Introduction

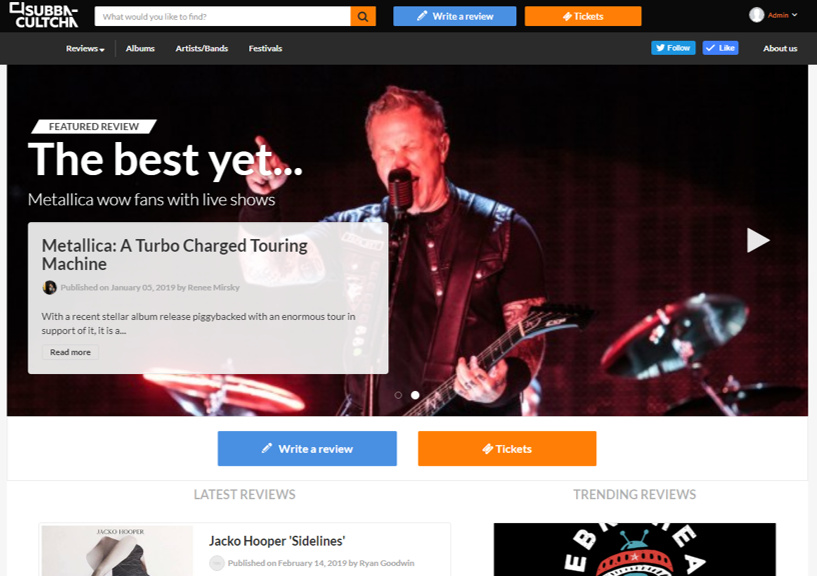

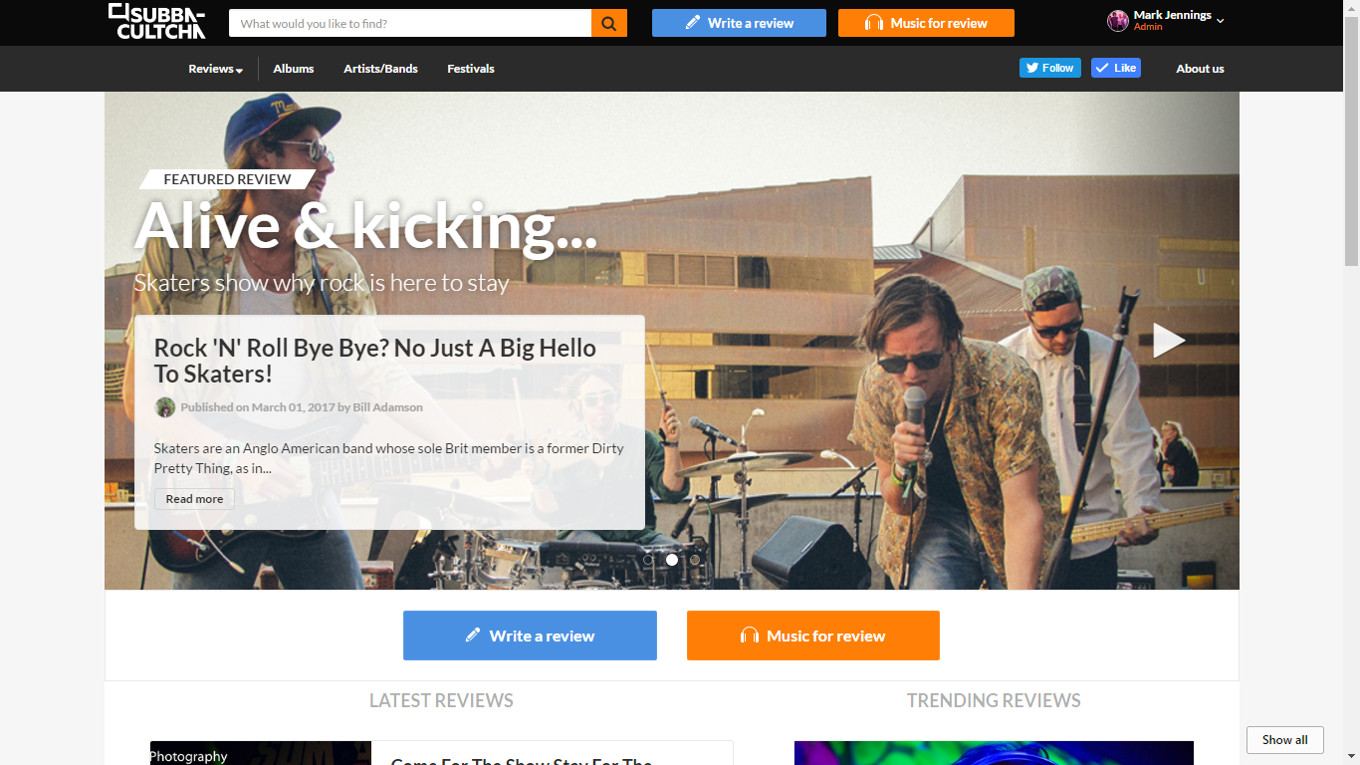

Subba-Cultcha.com, run by Subba Media, is a TripAdvisor style fan reviews platform for music and festivals! Built from a strong loyal community, the peer-to-peer content is trusted by fans, festivals, artists and venues.

