multifaceted positions in diverse organizations. He is a continuous learner capable of applying engineering and business principles to solve complex problems and concepts at OmniValley. Zack has a Bachelor of Science in Chemical Engineering and an MBA from the University of Wisconsin-Madison.

John Bruehler serves as CTO at OmniValley. He is responsible for strategic and technical planning and execution. Previously, John spent time in Chicago where he helped build a wide variety of software products specific to the social networking and venture capital spaces. He is focused on leading development of product features which support institutional investors, venture capital firms, and accelerators, to build stronger entrepreneurial ecosystems. John received a Bachelor of Science degree in Integrated Biology from the University of Illinois.

Testimonials

Advisors and Investors

A current Director at Manhattan West now focused on late stage venture, Henry previously managed the growing Capital Innovators portfolio of over 120 companies. His responsibilities included and still include sourcing new investments, due diligence, legal negotiations and investor relations. In addition, Henry provides guidance on fundraising, business development and talent recruitment for portfolio companies. He previously held roles at a leading equity crowdfunding firm, tech startups and the United States Attorney’s Office. Henry holds a J.D. from Washington University in St. Louis School of Law and a BA from UC Irvine.

Coming from over 15 years of consulting experience with digital transformation in the B2B manufacturing and distributing space, Paul not only brings a unique approach to technical innovation but has also built and managed organizations. A serial entrepreneur and one dedicated to the local ecosystem, Paul also runs development and coding programs for youth in the Milwaukee, WI area. His super power is his thirst for knowledge. Paul studied Computer Science at the University of Wisconsin-Milwaukee.

Use of Proceeds

If the offering's maximum amount of $250,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $50,000 | 20.0% |

| Sales and Marketing | $75,000 | 30.0% |

| Overhead, SGA, legal, accounting | $12,750 | 5.1% |

| Product Development/Developers | $100,000 | 40.0% |

| Intermediary fees | $12,250 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in OmniValley, Inc.. This offering must reach its target of at least $10,000 by its offering deadline of March 31, 2022 at 10:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

- Form C on December 9, 2020

- Form C/A on February 2, 2021

- Form C/A on March 26, 2021

- Form C/A on April 15, 2021

- Form C/A on April 23, 2021

- Form C/A on April 23, 2021

- Form C/A on May 26, 2021

- Form C/A on May 26, 2021

- Form C/A on July 27, 2021

- Form C/A on September 23, 2021

- Form C/A on November 5, 2021

- Form C/A on November 5, 2021

- Form C/A on December 9, 2021

- Form C/A on February 28, 2022

- Form C-U on April 4, 2022

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Apr 1, 2022Primary offering finalized, selling shares

- Mar 28, 2022Last chance to invest with us and 70+ others!...

- Mar 11, 2022A bit dated, but nice feature on this Podcast...

- Mar 3, 2022“As you can see from the equity crowdfunding...

- Feb 22, 2022Update from InvestorPlace: 7 Equity...

- Feb 16, 2022Making moves! Thanks to our friends at tZERO...

- Feb 10, 2022This VC industry has soared dramatically since...

- Feb 3, 2022Check out our recent conversation with Valley...

- Jan 26, 2022As we all still navigate through the virtual...

- Jan 18, 2022Hello OmniValley investors and supporters!...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.