Introduction

The BumBee Seat is a fresh, fun & flexible design created in Silicon Valley, California where blending work & play is a way of life!

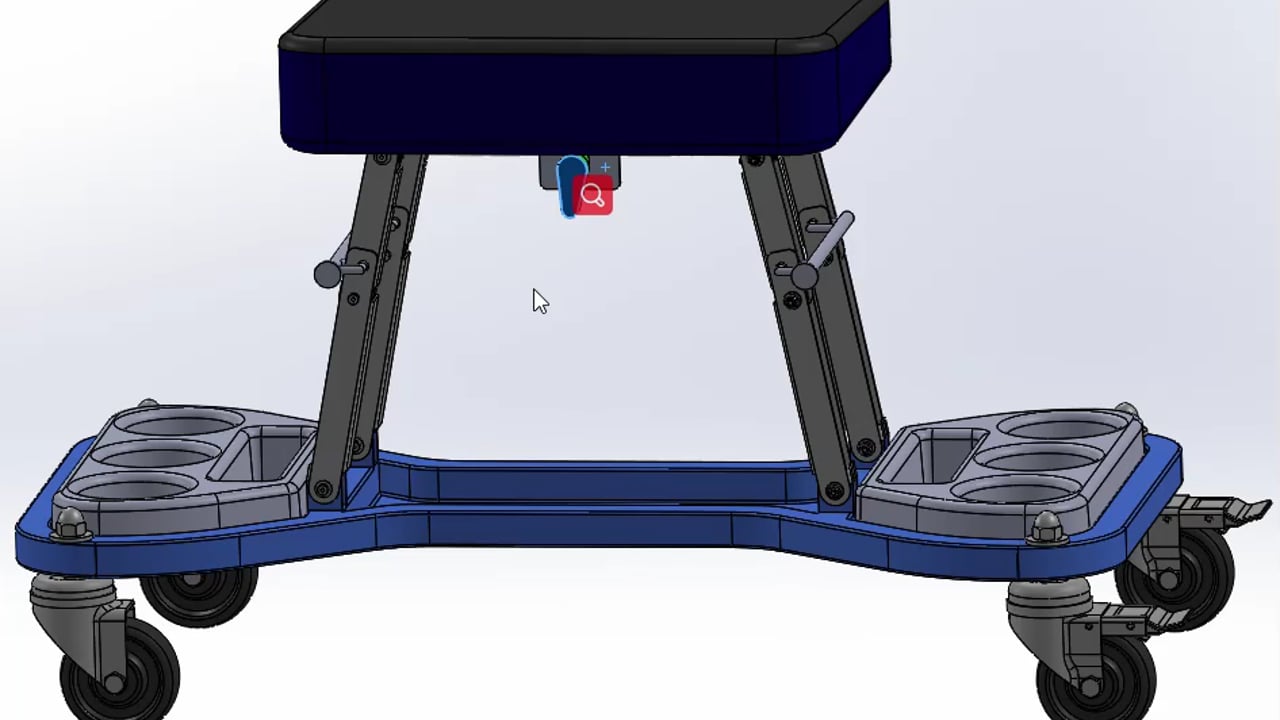

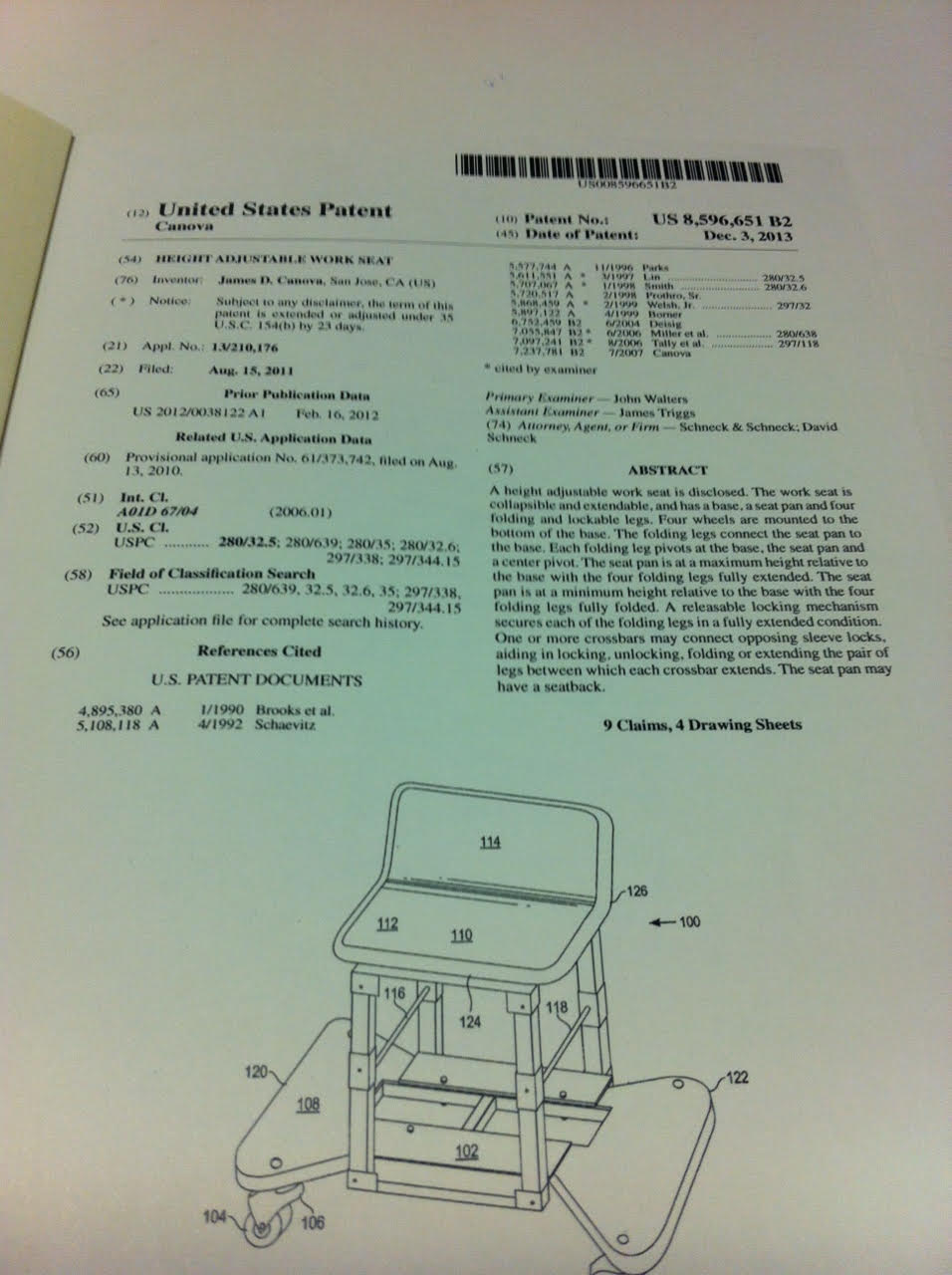

Featuring our patented adjustable RUSS (recreational utility seat system) design, The BumBee Seat is perfect in the office, at home, on your deck, in the garden or garage.

The BumBee Seat is beautifully designed for your multitasking lifestyle. Consider the 'BumBee Garden', 'BumBee BBQ & Tailgating', 'BumBee Office', 'BumBee Gaming', 'BumBee House Painting', 'BumBee Dog Grooming', 'BumBee Garage' seat applications and so much more!

This and the entire BumBee Designs Incorporated offering page was written seated comfortably on The BumBee Seat! The BumBee Seat represents a new product category we call 'recreational utility seating'.

Recommendations

Problem

Keeping Your Knees Happy & Healthy for a Lifetime!

“Excessive kneeling or squatting can damage the patella [your kneecap]. Avoid squatting past 90 degrees and, when possible, sit rather than kneel.” - Andy Pruitt, Ed.D., Director of the Boulder Center for Sports Medicine in Colorado.

