Introduction

Through the creation of 21-inch LCD screens attached to the passenger side door of vehicles, and a proprietary Ad Store eBumps, has created a new advertising practice in the out-of-home space that is beneficial for both driver, and advertiser.

Success To Date

- $500,000 raised to date (less than 1 year)

- Five LCD screens are already displayed in Times Square NYC in ‘the heart of the world’ on 46th and Broadway

- Deploying 20 additional screens to drivers around NYC who have already signed up and been approved.

- 100+ drivers signed up to drive in NYC alone

- Signed a Letter of Intent with an international investment group who is hoping to help us expand internationally in sections of the Asian Market.

- Have received revenue based on Ad Plays on the eBumps system.

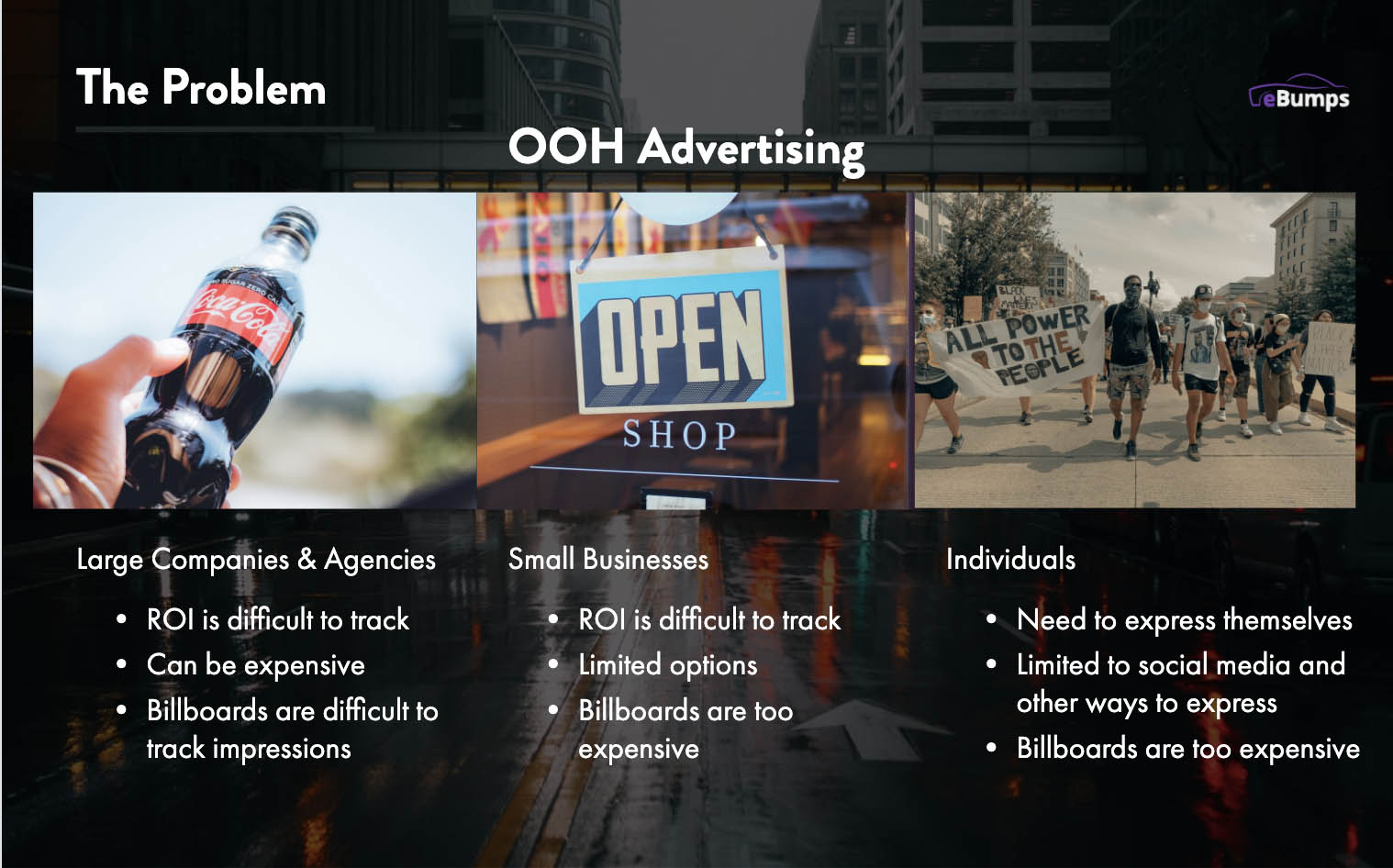

Problem

eBumps has identified two problems that we felt needed to be solved:

- The personal monetization space: influencers and those with large online followings are paid millions of dollars based on the eyes that view them. There’s no effective way for the everyday person to break into this space or to take advantage of this even with the eyes that see people in their everyday lives.

- The out-of-home advertising industry: Standard billboards and other traditional advertising practices are not only stagnant and expensive, but out of reach for most small businesses and individuals who have a smaller advertising budget and need to be able to visualize their return on investment (ROI).

