“When it comes to the safety of our drinking water we must remain ever vigilant. By bringing social impact investors to the water sector, we can help with the advancement of important technologies.”

Introduction

WaterWorks offers a new, accessible way to make an impact on the environment: through investing. WaterWorks is the only online investing site dedicated to helping advance water technologies and innovations.

We seek to advance potential water solutions by introducing investors to opportunities in technology companies and projects through our online investment platform: wtrwrx.com

Problem

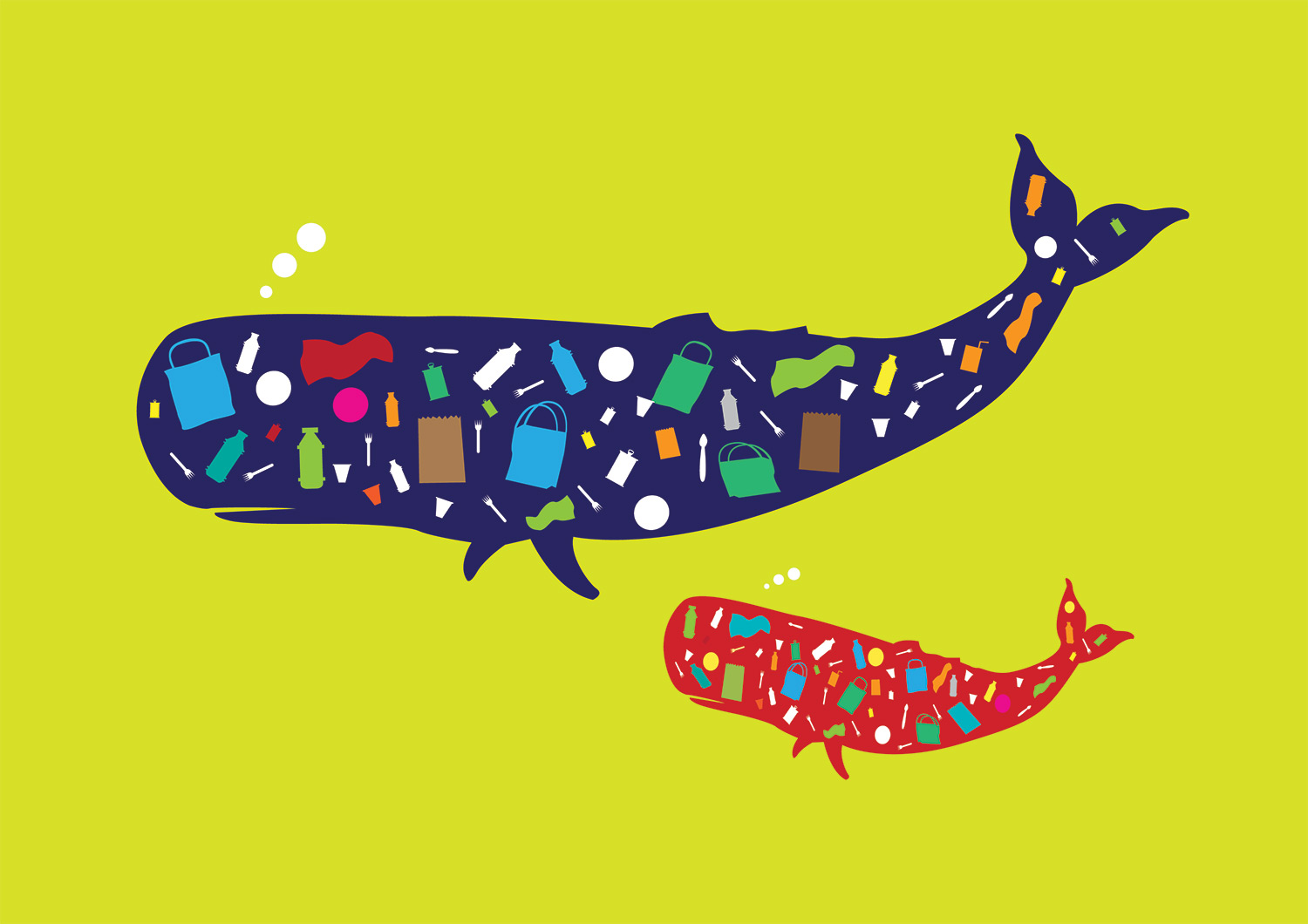

America is facing a water crisis: think Flint, boil alerts, water main breaks, PFAS, plastics, droughts or flooding. And because of population growth, climate change, aging infrastructure and limited public dollars - we believe it’s going to get worse. The American Water Works Association reports that the cost of simply restoring the country’s aging infrastructure could be as high as $1 trillion. Meanwhile, the World Economic Forum believes that most Americans could be facing freshwater scarcity over the next fifty years. The time to invest and support new water technologies and potential solutions is now.

