Introduction

FirstRoot is a SaaS company selling schools a software platform and integrated curriculum that teaches financial literacy and civics. The secret of our success is that we give students real money to invest in their schools and we support them as they work together to decide how to invest it.

Problem

The Financial Literacy Challenge

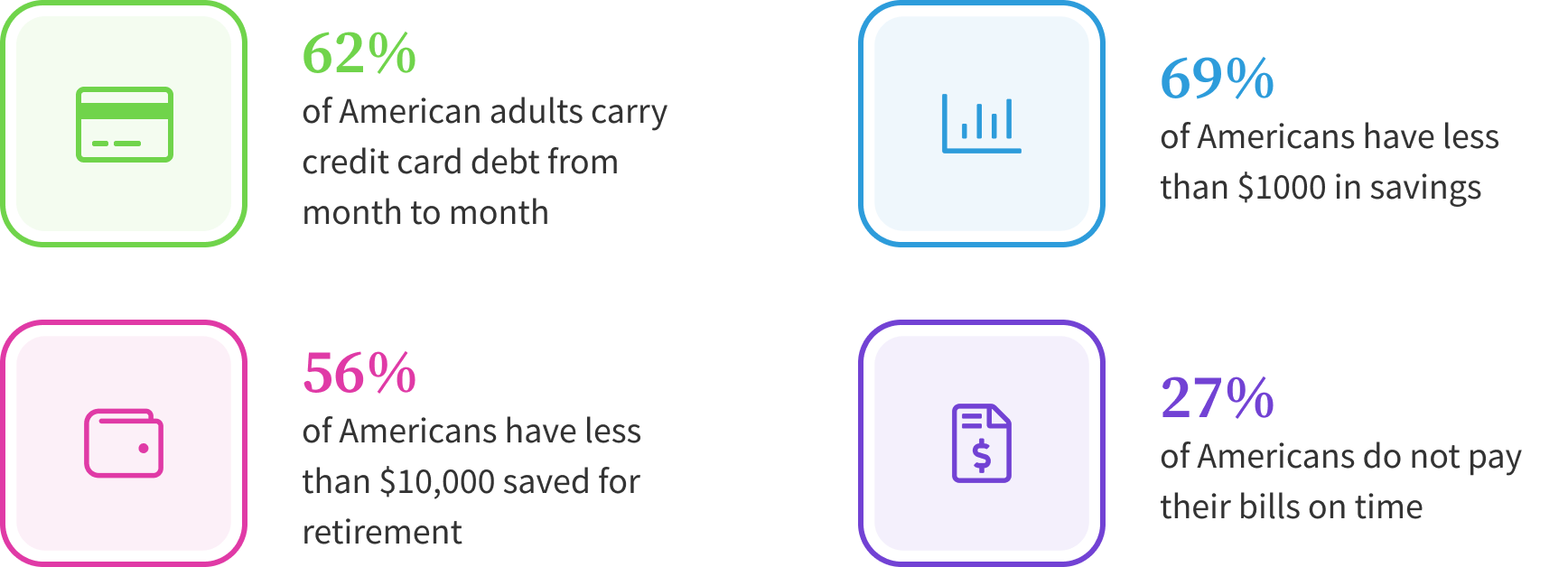

Nearly two-thirds of Americans can’t pass a basic test of financial literacy [1], creating real economic cost:

- 62% of American adults carry credit card debt from month to month (NFCC)

- 69% of Americans have less than $1000 in savings (GoBanking)

- 56% of Americans have less than $10,000 saved for retirement (Forbes)

- 27% of Americans do not pay their bills on time (NFCC)

Multiple Presidential Advisory Councils have recognized this problem and have recommended that the U.S. Congress and/or states mandate financial literacy education. Unfortunately, these mandates are not working.

Existing Solutions Are Failing

The reason existing financial literacy solutions fail is that they focus on facts, such as calculating an interest rate on a loan. Not only is this boring, it doesn’t work: students memorize facts to pass a test and then quickly forget them.

Even worse, many educational programs provide students with simulations based on scenarios that they will never encounter in their adult life. For example, stock market simulations in which students are rewarded for risky, short term investments teach exactly the opposite of what most investment advisors recommend.

Financial literacy is more than just running numbers or playing with fake money. Financial literacy is the ability to make effective decisions along with an understanding of your own personality and values.