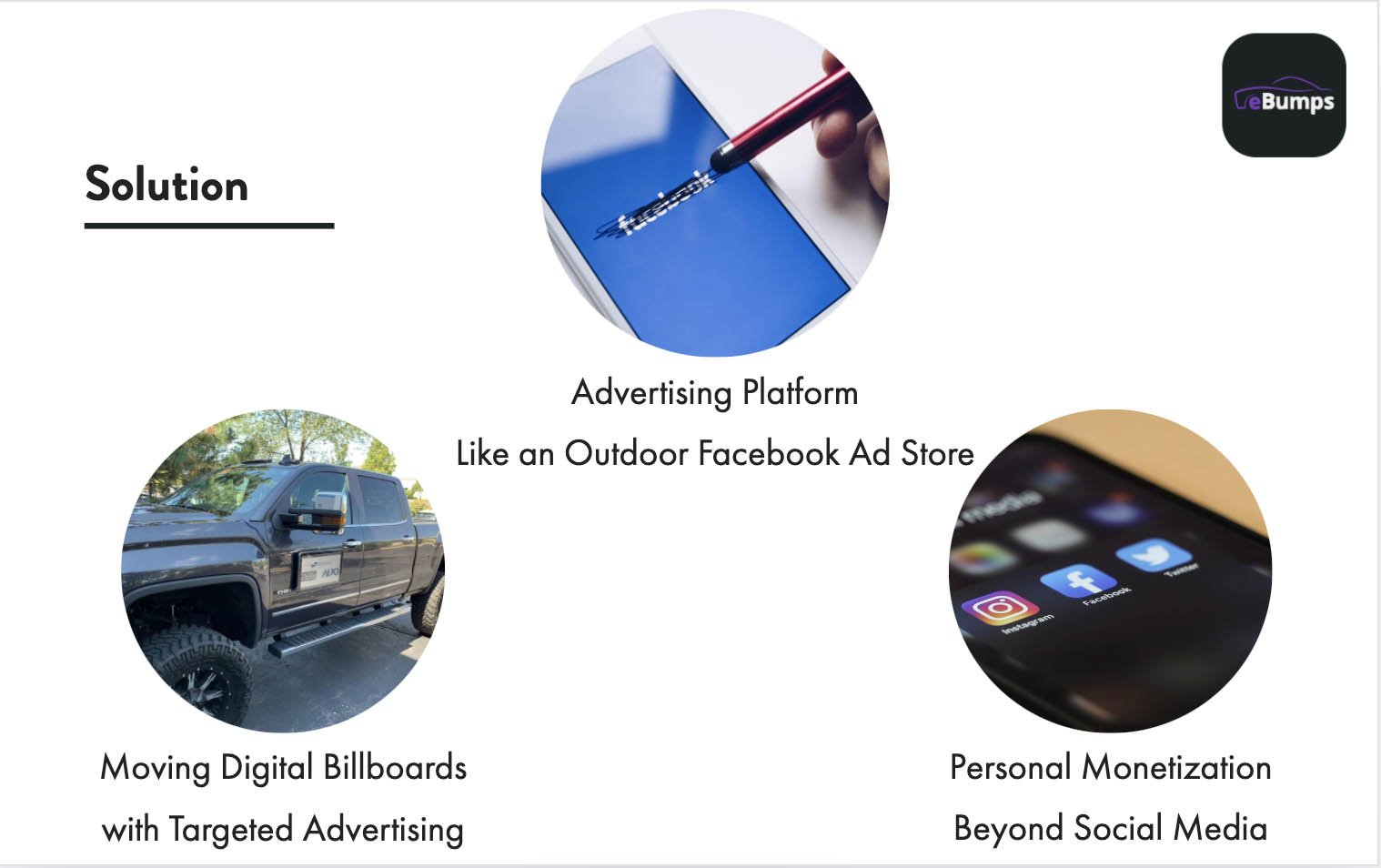

Solution

eBumps has found an intersection of these two advertising problems. By allowing vehicles to mount a 21 inch LCD screen on the side of their car, drivers will have the opportunity to be compensated for their everyday driving. eBumps will be something advertisers flock to, as they are now presented with geo-targeted advertising possibilities in the OOH space that allows for ROI tracking among other metrics currently only seen in the digital space.

We have developed strong partnerships with some of the top companies in the world in our industry. Our screens are built by AUO, commonly referred to as the best LCD manufacturers in the world who also build the LCD screens for companies like Samsung. Our systems are then built by Tech Global, an incredibly reputable systems integration firm who builds systems for companies such as 3M, Delta, Motorola, and more. We have also begun working with exciting established companies and startups such as Vistar Media, and Street Metrics who aid in the filling of our system with advertisements programmatically and the counting of impressions to provide our advertisers with details accounts of the viewership they are receiving.

Business Model

When drivers mount an eBumps screen onto their car and drive, every moment that they spend driving is an opportunity for an advertisement to be run on their screen.

Through our online Ad Store and private placement programatic advertising, advertisers are able to list ad campaigns with settings such as time of day, location, and more. They can start their advertising with the amount of impressions they would like to see and then geo-target their campaigns based on their target audiences.

Programmatic Advertising also allows us to fill all non-sold (non-filled in our internal Ad Store) ad spots with ads through open exchange advertising placements.

Long story short, advertisers pay us to run ads on these screens, and we then pay a portion of this ad revenue to those driving through no additional work for the driver.

