Introduction

Infinovate is a time savior to financial advisors across the United States.

Infinovate is one kickass real time financial platform that calculates complex performance analytics and builds individualized Fund and predictive models that uniquely meet the needs of financial advisors, family offices, analysts and investors seeking to create their own models and track individual performance.

Deal Highlights

- Highly Experienced Management Team

- 3 years of testing by a high growth Registered Investment Advisory firm

- Online, real time, predictive modeling platform

- Managed by the user

Problem

There are too many Mutual Funds to keep track of, even for experienced institutional investors.

It is possible but impractical (and outright ridiculous) to cram 30,000 Mutual Funds into excel spreadsheets. Spreadsheets are unwieldy and don’t offer valuable features like predictive modeling.

For investors, this means it can be very difficult to track the performance of funds, pick investments, or measure estimated returns.

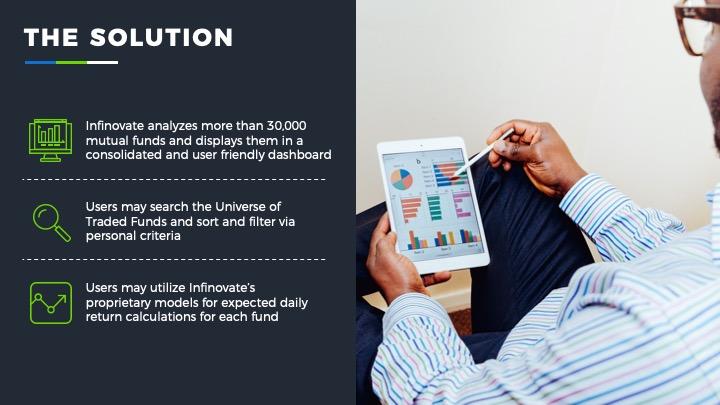

Solution

It takes an average of 8 hours to build a financial model from scratch in an excel spreadsheet.

With Infinovate, investors can use minimal clicks (3 max) and the ability to sort and filter through voluminous amounts of data to construct financial models seamlessly and efficiently.

We have built a real time financial platform that calculates complex performance analytics, builds individualized fund and predictive models that uniquely meets the needs of financial advisors, family offices, analysts, and investors seeking to create their own models and track individual performance.

Business Model

Infinovate plans to use a hybrid business model, combining a SaaS subscription model with additional advisory services for some clients.

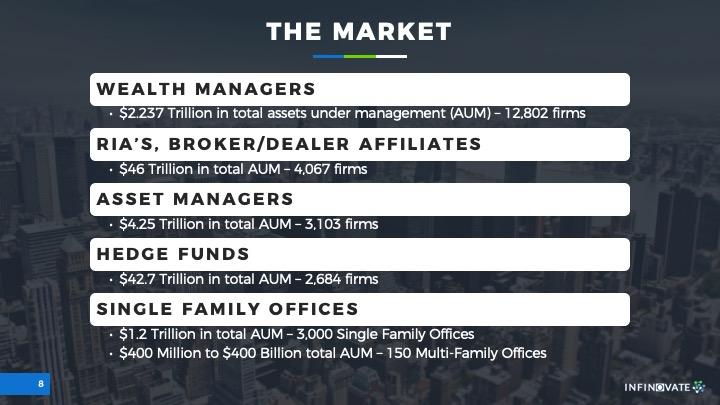

Market

The market focus is on financial entities that hold significant amounts of liquid assets under management (AUM). The amount of AUM indicates the need for investment analysis and predictive analytics. Infinovate does not receive any compensation based on an entity's amount of AUM but may received compensation based on the investment activity of the AUM.

Competitive Landscape

Progress

The Company has developed the platform and tested the analytics over the past 3 years. The Company has completed the basic product development and testing.

The Company is seeking funds to take the operating platform and analytics to market.

Team

Use of Proceeds

If the offering's maximum Reg CF allocation of $1,070,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $280,975 | 26.3% |

| Technology Development | $257,765 | 24.1% |

| Debt Reduction | $277,125 | 25.9% |

| Marketing | $201,705 | 18.9% |

| Intermediary fees | $52,430 | 4.9% |

If the offering's maximum amount of $2,000,000 across Reg. CF and Reg. D is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $350,000 | 17.5% |

| Technology Development | $500,000 | 25.0% |

| Debt Reduction | $250,000 | 12.5% |

| Marketing | $300,000 | 15.0% |

| Additional Hiring | $250,000 | 12.5% |

| Administrative/Legal Cost | $252,000 | 12.6% |

| Intermediary fees | $98,000 | 4.9% |

Terms

This is a side-by-side offering of Class Reg CF Common Units, under registration exemptions 4(a)(6) and 506(c), in Infinovate LLC. Up to $1,070,000 may be raised under the 4(a)(6) exemption. Netcapital will determine which exemption applies to your investment and notify you before you complete your investment.

The amount raised under the two exemptions must total at least $10,000 by December 4, 2020 at 11:59pm ET. If the total doesn’t reach its target, then your money will be refunded. Infinovate LLC may issue additional securities to raise up to $2,000,000, the offering’s maximum.

If the side-by-side offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemptions 4(a)(6) and 506(c) of the Securities Act of 1933. Similar information is sometimes offered in a Private Placement Memorandum for 506(c) offerings.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Dec 5, 2020Primary offering finalized, selling units

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.