None currently available

None currently available

27,299

$0.50 — $5

Introduction

KingsCrowd is bringing together financial experts and technologists to help investors like you make more informed startup investment decisions on portals like Netcapital.

Up until 2 years ago, only the super wealthy, elite, millionaires of the world could invest in startups. Thanks to a change in regulation (Title III of The JOBS Act), now literally anyone can invest in startups via Regulation Crowdfunding (Reg CF) and Regulation A+ (Reg A+) deals.

In Reg CF deals alone, investors have poured over $100M into almost 1,000 deals at a 178% growth rate between 2016 and 2017, via 41 FINRA registered startup investing portals. However, a major gap currently exist in this market that is hindering continued market development.

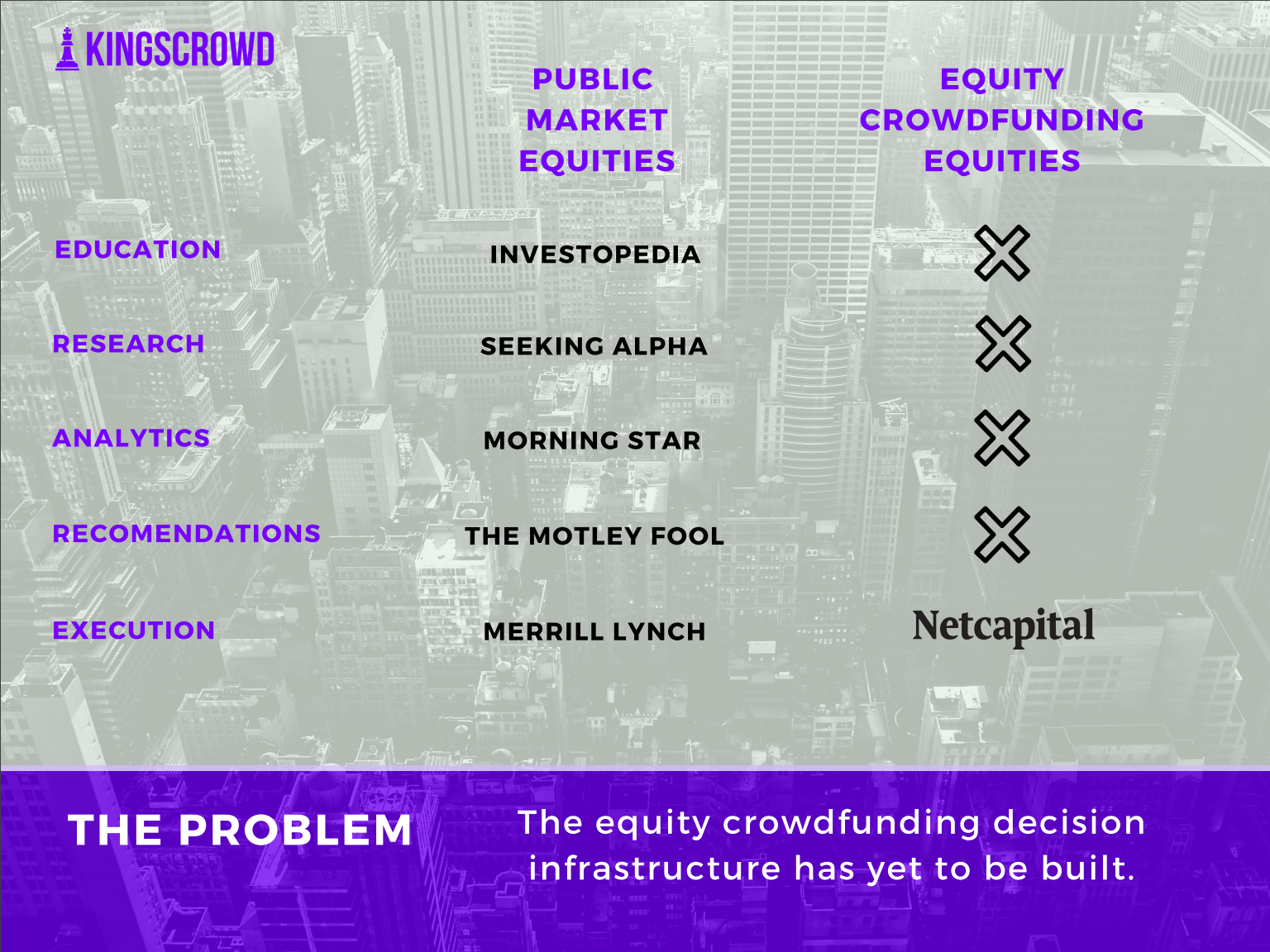

If you have ever invested in the public market then you know that there are a plethora of investment decision resources at your disposal: from Investopedia for education, to The Wall Street Journal and SeekingAlpha for research, to MorningStar and Bloomberg for analytics, to The Motley Fool and Zacks for recommendations.