For many years there have been mobile mechanics seats and creepers in the marketplace. The rolling seat designs allow an individual to roll around a car while seated at an average seat height. The creeper designs allow an individual to position themselves on their back and roll under a car for servicing. Additionally, there have been various rolling garden seat designs in the marketplace that typically have large wheels and that can be very heavy.

However, the marketplace has not provided a rolling upright seat design to address both normal seat height and extremely low level work. As a result, whether in the garage or garden, when we engage in very low level work we tend to do so on our knees. Although knee pads can be utilized, working on our knees is very damaging to the patella and can lead to osteoarthritis of the knee. Sports Medicine professionals highly recommend being kind to your knees whether at work or play [and at any age]. Additionally working on our knees is very slow and inefficient. “The BumBee Seat” saves your knees and makes work and play a pleasure!

Solution

'The BumBee Seat' is a crossover product that represents a new product category we call recreational utility seating. Garage, garden, office and recreational use will represent the largest market segments. "The BumBee Seat" crosses over into all of these categories.

We designed "The BumBee Seat" to be an adjustable rolling seat design with side utility trays to hold your tools, products or beverage of choice. The seat can be positioned in the up position for average seat height work and can also be folded flat for not only low level work but also easy transport and storage. Our goal was to manufacture an exceptionally high quality version of "The BumBee Seat" right here at home in the Silicon Valley and offer it through a Kickstarter campaign. As a result of our Successful Kickstarter campaign we shipped BumBee Seats [made in the Silicon Valley] throughout the United States and also to the United Kingdom, Canada, Australia and the Philippines.

We discovered through our Kickstarter campaign that "The BumBee Seat" is a new crossover product that disrupts the existing marketplace by creating a new novel product category. Our BumBee Seat owners are using their BumBee Seats for the garden, garage, tailgating, custom outdoor seating by the BBQ or your favorite gourmet food truck, dog grooming, ranch chores, tractor, aircraft and motorcycle maintenance, indoor and outdoor projects, art and photo studios, video gaming and fun extra mobile seating for the office that is easy to fold flat and store when not in use.

Market

A new crossover product design

We have identified over $612M in annual sales in the garden, garage, office & recreational seat categories in both Amazon [Amazon Prime] & the tool industry. Sources for these Amazon [Amazon Prime] sales figures are junglescout and amzscout both highly regarded Amazon marketing tools websites.

As a new crossover product in this space we hope “The BumBee Seat” will quickly dominate the market through a comprehensive direct response television campaign that incorporates Amazon Prime & social media as outlined in our 3 year business plan.

Business Model

3 year business plan as calculated utilizing LivePlan

After securing our seed round Acorn Product Development is expected to both improve the design and reduce the landed costs. Our first production round of 2,000 units would be test marketed through a direct response television campaign [by Script to Screen] for target Q3 2019 sales followed by possibly four sequential production rounds in 2019, 2020 & 2021 through our direct response television campaign to be developed by Script to Screen.

Potential expenses for first production round of 2,000 units [Target Q3 2019 Sales]:

- 2,000 units for launch of DRTV Campaign @50USD landed = $100,000.00

- Acorn Product Development to improve product function, size and weight. This work is expected to reduce the landed costs to <50USD. Improved version of the product will be optimized for Amazon Prime requirements. Bill Lev [from Acorn Product Development] has indicated this scope of work could range from $50,000.00 to $100,000.00 = $100,000.00 + $30,000.00 [to reduce future unit costs] = $130,000.00

- Alex Dinsmoor [EVP-Chief Strategy Officer] with 'Script to Screen' has suggested a DRTV Campaign that would incorporate a 1-2 minute infomercial that would launch in TBD test markets for a 2 to 4 week period [airtime TBD]. When the 2,000 units are sold out the DRTV Campaign would go 'dark' until the next round of inventory is available. This DRTV Campaign total with airtime in test markets = $230,000.00

Progress

BumBee Designs Incorporated is working with our marketing partner Alex Dinsmoor at 'Script to Screen' to market 'The BumBee Seat' through a comprehensive Direct Response Television campaign that includes social media marketing on multiple platforms. A DRTV campaign through 'Script to Screen' has the potential to achieve the greatest number of sales in the shortest period of time and also increase the value proposition to larger manufacturers who might be interested in acquiring 'The BumBee Seat' CrossOver Design.

