Introduction

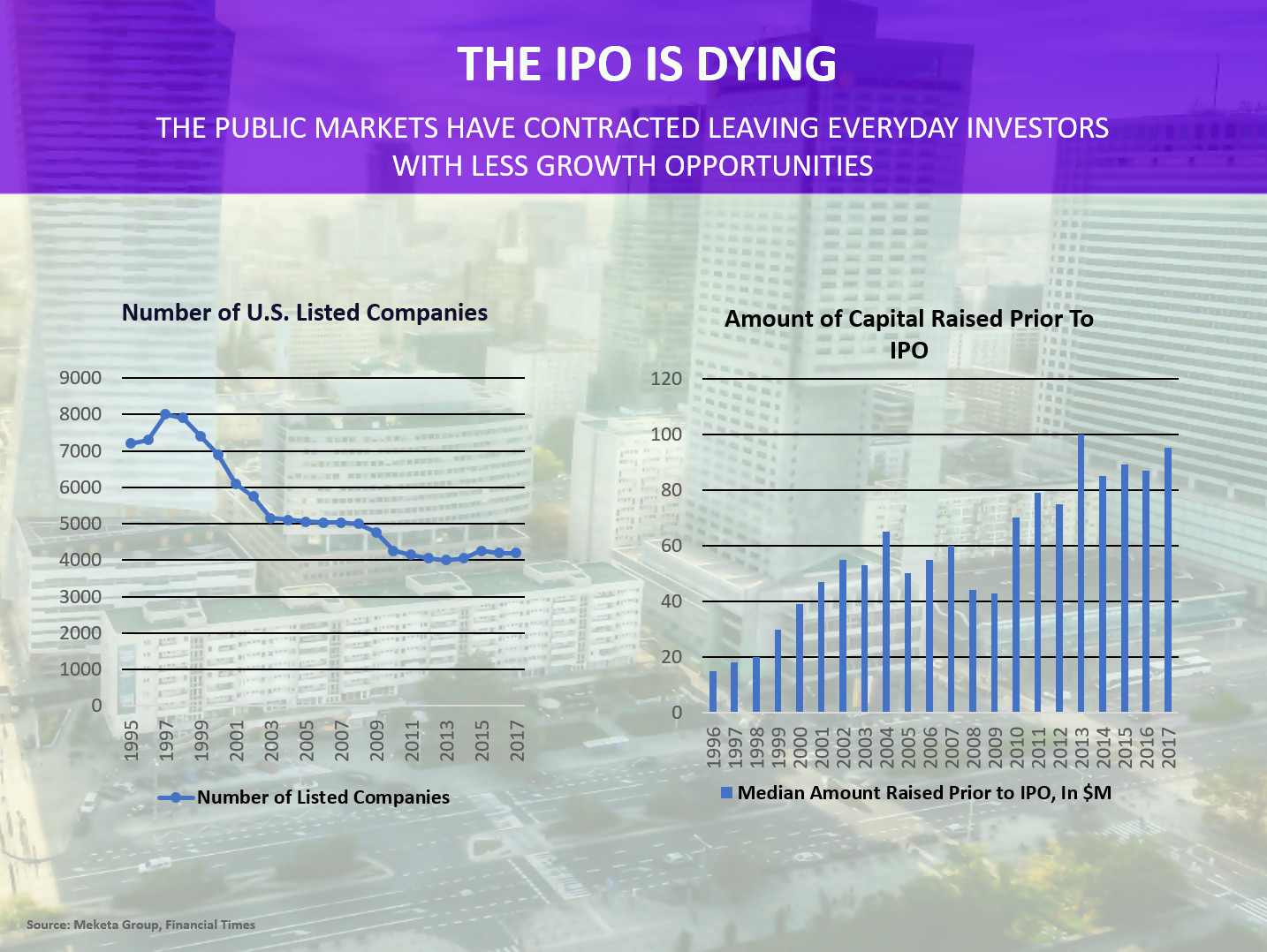

With IPO’s dying and more growth stage investing occuring in the private markets, it is important that investors have access to this $13 trillion asset class.

