Introduction

Harmonee provides adaptable and affordable digital life insurance products. We are focused on providing younger and minority populations with faster, simplified application processes and products that can adapt to their changing life over time. Harmonee will provide B2B partners with the ability to easily integrate our solution into their workflow expanding their portfolio of products and drastically reducing the follow up time to close sales.

Problem

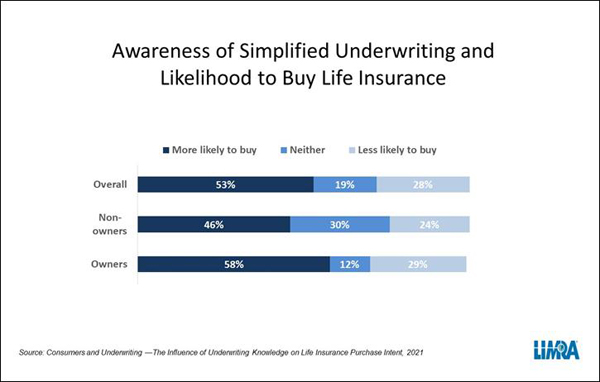

In the United States there is an $11 trillion financial gap due to underinsurance of life insurance. LIMRA research reported 60 million US households are uninsured/underinsured and 46% of the population has no life insurance at all. Younger demographics are buying life insurance at a much lower rate than their parents. Black and brown communities have 70% less coverage than their white peers. This creates a huge wealth gap and a burden making it tough to pass on wealth.

