Introduction

Your Gateway to Vineyard Ownership

Ever dreamed of owning your own vineyard, sipping on unique wines straight from Italy's heartland?

LiquidVineyards is your exclusive ticket to own, learn, and invest in time-honored, family-owned wineries. We're making vineyard ownership a reality by offering Digital Rights to the finest Italian vineyards. Yes, you can own a piece of the vineyard and embrace the joy of tending your own vines.

And the magic doesn't end there. As an investor, you gain exclusive access to the heart of winemaking. You'll explore the vineyards, learn from the experts, and savor the fruits of your investment.

Problem

LiquidVineyards brings innovation to the traditional universe of wine production by solving three key problems:

- Consumers are paying too much for high-quality wine.

- Profitable investments based on sustainable financial products have traditionally only been available to larger investors in the wine industry.

- Wine lovers are in general, not connected to wine production.

Many small vineyards make great wines but are unknown in international markets due to a lack of capital and a lack of marketing resources. Additionally, many people would like to own their own vineyards but cannot manage the size of the investment and often lack the management know-how such as farming, winemaking, and marketing. Running a successful winery is a hard-gained experience, not a hobby.

Solution

LiquidVineyards’ Digital Rights are powered by the Sun!

Vineyards have a limited production capacity and wine grows in price steadily each year like no other financial asset. LiquidVineyards’ (LV) technology allows individuals to select from a global range of premium wineries and are connected to their wine production by owning the Digital Rights to vines. LV handles the paperwork (Digital Rights), and the winemaker will handle winemaking.

By purchasing Digital Rights to vines through LiquidVineyards, you can select among our quickly increasing inventory of vineyards from different regions and varietal options. Digital Rights are the link between investors and wine producers; no intermediaries for a cost-effective solution to global wine markets.

Our exclusive Digital Rights patent-pending tracking technology communicates through RFID straps on each vine and the digital labels on each bottle. With 5G seals and labels, your bottles' journey is mapped worldwide giving you exclusive access to wineries and can learn about the wine production process.

How It Works

Become an investor and start enjoying your very own wine today.

- Choose Your Winery

With a growing selection from Italy's renowned regions, LiquidVineyards brings you closer to your vineyard dream. Experience the finest Italian grapes like Barolo, Nebbiolo, and Montepulciano straight from the source and Explore the map of Italian wine regions and best wineries in Piedmont, Tuscany, Veneto, and Sicily.

All the wineries available are carefully vetted by Liquid Vineyards to meet our standards. - Buy Your Digital Rights

We're making vineyard ownership a reality by offering Digital Rights to the finest Italian vineyards. Yes, you can own a piece of the vineyard and embrace the joy of tending your own vines.

With a growing selection from Italy's renowned regions, LiquidVineyards brings you closer to your vineyard dream. Experience the finest Italian grapes like Barolo, Nebbiolo, and Montepulciano straight from the source and Explore the map of Italian wine regions and best wineries in Piedmont, Tuscany, Veneto, and Sicily. - Enjoy returns or your wine

Each bottle is one-of-a-kind, and buyers can opt for yearly wine delivery or wait for the investment gain through annual wine appreciation. The buyer has ownership of the vine’s product for a period ranging from 3 to 30 years.