For years, private equity has been an opaque industry controlled by a small networks of Venture Capitalist and Private Equity shops. Thanks to a change in regulation that was fully enacted 3 years ago (Title III-V of The JOBS Act), now all Americans can invest in private companies including startups and growth stage companies online with more transparency and access then has ever existed before.

Over $1Bn dollars and over 1,000 deals have been invested into companies via Regulation Crowdfunding (Reg CF) and Regulation A+ (Reg A+) deals, which allow non-accredited ‘aka’ non-millionaires to partake in the upside of investing in growthstage companies on marketplaces like Netcapital and continues to grow rapidly. RegCF alone grew over 178% between 2016 and 2017.

Accredited investors can also utilize RegD506c to invest in even more deals online. From pre-seed to pre-IPO, growth stage investments have never been more accessible to the general public.

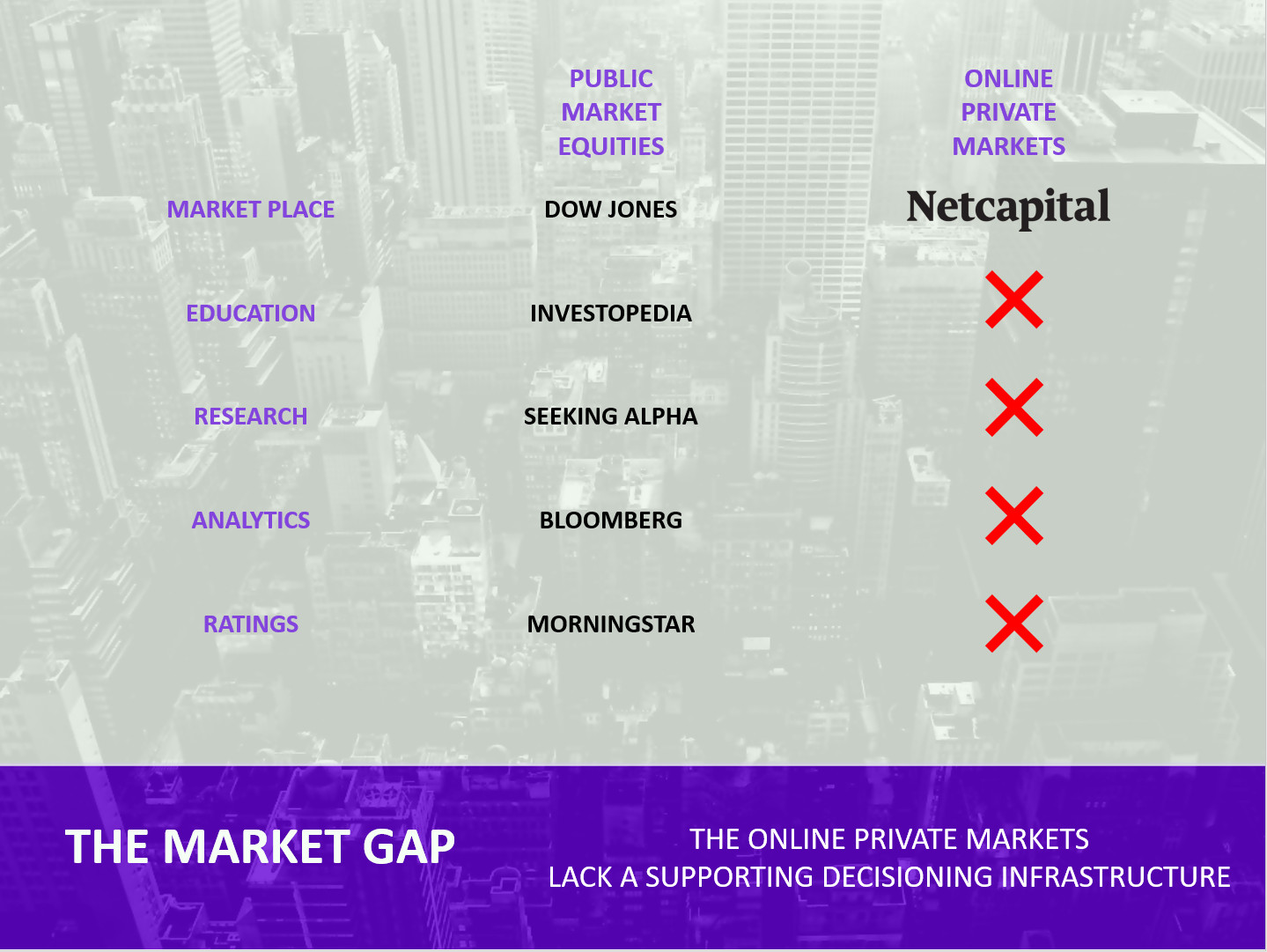

However, a major gap currently exists in this space. If you have ever invested in the public market then you know that there are a plethora of investment decision resources at your disposal: from Investopedia for education, to Zacks and SeekingAlpha for research, to Morningstar for ratings, and Bloomberg for analytics.

Unfortunately, the tools for education, research, ratings and analytics that exist in the public arena don’t exist in the newly accessible online private markets. As a result, investors looking for Reg CF, Reg A+ and RegD 506c deals struggle to find similar independent and unbiased decisioning resources that can help them make informed investment decisions.

It’s like imagining a world where only Dow Jones and Nasdaq existed with no publications or research tools to figure out where to find good deals to partake in and what deals to avoid. It’s a major gap and hindrance to individuals/institutions trying to invest in this asset class.

This lack of decisioning resources, along with a general lack of awareness around the private market asset class from investors leads them to:

- Not partake in startup investing at all

- Not partake in more than 1 deal (due to poor experience)

- Partake, but without making an optimized investment decision

If we want this new emerging market to grow efficiently, then we need more resources to simplify and inform the investment decision making process.

Solution

The KingsCrowd Solution:

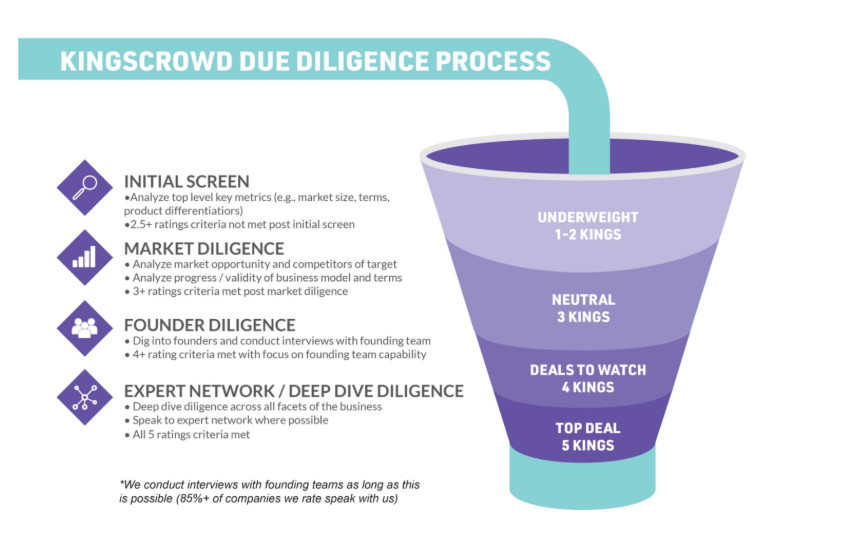

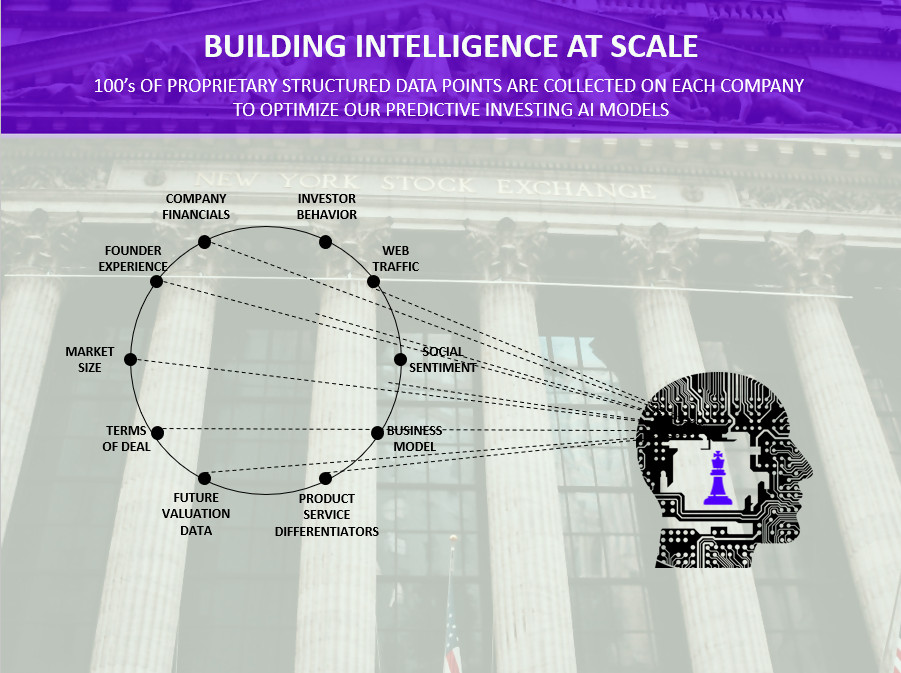

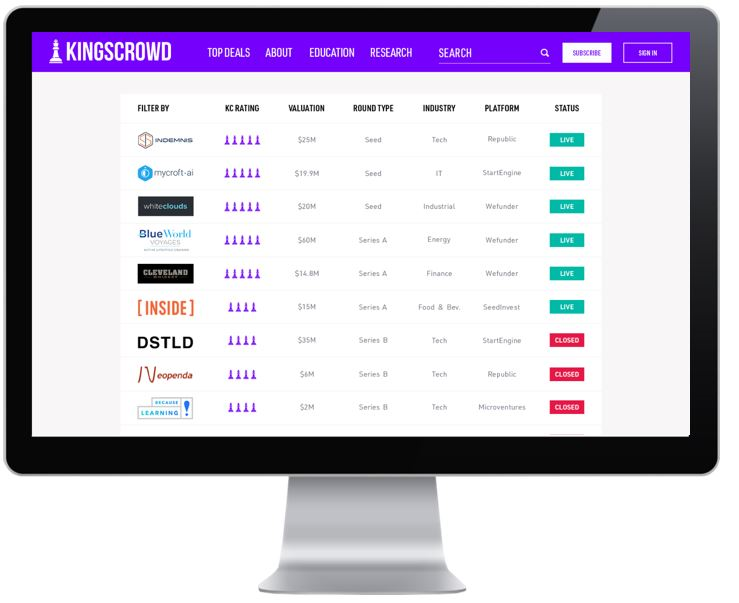

KingsCrowd is building the first independent and unbiased data driven online private market ratings and analytics platform powered by artificial intelligence that captures, rates, and tracks growth stage companies.

We are working to build the most comprehensive database of rated* private companies across key metrics, augmented by financial and operating data required to be filed by the SEC, and follow on funding / performance data from outsourced providers.

Through our robust in-house proprietary due diligence we are taking the guesswork out of investing in this asset class.

This enables KingsCrowd to create a predictive Artificial Intelligence (AI) driven startup investing platform that allows us to identify the factors that drive outsized startup investment returns…

Something that has never been possible because of a lack of data transparency, which is solved for by platforms like Netcapital.

Our data driven ratings platform will enable both individual and institutional investors to build diversified portfolios in a quick, informed way.

Note: *Companies are rated across market size, founder experience, terms, business model, product / service differentiators. Within each of these rating criteria are three 10 point scales that are standardized to create 15 standardized proprietary structured data points to inform our rating scores.

The Competitors

Over the past 9 months the competitors we initially identified have become more allies than competitors.