Water technology is in need of extensive innovation and disruption. Start-ups are answering the call and developing new technologies to help solve America’s water crisis. Yet TechCrunch disclosed that water and wastewater companies only receive about 1% of angel and VC funding, making it incredibly difficult for water companies to secure the capital they need.

Solution

WaterWorks is an online investing platform that helps water technology companies and projects raise capital. We’re providing motivated, environmentally-conscious investors access to early- stage water investment opportunities. In the past decade, water crises have popped up in the U.S. and around the world. We believe there's an opportunity to capture the public's interest in the water sector and use it to help fund investments in impactful but overlooked water technologies and innovations.

WaterWorks’ management team helped change American political fundraising and is ready to do the same to the water industry. Invest in WaterWorks and join the Rising Tide today!

Market

Water

The global water industry is a $696 billion market growing in excess of 7% per year, according to ResearchAndMarkets.com. And water start-ups tend to be more profitable than traditional early-stage companies. TechCrunch reports that water start-ups are 20% more likely than other types of new companies to be profitable in the first ten years.

Business Model

WaterWorks is currently the only online investing portal solely dedicated to water related innovations and technologies. And with each investment offering WaterWorks completes, we’re building a community of water investors.

When companies list their offering with WaterWorks and successfully raise funds, WaterWorks receives:

- A 5% success fee, and

- A 5% equity fee.

We intend to offer debt and equity investments in water projects and companies planning to use innovative technologies to help solve water problems. We're often asked about potential water solution investments, so here’s a start...

- Desalination

- Plastic Reduction

- Smart pumps

- Filtration technology

- Lead line replacement

- Aquaculture

- Biodegradable packaging

- Wastewater treatment

- Ocean energy

- Smart farming

- Green infrastructure

- Algae blooms & red tide reduction

- Water reuse

- IoT, A.I. & SaaS data analytics

- Water quality monitoring

- Plant-based protein

- Water saving appliances

- Maritime robotics

“WaterWorks can assist water technology companies with finding investment capital so they can get on with their work of helping to solve our water problems.”

Competitive Advantages

WaterWorks’ competitive advantages include proven fundraising ability, early mover advantage in the water funding online investing space, a deep network, and nationwide partnerships:

Members of our team were key players in the digital campaign marketing success of President Barack Obama’s 2008 and 2012 campaigns.

WaterWorks is one of the first fundraising platforms focused on the water space.

Our team’s network spans various industries, including numerous connections in the public and private sectors.

WaterWorks has established partnerships with key water organizations across the country which will serve as a potential pipeline for offerings on our portal.

Success to Date

WaterWorks soft-launched in early 2020 and has achieved the following successes to date:

- FINRA Registration: Obtained FINRA registration for the WaterWorks funding portal.

- Team: Built a strong leadership team and advisory board including previous government officials as well as water and finance professionals.

- Funding Portal Launch: WaterWorks’ funding portal is live, fully operational, and available to host offerings.

- Strategic Partnerships: Partnered with various water organizations, including: Cleveland Water Alliance, The Water Council, TMA BlueTech, Accelerate H2O and WaterStart.

Press

“By helping investors find opportunity and water innovators find capital, WaterWorks is building a nationwide community that can help speed innovative solutions to market.”

Team

Advisors and Investors

Ms. Browner served as Assistant to President Obama and Director of the White House Office of Energy and Climate Change Policy, where she oversaw the coordination of environmental, energy, climate, transport, and related policy across the U.S. federal government. From 1993 through 2001, Ms. Browner served as the Administrator of the Environmental Protection Agency. Prior to that, from 1991 through 1993, Ms. Browner served as Secretary of Environmental Regulation in Florida. Carol M. Browner is currently Senior Counselor at ASG and serves as chair of the League of Conservation Voters Board of Directors and the Sustainability Chair of the Board of Directors for Bunge Limited.

