Introduction

Connective is the most robust and modern community networking and communication platform for organizations to unify and grow their internal and external communities, in a secure branded environment.

Carii is a B2B platform for organizations to create their own private social networking community or market network and connect their customers, members, partners, and employees. Carii, Inc.& Connective.Network is far more expansive than competitors. It’s like combining Wix, Zoom, LinkedIn, Slack, Eventbrite, Quora, CMS, Trello, Crowdrise and Etsy in one consolidated branded platform.

Deal Highlights

- Award winning & fully developed solution with proven product market fit

- Numerous existing customers, prospects and partners

- Deep team, board and advisors

- Benefits from the new world of digital acceleration

Recommendations

Testimonials

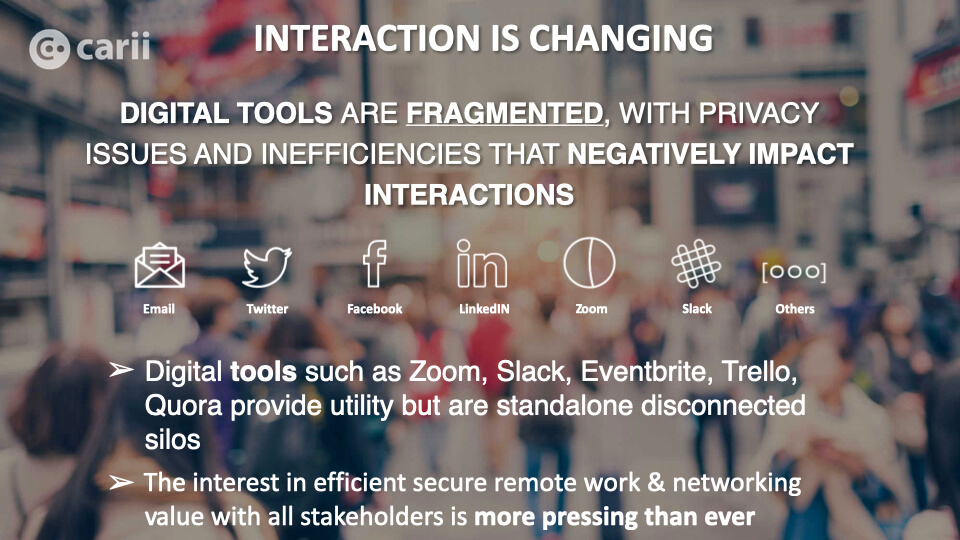

Problem

The key problems we solve include fragmentation in digital communications along with the lack of control, data ownership, security and revenue generation by organizations/businesses:

- Communities are operating on other companies’ brands (Facebook, Instagram) which shut them off from the profits they generate

- Connections to members are mostly one way and limited by algorithms

- Communities don’t control their content or own their brand/data

- Lack of security and privacy are major and growing concerns with the disconnected silos of digital video conferencing, messaging, and content sharing tools

- Organizations can’t monetize the communities they’ve worked hard to build

Solution

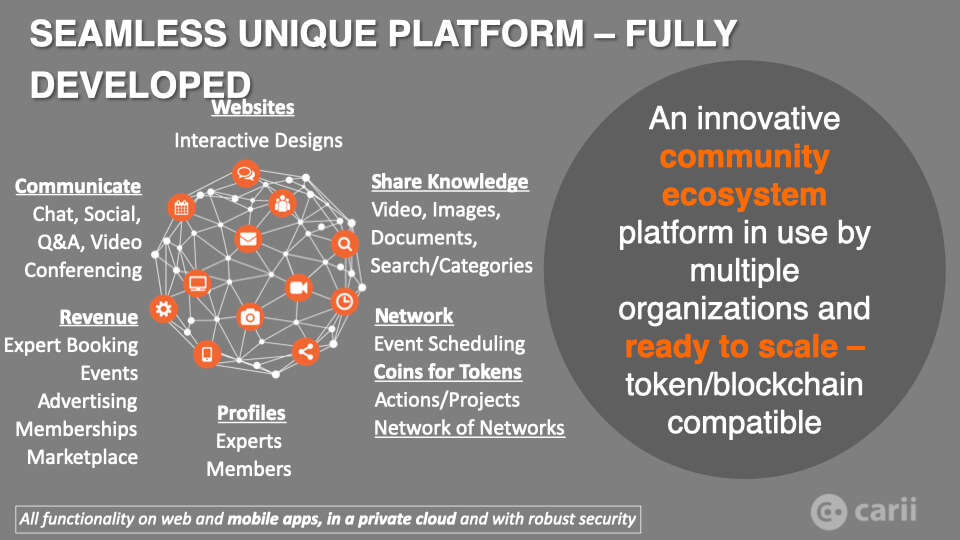

Connective provides unified functionality for engaging an organization’s network of customers, members, partners and prospects with a branded digital experience where they own their brand and their data and can generate revenue from their membership. In simple terms it’s like having their own social network.