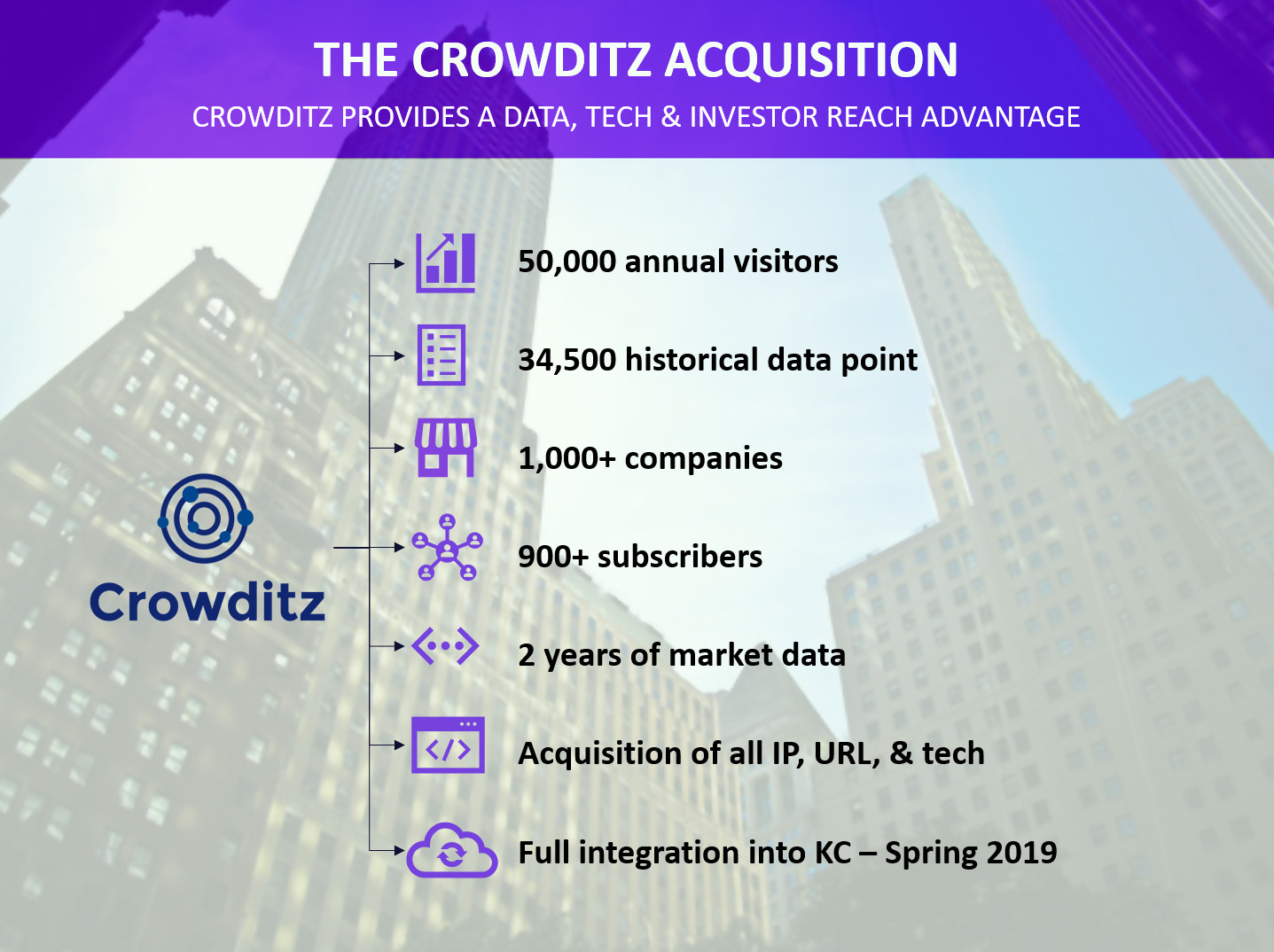

In fact, we acquired one of our competitors in Crowditz, which has provided us a significant advantage as this team had been collecting data on the RegCF market for the past couple of years.

The CTO of Crowditz has continued to support our efforts to integrate Crowditz into our new data architecture, which will enable our future AI efforts.

We have also built relationships with some of our other competitors where we execute on joint initiatives. We truly believe in the idea that 1+1=3, and that working to build a collaborative ecosystem will benefit all of us in an outsized way.

Business Model

Over the past 9 months we have learned what our customer looks like.

Amongst our 3,500 subscribers, our core user is a 35-55 year old individual slanted towards males, who make $100K to $250K+ per year and are looking to invest $10K+ into private companies yearly. Historically these individuals have invested in 10+ private companies to date on platforms like Netcapital.