Jo-Ellen Darcy is a highly accomplished national policy leader in the areas of infrastructure, environment, conservation, and water. As the Assistant Secretary of the Army for Civil Works, she supervised programs for conservation and development of the nation's water and wetland resources, flood control, navigation, shore protection and ecosystem restoration. Ms. Darcy also held numerous high-level staff positions in Congress, including as Senior Environmental Advisor to the Senate Finance Committee, Senior Policy Advisor to the Senate Environment and Public Works (EPW) Committee, and Deputy Staff Director for the EPW Committee.

Jon W. Allan currently serves as the senior advisor and senior academic and research program officer at University of Michigan’s School for Environment and Sustainability. Previously, Mr. Allan spent a number of years as Director of Michigan’s Office of the Great Lakes. Prior to that, Mr. Allan served in executive management positions in corporate environmental and energy management, government and regulatory affairs, and strategy. He holds a BS in Fisheries and Wildlife, and an MS in Aquatic Ecology and Zoology from MSU.

Nathan Allen is a results-oriented environmentalist and intrapreneur. Now dedicated to accelerating the adoption of water technology as the Executive Director of WaterStart, Mr. Allen has grown this public-private-partnership to include leading water agencies and large consumers. Mr. Allen has also served on the U.S. Department of Commerce Environmental Trade Advisory Committee. Previously, Mr. Allen founded and managed the Model City R+D program for the University of Arizona and served as the sustainability coordinator for Biosphere 2 following time with a solar power start-up.

Dean Amhaus has served as the founding president and CEO of The Water Council since March 2010. Under Mr. Amhaus’ leadership The Water Council has received numerous international and national economic development and leadership awards. His diverse, forty-year background in multiple sectors encapsulates a wide-range of expertise in government relations, branding, fundraising, economic development and non-profit management in Washington, D.C. and Madison, Wisconsin.

Scott Goldstein has pioneered digital strategy and technology for top political campaigns and progressive causes around the world. In 2016, Mr. Goldstein helped lead Bernie Sanders’ online fundraising, digital advertising, email, website, mobile, video, photography, social media graphics and more - raising $220 million online and achieving new records of young voter support. In 2008, Mr. Goldstein was the External Online Director for the Obama for America Presidential campaign.

Michael B. Jones is Founder and President of both TMA BlueTech and TMA Foundation. Mr. Jones is also a managing partner of SubSeaSail, as well as the Founder and President of ProFinance Associates, Inc., a boutique broker-dealer firm focused on corporate finance and M&A. He is an ex-officio Board member of the Maritime Museum of San Diego and a member of the Board of Governors of the Southern California Coastal Ocean Observing System (SCCOOS). Mr. Jones has sat on a number of corporate Boards of Directors including one American Stock Exchange company.

Over the last 18 years, Ms. Burdick has developed and managed all aspects of grassroots fundraising, target marketing and stakeholder engagement. From her time at EMILY’s List as a Direct Marketing Assistant to serving as the Director of Marketing and Merchandising for President Barack Obama’s 2008 and 2012 campaigns, Ms. Burdick has raised more than $1.1 billion. Meaghan’s experience also includes serving from 2009 to 2011 as Deputy Chief of Staff and White House Liaison under Administrator Karen Mills at the U.S. Small Business Administration. Meaghan launched Burdick Consulting Group in early 2013, and has a variety of clients which include political campaigns, charities, foundations as well as private businesses.

Felicia Marcus is an attorney/consultant who has served in positions in government, the nonprofit world, and the private sector. She is also a member of the Water Policy Group. In government, Ms. Marcus was most recently Chair of the State Water Resources Control Board, with responsibility for drinking water, water quality, and water rights. Prior to that, Felicia headed the Los Angeles Department of Public Works dealing with wastewater, recycling, stormwater and other environmental issues. In the non-profit world, she was the Western Director for the Natural Resources Defense Council and the EVP/COO of the Trust for Public Land.