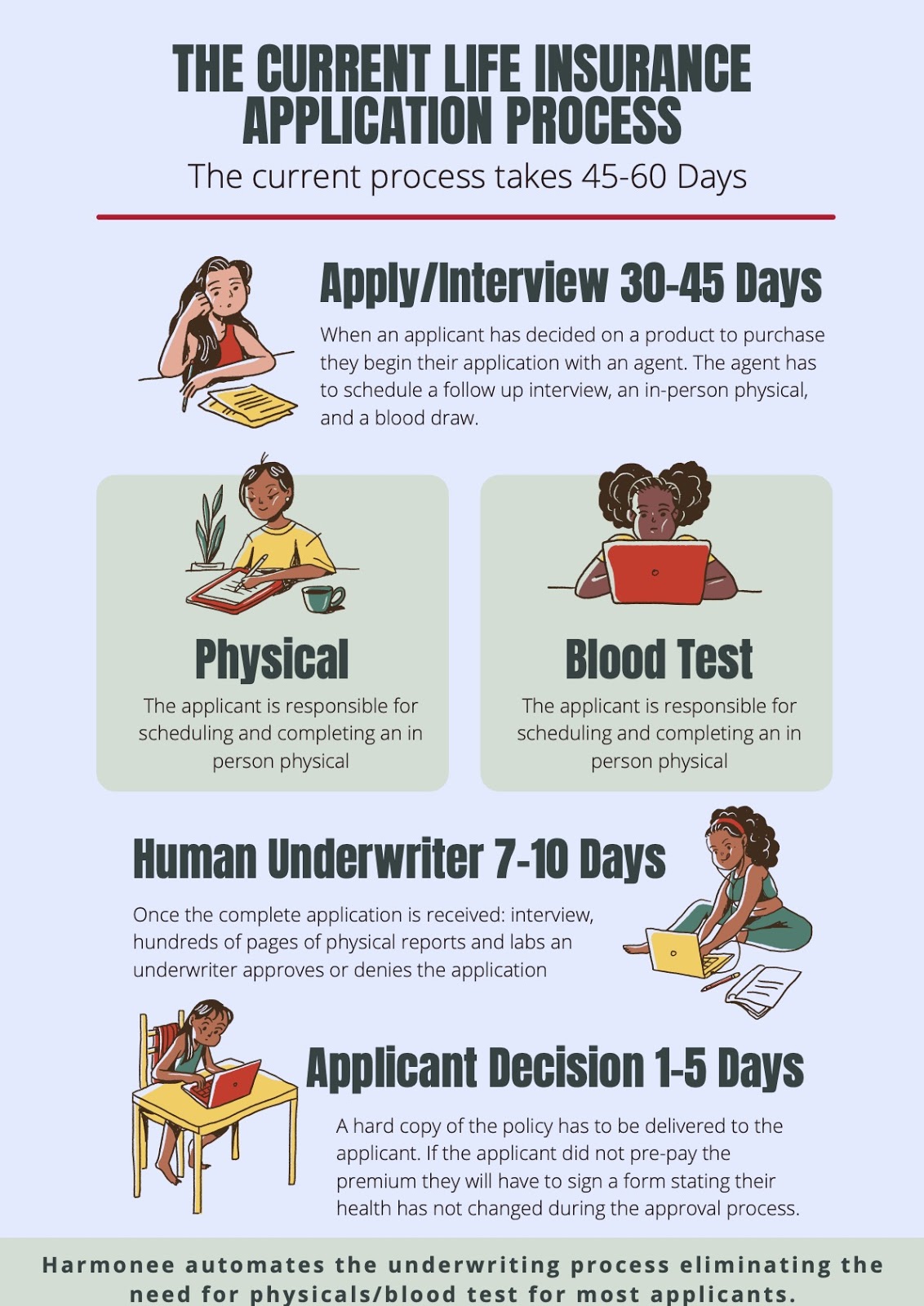

The two biggest problems with life insurance are:

- The time it takes to underwrite a policy

- The way that policies are currently being sold

Solution

Harmonee is developing a cutting edge process to drastically reduce the life insurance application processing time down from 45 days to under 1 hour. With the integration of more data points and an enhanced AI-driven risk profiler, Harmonee will have the ability to greatly reduce human error from the current process.

