Introduction

TechBio is a reference to the rising convergence of biology and technology. It is at this intersection that we’re seeing unprecedented innovation that stands to radically reshape and transform the future of healthcare over the coming decades.

Emerging technology areas such as AI & Machine Learning, Regenerative Medicine, Cell & Gene Therapy, Digital Health, Intelligent Devices, Sequencing, 3D Bioprinting, and Health Services and Software are paving the way to a brighter future for all of us and creating immensely valuable businesses and market opportunities in the process.

We’re seeing the first wave of TechBio companies, those started ~10 years ago, successfully realize their visions and be able to reward their investors and employees with massive exits via IPO or acquisition:

- Recursion (Nasdaq: RXRX): ~$5.7B market cap (AI-enabled drug discovery)

- Zymergen (Nasdaq: ZY): $4.3B market cap (synthetic biology)

- Gingko Bioworks: $15B SPAC (synthetic biology)

- AbCellera (Nasdaq: ABCL): ~$5.5B market cap (antibody discovery)

- Grail: $8B acquisition by Illunina (liquid biopsies for early cancer detection)

- Guardant (Nasdaq: GH): ~12.2B market cap (early cancer detection)

- Twist (Nasdaq: TWIST) ~$5.8B market cap (synthetic biology)

It is our mission at Bioverge to identify and help accelerate the next generation of these startups who are pushing the boundaries of healthcare and bringing science fiction to life.

To that end, we have built the world’s first-ever investment platform dedicated to democratizing access to emerging opportunities at the forefront of the TechBio revolution.

And for a limited time, we are offering our supporters the opportunity to secure an ownership stake in Bioverge, enabling you to own a piece of our expanding portfolio of TechBio startups and funds. This opportunity is analogous to becoming a Bioverge General Partner in our firm, the type of ownership typically reserved for senior leadership and founding members.

Success To Date

The overall BV portfolio has significant momentum:

- Since October 2016, we've raised $5.5M+ for 28 TechBio companies across 39 deals and 3 multi-company funds (and counting...)

- We’ve invested alongside many of the world’s premier venture firms, including Andreesen Horowitz, Lux Capital, Perceptive Advisors, NEA, First Round Capital. Lightspeed Venture Partners, Greylock Partners, Polaris Partners, Social Capital, Khosla Ventures, Founders Fund, Amgen Ventures, Thiel Capital, Y Combinator, and many others.

- 4 companies within the portfolio (14%) are now valued over $100M and we've recorded 2 company exits to date (Blue Mesa Health acq. by Virgin Pulse; Echo acq. by CELLINK for $110M)

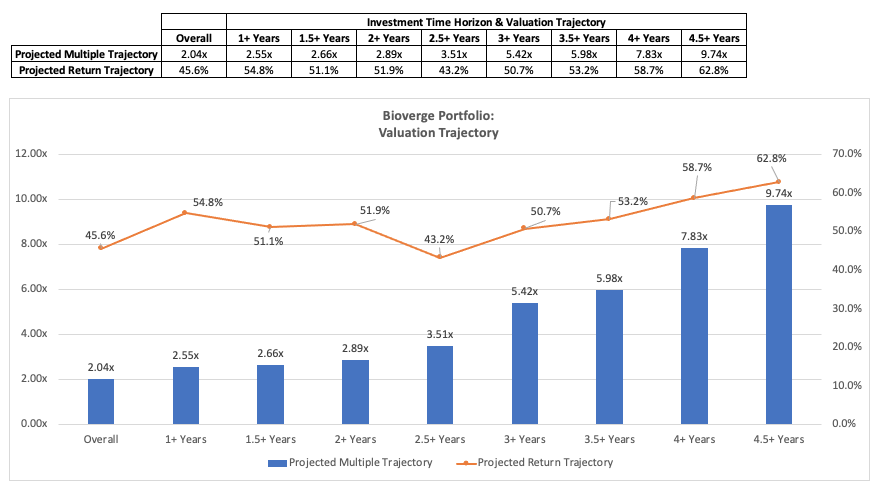

- Mature companies in our portfolio (4.5+ years old) have generated unrealized returns of 9.74x (62.8% IRR) on a valuation-to-valuation basis.