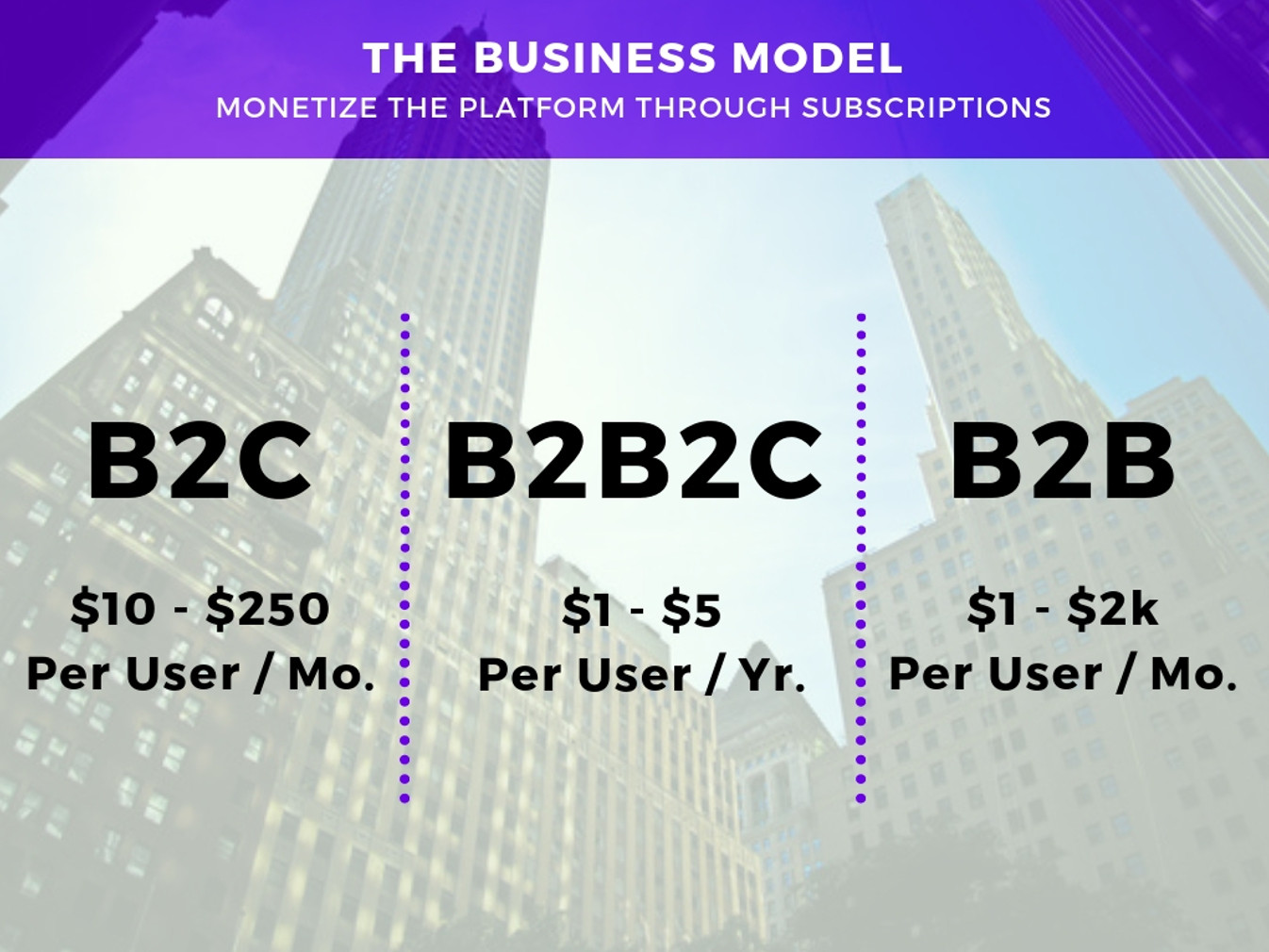

With this user profile, we have focused on three distribution channels for selling the KingsCrowd ratings and analytics products and have engaged in business development discussions with 15+ financial organizations that cater to this type of individual with several discussions moving into the later stages.

Collectively these channels represent over 60M potential users for KingsCrowd to pursue. We plan to monetize utilizing subscriptions / licensing deals as illustrated below.