Solution

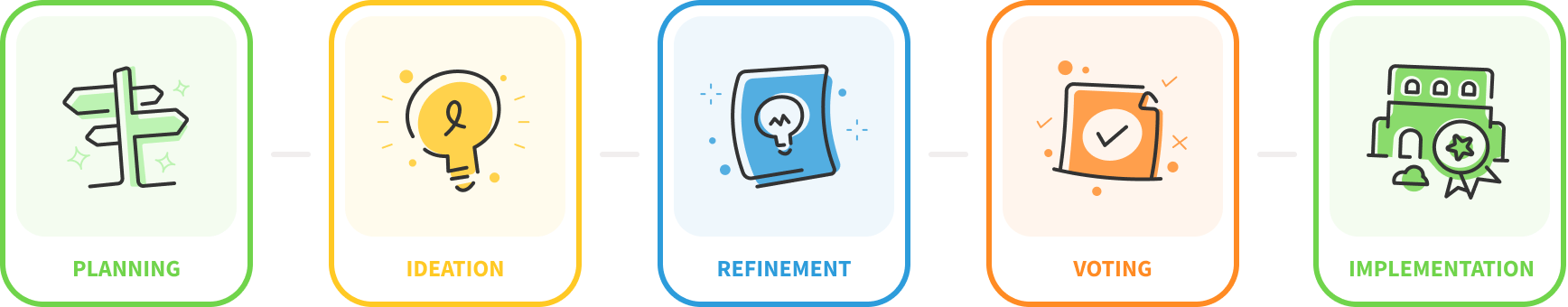

FirstRoot teaches financial literacy by giving students real money to invest in their schools. Our software platform guides students (and their teachers) in creating ideas to improve their school, refining these ideas into specific proposals, determining the costs of each proposal, voting on the best proposals, and tracking the implementation of their ideas.

Why FirstRoot Works for Students

FirstRoot’s unique solution leverages project-based learning to transform the learning experience. As students manage a real budget, they:

- Learn factual knowledge, such as how much a proposal will cost

- Acquire skills in managing budgets and negotiating investment decisions

- Gain insights into their personal dispositions around money

The Soul of Our Solution: Participatory Budgeting

The soul of our solution is Participatory Budgeting (PB), a democratic process endorsed by the United Nations that has been used thousands of times worldwide.

In a typical school, the PB program is managed by a teacher, with funding of $2,000 to $10,000 provided by the Principal, the PTA, or the school district.

Our platform guides students through the process, giving them the opportunity to learn how to manage money by actually managing a real budget. As the students decide how to invest the money, they learn important life lessons about financial literacy, design thinking, and civics.

Watch this video to see how the FirstRoot app supports students

FirstRoot Meets the Needs of All Stakeholders

Our solution includes a complete offering for all stakeholders:

- We provide a gorgeous, easy to use, secure, and internationalized application that runs on any modern web browser and supports local languages and currencies.

- For teachers, we provide training on Participatory Budgeting and complete, standards aligned Financial Literacy curriculum that is ‘ready to use’.

- For students, we provide a fun and meaningful way to do more than just learn financial facts: Using our app enables students to gain credit for community service and bolsters their resume for college and/or future jobs.

- For parents, we provide a secure platform that allows them to engage in the community.

- For administrators, we provide all of the necessary security, compliance, and operational controls to make sure our app can be used with minimal overhead and disruption.

Our solution is informed by more than a decade of experience in producing Participatory Budgeting solutions in the private and public sector and our extensive experience in creating education solutions. Our expertise in design thinking and product development coupled with our extensive experience and research has created a truly revolutionary app.

FirstRoot has successfully completed pilots of our solution at high schools in California, Indiana, and New York. We are presently planning and/or producing additional pilots in schools in the US, Mexico, India, and France.

Business Model

Our business model is designed to make it easy for teachers to start and for schools to scale.

Revenue Model

Our software-as-a-service business generates revenue in three ways:

- Classrooms: A teacher can use FirstRoot to manage a Participatory Budgeting program in their class for a one time fee starting at $25.

- Schools: A single school can use FirstRoot to manage an unlimited number of Participatory Budgeting programs for an annual fee of $10/student. The Schoolwide offering includes additional capabilities needed to manage larger number of students, such as support for Single Sign-On (SSO) and student engagement reports.

