The Problem

Did you know that car companies need to cut 270 pounds from the average vehicle by 2025, in order to meet legislated fuel efficiency standards?

Major industries from all over the world have spent years trying to solve the problem of cutting weight from their products, while maintaining strength and integrity. Today, lightweighting is a mega-trend, causing a generational revolution in global transportation, and metals and mining companies. One common solution, for the automotive industry for example, is to substitute light metals like aluminum for heavier metals like steel. However, recent tariffs have caused a significant shortage of aluminum in the North American market, bringing rise to the need for additional supply. And on the next frontier, there is a growing need for even harder, stronger and more heat-resistant replacement materials.

The Solution

Braidy Industries offers multiple solutions to solve the lightweighting problem:

- Veloxint - our proprietary, ultra high-strength, next generation metal alloy that is stronger than steel and lighter than stainless, 3x stronger than today's most commonly-used metals

- The Braidy Atlas Mill - a state-of-the-art aluminum mill now under construction in Ashland, Kentucky that should allow us to produce sheet aluminum for the automotive industry at a 20-30% discount to peers

Veloxint

Veloxint: The Next Generation of Metals

Developed by a team of MIT scientists, Veloxint is producing some of the strongest metals ever made and provides 2-3x more lightweighting potential than current solutions.

Prof. Christopher Schuh, the Department Head of Materials Science and Engineering at MIT, and the lead inventor of this technology, is widely recognized as one of the world’s leading academic metallurgists. He has developed multiple patented metal technologies used in billions of electronics products all over the world.

Advantages

Veloxint: Competitive Advantages

Veloxint is

2-5x stronger than other commonly-used metals, while offering significant weight savings.

The secret is in the crystalline structure. Almost all metals are made up of tiny building blocks called crystals or "grains". Traditional metals have grain size in the order of 1/1,000,000 meter, about the width of a human hair. Veloxint alloys take advantage of nano-grains that are 100-1,000X times smaller.

By controlling and exploiting structures at the nanometer scale, Veloxint technology can produce alloys that are 2-3X stronger, and have better wear, corrosion resistance, and perform much better at high temperatures than conventional metals. As a result, Veloxint alloys can be used to replace much heavier metals in automotive engine and other components, or to make cutting tools that cut 2-3X faster and last 2X longer than other high end cutting tools.

Veloxint alloys are readily processed using high proven and scalable powder metallurgy approach, wherein metal powders are compacted then sintered to near net shape components for finishing. In addition, the Veloxint alloys can also be 3D printed to produce exceptional components with complex designs not achievable by traditional manufacturing processes.

Applications

Veloxint: Commercial Applications and Strategic Partnerships

Veloxint is engaging with dozens of customers, partners and prospects from a broad range of markets and industries. Below are a few examples of ongoing activities.

Stanley Black & Decker

Stanley Black & Decker, the largest tool company in the world, has a co-development agreement with Veloxint. Veloxint alloys could be used to produce tools that are lighter, stronger and more corrosion resistant compared to previous models.

Desktop Metal

Desktop Metal, the fastest growing 3D printing company in the world, is our partner in advanced manufacturing. We will be using their machines to print parts with Veloxint powder.

Race Car Manufacturers

Leading race car manufacturers are working with Veloxint to make lighter, stronger metal parts that will allow faster speeds and fewer pit stops.

Auto Companies

Auto original equipment manufacturers (OEMs) and leading suppliers are working with us to design and develop Veloxint parts where strength, weight reduction, and the ability to withstand high temperatures are required. These new design concepts have the potential to deliver significant weight reductions to increase the efficiency of next generation vehicles.

Cutting and Wear Tools

We have multiple joint development agreements in place with world-class companies to develop new cutting and wear tools with Veloxint Hard Metal. These next generational tools will allow significantly increased cutting speed and higher material removal rates, thereby delivering step-change productivity improvement to customers.

Braidy Atlas

Braidy Atlas: Greenfield Aluminum Mill

Braidy Atlas, a majority-owned subsidiary of Braidy Industries, is also building an aluminum mill from the ground up, that will take full advantage of the latest available technological advancements and process efficiencies. No other aluminum mill in the US has done this for 35 years. Phase 1 of the Braidy Atlas mill will target the rapidly growing demand from the automotive industries for lightweight exposed sheet and structural plate aluminum.