- We've earned ~15% carried interest on the $5.5M total and have also invested directly into each deal.

- If the overall portfolio return is 5x, the assets we hold today will alone be worth over $5M to Bioverge. At 10x, they'll be worth over $10M. And we're just getting started! Each new company we add to the portfolio acts as a force multiplier with asymmetric return potential.

Problem

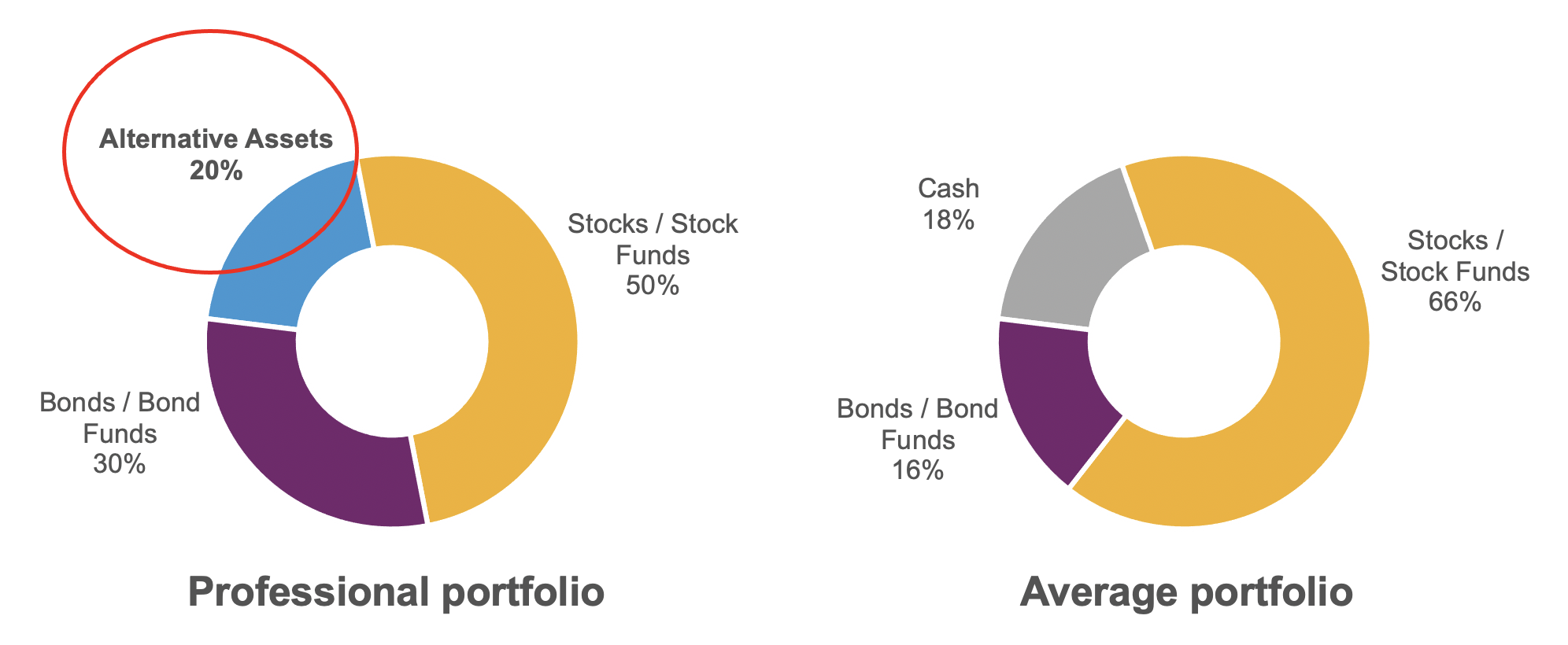

Startup investing historically reserved for professionals and the wealthy

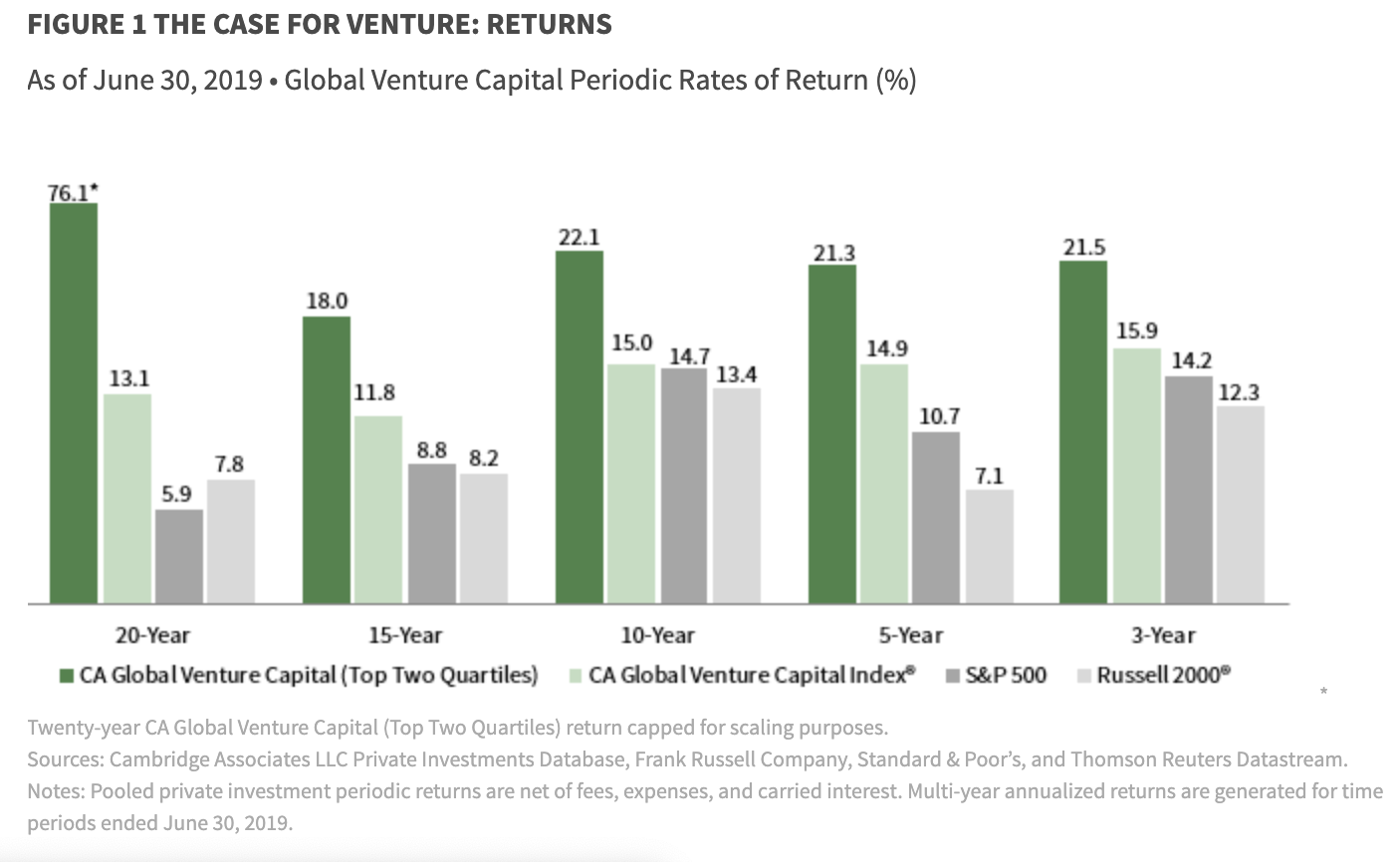

The venture capital asset class has historically been the exclusive domain of venture capital firms, professional investors, and high net worth individuals.

Why? The answer is simple: venture capital has consistently outperformed all other asset classes!

Barriers to Entry for the Average Person

There are three key barriers that must be solved to level the playing field for everyone:

- Lack of Awareness. The vast majority of people in the U.S. have never invested in a startup or private investment fund even though they are eligible to and it is advantageous for diversification and outperforming the public markets.

