“As a three-time successful entrepreneur and a new venture capitalist, I believe there are only a rare handful of truly great opportunities, like Facebook, that many VCs nonetheless allow to pass by, refusing to recognize them for the golden nuggets they are. With almost 20 years as an entrepreneur and one year as a VC, I strongly believe that Demand Derivatives has more than the potential to become one of these, and fast.”

Introduction

The company plans to use its four unique instrument designs, pioneering blockchain technology, instant clearing, and default-free, fully collateralized positions to create a significant competitive challenge to existing exchanges and clearing houses.

Deal Highlights

Deal Highlights

- Derivatives markets transact $10 trillion per day. This amount is 10,000 times bigger than Amazon customers buy each day

- We plan to trade traditional assets in all major asset classes (no crypto)

- Our edge is four new derivative instrument designs — providing users with high-demand risk control

- Our target market is institutional market participants (same as the CME)

- Current exchanges cannot guarantee payment (we can)

- Current exchange cannot limit risk to pre-selected levels (we can)

- Current exchanges have many “best efforts” or “close enough” orders (we have guaranteed and precise orders)

- Current exchanges charge high fees (ours are 50 to 90% less)

- Each team member has over 30 years’ experience in derivative markets

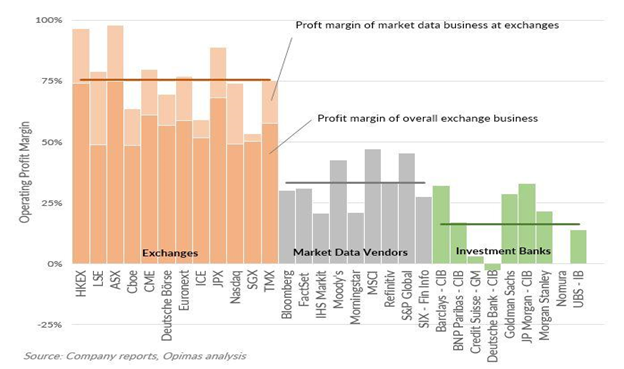

- The entire industry has enjoyed very high profit margins (Typically at least 50% or more of revenue falls to the bottom line)

Invest in Demand Derivatives

- All Investors receive waived trading fees for three months upon launch of the exchange (both exchange fees and clearing fees).

- An additional three months of waived fees if investing in the first $250k of the SEC Reg. CF offering.

Recommendations

“RealBOT and RealClear are simply the smartest things to hit the financial markets since the invention of derivatives. They’ve been developed and perfected by a few brilliant people over some ten years and I’m thrilled to be an investor now that their operations are soon to go live.”

“The risk limiting concept has the potential to really benefit the markets. I do think this will transform the retail, derivative risk-taking markets due to their superior design.”

“Demand Derivatives is always on the cutting edge of developing new derivative products that can be used for both trading or hedging. By listing them on regulated markets, they will offer transparency and a reduction of transaction costs.”

Testimonials

“As our global financial markets continue to evolve, now is the time for systematic risk management and stable clearing house solutions. Creation of product and services designed for the future will become more important than ever, and Demand Derivatives is at the forefront of these solutions.”

“The highly experienced team at Demand Derivatives is going to transform the business of risk management and ultimately the control of large risks in the economic fabric of society. The CEO, Robert Krause, has been at the forefront of risk concepts and risk mitigation for decades. We were thrilled when, last year, he agreed to serve on Brandywine’s advisory board.”

“Demand Derivatives is building the futures exchange of the future!”

“Demand Derivatives is a groundbreaking futures exchange and clearing house project the need for which is greater than ever before. The market needs products that reduce not only risk but also costs. Demand Derivatives instruments solve this in a way that current futures contracts do not.”

Problem

Exchange-traded derivatives are on a collision course with destiny. The financial system must still obey the immutable law of risk vs. reward. On a macro scale, there have been many instances where the global financial system has been stressed to the point of collapse. On a micro scale, costs are very high and few options exist for participants to control risk.

