Team

Problem

Hollywood is in trouble: too many new choices in movies, series, and streaming platforms have consumers frustrated deciding what to watch. Meanwhile, the very same streaming services are desperately competing for subscribers, with new platforms emerging each week.

Billions are spent, and sometimes wasted, every year producing and marketing ever more content. And as the stakes go up, originality diminishes. How many more reboots and sequels will it take before people have had enough?

While the fight for eyeballs and attention has never been more competitive, Hollywood remains unable to capitalize on actionable, data driven insights. Entertainment companies are forced to make decisions based on historical precedent rather than real time, authentic audience demand.

Solution

The legacy system of Hollywood needs a new way of understanding and analyzing content–an empirical, objective way of organizing itself. Enter the Katch Media Genome, an advanced language that captures the unique, personalized reasons why we like what we like. Designed by Dr. Nolan Gasser, the genome is the foundation of Katch’s analytics and recommendation technology.

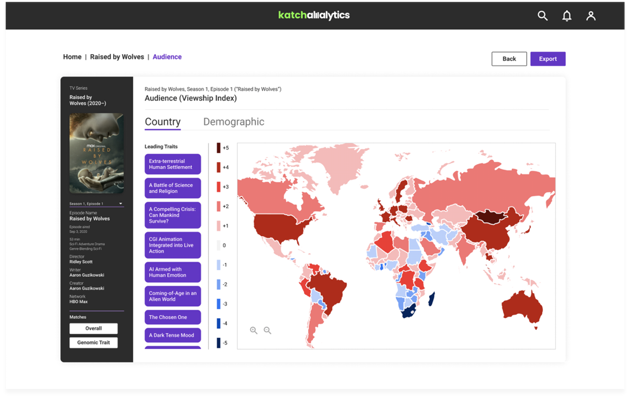

Using the Genome, Katch has built a series of Media Market Indexing products that predict where a film or series will perform better or worse across cities, countries, and even demographics. Like the “Google Maps” of filmmaking: we tell you where you should go, how to get there, and which routes to avoid.