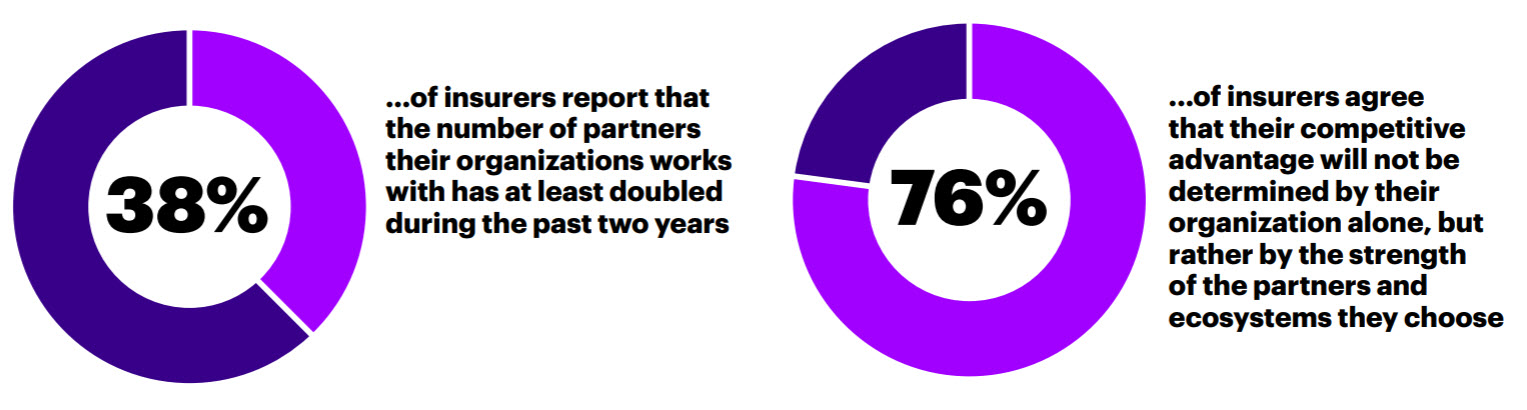

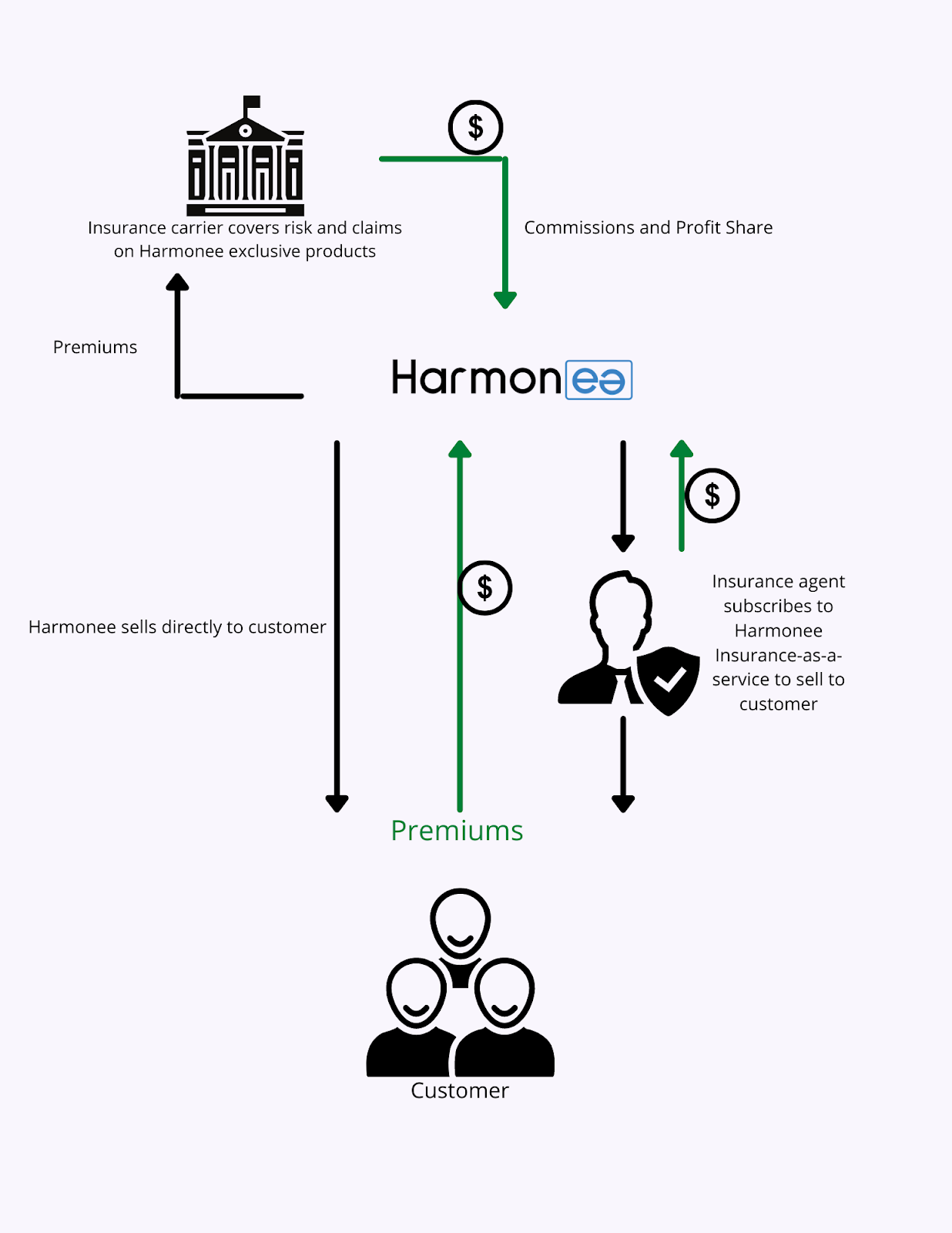

Through our proprietary health device integration solution, the opportunity to provide flexible plans based on lifestyle changes and life events will be more accessible. Our customers get the coverage they need, when they need it, at the right price. Harmonee plans to work directly with customers in a B2C model while also enabling agents and other insurance platforms to use its insurance-as-a-service to extend their offerings.