Over the next 2 years with the capital raised we plan to get 2-3 licensing partnerships live with 500K+ users accessing KingsCrowd ratings, have 5-10 family offices representing 500+ families live, and have 25K individual subscribers to the KingsCrowd platform.

Progress

Since launching KingsCrowd in May of 2018, we have made significant strides on capital raising, product development and distribution.

As mentioned above, from a distribution / business development perspective our acquisition of Crowditz gives us a data advantage and accelerates our ability to build out our ratings platform. We also acquired all subscribers in the acquisition.

Additionally, we have developed our thinking around how to scale this business cost efficiently by partnering / licensing our ratings through larger distribution channels (e.g., self-directed IRA providers, alternative brokerage accounts, financial publications, B2B) and have built a deep pipeline of business development sales opportunities across all of these key channels.

Some names we have started to collaborate with include Rocket Dollar, Wealth Noir, and Newchip. We have also started working with other key players in the space that we can’t disclose just yet, but collectively represent 100’s of thousands of users that will have access to KingsCrowd ratings.

We’ve also bolstered our advisory board with experts across data science, venture capital, marketing and strategy who are helping to shape KingsCrowd.

Press

- The DCU FinTech Innovation Center Announces Summer 2018 Cohort

- KingsCrowd Provides Actionable Startup Investment Research

- Startup Spotlight: KingsCrowd

- KingsCrowd Wants to Become Morningstar of Crowdfunding

- Most Influential Entrepreneurs of 2018

- How I Maxed Out My First Equity Crowdfunding Raise

- KingsCrowd Building A New Rating System For Startups

Team

Founder of Fintech publication, Simple.Innovative.Change, Chris was nominated as Fintech Journalist of the Year by LendIt in 2018, for his coverage of Fintech founders across the alternative investing and lending markets. He also spent 3 years as a strategy consultant for LEK Consulting with a focus on PE deal due diligence and corporate strategy. Most recently, he worked at Freebird, a Travel Tech Startup, where he developed the Sales and Finance Ops function for the team that has raised $16M to date including General Catalyst and Accomplice.

Former Editor and Podcast Host at The Motley Fool, covering energy, industrials, technology and consumer goods, Sean is a content strategist for B2B and B2C organizations, with a passion for the financial markets and enabling individuals to invest confidently. He graduated from Case Western with a degree in Management, Economics and Finance.

John Fanning, Founding Chairman and CEO of napster, has been a pioneer in internet technologies for over 25 years. In addition to his work with napster on the distributed aggregation of content, he has introduced such net-related innovations as client-server game play, voice over IP, and auto-upgrading/authentication. Since 1994, he has founded numerous successful Internet ventures, including napster, NetGames and NetMovies. John attended Boston College and has a background in finance from his work at Fidelity Investments in Boston, MA.

Mike Even is an investment professional with over 35 years of industry experience. Mike worked for Citigroup for nine years building a global asset management organization. After Citi merged with Travelers, he became global CIO of the Private Bank and eventually, global CIO for and Co-Head of Citigroup Asset Management, overseeing investment teams running more than $500B in client assets. Following his time as CIO of Citi, he spent several years as President and CEO of Man Numeric, a quantitative driven investment firm. He is currently an adviser to Forge.AI, and Quantopian. He also spends time working closely with the Massachusetts Pension Reserves Management Board (PRIM).

Jenn Lee was the Director Of Technology of StreetAccounts. She built the tech behind the real time analytics platform that catered to the public markets, which was acquired by FactSet in 2012, where she spent time as Lead Software Engineer. She currently serves as Senior Software Development Manager at Amazon where she works on Audible features for Alexa. She has extensive experience in application and database architecture, Agile project management, as well as growing high-performing and diverse software engineering teams.

Patrik Hellstrand, an entrepreneurial executive with broad experience working with lifestyle and luxury companies, is the CEO of by CHLOE, a plant-based fast-casual restaurant brand based in New York, NY.

He was the Founder of SQInsight Hospitality, which was a hospitality service analytics and technology product development company, and is currently the founder and author of thrivewired (www.thrivewired.co), an original and curated content-driven site offering advice on tackling the challenges of excelling in a growing business while achieving a thriving life. He has a keen focus on growth strategies, revenue growth and customer-centricity.