- Lack of Access. Even if they might be aware of the potential benefits of investing in private companies, most people lack access to the highest quality companies and investment rounds, those opportunities capable of generating the highest returns.

- Lack of Bandwidth/Expertise. Investing in early-stage, private technology companies requires time, expertise, and the ability to understand nuanced and oftentimes complex science and novel technologies, industries and business models.

Solution

Bioverge is Leveling the Playing Field

Rick and Neil founded Bioverge in 2016 based on the premise of democratizing access to the best investment opportunities in startups leading the TechBio revolution.

We provide individuals with the opportunity to incorporate venture capital into their investment portfolios and own a piece of highly vetted startups at the cutting edge of medical innovation.

We believe everyone should be able to invest in innovations that have the potential to improve the quality and length of people’s lives and fight the diseases most important to them, so we've built our platform to promote awareness, enable access, and help individual investors understand complex science and early-stage businesses.

At Bioverge, we recognize that health is universal and you should have the opportunity to own the future of your health!

And we’re certainly not in this alone. We’ve been fortunate to invest in companies alongside many of the world’s premier venture firms:

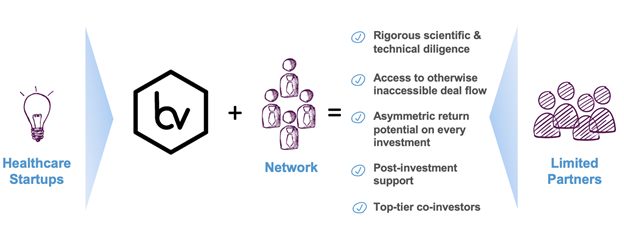

The Bioverge Member Experience

Our member community enjoys access to the same innovative health investment opportunities offered to clients of top venture capital firms. With Bioverge, that experience includes:

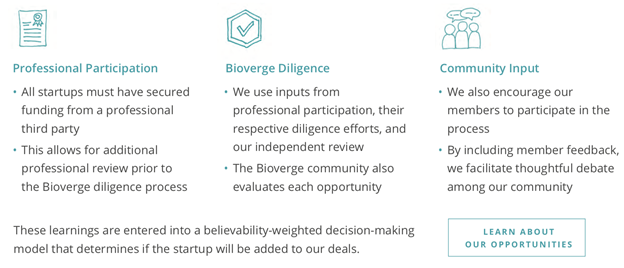

- Professional sourcing - early-stage startups carefully chosen for their innovative vision, scientific validity, and growth potential. We accept less than 5% of prospective startups.

- Meticulous vetting - specialized Bioverge diligence review and professional co-investor participation.

- Exclusive access - opportunities that aren’t available on the open market.

- Impact + Financial Returns - investment opportunities aligned with personal values that have the potential to impact the world.

Bioverge members are part of a community anchored by the Bioverge Network - a healthcare-specific grouping of strategic partners, advisors, subject matter experts, and institutional investors who enable us to maintain our rigorous standards and support our portfolio companies.

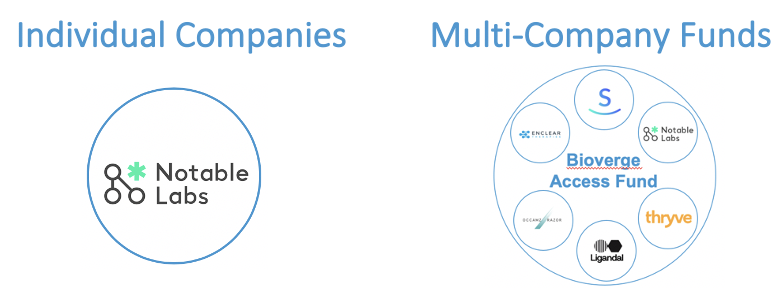

The Bioverge platform enables multiple investment pathways for members:

- Bioverge Deals - investing into a specific startup of your choosing

- Bioverge Access Funds - spreading a single investment across a diversified set of 10-15 Bioverge-curated startups

Since inception, Bioverge has invested in a portfolio of game-changing medical solutions that have the potential to save lives and generate financial returns. By investing in Bioverge, you get an ownership piece of each and every investment we make!