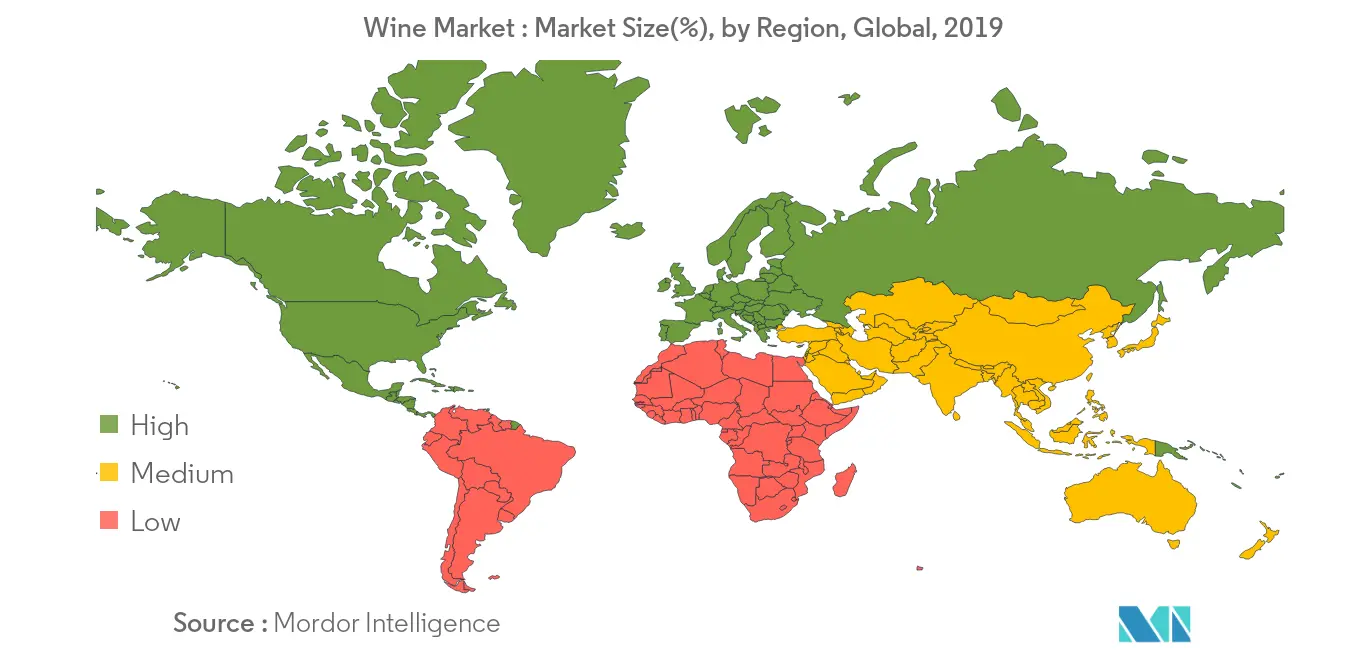

Market

According to a recent report by BusinessWire, the global wine market has witnessed steady growth over the years and is projected to grow 21% percent by 2023 and valued at $434 billion by 2027. The US Market, one of the biggest global producers, is estimated to reach $88 Billion by 2023.

Business Model

LV is a cash flow business between Wineries and their clients/owners.

- In the typical 3-tier distribution system, the price of each and every bottle of wine is multiplied by 4 once reaching your home to pay out all the players involved. With LiquidVineyards it is your own wine that you are shipping home and at a fixed price. This allows LV to mark up the wine produced by only 100% and yet still be very profitable.

- LV does not manufacture anything reducing the industrial risk to zero.

- LV requires the payment for the first year of delivery at the initial order plus 25% advance payment for each year up to 3 years 15% up to 5 years and 10% above, of the Digital Rights reservation.

- This adds up to the first year plus the additional percent of each coming year of cash flow.

- LV contracts straight with the farmers an “acquisition contract” and another with the clients a “distribution contract”, this system is simple and yet efficient, clients and farmers do not sign an agreement between them.

- The agreement with farmers is based on an enhanced price (depends on agreement, generally 10%) than their annual standard in order to give them margin. This has proven very attractive to farmers who have shown great enthusiasm for the LV business model, understanding the benefit for them too.

- The potential market is simply enormous. It is the whole planet, not everyone drinks wine but others like the financial gaining of digital rights.

Team

40 Years’ experience in electronics manufacturing and telecommunication systems in Europe and Canada. Managing deployment of nationwide infrastructures for the world biggest telecommunication players.

GSM, LTE, 5G expert and developer of transmission and communication devices coding/tracking systems.

Worldwide business experience and top level international relator.

Airplane pilot

Passionate for innovation and wine business (my first and only degree is in agriculture)

Chef Riezenman is one of California Wine Country’s most sought-after chefs, and a foremost speaker on the subject of Food & Wine Pairing. His experience in building his company Park Avenue Catering into one of the top in the Bay Area is invaluable for establishing the LiquidVineyards brand. Bruce's 30 years of connecting with many of the top wineries in California, makes him a great resource for assessing and growing our portfolio of wineries.