Live music attendances are at a record high. 195.7m people went to live music events in the US & UK in 2016. With streaming thrown into the mix, fans are consuming artists’ music and shows like never before. Coupled with this, there is a huge increase in consumers contributing to user-generated content platforms - and studies suggest they trust user generated content 50% more than traditional media.

Music and entertainment media publishers are failing to keep up with the demand for more authentic, fan-led content. There are a number of editorially-led review sites such as Pitchfork, Vice, and The NME to name a few, crucially though, none offer fans the opportunity to review music experiences themselves. Fans want to share their opinions on the experiences they love and be more connected to the artists and events they are passionate about. Also, many up and coming artists are left behind by traditional media, and with 80% of their revenue coming from live performances it’s never been more important to connect with fans.

Subba Media started with a handful of music fans writing passionately about the local music they cared about. As more and more fans started submitting reviews, Subba-Cultcha.com has become a platform for artists to connect with fans and grow their audience.

While traditional music media publishers continue to experience declines in circulation and revenues, the user-generated reviews model continues to grow and engage much larger audiences. Our aim is to make Subba-Cultcha.com the go-to fan reviews platform for the music industry and by 2022 become the primary platform for fan generated reviews globally.

The Market

Crowd-sourcing and user generated content platforms have grown exponentially in recent years as users become active participants. Young consumers are habitually using fan generated content platforms like Yelp and TripAdvisor.

Brands are also turning to user generated content platforms to reach new customers as these platforms enable a higher frequency of engagement and better customer relationships. Yelp saw 27.29% growth in 2017 and TripAdvisor generated over $1.56bn in revenue.

On top of that, global entertainment revenues are forecast to rise by 5.1% over the course of the coming 12 months, with consumers looking for “inspiring, personalised experiences” (Global Entertainment and Media Outlook 2015-2019, PwC).

The enormous growth potential of festival focused ticketing platforms can be seen in the recent $13.8 million funding secured by the UK’s Festicket.

We believe Subba-Cultcha.com will be the trailblazing user generated content platform for the music industry. Due to our business model we also have extremely low operating costs, with a constant stream of content created by an engaged community of users.

Traction

Subba-Cultcha.com currently publishes over 6,500 fan reviews per year; featuring reviews of more than 3,000 bands/artists, over 150 festivals in the US/Europe/Asia and all with no marketing support. All reviews are vetted before being published with the average review between 300-400 words in length. 20,000 users use the site each month, reading more than 5 reviews per visit. 90% of fans share their reviews across their social media channels once they’ve been published.

We have a ticket affiliate partnership with Ticketmaster enabling us to sell their US & European ticket inventory, which is more than 150M tickets! And, we’ll soon be launching a 'direct to fan' e-ticketing system providing every band/artist with a way of e-ticketing all size gigs/shows coupled with the tools to know/grow their fan base.

Subba Media works with more than 60 record labels across the globe, including industry leaders; Universal, Warner and Sony, artist management companies, artists directly, and more than 60 US, UK, European & Asian festivals. We're in discussions with various venues - from local bars to regional stadiums - all with the aim of increasing their customer engagement and revenues through fan led reviewing.

Subba Media has also successfully generated a total of $40k in advertising revenue from Sonos, the wireless speaker company over the course of 2 months.

Business Model

Subba Media is taking the peer-to-peer reviewing model and launching it into music, one of the biggest passion points around the world. Our primary revenue sources will initially be from ticketing and advertising. Including the affiliate partnership with Ticketmaster and our proprietary ticketing system enabling festivals, artists and promoters to sell tour and event tickets directly to fans.

The proprietary ticketing system will initially be geared towards artists at the start of their career and small to medium festivals (5k-50k capacity). It will take a 10% commission for every ticket sold and will provide artists and festivals with a way of e-ticketing their events while knowing exactly who’s at the event. The system will provide a valuable fan relationship management tool so artist’s and festivals can know and grow their fanbase.

Advertising and sponsorship opportunities will also be sold across the platform to increase revenue.