200% of the mill’s capacity for the next seven years has been reserved by top worldwide automotive OEMs.

Braidy Atlas Mill: Competitive Advantages

Location

The mill is currently under construction in Ashland, Kentucky, which is located near major auto manufacturers. This location provides perfect logistics for same day closed-loop recycling, with direct access to rail, land, and water transportation.

Economic Incentives

The Commonwealth of Kentucky provided significant economic incentives and invested $15 million in Braidy’s Series A round of financing, with unanimous legislative approval. The company also received a favorable, fixed power rate from Kentucky Power, which is up to 50% lower than that paid by competitors.

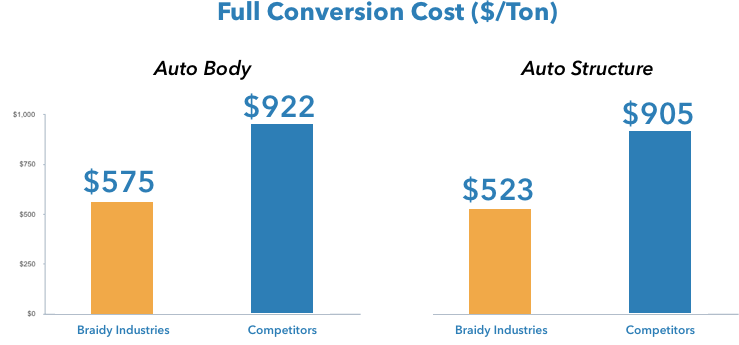

Cost Advantage

Unlike peers, we believe the Braidy Atlas mill will operate at the highest available level of efficiency and will have low maintenance capex, no environmental or pension legacy costs, and little overhead.

We expect that the combination of the above factors will allow us to produce high quality aluminum sheet at roughly half the cost of most of the competitors in the United States, Europe, or Asia.

We believe that this advantage will allow us to enter the aluminum sheet market as the lowest cost producer by a wide margin and will enable us to offer an immediate price discount to customers. This has been independently verified by CRU, a leading aluminum research firm. As a result, demand for the company’s product has been strong, and 200% of the mill’s capacity for the next seven years has been reserved under non-binding MOUs by top automotive OEMs, prior to construction.

Technology

Our state-of-the-art technology will allow us to achieve maximum efficiency in man hours per ton. We will also be able to provide the widest transportation-grade aluminum sheet produced in North America.

Appalachia

Rebuilding Appalachia with Technology

We are proud to be helping rebuild the Appalachian economy with good, long-term, high-paying jobs. Working closely with local, state, and federal governments, and trade groups, we plan to help revitalize coal country, drawing on its large pool of skilled labor to build and operate our greenfield manufacturing facility. The region has an abundance of highly skilled labor, particularly metal working families, and applications have been pouring in; almost 7,000 people have already applied for 550 positions at the company.

The Commonwealth of Kentucky has welcomed us with open arms. With the legislature voting 128 to 0 to invest in Braidy, Kentucky is now our second largest shareholder. We have also received all necessary local, state and federal environmental construction-related permits, and our locations in Boyd and Greenup Counties were designated by the Governor as Opportunity Zones, potentially qualifying for 50-100% reductions in capital gains tax.

Join us in our efforts to return Eastern Kentucky to a place of prominence in American manufacturing, while building a long-lasting pillar of the local economy.