Because of the near monopolies in this industry, exchanges and clearing houses seem to be concerned only with extracting higher and higher fees from the trading community.

The risk to investors can be great in the current system. Here is an article explaining how a trader with $77k in his account lost $9 million trading futures. This is a huge problem in our industry.

One Trader Started The Day With $77,000 In His Account; By The End He Owed $9 Million – ZeroHedge

We have created our exchange, through the novel design of our contracts, so that investors should be protected from loss beyond their predefined tolerance.

Solution

Demand Derivatives plans to provide much-needed competition in this industry. It expects to break through those near monopolies by offering better products (optimized instrument designs) at lower costs (fee savings of 50% to 90%) with reduced risk (user-selected risk levels) and greater precision (exact close-to-close exposure possible).

We plan to accomplish this by launching a U.S.-regulated futures exchange and clearing house. The key to its success will be four innovative instrument designs, fully collateralized positions, and blockchain clearing on six key underlying assets.

FOUR INSTRUMENT DESIGNS:

- RealVol® (realized volatility)

- RealDay™ (delayed strike daily options)

- RealGlobe™ (39 major country equity indices)

- RealLimit™ (limited risk futures)

REDUCING RISK:

The risk is limited because of the instrument design attributable primarily to the RealLimit concept. This means that all positions on the exchange have limited risk, or in industry parlance are said to be “fully collateralized.” Traders will not be forced to deposit additional money into their account (as is possible with adverse moves in current futures contracts). The financial system (i.e., brokers, and clearing firms) will no longer have risk to rogue traders, improper risk controls, or just extremely volatile markets.

RISK LEVELS:

Because traders have different risk tolerances, the exchange plans to offer three risk levels, with more possible.

COST SAVINGS:

Because fully collateralized positions are dramatically easier to clear, internal costs to the clearing house can be substantially reduced as follows:

- Eliminating the guarantee fund (no need for credit backstop)

- Eliminating the risk modeling group (no need to assess margin levels)

- Eliminating physical clearing (a cash settlement process is vastly simpler)

- Eliminating FCMs and clearing members (no need for guarantors)

- Outsourcing compliance and surveillance (reduces conflicts of interest)

- Converting to private, or “internal,” blockchain (produces additional efficiencies)

- Because internal costs are drastically reduced, we can cut fees by 50% to 90% to traders to gain market share quickly.

GREATER PRECISION:

One phenomenon in markets is an attempt by market participants to execute at the close. Only one trader can be the last one of the day, so it is nearly impossible to “get the closing price” each day unless one is very lucky. Our process essentially guarantees execution on the close if desired.

BUILDING VOLUME:

One of the biggest challenges to starting a new marketplace is building volume to critical mass — the classic “chicken or egg” problem. Our team recently had a major breakthrough — a new process called “Perfect Execution at Settlement” (PEAS). This process is expected to attract volume without liquidity, making it easier to achieve critical mass. In addition, our new market microstructure process encourages volume at the best bid and offer prices.

BLOCKCHAIN CLEARING:

Demand Derivatives plans to clear using a private blockchain (i.e., non-distributed ledger). In other words, we are using blockchain format in a simple ledger. This allows us to benefit from the technology (immutable record of trades and to eliminate the need for cash transactions) and not the drawbacks (hackable and slow speeds). In addition, if in the future, there is a need or desire to distribute the ledger, we won’t have to revamp the clearing process, just simply distribute the ledger — potentially saving conversion costs down the line.

Note: to clarify, Demand Derivatives has no plans to compete in the cryptocurrency space. There are currently hundreds of crypto exchanges. Our business model is to compete using cutting edge technology, novel instrument designs, and a streamlined clearing house to add to global volumes or usurp volumes from existing exchanges in the world’s key global assets.

Business Model

- Exchange fees

- Clearing fees

- License fees

- Data fees

Note that exchanges have the highest profit margins of any business we know. The next graphic shows the operating profit margin compared with data vendors and investment banks.