As the platform grows we will add additional revenue sources such as; providing artists with the ability to sell merchandise, music streaming, brand sponsorship of events and a B2B offering for record labels and venues for managing and understanding customer/fan data.

Team

Subba Media is proud to be supported by an incredible board along with key advisers who have decades of experience in music, entertainment and technology.

Core Team

Mark Jennings set up Subba Media in September 2013 with the aim of disrupting the publishing market.

Mark has worked in digital publishing and advertising his whole career. Having previously worked in the US and UK for the Financial Times, he most recently launched the digital portfolio for Last Word Media. He's witnessed the change in audience participation across digital media and pivoted Subba-Cultcha.com's business strategy accordingly.

Mark originally met Jess Dawson and Luke Forshaw through Subba-Cultcha.com. Along with being huge music fans they were both active reviewers for the platform and following detailed conversations about the possibility of transforming the market, it became evident that they all shared the same vision and ambition.

Jess is an award-winning content creator. Nationally recognized for her work, Jess was most recently a video production manager at ITN and prior to that part of the BBC Newsbeat team where she led the charge for creating films based around issues affecting young people.

Luke has the ability to successfully market music and technology brands due his extensive experience. He was previously responsible for Universal NBC’s digital marketing at Mediacom in London, and most recently became leader of European digital advertising for Apple Music's account at OMD International.

Board Members

Advisors

The Roadmap

2019 Q2 - US/UK

- Fully responsive platform/app

- Integrated ticketing system

2020 Q1 - Europe/Australia

- Fan CRM tool

- B2B Label/Festival/Venue offering

- Music/Merchandise sales

2021 Q2 - Asia/South America

- Events

2022 - Global

- Data led revenue/tools

- Launch into parallel markets (Film, Theatre, Sport)

Use of Proceeds

If the offering's maximum Reg CF allocation of $1,070,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Working Capital | $1,017,570 | 95.1% |

| Intermediary fees | $52,430 | 4.9% |

If the offering's maximum amount of $1,070,000 across Reg. CF and Reg. D is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for Directors, Officers, and Promoters | $204,500 | 19.1% |

| Working Capital | $298,070 | 27.9% |

| Equipment / Machinery | $5,000 | 0.5% |

| Real Estate | $40,000 | 3.7% |

| Subsidiary Obligations | $60,000 | 5.6% |

| Technology Development | $160,000 | 15.0% |

| Marketing | $250,000 | 23.4% |

| Intermediary fees | $52,430 | 4.9% |

Terms

The music & festival ecosystem is evolving and we’d like to invite you to help us shape the future.

Subba Media aims to put the music fan front and centre, redefining the relationship they have with artists and festivals. With your help we can extend our platform to a global audience.

Subba Media is offering 10,700 shares of common stock in order to raise $1.1M for the following purposes:

Recruitment — $260,000

- C-level Executive

- Head of Marketing

- Head of Content

Tech Development — $260,000

- Fully Responsive Site Development

- Ticketing System

- Fan CRM system

Marketing — $385,500

- Display

- Social

- Search

- Video

Overhead — $100,000

- Office Space

- Expenses

* A portion of the seed investment will be set aside as contingency.

This is a side-by-side offering of Common Stock, under registration exemptions 4(a)(6) and 506(c), in Subba Media Inc. Up to $1,070,000 may be raised under the 4(a)(6) exemption. Netcapital will determine which exemption applies to your investment and notify you before you complete your investment.

The amount raised under the two exemptions must total at least $10,000 by April 30, 2019 at 6:59pm ET. If the total doesn’t reach its target, then your money will be refunded. Subba Media may issue additional securities to raise up to $1,070,000, the offering’s maximum.

If the side-by-side offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

Subba Media is a newly incorporated business founded by Mark Jennings.

The business acquired technology and industry advisors and needs investment dollars to take it to the next level by developing the technology, growing the team and scaling the user base.

These financial statements have been reviewed by an independent accounting firm.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemptions 4(a)(6) and 506(c) of the Securities Act of 1933. Similar information is sometimes offered in a Private Placement Memorandum for 506(c) offerings.

We’re also required to share links to each of the SEC filings related to this side-by-side offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Summary

- User generated content has a hugely successful track record proven by some of the biggest publishers globally.

- Subba Media is a fan driven business, specifically serving their needs. The live music market is big and more importantly it’s growing (by 7% in the US & 12% in the UK).

- The model has received high praise and tangible support from fans, artists, management and promoters, who continue to use it to encourage their fans to review their music and gigs.

More Info

Updates

- Apr 30, 2019Primary offering finalized, selling shares

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.