Business Model

We plan to partner with insurance carriers that will take on the risk of underwriting, financially backing our life insurance products. We envision Harmonee serving as a platform that receives commissions and profit sharing from the sale of our proprietary life insurance products. Our platform will have the opportunity to be utilized by independent life insurance agents by providing them our application programming interface (API). Sales via the agents will help generate revenue through commission.

Market

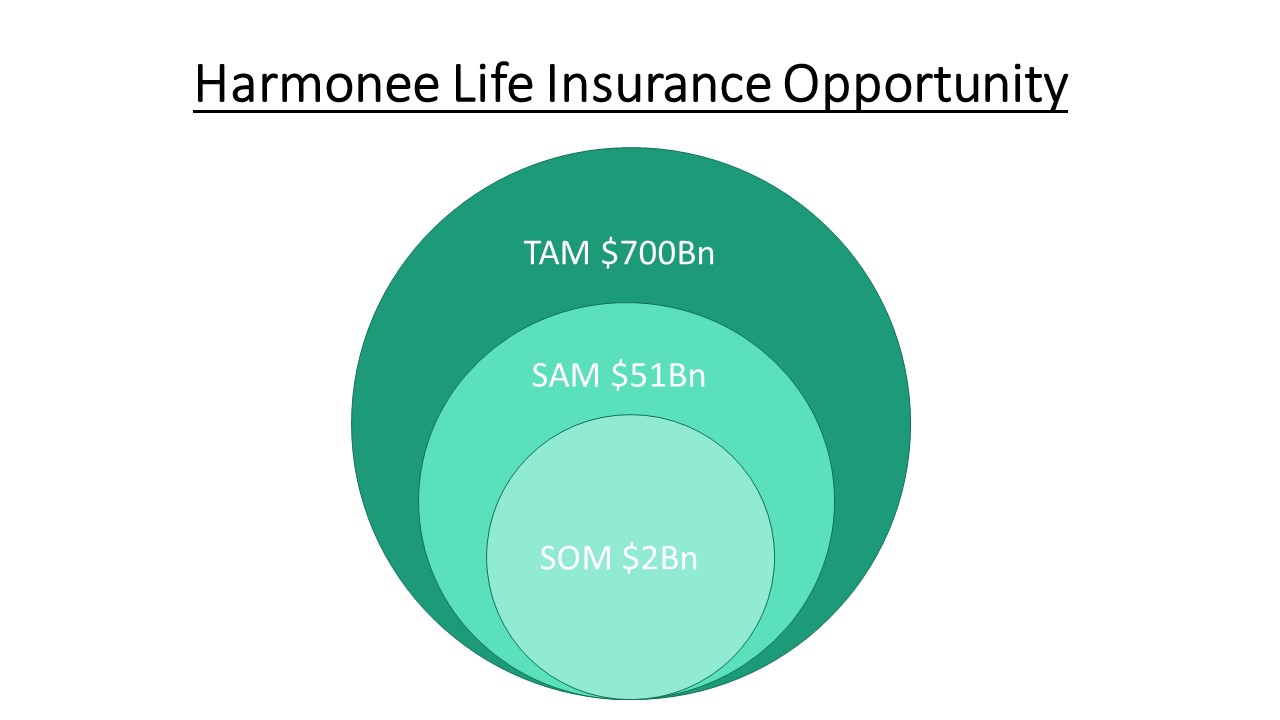

- According to Research and Markets, the life insurance market is currently a $700 billion industry with 10.4% compound annual growth rate (CAGR). The market is projected to expand to $2.3 trillion by 2030.