Market Opportunity

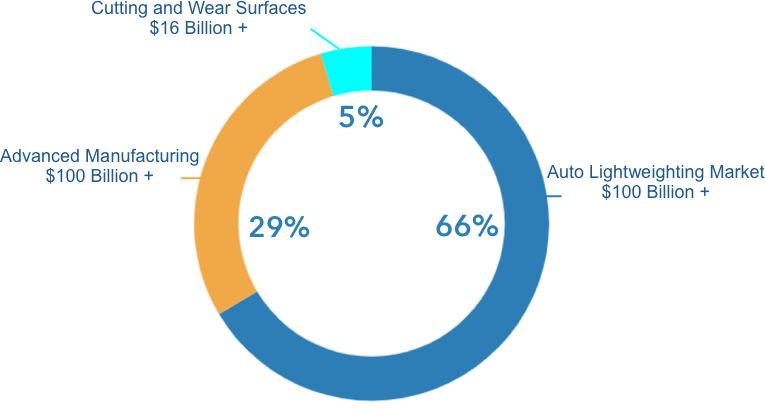

A major Wall St. brokerage firm predicts that by 2020, the demand for aluminum sheet will outstrip supply by almost one million tons, driven by the global lightweighting trend. Braidy Atlas intends to produce more mills in the future to address this need. In addition, we believe that the total market opportunity for Veloxint metals alone exceeds $340 billion. Of that number, the auto lightweighting market represents $230 billion, as OEMs replace as many parts as possible with lighter and stronger metals in order to achieve fuel and emissions standards. We expect the non-automotive advanced manufacturing market, which includes 3D printing and metal injection molding, to be greater than $100 billion, while cutting and wear surfaces should exceed $16 billion.

Business Model

Braidy Industries will generate revenue from the sale of Veloxint parts, Veloxint powder, and aluminum sheet from Braidy Atlas.

Revenue Sources:

- Sale of aluminum sheet to the automotive industry

- Sales of high performance parts to customers in the automotive, industrial, and consumer industries

- Sale of 3D printing powder and printed parts to customers in the automotive, industrial, and consumer industries

Success to Date

Braidy Industries has completed many significant milestones, including our recent Series B round of financing.

- March 2017: First round of equity raised

- July 2017: Reached 180% reservation of Phase I mill capacity

- February 2018: $75 million Series B raised

- February 2018: Acquired Veloxint

- March 2018: Finalist in four categories of Platts Global Metals Awards

- April 2018: Veloxint wins Bronze Edison Award for Space Technology

- May 2018: Veloxint wins S&P Global Platts Metals Breakthrough Solution of the Year Award

- June 2018: Groundbreaking of Braidy Altas aluminum mill

- June 2018: Reached agreement to acquire NanoAI (leader in high strength aluminum alloys)

- September 2018: Closed NanoAI acquisition

Events

Watch Braidy Industries' Investor Event featuring Craig Bouchard, Chairman & CEO, and Alan Lund, CEO of Veloxint.

Note that the offering statement accessible under “Braidy Industries’ SEC Filings” below contains information that supplements or supersedes information contained in the video. All statements expressed in the video shall be deemed to be modified or superseded to the extent the information contained in the offering statement supplements or modifies the statements expressed in the video.

Click here to read Braidy Industries' offering update July 15, 2019.

Click here to read Braidy Industries' offering update June 13, 2019.

Click here to read Braidy Industries' offering update March 28, 2019.

Click here to read Braidy Industries' offering update January 23, 2019.

Click here to read Braidy Industries' offering update December 31, 2018.

Click here to read Braidy Industries' offering update December 28, 2018.

Click here to read Braidy Industries' offering update November 12, 2018.

Team

Craig Bouchard, Chairman and Chief Executive Officer, is a strategist and industrialist who built three billion-dollar revenue companies within the past decade. Mr. Bouchard is a noted expert on Lean/Six-Sigma and capital allocation, and is a New York Times bestselling author of “The Caterpillar Way.”

Ret. General Norty Schwartz served as the 19th Chief of Staff of the United States Air Force, serving as a member of the Joint Chiefs of Staff, leading Air, Space and Cyber for the Department of Defense. As Commander of the United States Transportation Command, General Schwartz led the Defense Transportation System, with strategic oversight of all logistics operations including Operations Enduring Freedom and Iraqi Freedom. General Schwartz is currently the President and CEO of Business Executives for National Security (BENS) and serves as an independent director for CAE, USA and Wesco Aircraft Holdings.

Prof. Christopher Schuh is the Head of the Department of Materials Science and Engineering at MIT. Prof. Schuh’s research is focused on the optimization of mechanical properties in metals, forming the basis of numerous metallurgical companies, including Xtalic Corporation which produces coatings on over 10 billion components used in both enterprise and mobile electronics. Prof. Schuh is also involved in Desktop Metal, which provides a lower-cost option for metal additive manufacturing via its proprietary 3D metal printers.

