Introduction

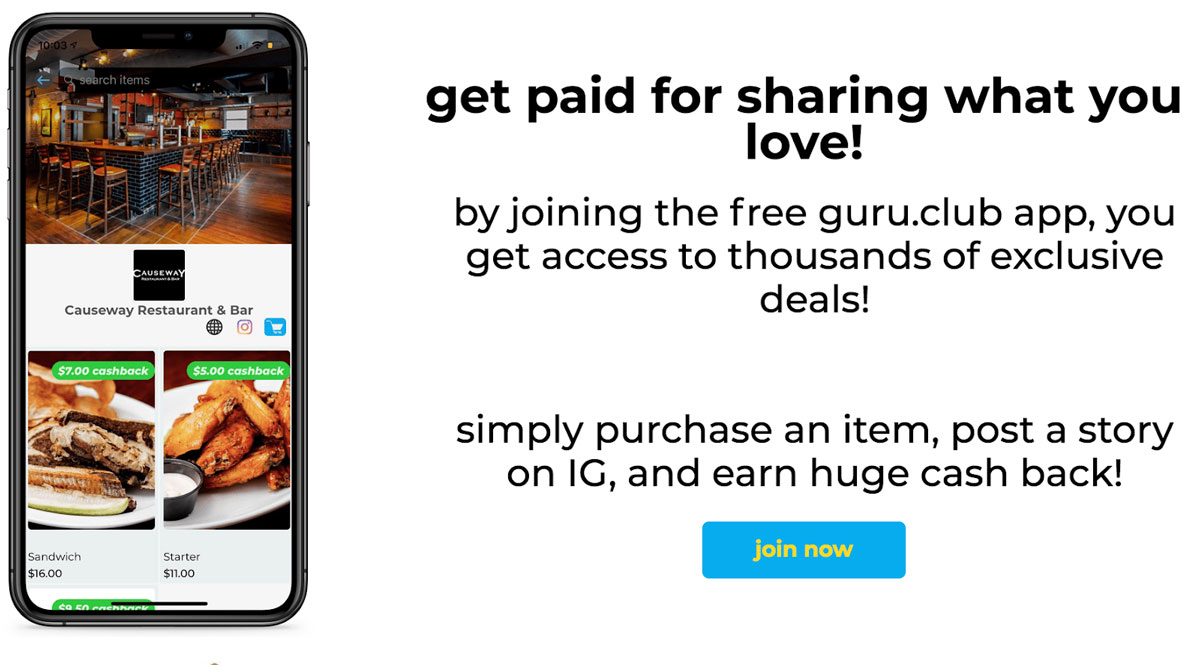

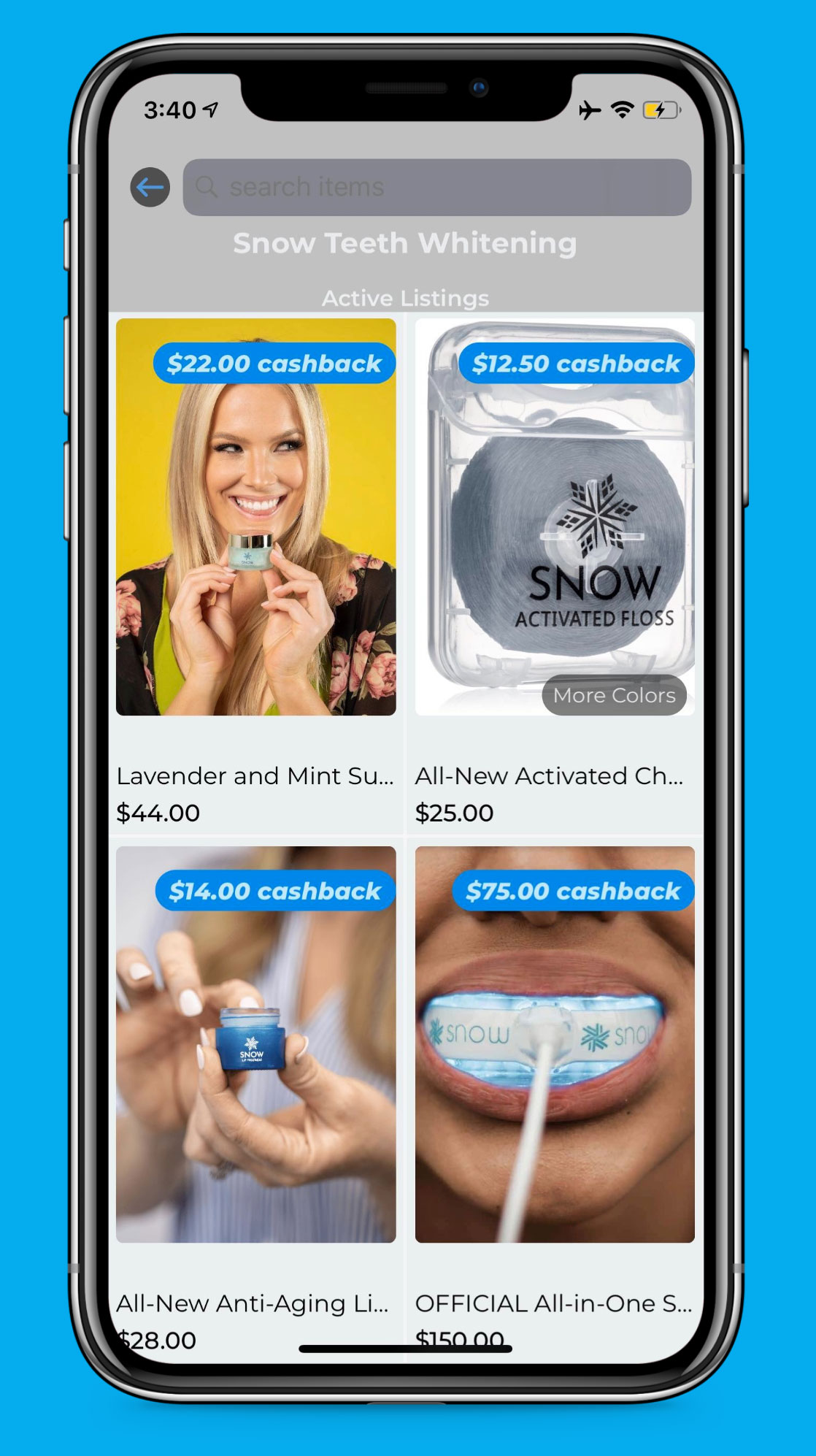

guru.club allows brands to receive authentic word-of-mouth advertising, valuable feedback from customers (first-party data), and user-generated content at scale with the only cost being inventory. For shoppers that qualify (the majority of Instagram users), guru.club gives amazing cashback rebates on products, at restaurants, nightclubs, fitness classes, beauty parlors and much more.

Testimonials

“Choosing the correct form of marketing hasn’t been easy. Social media ads are intrusive, paid influencer promotions seem fake and if you gift items to influencers you might never get a post. guru.club is the easiest, least expensive way to reach young consumers and you get great content for your Instagram too!”

“I love being able to shop on the guru.club app. It’s fun and different than any shopping experience I’ve ever had before. I already tag my favorite brands on Instagram and now I get to earn money for it.”

Problem

For Consumers:

Social media, most notably Instagram, has turned ordinary consumers into avid and voluntary content creators. Anyone with a modest social media presence now possesses value in the photos and videos that they choose to create and share, or in other words, just about everyone has “social currency”. In fact, approximately 52% of social media users post at least once a month about products they’ve purchased; creating enormous value for brands. Despite this universal trend, the only people currently cashing in are a small percentage of the population who describe themselves as “influencers”. Until guru.club, there has been no way for the ordinary, authentic consumer to benefit from sharing their favorite products or services. Customers expect great deals, strong relationships with brands, and to be part of that brands mission and culture.

For Brands:

There are very few options for digital marketers to get their brand in front of the masses. Google and Facebook, aka the duopoly, have dominated digital advertising for years. Paying these tech giants for advertising will almost always result in diminishing effects over time. With algorithms constantly changing and ad prices rising, companies are desperate for an alternative to the duopoly.

In today’s digital first world, brands need content at scale (with ownership rights), they need first party data, and most importantly, they need customers to tell their story for them.

Solution

Instead of paying money to ad agencies and tech giants, guru.club puts marketing dollars back in the pockets of real customers. It is a one of a kind, digital marketplace that rewards guru.club members for mentioning brands on social media.