- Multi-school Networks: A group of schools, such as a district or charter network, can deploy FirstRoot across multiple locations for a negotiated fee. In this scenario we help the school network manage budgets and collaboration across locations.

Go-To-Market

Our go-to-market strategy combines traditional enterprise sales techniques with product-led growth including:

- Social Sharing: The best proponents of FirstRoot are the students, teachers, and parents who experience the power of Participatory Budgeting. Accordingly, we have integrated social media into our app so that all stakeholders can share their work across their personal and professional networks.

- Targeted Grants: Instead of relying solely on advertising, FirstRoot is building market share by making targeted grants to schools to help them initiate Participatory Budgeting programs. See the detailed discussion of the FirstRoot School Fund below.

- Families: As a public benefit corporation, FirstRoot also provides a free edition for families that enables them to use Participatory Budgeting in their home. Using the FirstRoot Family Edition, they work together to do such things as plan and fund family vacations, charitable donations, home remodels, and other significant investments.

- Partnerships: FirstRoot is developing partnerships with organizations such as PTAs/PTOs and affinity groups to bring Participatory Budgeting into schools at scale.

- Sponsorships: FirstRoot also works with foundations and individuals who wish to sponsor Participatory Budgeting in specific locations. For example, we have partnered with the Salesforce Educational Foundation and a Salesforce executive to create a $3,000 Participatory Budgeting grant for Hillsdale High School in San Mateo, CA

Profitability

Profitability in SaaS companies is largely based on carefully designing the operational infrastructure to promote ease of use and self-service. Our solution provides all necessary capabilities to purchase and self-provision a single class or a single school. Managing school districts requires minimal overhead in our solution. We minimize costly customer service through extremely high quality and very low defect rates coupled with extensive product documentation.

FirstRoot Is a B-Corp

FirstRoot is a public benefit corporation. This means that in addition to generating profits and a return for our investors, we are deeply committed to creating a public benefit of increasing financial literacy and sustainable value for all stakeholders. It also means that we are voluntarily committing to additional obligations regarding accountability and transparency.