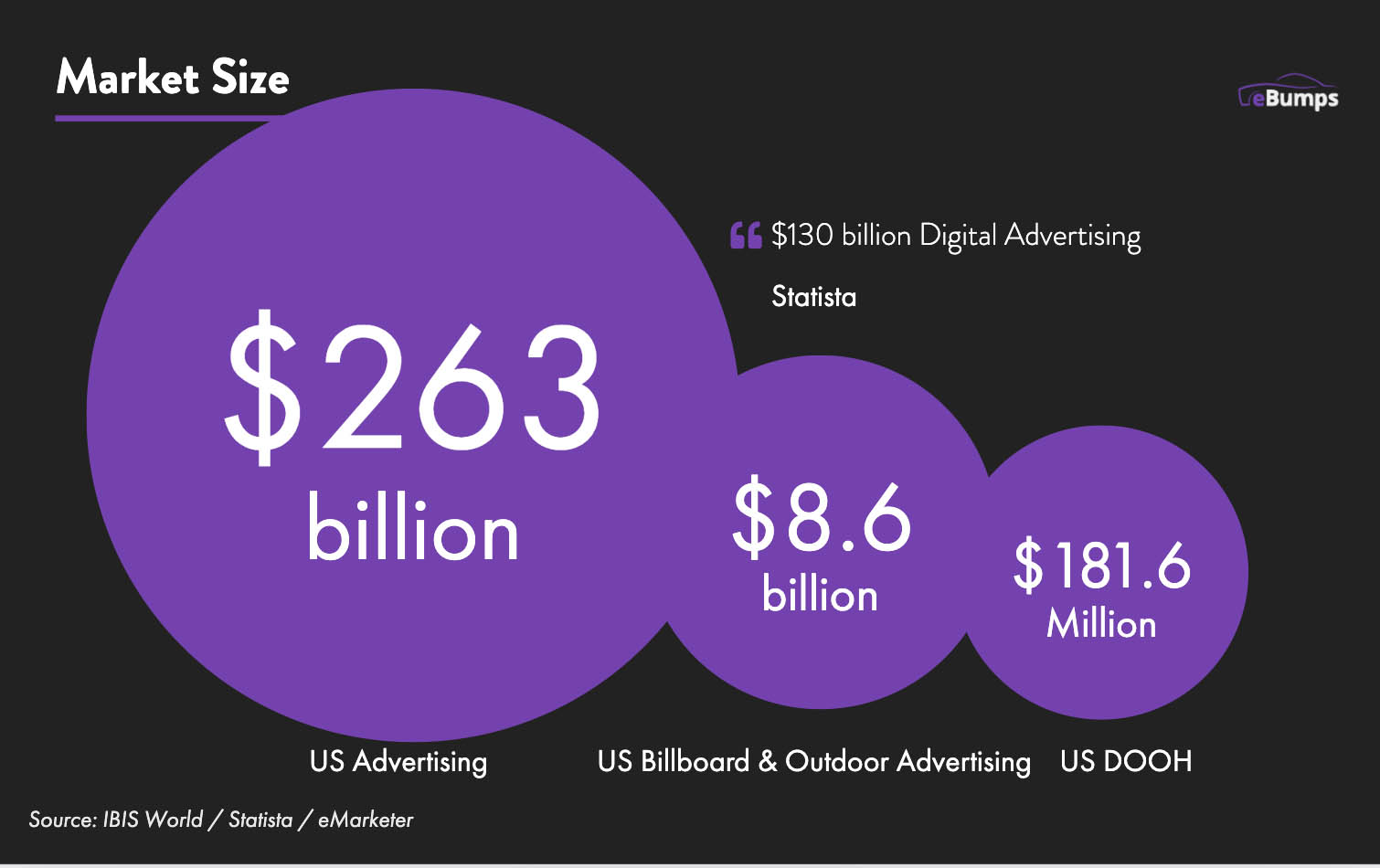

Market

eBumps’ target market is the out of home (OOH) advertising market where Large Companies, Small Businesses, and Individuals place advertisements. In addition, we have an opportunity to capture some of the digital advertising market based on the work StreetMetrics is doing in providing intensive ROI data to our campaigns that parallels that seen in Digital Advertising.

According to IBIS, Statista and eMarketer, the US Advertising market is a $263 billion annual market - with $8.6 billion spent annually in the US Billboard and Outdoor advertising submarkets, and $181 million spent annually in the Digital OOH advertising submarket. Also, according to statista US Digital Advertising spend is $130 billion annually.

Our system has the ability to be easily removed by the drivers (the screen slides on and off seamlessly) thus we broaden our market to be outside of the solely ‘professional drivers’ and to the broader portion of drivers who would not want to permanently mount a 55” screen on top of their car.

Similarly, our competitors run only programmatic advertising, so we also expand our competitive advantage in terms of the advertiser with our online Ad Store. Our Ad Store allows for small businesses, individuals, and truly anyone to advertise in the mobile outdoor space.

Press

Team

This is the second startup that Jonah has worked on in a director role and the fifth in his professional career. He, alongside Cole and Corin, founded eBumps in December of 2019 while studying in undergraduate at Vassar College and built it through its first few months in an off-campus house with Corin while also being a full-time student.