Unfortunately, the tools for education, research, analytics and recommendations that exist in the public market don’t exist in the newly accessible startup market. As a result, startups leveraging Reg CF and Reg A+ struggle to captivate an audience beyond those who are already active on their current funding portal.

This lack of decisioning resources, along with a general lack of awareness around the startup asset class from everyday investors leads investors to:

- Not partake in startup investing at all

- Not partake in more than 1 deal (due to poor experience)

- Partake, but without making an optimized investment decision

If we want this new emerging market to grow efficiently, then we need more resources to simplify and inform the investment decision making process.

Opportunity

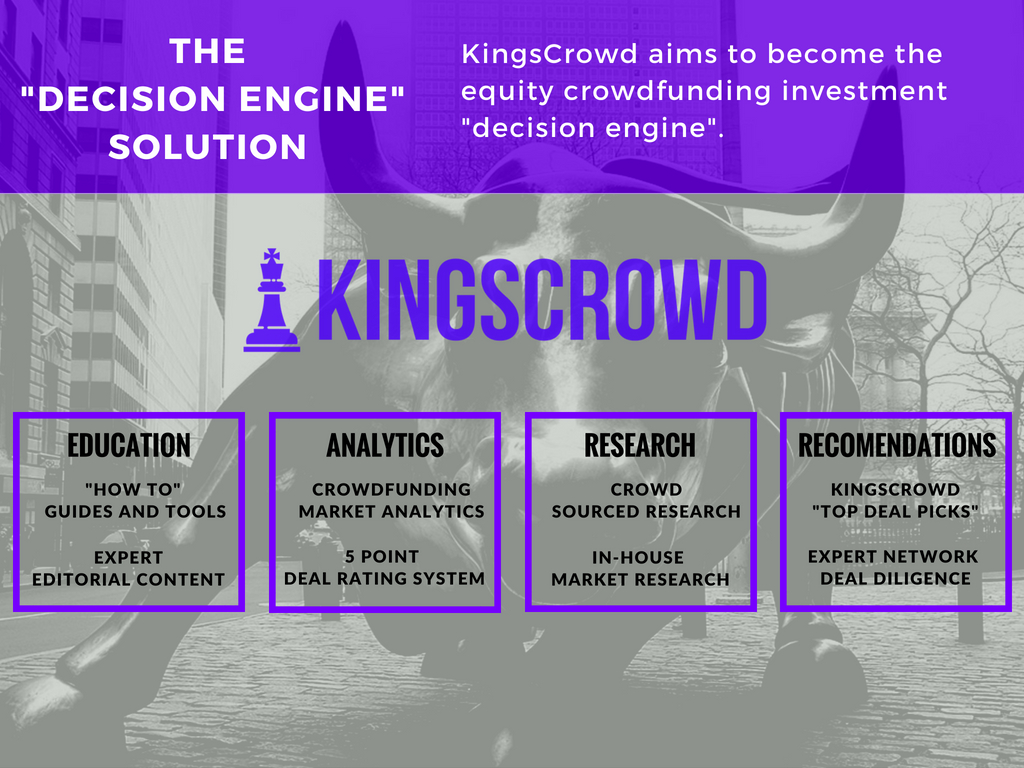

KingsCrowd provides the infrastructure for startup investment decision making. At KingsCrowd, we provide a portal-agnostic research and analytics solution built on four key components:

- Education: We provide expert editorial content in addition to “how to guides” and tools

- Analytics: We offer standardized deal ratings and synthesized data analytics

- Research: We combine in-house market research with crowd sourced research

- Recommendations: We provide KingsCrowd “Top Deal” picks and access to expert network due diligence

What makes KingsCrowd a better, simpler, or smarter experience?

Current solutions:

Current solutions provide deal aggregation, but still put the burden of determining, where, what and who to invest in on you, the individual investor.

The KingsCrowd solution:

Data aggregation in an asset class like startups where few have ever invested before is ineffective because data means nothing without context. KingsCrowd provides context to the startup investing market by providing a framework by which to evaluate startup deals.

Across company stage (seed, series A), equity type (common shares, convertible note, preferred equity), industry, etc., we can help individuals to understand their investment options. And as a third party provider of research and deal recommendations, investors can know they are receiving independent third party evaluations they can trust.