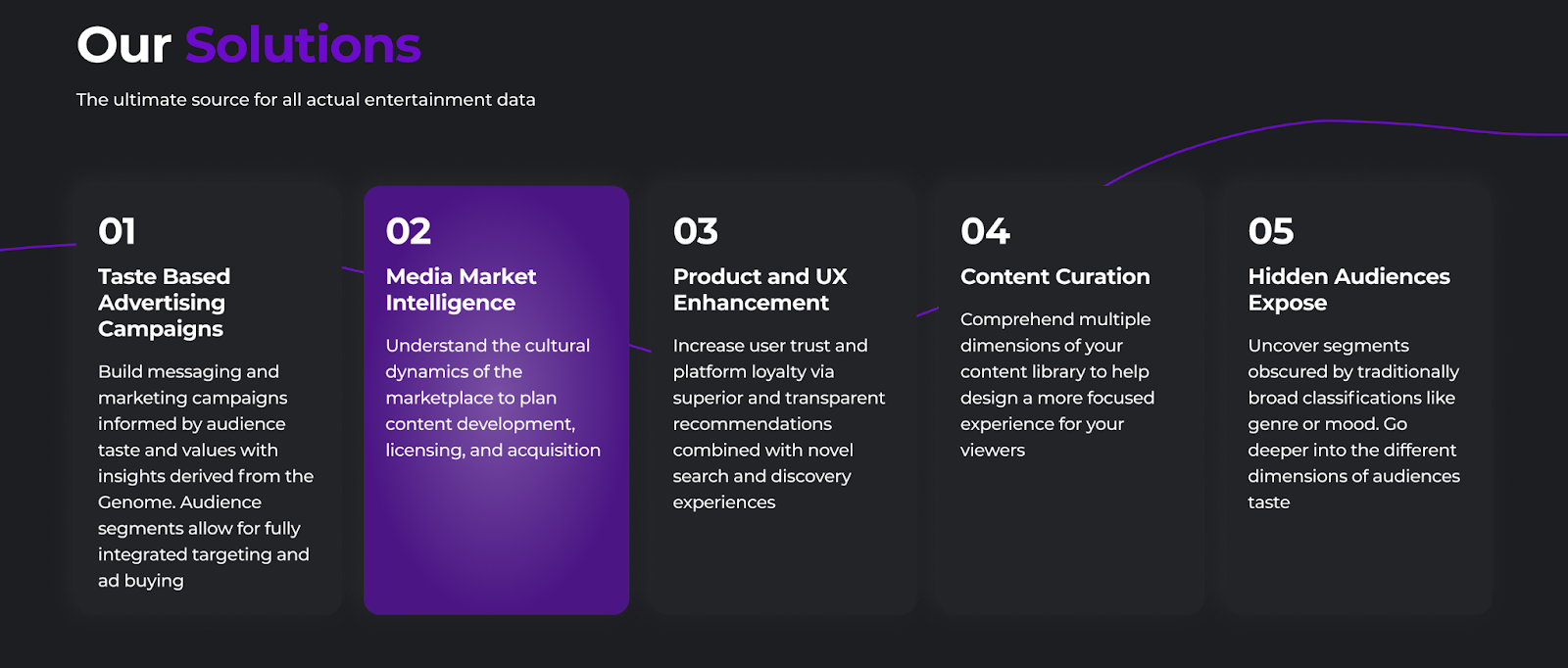

The same indexing capability that predicts geographic success can be paired with media buying audiences too: Katch’s Genomic Media Segments are built from our expertise in consumer data. These media buying audiences completely upend the way products are targeted and campaigns are designed. Rather than building messaging around broad demographic groups or behavioral segments (“repeat customers” or “frequent shoppers”), Katch’s Genomic Media Segments are defined by consumer taste. This allows marketers to build incredibly sticky campaigns with powerful emotional resonance, driving up conversion rates, brand equity, and lifetime value metrics.

Genomic traits explain the reasons why different films have unique resonance in different countries. This “explainability” factor offers unprecedented levels of personalization and targeting for a multitude of use cases.

Business Model

As a B2B entertainment-focused data analytics company, the beauty of Katch is that our technology solutions touch every part of the content lifecycle.

Pre Product / Early Revenue:

Consulting/Project Based

- Retainer-C-Level Advisory

- Time/Materials or Project P&L

- Data Exchange

Post Product Launch / Post Proof of Concept:

Annual License Fee (SaaS)