Portfolio Highlights:

Since October 2016, we’ve completed a total of 39 investments and have built a portfolio of 28 companies. As of this writing, 22 investments (56% of the portfolio) are being held at cost (1.0x) since they have not raised additional rounds and/or do not otherwise have objective third-party valuation metrics. The average age of investment in our portfolio is just 625 days (1.71 years), so our portfolio is very young. We’ve broken performance out by six-month intervals, as we believe that provides the most accurate and complete representation of performance.

What Our Members Say About Us:

What Founders Say About Us:

Business Model

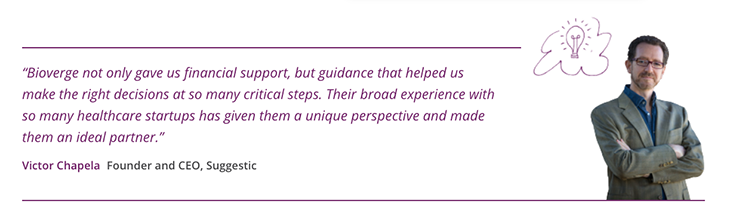

Bioverge operates two core businesses with significant revenue potential:

- Online Venture Capital. We have a syndication model which aggregates accredited investors into a Special Purpose Vehicle (SPV). That SPV will then either invest directly in a single company, or invest in multiple companies through one of our Access Funds. We typically charge investors an administrative and management fee for these services plus a carried interest on the total investment.

- Crowdfunding Portal. This is a new business for us and one we are very excited about as it enables us to open up investment opportunities to non-accredited investors (~90% of the U.S. population). We charge companies a success-based transaction fee based on the amount of capital they raise through their offering from Bioverge investors.

Market

Online Fundraising

Traditionally, non-accredited investors were barred altogether from participating in private startup offerings, which is quite shocking because 90% of the U.S. falls in this category.

Regulation Crowdfunding (Reg CF), introduced in 2012 via the JOBS Act, opened up private investment opportunities that were previously restricted to accredited investors. Since 2016, 1700+ companies have collectively raised over $400 million via Reg CF.

According to the SEC, the private placements market was $1.8 trillion in 2017 as roughly 300,000 accredited investors participated in 23,000 offerings. In 2019, the market grew to $2.7 trillion (+25% CAGR).

While an impressive growth trajectory, relative to the 20 million accredited households in the U.S. and 110 million non-accredited households, this is just a drop in the bucket - we expect this trend to continue to accelerate.