- On average, term life insurance costs $26/mo or $312/yr. A highly fragmented market with 770 firms in the US, many are regional or local players without high levels of complexity or ability to expand nationally.

US New Market Opportunity

- The US life insurance market is large. The 2020 LIMRA Barometer Study reported there are 184 million people or 46% eligible (21-65) in the US, meaning a $26.4 billion untapped market.

- Our potential new market share opportunity: 6%

- Serviceable Obtainable Market (SOM): $1.6 billion

US Current Market Opportunity (underinsured)

- The current market has 60 million underinsured households. With 78.8 million people (21-65), the current market opportunity sits at $24.6 billion.

- Our potential current market share opportunity: 2%

- Serviceable Obtainable Market (SOM): $492 million

- The current market and untapped market total $51 billion, providing Harmonee the opportunity to change lives for the better.

Success To Date

- Accepted/completed Founder Gym accelerator and Y-Combinator Startup School

- Formed relationships with 3 major universities & corporate clients

- Developed go-to-market strategy & roadmap enrolling 100+ users

- Performed 500+ user & expert interviews, leading to beta product development cycle

- Networked with over 200 independent agents and customers

- Pre-orders/test orders from 2 large independent agent groups

- Successfully obtained insurance license in the state of Texas (ability to sell within 25 other states through reciprocity)

- Successfully identified reinsurance broker to obtain an insurance partner

Team

An experienced product and product marketing manager in SaaS and cloud based products for Adobe, Intel, John Deere Cloud Solutions, and launching a telehealth platform focusing on low-middle level mental health concerns. Anthony has led and operated Sangus Partners, his own technology focused investment fund focusing on SaaS based companies. He’s a licensed life insurance agent in Texas, leading organic growth marketing and sales initiatives as well as partnership acquisitions. A 2012 North Carolina A&T graduate, earning an Electrical and Computer Engineering degree. 2017 MBA graduate from the Duke Fuqua School of Business.

Jordan has 5+ years of enterprise software experience working for John Deere and Cisco Systems. A 2015 North Carolina A&T State University graduate, earning a B.S. in computer engineering. Experienced as a full stack developer specializing in Java EE, Typescript/Javascript, Angular, and Flutter. Jordan has previously worked as a devops engineer gaining technical skills for use in linux, database administration, source control management, and containers. He's also worked at Cisco Systems on the support side of software as a technical consulting engineer providing live troubleshooting support for high impact cases. Jordan currently leads his own technical consulting firm, producing multi-platform mobile apps, websites, and provides other technical consulting services.

Use of Proceeds

If the offering's maximum amount of $107,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $15,000 | 14.0% |

| Actuarial consulting | $10,000 | 9.3% |

| UI/UX high fidelity interactive model | $10,000 | 9.3% |

| Backend database initialization | $36,757 | 34.4% |

| Marketing development | $10,000 | 9.3% |

| Data science modeling | $20,000 | 18.7% |

| Intermediary fees | $5,243 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Harmonee, Inc. dba Emerge. This offering must reach its target of at least $10,000 by its offering deadline of October 1, 2021 at 11:58pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

Emerge’s official name is Harmonee, Inc., so that’s the name that appears in the statements below.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Oct 2, 2021Primary offering finalized, selling shares

- Sep 27, 2021Harmonee is receiving overwhelmingly positive...

- Sep 17, 2021Harmonee has received its first press:...

- Sep 14, 2021Harmonee is currently receiving positive...

- Sep 14, 2021Harmonee mentioned in Triad Business Journal...

- Sep 3, 2021Harmonee has completed the first phase of our...

- Aug 23, 2021Harmonee has begun conversations with insurance...

- Aug 23, 2021Harmonee has begun its core policy management...

- Aug 13, 2021Harmonee will be kicking off our policy...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.