We’re also well positioned as an efficient mechanism to help encourage the growth of the startup investment market as a whole by providing a captured investor audience.

While current platforms and startups have leveraged traditional ad channels, like Facebook and Twitter, these solutions provide poor investor acquisition ROI. Ultimately, KingsCrowd provides a higher investor acquisition ROI solution by capturing warmed investors across the entire startup investment landscape.

Market

KingsCrowd is disrupting the $4.2 Billion Venture Capital due diligence market with a “Morningstar” solution that empowers every person regardless of wealth or financial sophistication to invest confidently in startups.

Our current competitors are primarily focused on deal aggregation, providing little education or recommendations.

- Crowditz: Crowdfunding deal aggregator

- Newchip: Crowdfunding deal aggregator

- Early Investing: Occasional deal recommendations

- Crowdability: Deal aggregation / research

Ultimately, we’re taking a long term vision to this market by building the startup investing “decision engine” focused on providing a comprehensive suite of tools needed to make informed startup investment decisions via online portals.

Progress

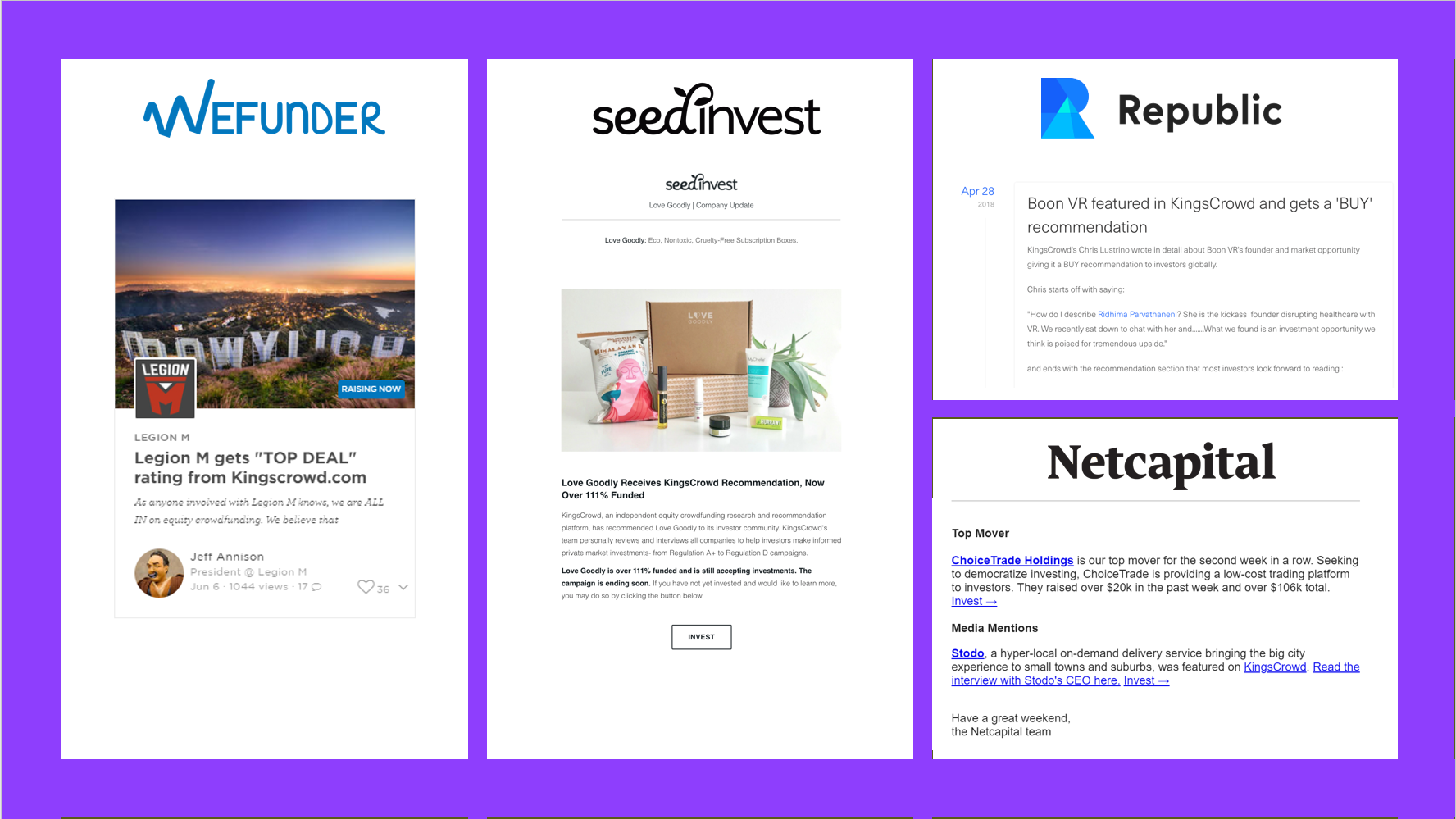

KingsCrowd is currently live with version 1.0 of our website. We’re developing our brand by conducting in-depth founder discussions, producing market and deal research, and selectively recommending 5%-10% of all live deals as “Top Deals”.