This will also place 'The BumBee Seat' on the fast track for both big box retail and Amazon Prime. Acorn Product Development plans to improve 'The BumBee Seat' design in both form and function in addition to being properly sized for Amazon Prime. Amazon Prime can represent a huge boost in sales volume for this type of product. 'Script to Screen' plans to incorporate Amazon Prime distribution into our DRTV Campaign.

'The BumBee Seat' offered through this comprehensive DRTV Campaign will offer upgrades to the product through larger wheel options for example. Custom Color utility tray options could also be considered [garage, garden and recreational]. Through our Kickstarter Campaign we have learned that the 'sweet spot' retail price point for 'The BumBee Seat' is $199 USD. This Business Plan has a proposed retail of $199.99 however this number could set at a lower retail price point as the work from Acorn Product Development with the outlined design improvements could reduce our landed costs to <50 USD per unit.

Also note that Alex Dinsmoor at 'Script to Screen' may choose to use a different product name rather than 'The BumBee Seat' for this comprehensive DRTV campaign. Learn more about Alex and 'Script to Screen' in the 'Complete Bios on our Management Team and Advisors' section of this business plan.

Success yesterday, today & tomorrow

- a patented, novel and award winning crossover design with proven manufacturing and successful test marketing via Kickstarter exceeding goals with highly favorable reviews

- well positioned for rapid growth with our manufacturing partner Acorn Product Development and our marketing partner Script to Screen

BumBee Designs Incorporated has developed a 3 Year Sales and Exit Strategy that we hope would achieve over $10M in sales of “The BumBee Seat” over 2019, 2020 and 2021.

Exit Strategy Options include ...

- the Sale of BumBee Designs Incorporated [including the 2 US Utility Patents for 'The BumBee Seat'].

- the Sale of the 2 US Utility Patents for 'The BumBee Seat'.

Press mentions:

- You can view "The BumBee Seat - A Successful Kickstarter Design Project" at the Kickstarter website.

- It was an honor to have "The BumBee Seat - A Kickstarter Design Project" Named "Product of the Week" by 3D Innovations.

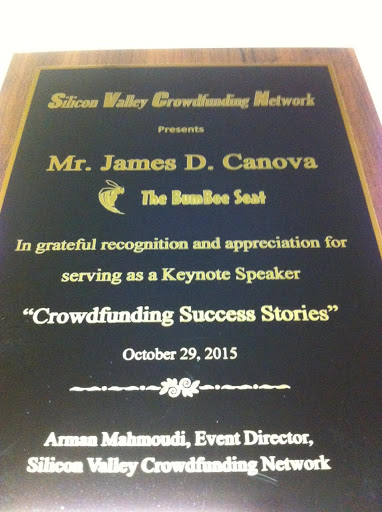

- James Douglas Canova - Keynote Speaker for the Silicon Valley Crowdfunding Network - The BumBee Seat - "Crowdfunding Success Stories" October 29, 2015.

Team

Our Capabilities Map - A Proven Silicon Valley Team!

The principal and founder of BumBee Designs Incorporated a Design Company located in the Heart of the Silicon Valley. BumBeeDesigns Incorporated is dedicated to fun, flexible and fresh designs.

As a premier auto detailing specialist in the Silicon Valley and Greater Bay Area [Canova Brothers Auto Detailing - James Douglas Canova] 'The BumBee Seat' represents over 25 Years of Design Research. Born in the Silicon Valley “The BumBee Seat” is a fast, fun, flexible design for work or play. Inspired by the beautiful and seemingly effortless efficiency of the honeybee 'The BumBee Seat' is a CrossOver Product Designed to delight you as you create and recreate.

In addition to operating both Canova Brothers & BumBee Designs Incorporated James Douglas Canova also provides Public Service on the MetroEd Governing Board as well as the Santa Clara Unified School District Governing Board of Education.