Prof. Michael E. Porter is a world-renowned economist, and a frequently cited scholar in economics and business. He leads Harvard University’s Institute for Strategy & Competitiveness and is a long-serving professor at the Harvard Business School. Prof. Porter is the recipient of numerous awards and honors for his contributions to global economic theory, including the Lifetime Achievement Award from the U.S. Department of Commerce for his contributions to economic development and is the author of nineteen books, including the business classic Competitive Advantage. He has served on several Fortune 500 public boards and has played an active role in U.S. economic policy at the federal and state levels.

Charles Price is an entrepreneur, industrialist, and President and CEO of Louisville, Kentucky based Charah Solutions. Mr. Price has over 35 years of experience in the construction and industrial industries within the State of Kentucky and beyond. Mr. Price also serves as the Chairman of the Board of Directors of the American Coal Ash Association.

John Preston is the former Director of Technology Development (and Licensing) at MIT where he was responsible for the commercialization of MIT-developed technologies. In Mr. Preston's capacity, he oversaw activities that led to the creation of hundreds of new technology-based companies as well as the negotiation of thousands of licenses with existing companies. Mr. Preston was awarded the rank of “Knight of the Order of National Merit of France” by French President Mitterrand and the “Hammer Award for Reinventing Government” by Vice President Gore. He chaired President George H. W. Bush’s conference announcing the President’s technology initiative and has previously served as a Board Advisor to Mars Incorporated.

Use of Proceeds

Net proceeds will be applied toward the construction, outfitting and development of the Braidy Atlas mill.

Terms

This is a side-by-side offering of Common Stock, under registration exemptions 4(a)(6) and 506(c), in Braidy Industries, Inc.. Up to $1,069,992.00 may be raised under the 4(a)(6) exemption.

Braidy Industries intends to issue additional securities to raise up to $301,070,006. The amount set forth below reflects only the amount raised under the 4(a)(6) exemption and a portion of the amount raised under the 506(c) exemption. The amount presented does not include the full commitment of $200 million by an affiliate of Rusal (as described in the offering statement) or other funds and commitments to date under the 506(c) exemption, which investments are expected to be made directly instead of through the portal. The 506(c) offering will continue to be conducted on a private basis after completion of the 4(a)(6) offering. In light of the ongoing and private nature of such offering, such amounts are not being, and will not in the future be, reported here.

Note that the offering statement accessible under “Braidy Industries’ SEC Filings” below contains information that supplements or supersedes information contained in the following October 2018 Pitch Deck. All information contained in the Pitch Deck shall be deemed to be modified or superseded to the extent the information contained in the offering statement modifies or supersedes information contained in the Pitch Deck.

Pitch Deck

Financials

Braidy Industries currently owns 100% of Veloxint and NanoAI, as well as 60% of Braidy Atlas, which holds 235 acres of land in Ashland, Kentucky and access to $105 million in economic incentives. Braidy Industries has a cash balance of roughly $20 million as of June 30, 2019, with zero debt.

We began meaningful operations in March 2017. For the year ended in December 31, 2017, we incurred a net loss of $5,785,979. We had no revenues and our expenses consisted primarily of selling, general and administrative expenses of $3,562,111, the majority of which consisted of salaries and benefits, and professional fees of $1,727,799. Our net loss per share of common stock amounted to $132.24.

For the year ended December 31, 2018, we incurred a net loss of $20.3 million. We had revenues of $0.5 million and our expenses consisted primarily of selling, general and administrative expenses of $17.6 million, the majority of which consisted of salaries and benefits. Our net loss per share of common stock amounted to $5.89. We anticipate losses to continue through 2019 and into 2020. We continue to spend money in 2019 at a rapid pace, and we need financing for the construction of the Braidy Atlas mill and for our start-up costs.

Our 2017 financial statements have been audited by an independent certified public accountant. Our 2018 financial statements were reviewed by an independent certified public accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemptions 4(a)(6) and 506(c) of the Securities Act of 1933. Similar information is sometimes offered in a Private Placement Memorandum for 506(c) offerings.

We’re also required to share links to each of the SEC filings related to this side-by-side offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jun 11, 2020Braidy Industries today announced the...

- Jul 22, 2019Primary offering finalized, selling shares

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.