Jonah has written software for multiple startup companies before (in the SAAS Space, AI Solar Space, Blockchain Space, and more). He has led the eBumps team through the creation of manufacturing partnerships with companies such as AUO, Tech Global, Vistar, Street Metrics, and more, aided in the high-level building of the software and hardware, been in charge of hiring, overseeing employees, led charges on the fundraising, oversaw the sales and marketing teams, vetted potential drivers and allocated screen placements, and also handled all broader administrative and directional matters and more.

Jonah graduated from Vassar College in 2020 with a Bachelor's degree focusing in Computer Science and Mathematics.

George has been working with eBumps since its founding as the lead engineer of the software stack and is actively involved in the system design as its lead software developer. Previously, George helped design and lead pilot 5G mmWave wireless academic research studies into MIMO technologies and has an extensive publication record. He also worked in a high-frequency trade division developing monitoring solutions for a spot trading engine. George has extensive experience in high-performance computing, databases, and distributed systems.

George is also a doctoral candidate in the Department of Physics at the University of Illinois at Urbana–Champaign, where he studies high-energy astrophysical phenomena near supermassive black holes. He is a member of the Event Horizon Telescope (EHT) collaboration and the Horizon collaboration. Recently, he has also been a part of COVID-19 modeling efforts for the State of Illinois and the University.

Tim, a US Marine veteran has expertise at the C-Suite, V-Suite, and senior management levels in the real estate, hospitality, consumer packaged goods, digital media, and cannabis sectors. He most recently affected organizational turnaround and took an underperforming and undercapitalized cannabis company to a performing thriving company, the result was taking the company to a successful liquidity acquisition event of $70M, which was just under 9x the capital invested. He has expertise and over two decades of professional experience in finance and operations management within start-ups and global multi-billion-dollar organizations, including experience in capital raising, mergers & acquisitions, investment fund management, and growth strategy development.

Tim has a Bachelor’s of Business Administration and Accounting degree, a Law degree and a professional certificate in Corporate Finance.

Cole works as the director of business development and aids in the long-term direction of the company as a whole. Cole has an extensive network of contacts including, rideshare executives, advertising executives, hedge fund managers, and private equity investors and heads the outreach during fundraising rounds as well as the finding of necessary channels of business relations.

Cole Graduated from Bucknell University in 2020 with a Bachelor's degree focusing in Global Management.

This is the second start-up that Corin has worked on. Corin originally began at eBumps at its founding as a founder and CTO at which time he wrote the software and built the hardware for the demo used as a Proof of Concept in the initial funding round in February. After this round as the software team expanded, Corin was in charge of working alongside the engineers building out the software system and overseeing the partners building the hardware. Corin built the demo in totality prior to the initial pre-seed round, both the hardware components and the mobile app mockup. Corin had taken lead on all matters technical and has shaped the technical specifics of the company.

Corin graduated from Vassar College in 2020 with a Bachelor's degree focusing in Mathematics and Computer Science.

Use of Proceeds

If the offering's maximum amount of $1,069,981 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Manufacturing LCD Screens | $587,500 | 54.9% |

| Sales and Marketing | $166,440 | 15.6% |

| Intermediary Fees | $52,429 | 4.9% |

| Labor Costs of Managers, Executives, Current Engineers | $211,183 | 19.7% |

| Intermediary fees | $52,429 | 4.9% |

Terms

This is an offering of Common Stock, under registration exemption 4(a)(6), in eBumps Inc.. This offering must raise at least $10,000 by June 22, 2021 at 12:59am ET. If this offering doesn’t reach its target, then your money will be refunded. eBumps may issue additional securities to raise up to $1,069,981, the offering’s maximum.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jun 22, 2021Primary offering finalized, selling shares

- Apr 15, 2021For anyone who was not able to attend our...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.