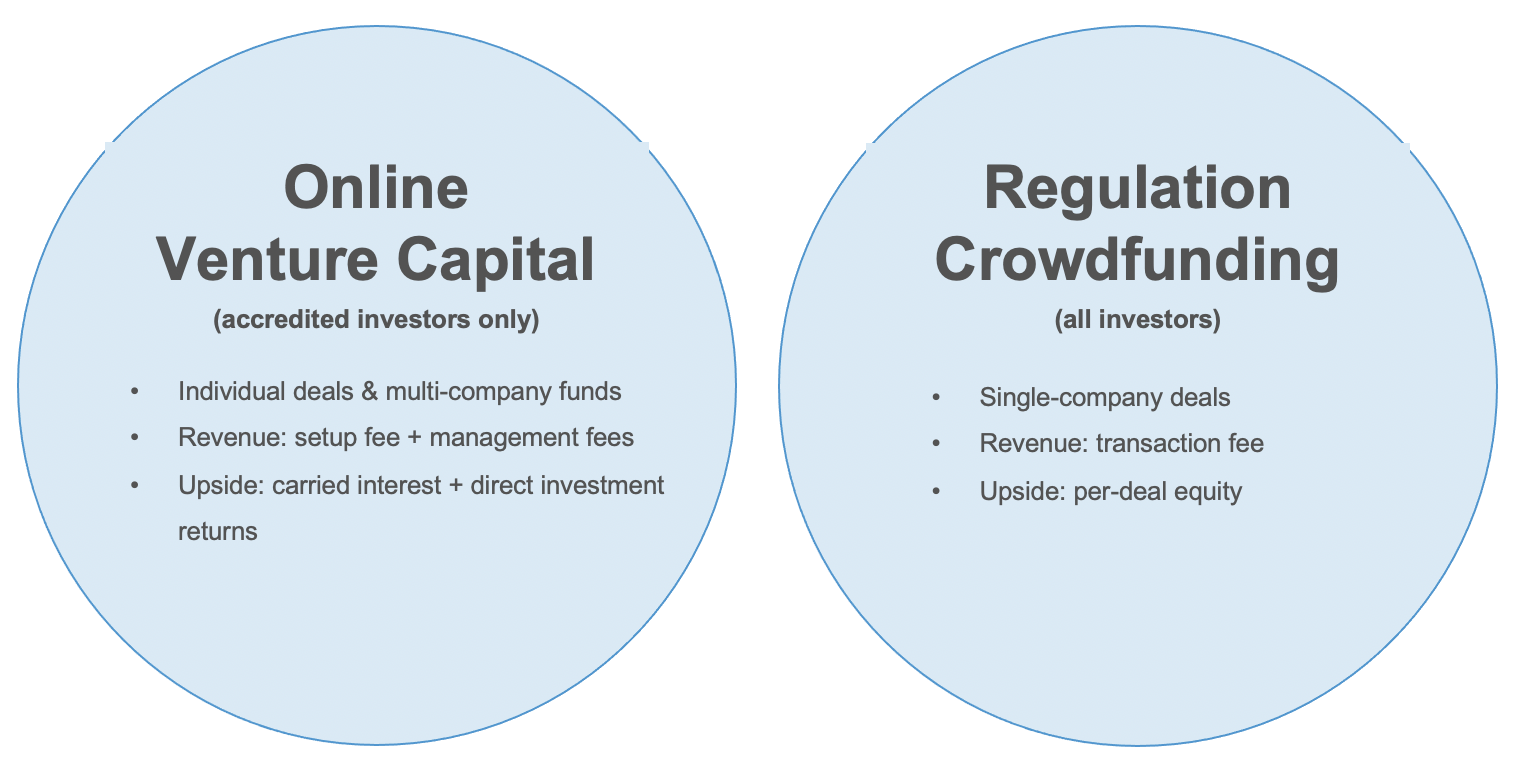

An estimated $30 trillion is held in U.S. savings accounts. If just 1% of these savings were to be reallocated to private health companies, it would create a $300 billion market, 2.8x larger than today's entire venture capital market:

In March 2021, the offering limit for Reg CF offerings is set to be raised from $1.07 million to $5.0 million. With this new change, the Reg CF pathway via funding portals like ours will become an even more attractive option for companies at various stages of growth.

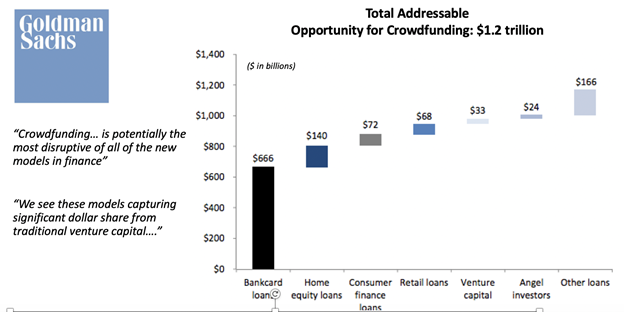

According to a report by Goldman Sachs, finance is meeting the network effect. Technology and an increasingly social consumer are democratizing access to funds and services beyond the walls of financial institutions. With Millennials as important agents of change, new business models for crowdfunding, peer-to-peer lending, socialized payments, and automated investing are rising to take market share from existing banking channels.

In addition, by 2030, we estimate that a key customer segment of ours - Millennials - will control $20 trillion in financial assets, 5x what they control today. Data from the same Goldman Sachs reports shows Millennials are less invested in stocks and are more likely to participate in crowdfunding.

The Rise of Impact Investing

- Healthcare represents an attractive opportunity for investors who are looking to make a financial return and have a global impact.