David Kelley is the founder and chairman of the global design and innovation company IDEO. Kelley also founded Stanford University’s Hasso Plattner Institute of Design, known as the d.school. As Stanford’s Donald W. Whittier Professor in Mechanical Engineering, Kelley is the Academic Director of both of the degree-granting undergraduate and graduate programs in Design within the School of Engineering, and has taught classes in the program for more than 35 years.

Kelley’s most enduring contributions are in human-centered design methodology and design thinking. He is most passionate about using design to help unlock creative confidence in everyone from students to business executives. A frequent speaker on these topics, Kelley and his brother co-authored the New York Times best-selling book Creative Confidence: Unleashing the Creative Potential Within Us All.

After earning a bachelor’s degree in electrical engineering at Carnegie Mellon University, Kelley worked as an engineer at both Boeing and NCR. Drawn to design, he entered Stanford University in 1975, where he earned his master’s degree in Engineering/Product Design. In 1978, he founded the design firm that would become IDEO and, in that same year, began his teaching career at Stanford, receiving tenure in 1990. He also founded an early-stage venture-capital firm in 1984 called Onset, and was instrumental in starting a special effects firm called Edge Innovations, which creates unique Animatronics for the film industry.

Kelley was inducted into the National Academy of Engineering in 2000. He holds honorary PhD's from both the Thayer School of Engineering at Dartmouth and Art Center College in Pasadena. He has been recognized with numerous honors, including the Chrysler Design Award and the National Design Award in Product Design from the Smithsonian’s Cooper-Hewitt National Design Museum, the Robert Fletcher Award from Dartmouth, and the Edison Achievement Award for Innovation. Preparing the design thinkers of tomorrow earned him the Sir Misha Black Medal for his “distinguished contribution to design education.”

Go online to view David Kelley’s Ted Talk - "How to build your creative confidence" & his book "Creative Confidence".

Founded in 1993, Acorn Product Development is based in Silicon Valley with design centers in Boston, Atlanta, and China. We provide comprehensive product engineering services—from turnkey product development, subassembly development, and engineering analysis to materials cost analysis and manufacturing cost reduction—for leading companies around the globe.

We embrace collaboration, simplify complex engineering challenges, establish supply chains, and plan for manufacturing and delivery. Our proven expertise, relationships, and processes help our clients bring innovative, reliable, and cost-effective products to market quickly while maintaining profitability throughout their life cycles.

Tim has 25+ years product development experience in technology product development, and manufacturing liaison roles for NeXT Computer, Wyse Technology, and Plantronics. Tim holds a BS in mechanical engineering from University of Rochester and an MS in mechanical engineering from University of California, Berkeley.

Responsible for business development and sales in the Western United States, Bill has more than 20 years of experience in the high-tech sector, working for startups and established companies delivering mission critical solutions to his clients. Based at Acorn’s headquarters, he works with the Acorn engineering team to help clients bring their ideas and new products to production. Bill has a B.S. in chemistry from Rutgers and an MBA from Fairleigh Dickenson.

Minxiang Liu leads the engineering team in our China Design Center. He has more than 17 years of product design and development experience and five years of teaching experience at the college level. He holds a MS degree in mechanical engineering from Northern Illinois University and BS degree in mechanical engineering from Shanghai University of Technology.

In 2014, Alex re-joined Script to Screen as Executive Vice President and Chief Strategy Officer. He works closely with companies exploring direct response television to evaluate the feasibility of the format in meeting the sales and marketing objectives of their products.

He previously served as a senior marketing executive with Script to Screen for ten years (1999-2010). During that time, he contributed to the marketing strategy for numerous agency clients, including Estée Lauder, EyeQ, Investools, Abbott Labs, Shark/Ninja, Serta, LifeLock, Fusion Beauty, Wordsmart, and Rubbermaid to name a few.

In 2010, he was recruited to partner on a lifestyle-based direct response product, which he launched as a long-form television campaign (working with Script to Screen as agency) and effectively moved into retail, achieving success on the product side of the business.