Barry is currently the Chief Operating Officer at Cecelia Health, a venture-backed healthcare technology company focused on improving the lives and health outcomes of people living with diabetes and related chronic conditions. Previously he started up and scaled five businesses in emerging markets while a General Manager at Microsoft, was an Operating Partner at a venture capital firm that invested in technology-enabled business services, a VP of Early Stage Product and Business Development at a NYSE listed corporate payment and business solutions company, and a Chief Operating Officer of several technology startups.

John Engle is the President of Almington Capital, a merchant banking and venture capital firm founder in 2013, which is reimagining the merchant banking concept. He is also a business adviser to Redcrow, an online private market focused on funding healthcare related startups.

Use of Proceeds

If the offering's maximum Reg CF allocation of $902,952 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Management Compensation | $162,532 | 18.0% |

| Technical/Engineering Compensation | $180,590 | 20.0% |

| Investment Team / Research Compensation | $338,607 | 37.5% |

| Marketing / BD Expenses | $135,443 | 15.0% |

| Legal / Admin | $41,535 | 4.6% |

| Intermediary fees | $44,245 | 4.9% |

If the offering's maximum amount of $1,000,001 across Reg. CF and Reg. D is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Management Compensation | $180,000 | 18.0% |

| Technical/Engineering Compensation | $200,000 | 20.0% |

| Investment Team / Research Compensation | $375,000 | 37.5% |

| Marketing / BD Expenses | $150,000 | 15.0% |

| Legal / Admin | $46,001 | 4.6% |

| Intermediary fees | $49,000 | 4.9% |

Terms

KingsCrowd plans to allocate this fundraising round accordingly over the next 2 years:

Ratings and analytics platform: 30-40%

- Hire 1 full time Full Stack Developer

- Invest in developing and launching the full ratings platform

- Improve UI/UX and continue to add user features

- Tailor product for B2B, and B2B2C sales: Buildout of APIs

- Invest in initial data science to enable future AI capabilities

Research Team: 20-30%

- Hire 1 full time Director of Investments and and 1 full time Investment Analyst

- Enable KC to rate all companies raising capital via FINRA registered platforms

- Develop streamlined processes for generating ratings reports

- Produce supporting educational content and industry analysis for readers

Business Development / Customer acquisition: 30-40%

- Invest in traditional / market specific channels to build user base

- Invest in pursuing larger BD deals with large IRAs, brokerage accounts, and financial publications

- Invest in sales to family offices and hedge funds

General/Admin: 5-10%

- Invest in office space, legal support, etc.

This is a side-by-side offering of Membership Units, under registration exemptions 4(a)(6) and 506(c), in Kings Crowd LLC, doing business as KingsCrowd. Up to $902,952 may be raised under the 4(a)(6) exemption. Netcapital will determine which exemption applies to your investment and notify you before you complete your investment.

The amount raised under the two exemptions must total at least $10,000 by March 13, 2020 at 11:55pm ET. If the total doesn’t reach its target, then your money will be refunded. KingsCrowd may issue additional securities to raise up to $1,000,001, the offering’s maximum.

If the side-by-side offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

The purpose of this offering is to help KingsCrowd build more tools and create compelling content to help investors like you make better investment decisions.

KingsCrowd’s official name is Kings Crowd LLC, so that’s the name that appears in the statements below.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemptions 4(a)(6) and 506(c) of the Securities Act of 1933. Similar information is sometimes offered in a Private Placement Memorandum for 506(c) offerings.

We’re also required to share links to each of the SEC filings related to this side-by-side offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Mar 14, 2020Primary offering finalized, selling units

- Jan 25, 2020KingsCrowd announces the full-time hire of...

- Dec 28, 2019Today, KingsCrowd announces the full-time hire...

- Dec 10, 2019Major News. Today, we announced that we have...

- Aug 13, 2019KingsCrowd received a shoutout in the Boston...

- Jul 10, 2019KingsCrowd's Founder & CEO was interviewed by...

- Oct 15, 2018Primary offering finalized, selling units

- Aug 11, 2018Primary offering finalized, selling units

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.