Why We’re a B-Corp

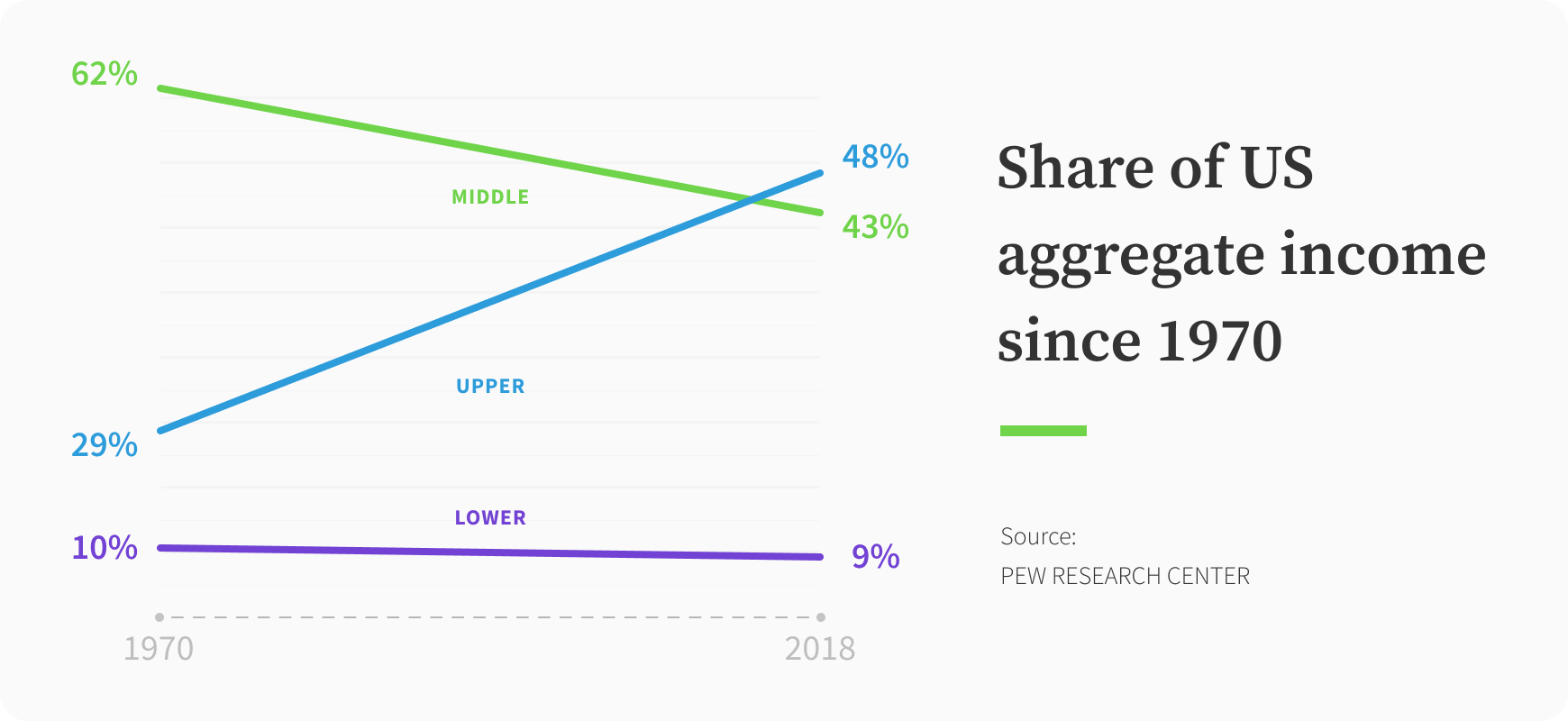

Over the last 40 years, economic inequality in the United States and many other countries has worsened.

Economic inequality creates substantial societal harm: the more unequal the society, the worse the society performs on numerous dimensions of health and well-being.

More economically unequal societies have:

- Greater rates of opiate addiction and higher incidence of mental illness

- Increased and unfairly distributed incarceration rates

- Lower social mobility and higher teenage births

- More obese citizens

One root cause of economic inequality is financial illiteracy. Financially illiterate people are not able to effectively live and work in the complex society we’ve created. By increasing financial literacy, we create greater opportunity for those members of our society who need it the most.

The FirstRoot BHAG

FirstRoot has a Big Hairy Audacious Goal (BHAG) in line with its mission as a B-Corp: We want to put $1K into 1M schools globally and watch what happens when students can control $1B in capital to make their schools — and our world — a better place.

The FirstRoot School Fund

While the amount of money needed to initiate a Participatory Budgeting program in a school is modest, we also recognize that not every school has the financial means to fund even a small program. We also realize that as a company we need a means to market our solution in a way that is aligned to our values and mission.

As it turns out, putting these ideas together creates a wonderful opportunity to achieve our social mission while creating awareness of our offering!

Instead of spending a lot of money on advertising, and in alignment with our public benefit mission, FirstRoot has created the FirstRoot School Fund.

The purpose of the FirstRoot School Fund is to promote Participatory Budgeting by making targeted grants to schools to help them initiate Participatory Budgeting programs. Our focus is on schools that need the most help. Our one condition is that students are in control of these funds.

We have already successfully raised $3,000 via direct donations. These funds have been earmarked to The Academy of American Studies in Queens, NY ($2,000) and Fremont High School in Sunnyvale, CA ($1,000).

FirstRoot plans to use some of the capital we raise in this round for grants. Every investment benefits schools, and the more that is invested the greater the impact, as shown in the table below.

| If we raise a total of... | We aim to add this amount to the FirstRoot School Fund |

|---|---|

| $300,000 | $9,000 |

| $750,000 | $30,000 |

| $1,000,000 | $50,000 |

Market

FirstRoot’s addressable market includes every student in every school, both in the US and abroad. Our phased rollout assumes the following pace:

In 2021-2022 FirstRoot will focus on the US secondary school market:

- 23,735 schools with 15 million students

- This represents a potential market of $150M at $10/student

In 2022-2023 FirstRoot will expand our offerings to the US elementary school market:

- 59,000 schools with 36 million students

- This represents a potential market of $350M at $10/student

A leading source in education intelligence, HolonIQ, projects a current market of more than $100B for EdTech, growing to $400B+ by 2025. Additionally, Grand View Research projects the 2021 EdTech market as $106B, growing to a less aggressive estimate of $377B by 2028.

Additional opportunity exists across the globe: Participatory Budgeting is endorsed by the United Nations and in-person Participatory Budgeting programs have been produced in schools located in many countries.