Alex received his Bachelor of Arts degree from Pepperdine University and, before joining Script to Screen in 1999, he worked for IMG, a global sports marketing and media firm, where he managed events and corporate sponsorships for professional tennis.

Alex is married with three children and enjoys golf, tennis, basketball and the occasional sailing trip. Which might explain why he’s a fan of this Oliver Wendell Holmes quote: “Greatness is not in where we stand, but in what direction we are moving. We must sail sometimes with the wind, and sometimes against it— but sail we must, and not drift, nor lie at anchor.”

Intellectual property attorney with substantial experience obtaining patents, trademarks and copyright protections for enterprises ranging from small start-ups and individual inventors to Fortune 500 companies. I focus on providing clients with the information and applying 15 years of experience to allow my clients to capture value from inventions and branding. I provide service to high technology companies, including semiconductor, optics, telecommunications, scientific and manufacturing instrumentation, medical devices, biotech and mechanical devices (among others).

Specialties: Patent, trademark, copyright, licensing, due diligence, intellectual property opinion work (including freedom to operate, patent novelty, and infringement opinions), post grant review of patents strategic intellectual property counseling and litigation support. I have worked extensively with protection of intellectual property worldwide, and my relationships with foreign associates allow global protection of intellectual property rights.

Alyssa Lynch is the Superintendent of Metropolitan Education School District (MetroED) in San Jose. MetroED is focused on preparing students to thrive in college and careers. Programs include Silicon Valley Career Technical Education (SVCTE) and Silicon Valley Adult Education (SVAE). In 2016, she was named one of Silicon Valley Business Journal’s Women of Influence.

Ms. Lynch has a quarter century of experience in education and marketing. She began her career as a counselor at St. Mary’s College in the marketing department. She then combined her passion for marketing and education and became a marketing instructor at American High School in Fremont. In 2008, Ms. Lynch was named the ACSA Career Technical Education Administrator of the Year for

California. From 2013 to 2016 she rebranded an entire school district by changing the name, updating logos, websites, increased advertising, visibility social media and publicity. She holds a bachelor’s and master’s degree in Home Economics & Fashion from California State University Fresno and San Francisco State University, a teaching credential, Administrative Services Credential and a master’s degree in Educational Leadership from San Jose State University. In addition, she’s a frequent contributor to the San Jose Mercury News and Silicon Valley Business Journal on the topic of the importance of CTE in Silicon Valley.

Prior to joining MetroED, Ms. Lynch served as the Career Technical Education Director at the Santa Clara County Office of Education (SCCOE). Ms. Lynch is well known throughout the CTE community for her marketing and leadership role in spearheading the CTE initiative in Santa Clara County in 2009.

Kevin has many years experience as a successful CPA in the Silicon Valley working with both High Tech Start Ups and complex financial portfolios. We are very fortunate to benefit from his expertise.

Kevin M. Epes, CPA - Abbott, Stringham & Lynch - Certified Public Accountants & Business Advisors

Use of Proceeds

Upon completion of this round our first priority will be Acorn Product Development creating an improved version of “The BumBee Seat” featuring easy to carry portability, memory foam seat cushion comfort, custom side trays and fold flat capability that can go anywhere and do anything. This new version of the product will be optimized for for our first production run along with our Direct Response Television campaign that will be designed and implemented by our marketing and sales partner “Script to Screen” who has a 40 year track record of success. We will also use this funding to build inventory.

If the offering's maximum amount of $575,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| CFO starting salary | $50,000 | 8.7% |

| Script to Screen marketing/sales | $230,000 | 40.0% |

| Acorn Product Development design/manufacturing | $230,000 | 40.0% |

| Office Location, Insurance & Overhead | $36,825 | 6.4% |

| Intermediary fees | $28,175 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in BumBee Designs Incorporated. This offering must reach its target of at least $10,000 by its offering deadline of January 30, 2020 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Pitch Deck

Financials

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jan 31, 2020Primary offering finalized, selling shares

- Sep 5, 2019BumBee Designs Incorporated is excited to...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.

Looking to raise capital?

We can help turn your friends, family and customers into investors.

Interested in more investment opportunities?

Browse all offerings currently available.