How it Works

Customers, or gurus as they are called, purchase a product or on the marketplace at full retail price. When they post a story or a post on Instagram tagging the brand, guru.club automatically confirms the post has been left up for 24 hours and compensates them with a rebate from the brand that is deposited into their bank account. gurus can also earn extra store credit as a tip for a post or story that is exemplary.

For shoppers, this approach leads to a highly motivated group of customers who take pride in monetizing their social media presence while enjoying the status of working with brands. The cashback rebate is “found money” that simply didn’t exist before guru.club. The process is a game-like experience with gratifying rewards.

For brands, guru.club turns their marketing programs from a cost center to a profit center. After gaining all the benefits from their alliance with gurus, including brand awareness, customer input (first party data) and ownership of user generated content, brands can still make a profit from the transaction. Best of all, this entire system is conducted on a self-serve basis by the brand. Within minutes, brands can select which products to sell, set the rebates, and distribute tips at a level that they deem appropriate. The direct to consumer brands pay no introductory costs and are only charged a 15% fee by guru.club after a transaction occurs. For brick & mortar establishments such as restaurants and fitness centers, the service is free.

There is a natural pull on the consumer side and brand side of the marketplace with both sides experiencing significant economic advantages.

Market

Consumers

It is projected by next year Instagram will have more than 120 million active monthly users in the U.S. alone. The team at guru.club believes that they can attract at least 1% of those users from among the majority who meet the guru membership criteria. If 1.2 million gurus are making, on average, a $50 purchase per month on DTC products (projected by 2021), the annual revenue for guru.club will be $108 million.

Brands

To grasp the enormity of the untapped market that is open for pursuit by guru.club, one needs only to look at the success of Shopify which serves 800,000 businesses in 175 countries. Those statistics are from their 2019 First Quarter Investor Report and a very large percentage of those businesses are prime prospects for the service that guru.club plans to offer. This is particularly the case given guru.club’s unique partnership with Shopify. The needs that Shopify fills for merchants in areas such as fulfillment, payments and shipping will be complemented by guru.club’s powerful marketing solution.

Competitive Landscape

There are many companies that act as middlemen or brokers between brands and influencers. They facilitate the process by which brands compensate self-proclaimed “influencers” in return for brand awareness. These “influencers”, all too often, do not fit the image of the brand and are essentially a waste of money. It is well documented that this business model is fraught with problems including a lack of authenticity, fake followers, low engagement rates, fraud, and fabricated comments. This begs the question: why pay an influencer to endorse a product that they have never actually purchased? guru.club is not an influencer marketing company. It is a marketplace where customers become brand advocates. guru.club is the pioneer in this new advertising genre.