- We have all been first hand witnesses to the importance of healthcare innovation throughout the COVID-19 pandemic.

- Bioverge enables each of us to invest in the health-related causes and diseases that we care most about.

Press

- Forbes.com & Forbes Finance Council columns:

- San Francisco Business Times, Will new equity crowdfunding rules boost health care startups? One S.F. firm is betting on it.

- The Bioverge Podcast with Neil Littman

- Authority Magazine: Neil Littman of Bioverge: 5 Things I Need to See Before Making a VC Investment

- The Medtech Strategist Bioverge Democratizes Early-Stage Investing

- Awards:

- Best Healthcare Start-Ups Investment Platform 2021, GHP Magazine

- Bioverge wins 2nd place in TechRound’s Fintech50 Finalists for 2021!

- Podcast/interview appearances:

- The Meb Faber Show: Episode #146: Neil Littman, “The More Risk You Kill, Inherently, The More Value You Create”

- Building the Future Show Radio/TV/Podcast: Episode 307 with Neil Littman

- Club E Interview with Neil Littman: The Best Investment You'll Ever Make

- Press releases:

Team

Executive Leadership Team at $3B venture philanthropy organization. Formerly Vice President of Business Development at Notable Labs. Advisor on investment banking transactions totaling $1B+

Neil was previously Vice President of Business Development at Notable Labs, an oncology focused startup and Bioverge portfolio company, where he led the development of global corporate partnerships and contributed to the strategic vision. Neil oversaw business development at Notable through the successful completion of the company’s $40 million Series B and was instrumental in negotiating multiple terms sheets to in-license clinical stage oncology assets.

Prior to Notable, Neil was a member of the Executive Leadership Team and Director of Business Development at the California Institute for Regenerative Medicine (CIRM). As part of CIRM’s leadership team, Neil helped develop the five-year strategic plan for managing and deploying CIRM’s $3 billion across the organization’s discovery, translational, and clinical stage stem cell and regenerative medicines programs. At CIRM, Neil was Head of the Therapeutics Group and oversaw a team responsible for managing over 40 clinical stage therapies totaling over $500 million of CIRM investment, including Forty Seven, Inc. (acquired by Gilead for $4.9B), Orchard Therapeutics (Nasdaq: ORTX), Cellular Dynamics International (acquired by Fujifilm for $307M), Sangamo Therapeutics, Inc. (Nasdaq: SGMO), Poseida Therapeutics, Inc. (Nasdaq: PSTX), and others.

Prior to managing the Therapeutics Group, Neil oversaw the Strategic Infrastructure Group at CIRM, managing a portfolio of $125 million supporting infrastructure programs including: $30 million Stem Cell Center (partnership with IQVIA); $24 million Alpha Stem Cell Clinical Network (partnership with UCLA, UCSD, City of Hope, UC Irvine); $32 million iPSC Bank (partnership with Fujifilm); $40 million Genomics Center of Excellence (partnership with Stanford).

Prior to CIRM, Neil was a healthcare investment banker at Thomas WeiselPartners and Deutsche Bank, working on transactions totaling over $1 billion. His primary focus was on strategic advisory and public and private financings.

Neil received a Master of Science in Biotechnology from The Johns Hopkins University, and a Bachelor of Arts in Molecular, Cellular and Development Biology from the University of Colorado, Boulder. Neil worked in a virology lab during his time at CU Boulder.

Investment professional at Stanford’s $450M healthcare venture capital fund. Maintained portfolio of 300+ healthcare inventions at Stanford

Prior to founding Bioverge, Rick worked at Stanford University’s Office of the CFO as a Senior Venture Fund Analyst where he was involved in the management and oversight of the President’s Venture Fund and Stanford-StartX Fund. Across both of these funds, Rick was primarily involved with investment sourcing, due diligence, and portfolio management, investing $450M in aggregate across more than 400 companies. This further included providing ongoing support by connecting them to elite talent, fundraising opportunities and strategic partnerships, as well as stewarding long-term strategic plans and operating roadmaps to achieve commercialization, a stronger innovation pipeline, and enhanced product-market fit.