- Modular/Product Based

- Volume Based

- Contract Length

Placement Strategy

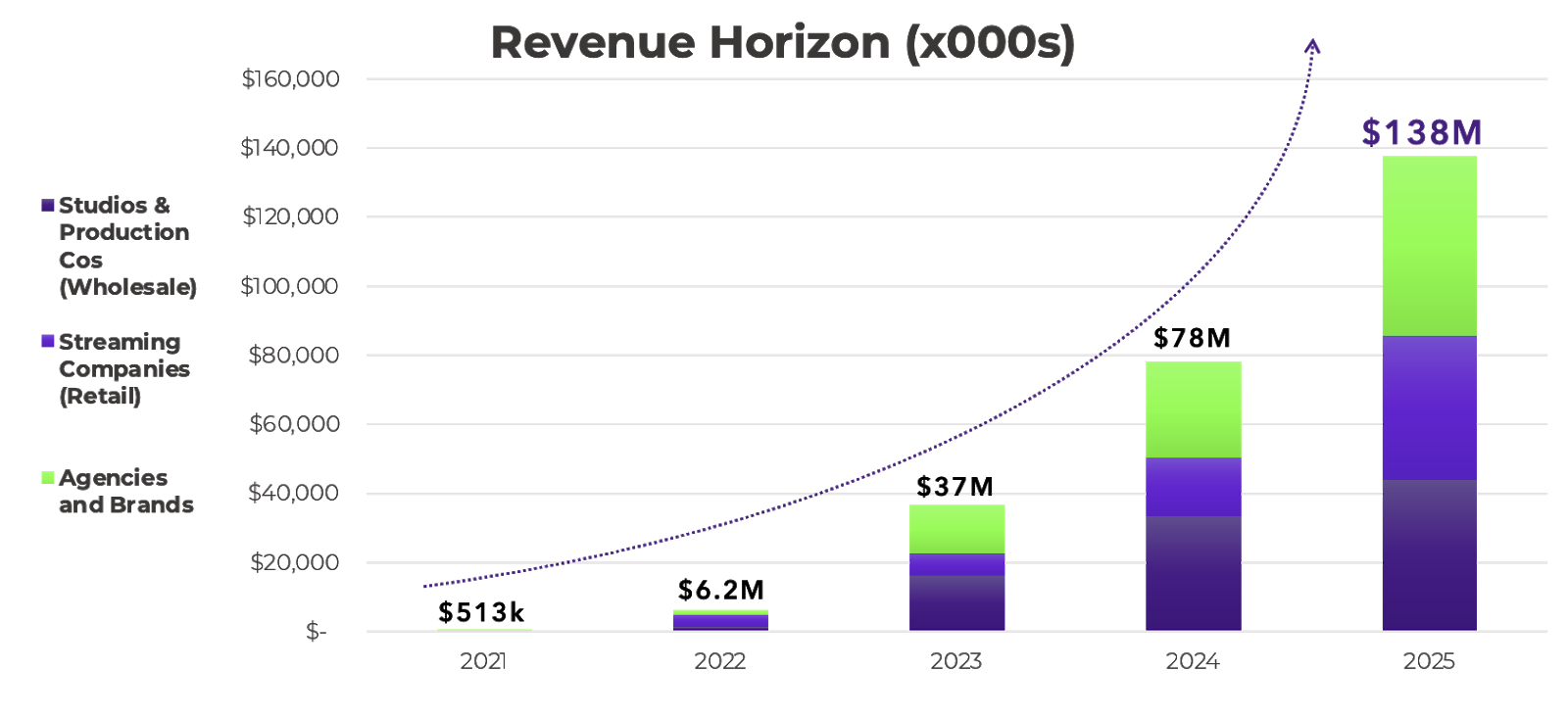

Initial Approach: B2B in entertainment industry ecosystem (content creation, acquisition, and distribution players) focused on Tier 2/3 evolving to Tier 1

3-5 Year plan: B2B in broader Marketing Agency Ecosystem utilizing licensing fee approach and "story telling" key learnings to capture 1.5 % -2 % of $5.4 Billion TAM

Market

Thankfully, data-driven approaches have never been more in demand: Amazon, Apple and Roku use their networks to drive sales of their devices and services, while Disney uses data collected on their streaming apps to sell more cruises, merchandise, and theme park visits.

