Introduction

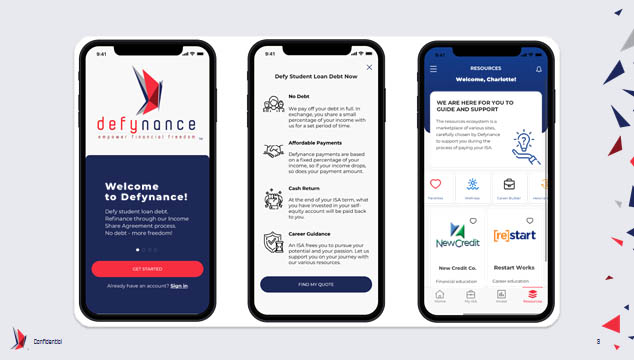

We pay off student loans with debt-free income share agreements (ISA). We also offer a resources marketplace with various career and other resources to optimize earning potential and improve quality of life.

The Defynance investment opportunity lets you get in on the ground floor of a unique student loan refinancing solution designed to help solve the student debt crisis and empower financial freedom for our customers, investors, and users.

Deal Highlights

- Earn dividends - When Defynance become profitable, our shareholders will start earning dividends.

- Solve the student debt crisis - We believe that no one else is directly tackling the student debt crisis with a debt-free student loan refinancing solution.

- Join our debt-free movement - Defynance is just starting. We have plans to expand and grow our offering and you may help define our journey. Plus, we'll be sure to thank you!

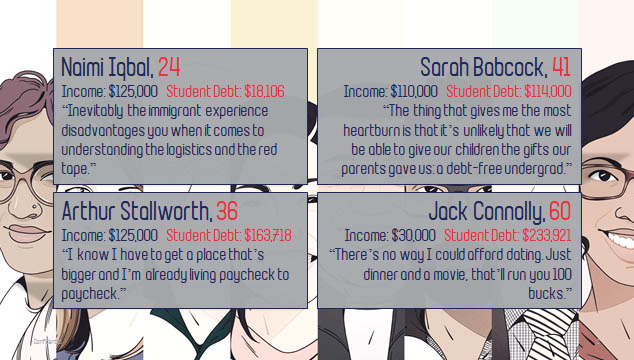

Problem

Sadly, student debt today is pervasive. It has become a full blown crisis! Its negative impact reaches across the demographic, racial, and income spectrum.

Here are the big numbers:

- $1.6+ Trillion of student debt growing 10% annually

- More than 45+ Million student loan borrowers

- 2nd largest consumer debt behind mortgages but more than credit cards and auto loans

- 70% of college students leave with student loans; many without even graduating

- Student loan refinancing has strict approval criteria and mostly requires co-signers

Additional reading:

- Student Loan Debt Statistics – Updated July 2020

- 5 facts about student loans

- Debt Nation: The faces and lives behind America’s student loan crisis

- America's Student Debt Crisis is a Civil Rights Crisis," New Research Concludes - Progressive Party USA

- Read. Vent. Inspire. Share student debt stories

- Paying student loans by becoming a "sugar baby"? "What Would You Do?

Solution

Defynance eliminates student debt and invests in the earning potential of our customers with our debt-free ISA student loan refinancing and investment platform, which has the following core offerings and benefits:

Debt-free ISA student loan refinancing

- Multiple ISA terms from 5 to 15 years

- Always affordable payments

- Removes student loan debt from credit report

- Automatic payment deferrals if income falls below $25,000

- Scaling payment cap

- Prepayment and buyout options

- Cash back at the end of the ISA

Impact investment fund

- Open to accredited investors

- Generates passive quarterly income from all ISA contracts funded

- Has low volatility with projected growing returns

- Dynamic correlation with the market has recession hedging properties

- Tax deferral benefits

Comprehensive resources marketplace

- Career guidance, recruitment, upskilling, networking, and jobs

- Entrepreneurship resources, support, and education

- Credit building and repair

- Financial tools, widgets, resources, and education

- Wellness support for mental, spiritual, and physical health

Business Model

Market

We plan to target the higher end of the student loan spectrum by refinancing Graduate PLUS, Parent PLUS, and private student loans.

The student loan refinancing market is largely untapped because existing lenders have:

- Strict approval criteria

- Require co-signers

- Very few banks refinance student loans

Defynance is not a lender. We invest in the earning potential of our customers. We offer:

- A debt-free refinancing solution

- Always has affordable payments

- Offers consumer protections

- Does not requires a co-signer

- Gives cash back at the end of the ISA

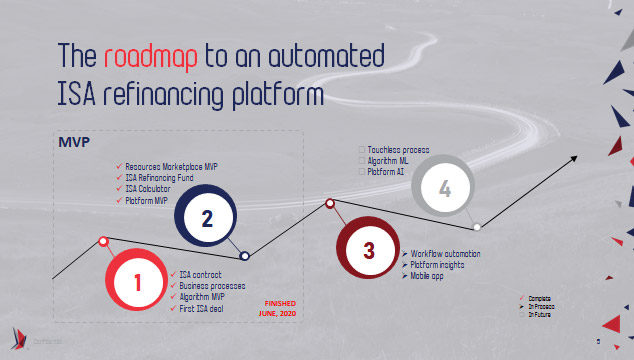

Progress

What have we built?