Notable highlights include leading seed-stage investments into Personalis (precision medicine and cancer genomics company; co-investors:Lightspeed; NASDAQ: PSNL), Kodiak Sciences (antibody therapies to treat and prevent blindness; NASDAQ: KOD), Oculeve (ocular stimulation to treat dry eye disease; acquired by Medtronic), Genapsys(desktop DNA sequencing), HeartFlow (real-time digital modeling of coronary arteries; co-investors: Medtronic, USVP, GE Ventures; $1.5B+ valuation), and Orca Bio (cellular therapies to treat cancer and autoimmune disorders; co-investors: Lightspeed, Data Collective, 8VC).

Prior to this, Rick was a part of the Licensing team at Stanford University’s Office of Technology Licensing (OTL). The OTL receives and evaluates over 500 invention disclosures each year to assess their commercial feasibility and potential. Royalties from successful licensing are collected and distributed to the inventors, their departments and schools. At the OTL, he managed a portfolio of 300+ technologies across their full lifecycle to support them with critical expertise in IP strategy, marketing, business development, licensing, fundraising and commercialization.

Rick holds a Master’s Degree in Biotechnology from The Johns Hopkins University, and graduated from Rice University with a B.S. in Bioengineering and Biomedical Engineering.

Additional Team Members

Bioverge has a diverse and growing multi-disciplinary team, including:

Use of Proceeds

If the offering's maximum amount of $1,069,998 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| General & administrative | $428,043 | 40.0% |

| Product development | $321,032 | 30.0% |

| Sales & marketing | $268,493 | 25.1% |

| Intermediary fees | $52,430 | 4.9% |

Terms

Investors who participate in the offering on or before May 15, 2021, will receive an early bird discount and be able to invest at a purchase price of $1.14 per share, which equates to a $10 million pre money valuation; and investors who participate in the offering after May 15, 2021 will invest at a purchase price of $1.71 per share, which equates to a $15 million pre money valuation.

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Class B Common Stock, under registration exemption 4(a)(6), in Bioverge, Inc.. This offering must reach its target of at least $10,000 by its offering deadline of March 1, 2022 at 10:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Mar 26, 2024Dive into the heart of healthcare innovation...

- Jan 22, 2024Hi Everyone, We recently released our January...

- Mar 2, 2022Primary offering finalized, selling shares

- Feb 22, 2022Hello Bioverge Community! Our Netcapital raise...

- Jan 19, 2022ICYMI: As the J.P. Morgan Healthcare Conference...

- Dec 11, 2021We are pleased to share that our CEO Neil...

- Dec 11, 2021ICYMI: On our latest podcast, Kareem Barghouti,...

- Nov 3, 2021We are excited to share with you an exciting...

- Oct 26, 2021We are pleased to share our Q3'21 investor...

- Oct 24, 2021On this week's podcast, Viswa Colluru, PhD,...

- Oct 6, 2021As seen on forbes.com, our latest article is...

- Sep 15, 2021On this week's episode of the Bioverge Podcast,...

- Sep 2, 2021We're pleased to share our Q2'21 investor...

- Aug 18, 2021On the latest episode of the Bioverge Podcast,...

- Aug 16, 2021On our most recent podcast, we sit down with...

- Jul 27, 2021We are pleased to share our latest feature in...

- Jul 15, 2021On this week's podcast, James Valentine talks...

- Jul 7, 2021Check out the newest episode of the Bioverge...

- Jun 29, 2021We're excited to share that one of out...

- Jun 22, 2021See our latest article on Forbes.com, "The...

- Jun 17, 2021For a long time, the common wisdom has...

- Jun 14, 2021See our article in Authority Magazine, "Neil...

- Jun 13, 2021Like and follow us on SoundCloud and iTunes to...

- Jun 12, 2021See our press coverage in the San Francisco...

- Jun 10, 2021Read our CEO Neil Littman's article on...

- Jun 8, 2021ICYMI: Bioverge founder, Neil Littman, was a...

- Jun 6, 2021ICYMI: Our Co-founder Neil Littman pitched...

- Jun 5, 2021Did you know we publish exclusive content...

- Jun 4, 2021We're pleased to share our newest episode of...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.