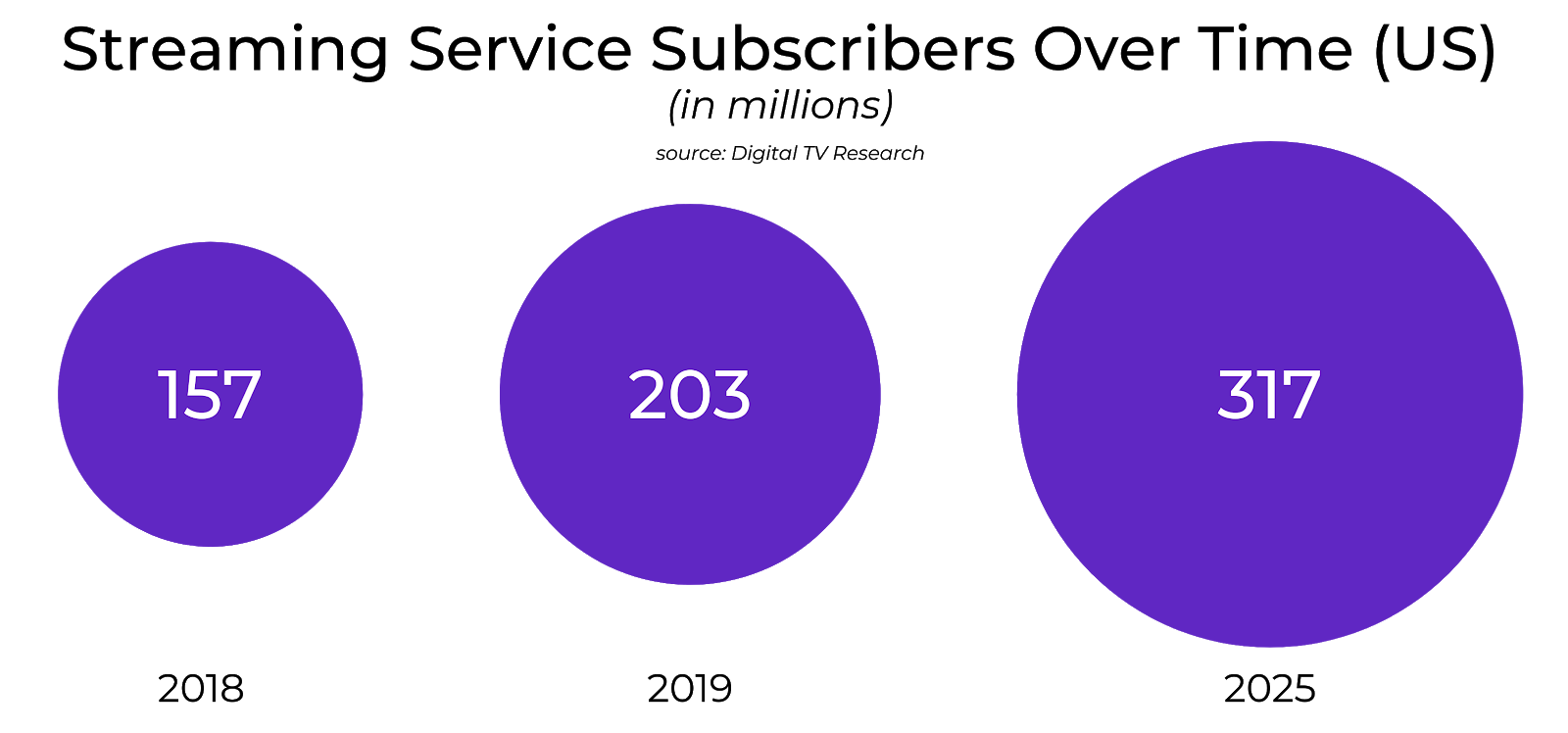

The sustained fire of the streaming wars means that entertainment companies absolutely need to understand their audiences better in order to stay relevant. In the last 10 years, Netflix has created a revolutionary and fundamentally data driven business model that every major entertainment player is now trying to replicate and enhance. This is evidenced in the massive increase in streaming service subscribers over the last several years

Hollywood also has a glaring diversity problem. McKinsey reported in March 2021 that the entertainment industry is missing out on at least $10 Billion in unrealized revenue due to the lingering effects of historical and ethnic bias. This unrealized potential results from the very same legacy systems that have failed to capitalize on high tech and big data. A genomic approach to content is inherently objective and empirical, optimized to remove personal bias while focusing on the real, emotional factors behind audience taste.

A more data driven industry is also a more equitable one.

Success To Date

So far in 2021, Katch has:

- Signed our first alpha client in the marketing agency space

- Negotiating SOWs with two streaming platforms

- Added two new strategic advisors

- Engaged in high level discussions with 5+ streaming companies for strategic analytics services

- Released MVP of Media Market Indexing Dashboard and Intelligence APIs

- Released a new version of the Genome 2.0

Press

Use of Proceeds

If the offering's maximum amount of $249,400 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Sales and Marketing | $147,179 | 59.0% |

| Research & Development | $25,000 | 10.0% |

| Product | $65,000 | 26.1% |

| Intermediary fees | $12,221 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Katch Entertainment Inc.. This offering must reach its target of at least $10,000 by its offering deadline of February 7, 2022 at 10:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Feb 8, 2022Primary offering finalized, selling shares

- Jan 31, 2022At the end of last year we oversubscribed our...

- Dec 22, 2021Last week was a great week for Katch and this...

- Sep 10, 2021On Wednesday there was a great Q&A interview...

- Jul 28, 2021Katch has officially launched their Consumer...

- Jul 12, 2021Katch has recently executed a pilot agreement...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.