We’ve grown our paying audience completely organically, with deal recommendation coverage on Republic, SeedInvest, Wefunder and Netcapital.

Over the next 6 months we will experiment with several traditional paid marketing channels and continue to find ways to work with the portals and startups to distribute our research and recommendations.

Success so far

To date, KingsCrowd has organically built up a user base of thousands of users, started forming relationships with several of the top funding portals, and was recently selected to be a member of theDCU Fintech Innovation Center, a highly selective Fintech focused accelerator in Boston.

We’ve also recently signed on Sean O’Reilly as Chief Content Officer. He is a former Motley Fool Editor who comes to us with an extensive background in equity research and financial market analysis.

Press mentions

Business Model

KingsCrowd.com’s business model has a multi-faceted approach:

- Reader Subscriptions:

- Three-tiered subscription model

- Crowd Membership: $10 per month

- Pro Membership: $20 per month

- Institutional Membership: Custom pricing based on needs.

- Pay for performance advertising

- Crowdfunding platforms (e.g., NetCapital, SeedInvest)

- Banner ads

- Newsletter sponsorship

- $15-$20 / account signup

- Startup Campaign Marketing

- Banner ads

- Premium newsletter placement

- Custom pricing

Team

Founder of Fintech publication, Simple.Innovative.Change, Chris was nominated as Fintech Journalist of the Year by LendIt in 2018, for his coverage of Fintech founders across the alternative investing and lending markets. He also spent 3 years as a strategy consultant for LEK Consulting with a focus on PE deal due diligence and corporate strategy. Most recently, he worked at Freebird, a Travel Tech Startup, where he developed the Sales and Finance Ops function for the team that has raised $8M to date from General Catalyst and Accomplice.

Former Editor and Podcast Host at The Motley Fool, covering energy, industrials, technology and consumer goods, Sean is a content strategist for B2B and B2C organizations, with a passion for the financial markets and enabling individuals to invest confidently. He graduated from Case Western with a degree in Management, Economics and Finance.

John Fanning, Founding Chairman and CEO of napster, has been a pioneer in internet technologies for over 25 years. In addition to his work with napster on the distributed aggregation of content, he has introduced such net-related innovations as client-server game play, voice over IP, and auto-upgrading/authentication. Since 1994, he has founded numerous successful Internet ventures, including napster, NetGames and NetMovies. John attended Boston College and has a background in finance from his work at Fidelity Investments in Boston, MA.

Use of Proceeds

If the offering's maximum amount of $1,000,001 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Working Capital | $451,000 | 45.1% |

| Product development | $500,000 | 50.0% |

| Unallocated Funds | $1 | less than 0.1% |

| Intermediary fees | $49,000 | 4.9% |

Terms

KingsCrowd plans to allocate this fundraising round accordingly:

Research and analytics MVP: 50%

- Continue to improve UI/UX

- Build MVP of crowdsourced research solution

- Build MVP of automated ratings solution / due diligence methodology

Customer acquisition: 30%

- Invest in traditional / market specific channels to build user base of 10-20K users

- Develop understanding of customer acquisition cost to inform at-scale planning

Content production: 20%

- Invest in producing quality market research and deal diligence solutions

- Build out network of editorial contributors

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Membership Units, under registration exemption 4(a)(6), in Kings Crowd LLC dba KingsCrowd. This offering must reach its target of at least $10,000 by its offering deadline of October 15, 2018 at 2:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

The purpose of this offering is to help KingsCrowd build more tools and create compelling content to help investors like you make better investment decisions.

KingsCrowd’s official name is Kings Crowd LLC, so that’s the name that appears in the statements below.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jan 25, 2020KingsCrowd announces the full-time hire of...

- Dec 28, 2019Today, KingsCrowd announces the full-time hire...

- Dec 10, 2019Major News. Today, we announced that we have...

- Aug 13, 2019KingsCrowd received a shoutout in the Boston...

- Jul 10, 2019KingsCrowd's Founder & CEO was interviewed by...

- Oct 15, 2018Primary offering finalized, selling units

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.