Market

- Statistic relevant to Demand Derivatives:

$10 trillion trades each day globally. The CME commands a near monopoly in the U.S. with 91% of U.S. futures trading.

- Statistic relevant to RealClear:

The OCC has a true monopoly clearing 100% of U.S. securities-options volume.

- Statistic relevant to RealVol products:

1/2 million VIX® futures and options trade each day.

- Statistic relevant to RealDay options:

84 million options trade each day on global exchanges.

- Statistic relevant to RealGlobe products:

74 million equity index futures and options trade each day worldwide.

- Statistic relevant to RealLimit futures:

101 million futures contracts trade each day at all exchanges.

Competitive Landscape

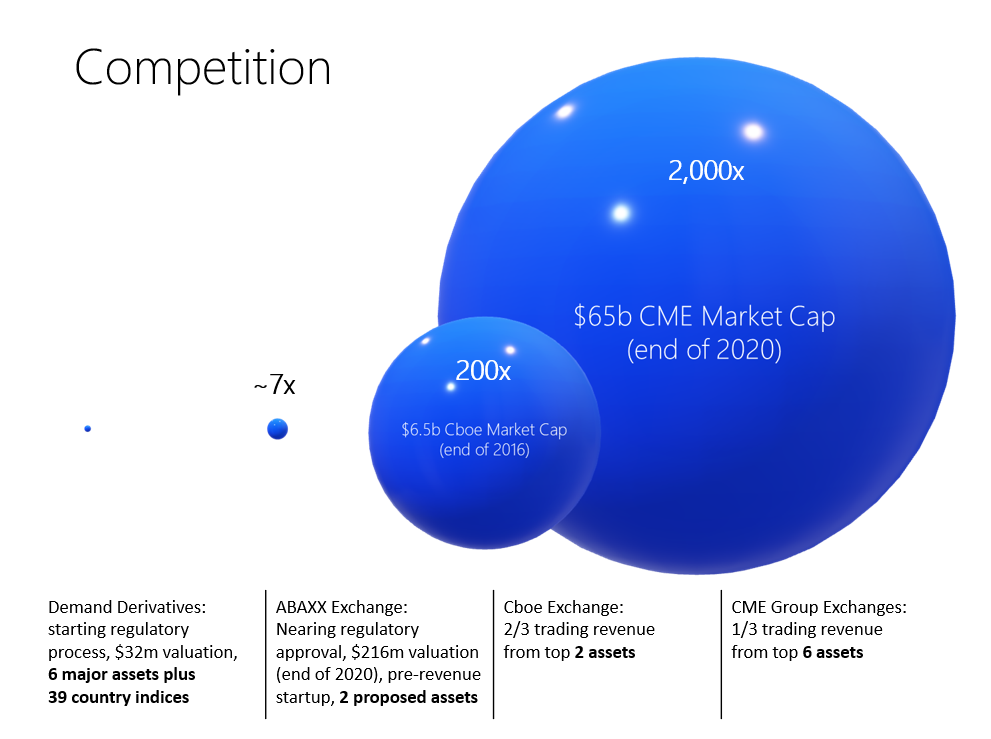

- The Chicago Mercantile Exchange (CME) is the largest futures exchange and has a near monopoly in the U.S. with 91% of futures volume.

- The Intercontinental Exchange (ICE) has about 8% market share in futures.

- Several other exchanges share the remaining 1%.

- Because of our better product design, limited risk, lower costs, and instant clearing, we expect to be a formidable competitor to the largest exchanges within five years of launch. And, because our first-to-market assets are all traded at the CME, we effectively have only one competitor.