Summary of Investment Rationale

- Financially literacy is a large and growing market.

- EdTech is experiencing explosive growth.

- Project-based learning is the fastest growing method for instruction.

- A solution that works, even during a pandemic.

- Huge U.S. market. Even larger global market.

- Participatory Budgeting is endorsed by the United Nations.

- The founders are experts in participatory budgeting, fintech, and agile software development.

- The founders are very capital efficient.

- The founders have proven they can sell a company and create above-market returns for investors.

- The company will create both social and financial returns.

Investors

We’ve been fortunate to attract investment from a large group of early stage investors already. For brevity, we’ve included bios of a few below:

“Luke will persevere/pivot until the venture is successful. I'm an investor in his current venture and an investor in his previous venture which provided a successful exit and return.” Verne Harnish speaking on FirstRoot founder Luke Hohmann

Alex is the inventor of the Business Model Canvas, co-founder strategyzer.com, and lead author of Business Model Generation, which has sold more than a million copies in 30 languages. He is ranked #4 on the Thinkers50 list of the world’s leading management thinkers.

Laureen is an expert in enterprise agility and author of the BizOps Manifesto. She had this to say about Luke: “I met Luke more than 10 years ago when we worked together. In the time I have known him, he has invented methods that make large and small companies more efficient, effective, and fun. Now, with FirstRoot, Luke is working to make the world better by educating people on finance. I believe in their purpose, their mission, and in Luke.”

Craig is an expert in EdTech and startup investing. Most recently, he transformed Testiv from a loss-making test prep company into a successful AI-driven technology platform that was sold in 2020.

Lyssa is an internationally recognized agile thought leader and speaker who coaches top leadership teams to radically improve the quality of their decisions. She is a proud investor in FirstRoot because she believes the power of collaboration and civic engagement are essential for realizing the just and sustainable world we must build.

Team

Luke is a veteran entrepreneur, author of four books, and internationally recognized expert in Participatory Budgeting and Agile software development. Prior to starting FirstRoot, Luke built Conteneo, an enterprise collaboration software company, from bootstrap to global business that he sold to Scaled Agile in 2019. At Conteneo, Luke helped large enterprises administer more than $3B using Participatory Budgeting techniques.

A veteran product leader, Clint Gossett has held leadership positions at Visa, Verifone, and Automation Anywhere.

Use of Proceeds

If the offering's maximum amount of $1,067,220 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Compensation for managers | $96,000 | 9.0% |

| Operational Expenses | $63,926 | 6.0% |

| Product Development | $600,000 | 56.2% |

| Marketing and Sales | $155,000 | 14.5% |

| Curriculum Development | $50,000 | 4.7% |

| FirstRoot School Fund | $50,000 | 4.7% |

| Unallocated Funds | $1 | less than 0.1% |

| Intermediary fees | $52,294 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Class A Common Stock, under registration exemption 4(a)(6), in FirstRoot, Inc.. This offering must reach its target of at least $10,000 by its offering deadline of October 20, 2021 at 12:57am ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Footnotes

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Dec 10, 2023Dear Investors - This is the second of two...

- Dec 10, 2023Dear Investors - This is the first of two...

- Oct 18, 2023Post 2 of 2 It is no secret that FirstRoot was...

- Oct 18, 2023Post 1 of 2: Dear FirstRoot, Inc....

- Oct 20, 2021Primary offering finalized, selling shares

- Aug 31, 2021**Enhanced Member Management** FirstRoot is...

- Aug 10, 2021** Multi-Currency Support **...

- Aug 5, 2021** Participatory Budgeting Toolkits ** PB is...

- Jul 26, 2021** New website ** We are pleased to announce...

- Jul 14, 2021Jump$tart Approved!: The [FirstRoot Financial...

- Jul 9, 2021ANOTHER! Customer Testimonial: We are pleased...

- Jun 29, 2021NEW Customer Testimonial: We are pleased to...

- Jun 18, 2021McKinsey and the Wealth Gap. McKinsey has...

- Jun 14, 2021Rotary and FirstRoot: We are pleased to...

- Jun 8, 2021We are pleased to announce our first set of...

- Jun 3, 2021We are pleased to announce that we have...

- Jun 1, 2021We are pleased to announce that the **FirstRoot...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.