- First ISA refinancing contract

- Application to funding to servicing process

- Customized ISA approval criteria

- Algorithm for ISA pricing and risk adjustment

- Online platform pilot with early beta users

- Career and more resources marketplace

- Fully functional mobile app prototype

- ISA Refinancing Fund structure

- First paying ISA student loan refinancing customer

- More than 70 applicants without marketing

Media mentions

- Featured Founder: Farrukh Siddiqui of Defynance - Embar Collective 2019

- RedPerit’s Defynance is out to disrupt the student loan market - Catalyst 2019

- Defynance: Tampa startup takes on student loan crisis - 83 Degrees 2019

- Tackling Student Loan Debt with Farrukh Siddiqui's Defynance | Startup Report - St. Pete Catalyst 2019

- Farrukh Siddiqui Red Carpet - Synapse Summit 2020

- Plan Out Your Bootstrap” The Inventive Journey Podcast for Entrepreneurs w/ Farrukh Siddiqui - Inventive Journeys Podcast

Team

Our day to day team consists of engineers and business development staff all focused on one thing: freeing people from their student debt.

Farrukh is a seasoned financial executive, social entrepreneur, and innovator with 30 years of diverse professional background in product development, technology, marketing, sales, business development, operations, and social impact. He has a consistent leadership track record of achieving results by empowering staff, demanding organization wide accountability, and technology innovation.

The Defynance team is comprised of a diverse group of young professionals who are passionate about solving the student debt crisis. Coming from engineering, marketing, research, and business development backgrounds, the team brings a wide variety of skills necessary for the constantly pivoting nature of startup growth. They have successfully contributed to creating a unique debt-free income share agreement solution to tackle the student debt crisis and are constantly working to efficiently execute Defynance technology, operations, business development, and marketing strategies and tactical plans.

Testimonials

Advisors

Use of Proceeds

If the offering's maximum amount of $1,070,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Management | $223,459 | 20.9% |

| BD & Marketing | $410,684 | 38.4% |

| IT & Systems | $80,852 | 7.6% |

| Product | $179,154 | 16.7% |

| Legal & Compliance | $59,619 | 5.6% |

| G&A | $44,801 | 4.2% |

| CF Marketing | $15,000 | 1.4% |

| CF Review | $1,500 | 0.1% |

| Net Capital Fixed Fees | $2,501 | 0.2% |

| Intermediary fees | $52,430 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Defynance Holdings, Inc.. This offering must reach its target of at least $10,000 by its offering deadline of January 29, 2021 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Mar 25, 2024Hello everyone, Our next Investor Update is...

- Jan 31, 2024Our next update is is coming out in half an...

- Dec 18, 2023Our next update is due tomorrow, December 19 so...

- Nov 22, 2023We just dropped our latest Investor Update...

- Mar 23, 2023A Defynancer is someone who is not afraid to...

- Mar 9, 2023Hey there Defynance Community, We know we’ve...

- Nov 10, 2021Hello, We have been sharing updates with many...

- Jan 30, 2021Primary offering finalized, selling shares

- Jan 29, 2021**The Importance of Techstars** > First...

- Jan 29, 2021**5 Reasons to invest in Defynance NOW** >...

- Jan 28, 2021**ONE DAY LEFT so LET'S FINISH STRONG** Thank...

- Jan 27, 2021Last week, Farrukh Siddiqui, Founder & CEO of...

- Jan 25, 2021**We begin our Techstars experience...

- Jan 21, 2021**THE ABSOLUTELY HUGE GAME CHANGING...

- Jan 20, 2021**Defynance Featured as a Top Fintech in...

- Jan 7, 2021**Welcome to 2021!** Who knew this time last...

- Dec 11, 2020**ROEP Spotlights** Another week coming to...

- Dec 8, 2020**Covid-19 Pandemic - Announcement 3 of...

- Dec 1, 2020**Covid-19 Pandemic - Announcement 2 of...

- Nov 25, 2020Congrats ATDC! ATDC or Advanced Technology...

- Nov 24, 2020We're in the news! Hypepotamus just published...

- Nov 9, 2020Cases are going up and the Covid-19 pandemic...

- Nov 6, 2020We can't wait any longer for Nevada! It's time...

- Oct 31, 2020Major Social Impact Announcement Coming...

- Oct 29, 2020Thank you Netcapital! Yesterday our Founder &...

- Oct 20, 2020It's SOCAP time! It is the largest social...

- Oct 15, 2020Defynance Is Being Featured at SOCAP, the...

- Oct 12, 2020Thank you to our first 22 investors. You guys...

- Oct 9, 2020Defynance User Hub Prototype Demo Farrukh...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.