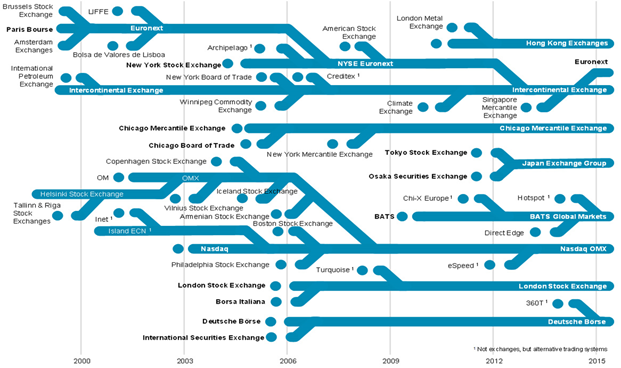

- The below graphic shows the consolidation in the industry over time.

Note: We are competing on ASSETS (i.e., gold, crude, corn, etc.). However, we are not competing on INSTRUMENTS (volatility, daily options, international indices, and limited risk futures). Our proprietary, patent pending instrument designs are not available on CME or ICE. Therefore, if one looks at assets, we realistically have one or maybe two competitors. If one looks at instruments, we have no competitors.

Progress

- Licensed RealVol to a U.S. securities options exchange

- License RealDay to a U.S. securities options exchange

- Our first clearing house customer — a U.S. options exchange — desires to clear options in our clearing house

- Distributing RealVol indices on Quandl (a Nasdaq company) and on Bloomberg

- Partnered with GMEX Technologies (to provide exchange and clearing house systems)

- Created/designed RealGlobe products

- Created/designed RealLimit instruments

- Merged two companies (VolX and RealDay), bringing along two instrument designs (RealVol and RealDay), which, combined with RealGlobe and RealLimit, make a total of four instruments under the Demand Derivatives umbrella

- Memorandum of Understanding signed with a large-scale stablecoin provider

- Letter of Intent signed with an investor of $60m for our next capital raising round

- Attracted seven very senior, highly experienced directors, advisers, and officers

- Gathered invaluable market intelligence by visiting hundreds of institutions, such as investment banks, hedge funds, market makers, options and volatility trading firms, and asset managers.

Press

Team

Advisors and Investors

Use of Proceeds

If the offering's maximum Reg CF allocation of $1,069,995 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Intermediary fees | $52,430 | 4.9% |

If the offering's maximum amount of $7,069,995 across Reg. CF and Reg. D is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Regulatory | $250,000 | 3.5% |

| Technology (initial) | $500,000 | 7.1% |

| Technology (testing) | $500,000 | 7.1% |

| IP | $250,000 | 3.5% |

| Marketing | $1,000,000 | 14.1% |

| Accounting | $75,000 | 1.1% |

| Miscellaneous | $248,565 | 3.5% |

| Legacy | $300,000 | 4.2% |

| Salaries | $1,600,000 | 22.6% |

| CFTC Capital Reserve Requirment (estimated) | $2,000,000 | 28.3% |

| Unallocated Funds | $0 | less than 0.1% |

| Intermediary fees | $346,430 | 4.9% |

Terms

This is a side-by-side offering of Common Stock, under registration exemptions 4(a)(6) and 506(c), in Demand Derivatives Corp.. Up to $1,069,995 may be raised under the 4(a)(6) exemption. Netcapital will determine which exemption applies to your investment and notify you before you complete your investment.

The amount raised under the two exemptions must total at least $10,000 by June 22, 2021 at 12:59am ET. If the total doesn’t reach its target, then your money will be refunded. Demand Derivatives may issue additional securities to raise up to $7,069,995, the offering’s maximum.

If the side-by-side offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemptions 4(a)(6) and 506(c) of the Securities Act of 1933. Similar information is sometimes offered in a Private Placement Memorandum for 506(c) offerings.

We’re also required to share links to each of the SEC filings related to this side-by-side offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Feb 24, 2023The capital-raising process is taking longer...

- Jun 22, 2021Primary offering finalized, selling shares

- Feb 5, 2021Comparison: The ABAXX exchange in Singapore is...

- Jan 25, 2021The answers to this survey will help guide our...

- Jan 25, 2021Each week, view our RealVol index rankings. You...

- Jan 25, 2021Compelling research on the theoretical...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.