George Rakis is a nationally recognized political strategist and organizer with over 20 years of political management experience. Mr. Rakis previously had served as the National Director of the Climate Action Campaign, a project of the Partnership Project’s Clean Air Defense Campaign.

Will Sarni is an internationally recognized thought leader on water strategy and innovation. He has authored numerous books and articles and presented on: the value of water, innovations in digital water technology, the circular economy, and the energy-water-food nexus. He has been a water strategy advisor to private and public-sector enterprises and NGOs for his entire career.

Charles Sell served for 21 years as a principal in a Nashville, TN-based private equity firm. Mr. Sell has also served as a Director on the Boards of four privately held middle market companies. Prior positions include Director of Equity Research at Wiley Brothers-Aintree Capital, LLC and Vice President, Municipal Finance, at J.C. Bradford Co.

Travis Loop has over 20 years of experience in strategic communications, public outreach, and media, with a focus on water and environmental issues. He is currently director of communications at the Water Environment Federation. He previously directed water communications at the U.S. Environmental Protection Agency and the Chesapeake Bay Program, served as speechwriter for the Governor of Hawaii, and worked as a newspaper reporter and editor.

Sanjiv Sinha has spent the last two decades helping execute innovative transactions and leading water infrastructure/resources projects. Currently he serves as a Board Member at the Delta Institute, a Chicago-based innovator; and as a Board Member and SVP at Environmental Consulting & Technology, Inc. (ECT), a national consulting firm.

Bryan Stubbs currently serves as the President and Executive Director of the Cleveland Water Alliance (CWA). Before joining CWA, Mr. Stubbs led technology-based economic development projects including as Managing Director of the Oberlin Project, Director of Entrepreneurship at the Chicago Westside Entrepreneurship Center, a partnership program of the Illinois Dept. of Commerce, University of Illinois and Chicago Community Ventures, and as Founder of Symbiotic Ventures.

Michael Likosky is a preeminent expert in public private partnerships (P3s). He has served as an expert to international organizations; federal, state and local governments; and US Senators. Mr. Likosky has written five books on infrastructure investment including three with Cambridge University Press. He holds a DPhil in Law from Oxford University.

Beliefs

WaterWorks is committed to a strong ethical code: no selling water, no buying water, no privatizing water.

WaterWorks believes that:

- Solutions exist which can help our oceans, watersheds and communities

- Investors can help reshape the world around them

- Water problems are local and can be solved locally

- Delivering clean water and sanitation to all people is attainable

- Healthy waters, from stream to seam are achievable

Use of Proceeds

If the offering's maximum amount of $900,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Offering related expenses | $10,000 | 1.1% |

| Current personnel | $217,980 | 24.2% |

| Additional Personnel | $204,980 | 22.8% |

| Sales & Marketing | $153,980 | 17.1% |

| Operations | $176,980 | 19.7% |

| Debt Servicing | $91,980 | 10.2% |

| Intermediary fees | $44,100 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Class B Common Stock, under registration exemption 4(a)(6), in WWF Holdings, Inc. dba WaterWorks. This offering must reach its target of at least $10,000 by its offering deadline of September 27, 2021 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

WaterWorks’ official name is WWF Holdings, Inc., so that’s the name that appears in the statements below.

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- May 3, 2022We're pleased to announce that on Friday, April...

- Sep 28, 2021Primary offering finalized, selling shares

- Aug 18, 2021Hi Everyone, I’ve worked my whole life for...

- Aug 11, 2021The Intergovernmental Panel on Climate Change...

- Jul 28, 2021Thanks for following our raise on NetCapital. ...

- Jun 30, 2021Hey Everyone! Wanted to share a fascinating...

- Jun 24, 2021It seems like every day another water problem...

- Jun 21, 2021WaterWorks is creating a simple new way to...

- Jun 16, 2021Thanks for following our raise! By investing...

- Apr 6, 2021Thanks for following WaterWorks here on...

- Mar 16, 2021Thanks for following WaterWorks. Here are a...

- Jun 17, 2020A new report from Crowdfund Capital Advisors...

- Jun 17, 2020A recent study estimated the size of the global...

- Mar 30, 2020WaterWorks Co-Founder & CEO Lon Johnson...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.