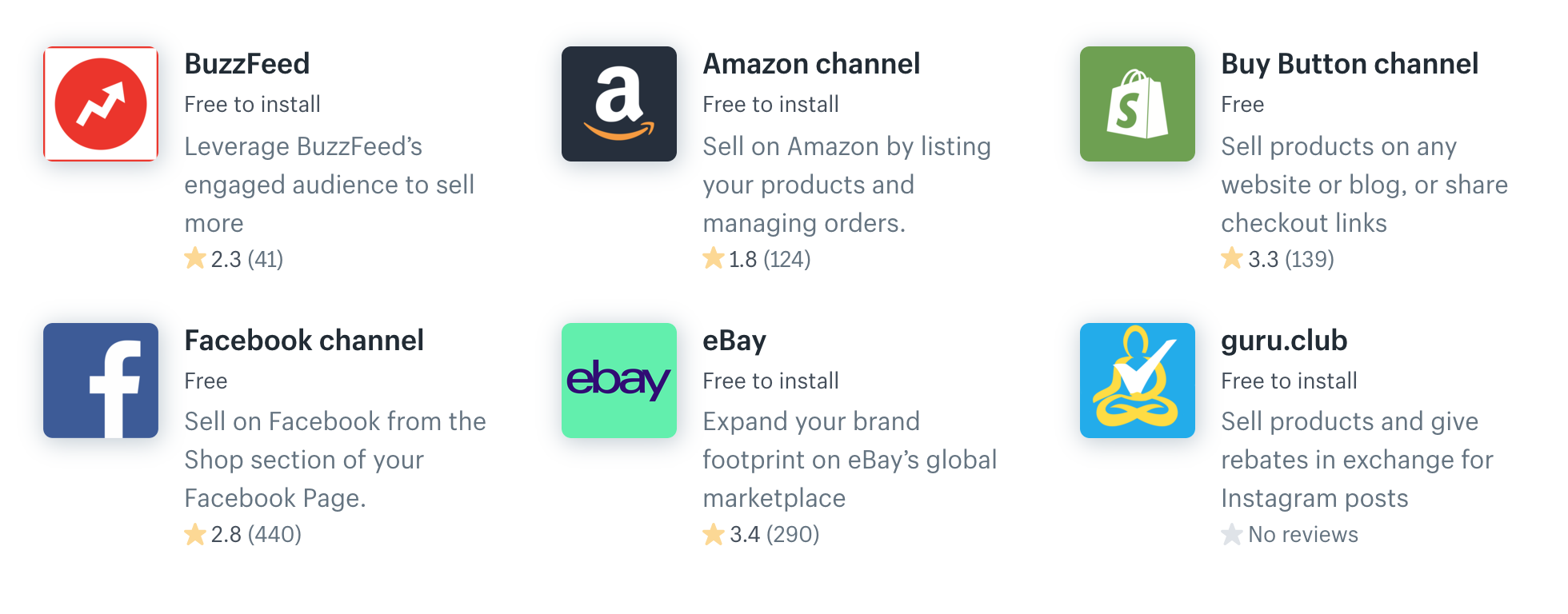

As the first mover in this space, guru.club has constructed a moat-like barrier to entry for competitors fortified by a powerful Shopify partnership and a growing network of independent brands and consumers.

Business Model

guru.club receives a 15% commission on every direct to consumer item sold on the platform. This is a standard fee among marketplaces such as Amazon. guru.club foresees a number of additional revenue streams including a subscription model for brick & mortar businesses.

Progress

The cost of acquiring new users is $0. Brick & mortar businesses are acquiring users for us by passing out cards and putting stickers in windows. Similar to Yelp and Postmates, the more customers that use the app, the more benefits they get. Once these users earn cashback at restaurants, fitness classes, nightclub etc., they are likely to use that cashback towards products.

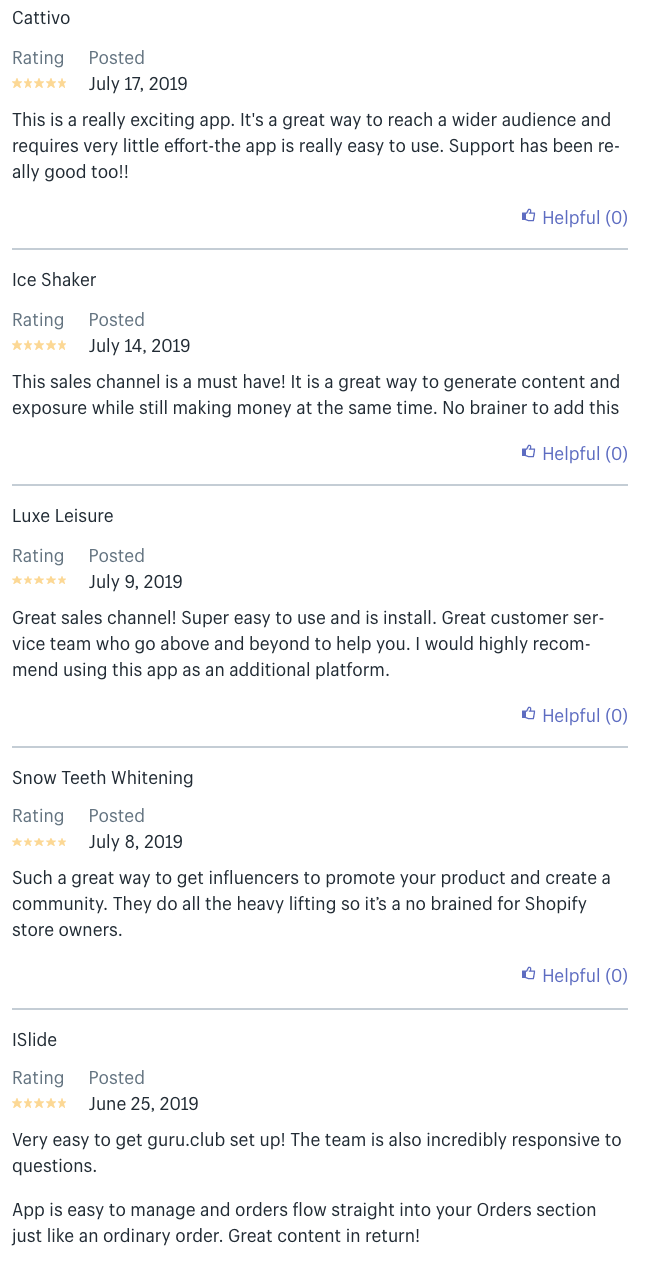

guru.club has developed a strong ground game that is targeting restaurants, fitness classes, and beauty parlors and more. Direct to consumer applications come in daily from business that find us on the Shopify app store and see our positive reviews.