Andrea is an experienced independent financial advisor and entrepreneur. Andrea graduated from the prestigious Yale University, earning a B.A. in Economics and Political Science. Andrea has expertise in cross border mergers and acquisitions, complex financings and restructurings, negotiations with finance providers, private equity. Andrea has a successful track record of turning companies around and creating financial solutions and restructurings. He currently serves as CEO, Partner at AdviCorp Plc which is an Independent investment banking firm involved in M&A - Corporate Finance advisory services and asset management.

David is the founder of BOAG LAW, PLLC, a boutique intellectual property legal practice that helps clients with issues in emerging areas of technology. David and the firm advise clients in a range of fields including distributed ledgers and Blockchain-based protocols, NFTS and digital assets, cryptocurrency, and the creation, settlement, and automation of the decentralized autonomous marketplaces.

David has extensive large-firm litigation experience and was previously senior counsel at a prominent New York intellectual property firm where he handled a wide range of intellectual property matters for a client base ranging from Fortune 100 multinational corporations to sole proprietors and inventors.

Prior to his legal career, David studied computer science and spent several years as a software developer.

Liquid Vineyards merges David’s professional experience in technology law with his lifelong interest in technology and enthusiasm for all things food and wine.

Use of Proceeds

If the offering's maximum amount of $1,070,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for Managers | $150,000 | 14.0% |

| Sales & Marketing | $300,000 | 28.0% |

| Technology Investments | $300,000 | 28.0% |

| Legal & Compliance | $150,000 | 14.0% |

| Advisory Fees | $80,000 | 7.5% |

| Travel Expenses | $37,570 | 3.5% |

| Intermediary fees | $52,430 | 4.9% |

Terms

This is an offering of Membership Units, under registration exemption 4(a)(6), in LiquidVineyards LLC. This offering must raise at least $10,000 by April 26, 2024 at 11:59pm ET. If this offering doesn’t reach its target, then your money will be refunded. LiquidVineyards may issue additional securities to raise up to $1,070,000, the offering’s maximum.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

- Form C on August 31, 2021

- Form C/A on October 5, 2021

- Form C/A on October 8, 2021

- Form C/A on November 1, 2021

- Form C/A on November 12, 2021

- Form C/A on December 14, 2021

- Form C/A on January 28, 2022

- Form C/A on March 24, 2022

- Form C/A on April 13, 2022

- Form C/A on August 15, 2022

- Form C/A on October 12, 2022

- Form C/A on December 9, 2022

- Form C/A on February 3, 2023

- Form C/A on March 28, 2023

- Form C/A on April 27, 2023

- Form C/A on June 21, 2023

- Form C/A on August 18, 2023

- Form C/A on October 24, 2023

- Form C/A on January 19, 2024

- Form C/A on February 1, 2024

- Form C/A on March 28, 2024

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Apr 27, 2024Primary offering finalized, selling units

- Feb 19, 2024We are starting to get the first sales of...

- Feb 19, 2024VERY IMPORTANT new listing on the...

- Oct 22, 2023Our online shop is up and running: Buy 10...

- Oct 20, 2023Since we are a high tech company, the voice...

- Oct 20, 2023Dear valuable partners, We have completed a...

- Aug 17, 2023Yesterday we visited VillaRussiz . They were...

- Aug 12, 2023The new LiquidVineyards website is finally...

- Apr 8, 2023Think of your vineyard in Italy We have started...

- Apr 7, 2023We have attended Vinitaly 2023 in Verona...

- Dec 26, 2022You are all receiving this...

- Sep 26, 2022Another beautiful wine estate in Tuscany to buy...

- Sep 22, 2022Here we are! The first VillaRussiz bottles with...

- Sep 5, 2022Today is Labor Day in the USA, but at...

- Aug 25, 2022We are finally releasing the name of two...

- Mar 6, 202203/04/2022: Brunello wine: Ferragamo's Cantina...

- Mar 1, 2022Wine is Peace and dialogue. Wish they could...

- Feb 24, 2022You asked for it and finally we have the first...

- Feb 15, 2022We have reached an agreement with...

- Feb 1, 2022Interesting article on "Motley Fool", Algorand...

- Jan 14, 2022LiquidVineyards plans to sell wine BEFORE it's...

- Jan 12, 2022It is pruning time in the vineyards and we are...

- Dec 25, 2021Today at the Christmas family event we had a...

- Dec 3, 2021LiquidVineyards and Algorand reached an...

- Nov 11, 2021LiquidVineyards is pleased to announce it has...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.