Value propositions include:

- Eliminating multiple tools and the related costs

- Activating member interaction and collaboration

- Owning your data and your brand

- Creating network value for all members and the organization

- Generating revenue on multiple dimensions

Business Model

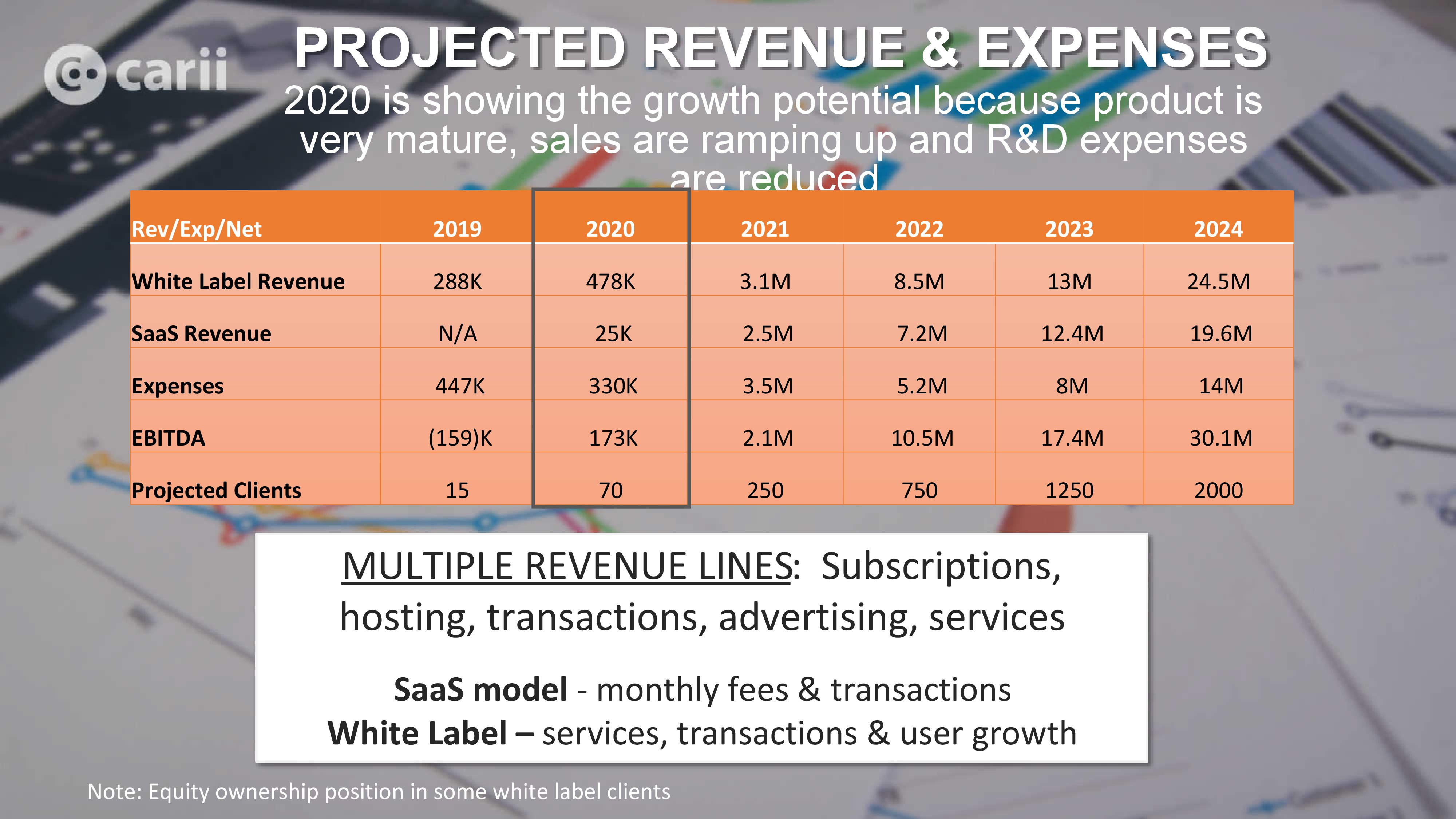

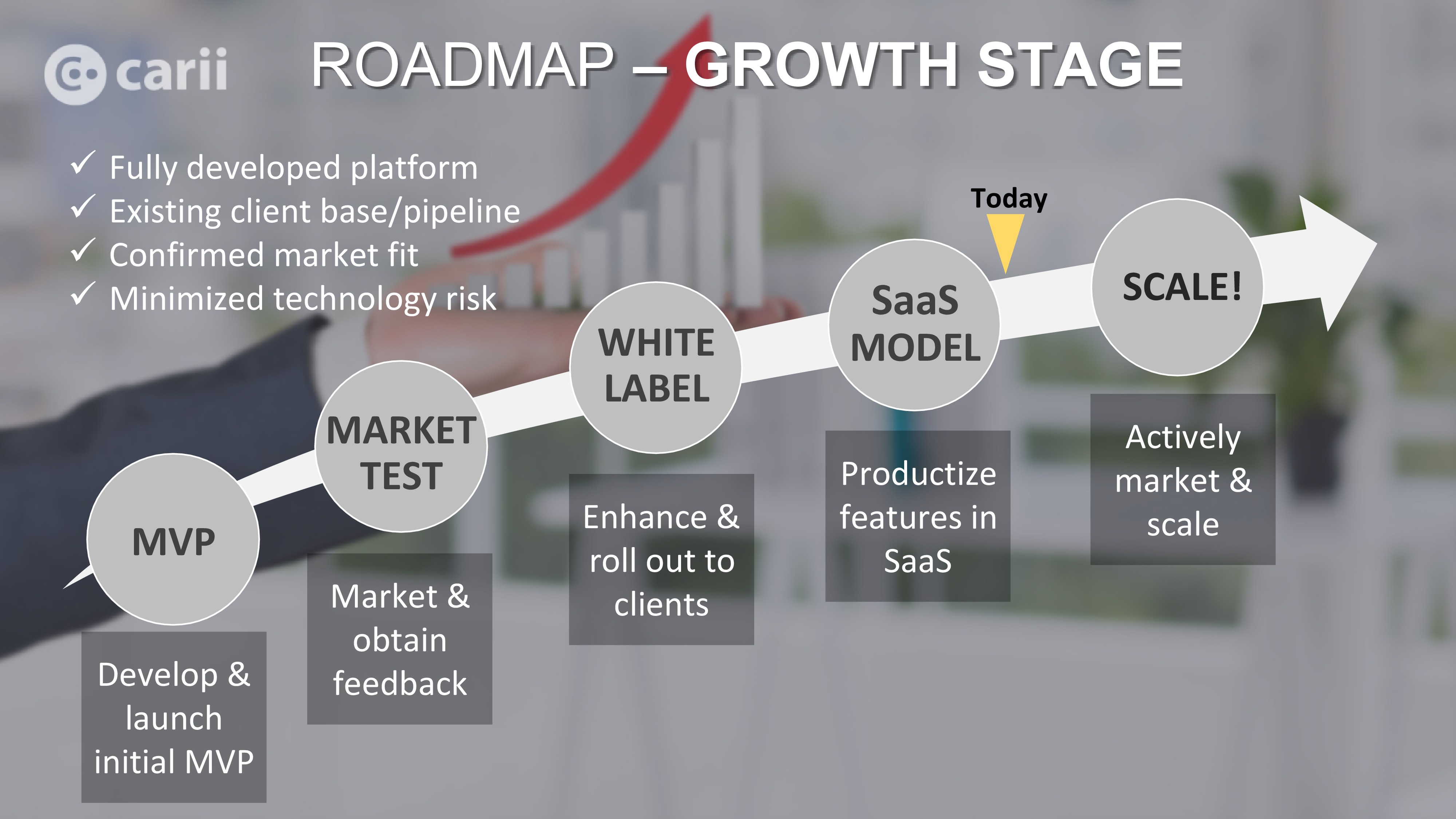

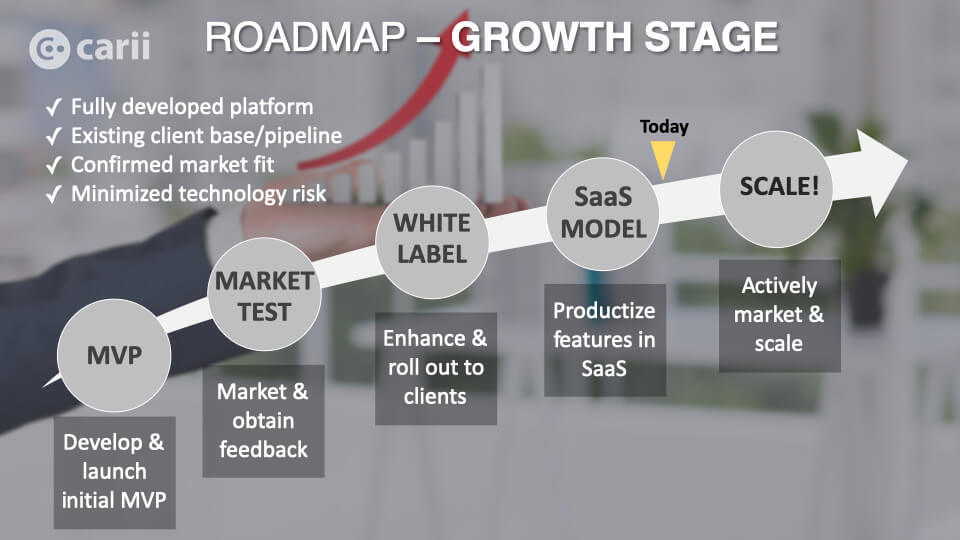

Carii, Inc. has two main product lines: White Label and SaaS.

White Label clients are organizations that have unique requirements that adjust our functionality in some manner (increased branding, added integrations, etc.) and/or require a higher level of services which we charge for. For White Label the pricing structure is:

- Implementation/development fees ranging from $25,000 - $300,000

- Ongoing hosting starting at $1250 a month

- Subscription/licensing per user starting at $2 a seat with a minimum of $1000 per month

- Transaction fees (1%) per monetary transaction (fundraising, event registrations, coaching booking, memberships, eCommerce, etc.)

Other revenue opportunities with White Label clients include services, revenue share and equity.

SaaS model clients can leverage our extensive and flexible functionality in our self-service model OR be supported by our sales partners. For SaaS the pricing structure is based on features, number of communities and number of users, plus transaction fees for all:

- Freemium for groups under 100 members to get started

- Basic Plus for groups up to 500 members - $99 per month

- Teams for groups between 500 and 1000 - $300 per month

- Premium for groups between 1001 and 3000 - $600 per month

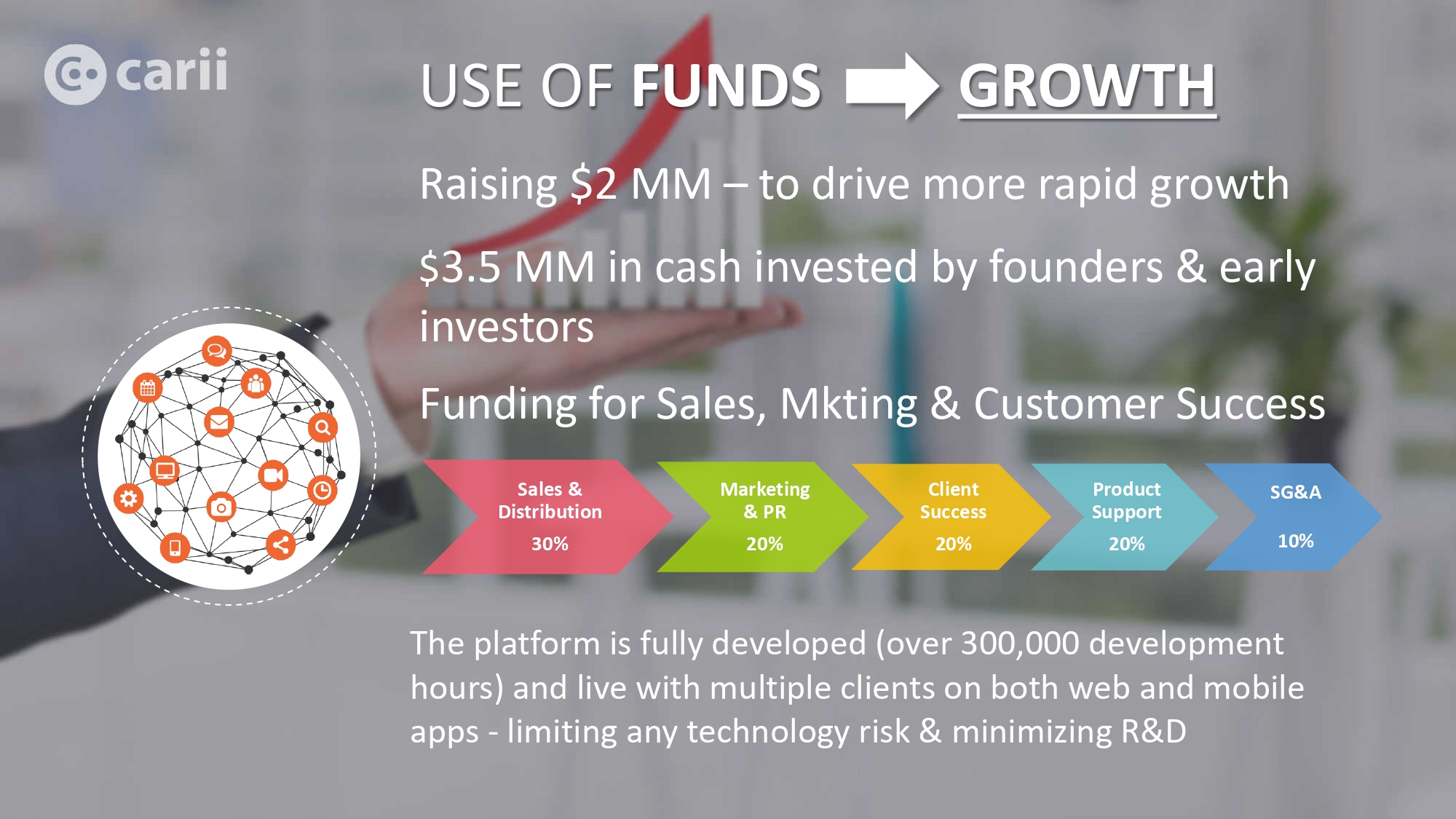

Funding and Use of Proceeds

Carii had early investors and has been primarily bootstrapped from founders’ funds and revenue since.

Since the platform is fully developed and only requires maintenance and smaller feature updates, limited funds are required for ongoing R&D. New funding is required to ramp up growth and will be allocated specifically for sales of white label and SaaS, marketing, PR and a customer success team to support and upsell.

Also required is a small US based development and design team to cover US hours, a product manager, upgrading of cloud technology to support growth in customer base, and SG&A (legal, accounting, hiring a COO, and modest management salaries).

Market

Demand for bespoke digital networks and communities is still early in its growth trajectory so there is significant runway ahead. And the current environment has accelerated digital adoption - leading to rapid growth already, and more opportunity on the horizon with funding.

We market exclusively to organizations and businesses and they in turn market to their customers, users, members, partners. Some of our clients are purpose driven and focused on social impact – leading to the platform becoming a hub for cross-networking for common initiatives. Another new client is a OTT TV Network with broad reach with music audiences. The mix of clients is broad, but with common denominators:

- Has a disparate, fragmented set of stakeholders where the experience would be improved if brought together efficiently in a way that caters to each member’s needs

- Interest in a private branded environment with control and trusted interactions - and data ownership

- Goal of generating revenue and increasing interactions and value exchange between members of all types - which also increases actions/results

The new SaaS model being rolled out targets small/medium organizations via a digital marketing strategy and outreach to influencers. Many of our larger white label clients are bringing their own networks onto the platform which provides extended opportunities for new customers. For example, our client GSX uses our platform to run their digital business of bringing together architects, builders, designers and product companies.

Organizations such as the UN can be provided with a community and content presence on our platform through GSX, which gives us brand recognition and exposure to potential customers.