Success

In the first 60 days since soft launch, there have been over 400 businesses that have applied to use the platform. The top 50 have been accepted, and there are currently thousands of products for sale. There are currently thousands of gurus customers on the app, and that number is growing fast.

Guru.Club’s technology partner, Shopify, whose stock has soared 87% from a year ago, hosts 800,000 brands, many of whom will be perfect partners for guru.club. guru.club is currently one of only 22 sales channels on Shopify alongside companies such as Facebook, Google, Messenger, Amazon, Ebay, and Etsy.

Team

Sam was a point guard for John Calipari, University of Kentucky’s Hall of Fame coach. During his days as a student athlete at Kentucky, Malone played on 3 Final Four teams, including the Wildcats 2012 NCAA championship team. Overcoming 4 knee surgeries during his playing career, Sam made the team as a walk-on and eventually earned a scholarship while excelling in the classroom as a 3-time Southeast Conference Academic All-American and earning the 2014 NCAA Elite 89 Award. The award honors “the individual who has reached the pinnacle of competition at the national championship level in his or her sport, while also achieving the highest academic standard among his or her peers.” Following his senior basketball season, Sam founded Won Every Game Productions selling viral apparel that was featured on major media outlets such as Sporting News, USA Today, Yahoo, Sports Illustrated, Bleacher Report and Barstool Sports. Sam’s passion for social media marketing and innovation inspired him to form guru.club LLC in 2017. Prior to co-founding guru.club, Sam was the full time manager for his friend and former teammate, Nerlens Noel, during Noel’s tenure with the Philadelphia 76ers.

Justin graduated from Harvard University in 2019 with a degree in computer science with a secondary in psychology, having taken a gap semester to dive into the technology industry where he eventually met his co-founders of guru.club. During his time at Harvard, Justin played for the rugby team, held many leadership positions as part of the Sigma Chi fraternity, and served as the Head Teaching Fellow for various computer science courses, a position which he still holds today. As a high-level technological thinker and organized manager, Justin has worked extensively on product development and operations handling of the guru.club, officially holding the title of Chief Operating Officer.

Peter graduated from the University of Massachusetts at Amherst in 2017 with a degree in computer science and mathematics. During his time at UMass, Peter honed his interest and skills in technology, maintaining the official UMass Transit Services application and interning as a Software QA Engineer at Verizon. Peter co-founded guru.club shortly following his graduation. As a full-stack software engineer and designer, Peter has worked almost exclusively on product development and implementation, officially holding the title of Chief Technology Officer.

Jimmy was the former Captain of the Northeastern Basketball team. He majored in Psychology with focuses in Social Behavior & Entrepreneurial Marketing. He has served in a marketing role at CBS Radio when he graduated from Northeastern, gaining experience in digital marketing and live events. He was the lead salesmen at Luxury gym Republic Fitness before joining Team Guru.

Gordie attended Jacksonville University, where he played baseball as an All-American. He was drafted by the Los Angeles Angels in 2006 and played in the minor leagues for a total of 6 years. Along with his time spent as head of business development at guru.club, Gordie leads the Gronk Fitness Brand expansion in Boston. He also has business development roles with several direct-to-consumer brands including Protein Cookie Co. and IceShaker.

More Info

Use of Proceeds

Additional funding will allow the company to increase its marketing budget and pay for server costs which will increase as a result of the rapid growth expected after the launch.

If the offering's maximum amount of $106,992 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $31,750 | 29.7% |

| Marketing | $40,000 | 37.4% |

| Server Expenses | $30,000 | 28.0% |

| Intermediary fees | $5,243 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Membership Units, under registration exemption 4(a)(6), in Guru.Club LLC. This offering must reach its target of at least $10,000 by its offering deadline of October 16, 2019 at 11:00pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Oct 17, 2019Primary offering finalized, selling units

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.