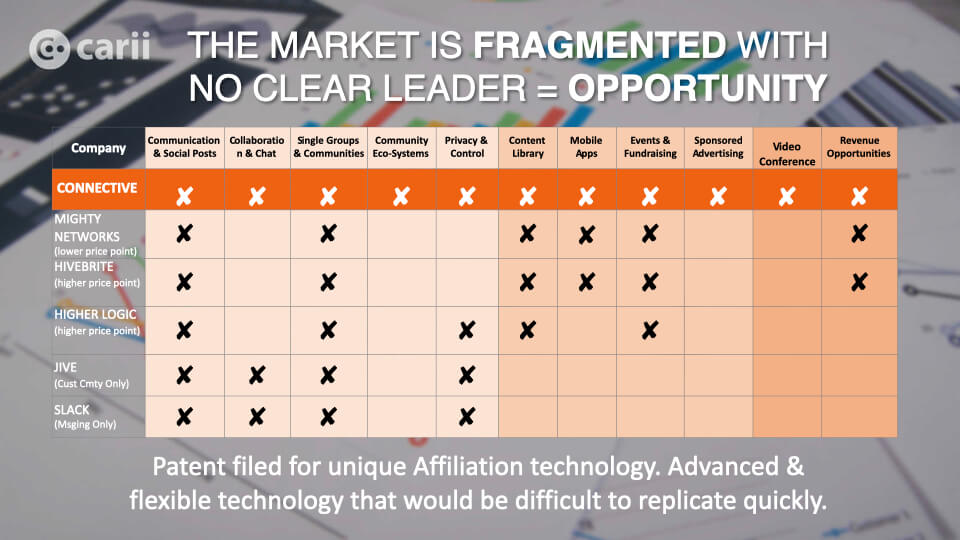

Competitive Landscape

Competitors include online community platforms like Mighty Networks and Higher Logic, messaging platforms like Slack, event and fundraising platforms and video conferencing like Zoom. Connective functionality goes far beyond our competition on many levels: it is more comprehensive, modern and flexible with more ways for organizations to generate revenue and add value to members.

Connective is fully developed and robust on the web and mobile apps. It’s like combining Wix, Zoom, LinkedIn, Slack, Eventbrite, Quora, CMS, Trello, Crowdrise and others in one consolidated branded platform. Uniquely, Connective also supports a cross site network of networks which no other solution in the market can do.

Functionality includes: Websites, Social Posting, Communities, Chat, Q&A Forum, Content Library, Video Conferencing (2 integrated tools!), Project Planning, Multi-tier Memberships, Events, Marketplaces, Advertising, Affiliation, Activity Coins, Expert Booking, Fundraising, Token & Blockchain Integration.

Progress

In the world we are all living in, initiated by COVID remote work, we are finding accelerated adoption of digital solutions, leading to a dramatic increase in uptake of our platform, as well as much quicker closes (in days and weeks instead of months). Examples of existing clients and prospects include:

goodLinc – Existing client

Community linking nonprofits and businesses together for support and services (LIVE)

GSX – Existing client

Global Sustainability Exchange for the architects, builders, designers and product companies in the “green” building space globally - MVP

Private Equity client

Using the platform to connect their 15 portfolio companies for cross organization operational and legal functions

Spacely

New client creating a connected network for the space industry linking professionals and companies and educating the public

Press

Team

Business Development Advisor

Accomplished media and branding executive with deep industry connections. Has made numerous business development related introductions, several of which have led to business.

Blockchain Expertise

Seasoned professional with deep background in the Blockchain and token economy world as well as connections in numerous other industries such as music, advertising, real estate

Use of Proceeds

If the offering's maximum amount of $1,069,999 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for Sr Mgmt | $150,000 | 14.0% |

| Working Capital | $197,569 | 18.5% |

| Sales | $70,000 | 6.5% |

| Marketing & Advertising | $100,000 | 9.3% |

| Customer, Sales & Partner Support | $200,000 | 18.7% |

| Project Manager | $75,000 | 7.0% |

| Infrastructure/Capacity | $50,000 | 4.7% |

| US Time Zone Dev Resources | $100,000 | 9.3% |

| Legal/Operations | $75,000 | 7.0% |

| Intermediary fees | $52,430 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Carii, Inc. dba Connective.Network. This offering must reach its target of at least $10,000 by its offering deadline of February 2, 2021 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

Connective.Network’s official name is Carii, Inc., so that’s the name that appears in the statements below.

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Feb 3, 2021Primary offering finalized, selling shares

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.