Deal Highlights

- Proprietary technology developed at Massachusetts General Hospital and Harvard University

- Founded by Harvard Scientists

- Multiple previous exits in excess of $8 billion

- $141 billion oncology market expected to reach more than $390 billion by 2027

Exit Strategy

C-Reveal's planned exit strategy is to sell the company to a major pharmaceutical company. Oncology companies are popular acquisition targets, and during the last five years, the median acquisition premium for oncology companies is 100% for transactions with a deal value of more than $5 billion (McKinsey).

Recently, companies like ours have sold for multi-billion dollar price tags:

- Pfizer’s 2019 acquisition of Array BioPharma for $11 billion

- Eli Lilly's 2019 acquisition of Loxo Oncology for $8 billion

- GlaxoSmithKline's 2019 acquisition of Tesaro for $5.1 billion

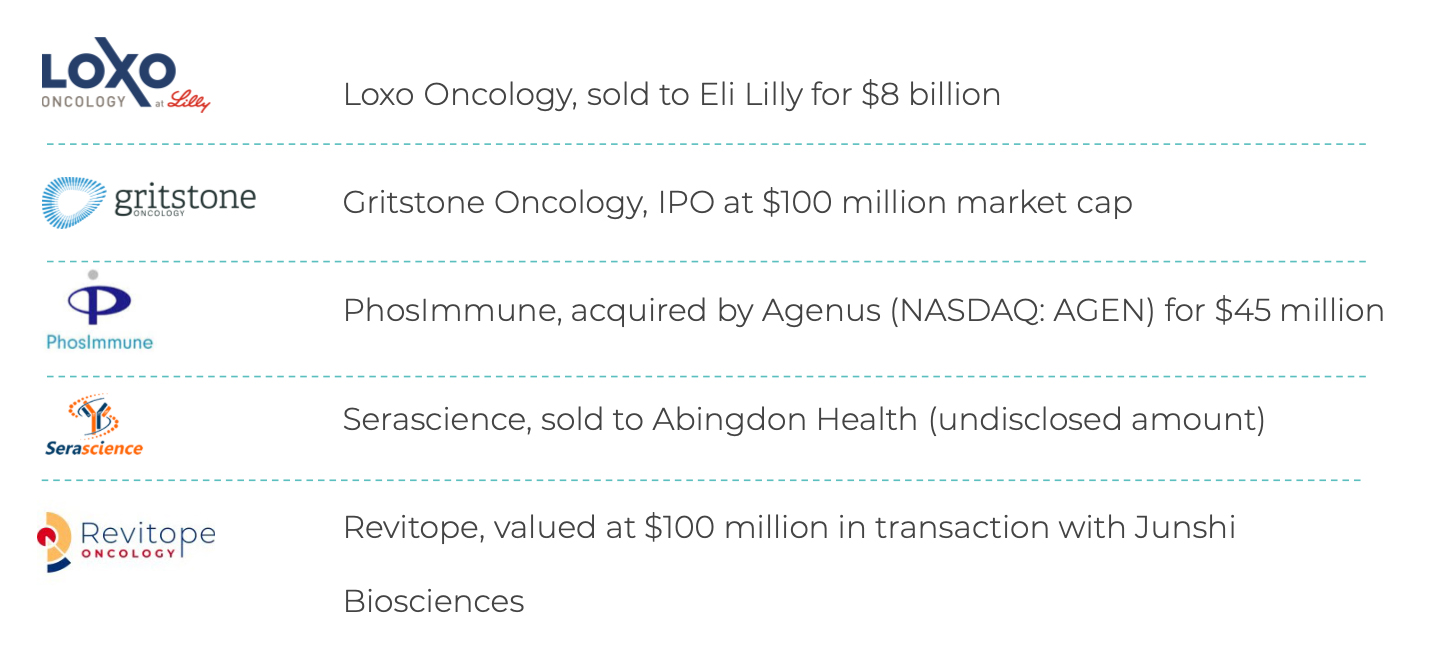

Previous Exits

C-Reveal’s founders have a history of successful exits in the oncology and pharmaceutical industries. Previous exits by members of our leadership team include:

Problem

Our immune system relies on distinct markers, called tumor antigens, to recognize what is and is not cancer. However, many tumors have a low antigen load and are thus largely hidden from the immune system. Because of this, new therapies that enlist the immune system to fight cancer (e.g., drugs such as OPDIVO® and KEYTRUDA®) are less effective than they could be, working well in only about 10% of patients.

Solution

Our company has identified 2 key cancer-specific enzymes that, when inhibited, reveal hidden tumors to the immune system. C-Reveal plans to develop inhibitors for these enzymes, which will allow the immune system to recognize, target, and attack cancer cells. They will also allow existing cancer immunotherapies to work in a greater number of patients.

These findings are especially meaningful because the enzymes we’ve identified are:

- Structurally unique from other enzymes

- Widely expressed in different cancers

- Produced exclusively in cancer cells and not normal healthy tissues

- Provide actionable targets for the treatment of cancer

Benefits

Our patent-pending discoveries will allow us to develop small molecule inhibitors for these enzymes. We expect these inhibitors to produce multiple benefits, including:

- Disabling a key tumor immune cloaking mechanism

- Exposing tumors to immune responses and therapies

- Improving the efficacy of cancer treatments on a broad range of cancers

- A high degree of safety as the target enzymes are not expressed in healthy tissues

Market

Our company will be entering the global oncology drug market, which was valued at $141 billion in 2019. The market is projected to reach $394.2 billion in 2027, with an estimated CAGR of 12% (Fortune Business Insights).

Globally, $200 billion will be spent on cancer therapeutics and care by 2022 (pwc). This is a growing market, and our technology has the potential to work as a support for emerging innovative therapies and drugs, expanding treatment options for the more than 18 million cancer patients in the United States alone.

Drug Development Partnership

C-Reveal is partnering with Evotec, a European-based contract research organization for the next step in our drug discovery process. With Evotec, we will be doing a chemical high-throughput screen for molecule discovery, with the goal of finding the drug candidates suited for inhibiting the enzymes we’ve identified.

Evotec is a world-leader in identification, with a compound collection that is one of the largest and most valuable sources of starting points for drug discovery. With a collection of 700,000 compounds representing 2 million molecules, Evotec has the flexibility to screen high volumes of molecules.

Team

C-Reveal’s leadership team has decades of experience in successful entrepreneurial ventures and extensive oncology research. Our scientific co-founders serve in senior positions at Massachusetts General Hospital’s cancer research center as well as Harvard Medical School and are leading experts in the field of oncology drug discovery.

Dr. Haag is a biotechnology IP lawyer, investor and entrepreneur. He previously served as co-founder and acting CEO of PhosImmune, acquired by Agenus, Inc. (NASDAQ: AGEN) for $45 million. He is the founder of Haag Life Sciences Law and is a Managing Partner of Linden Lake Venture Capital. Dr. Haag has a 20-year background in biotech IP and served as partner and Co-chair of Seyfarth Shaw LLP’s Life Sciences IP Practice.

Dr. Cobbold currently serves as the V.P. of Oncology Early Discovery at AstraZeneca. He previously co-founded Gritstone Oncology, which IPOed with a $100 million market cap. He also served as Scientific Co-Founder at Serascience, which was sold to Abingdon Health, PhosImmune Inc. (acquired by Agenus) and Revitope Oncology.

Dr. Flaherty previously co-founded Loxo Oncology, which was acquired by Eli Lilly for $8 billion. Dr. Flaherty currently serves as the Director of The Termeer Center for Targeted Therapies, Director of Clinical Research, and Richard Saltonstall Endowed Chair in Oncology at Mass General Hospital Cancer Center. He is also a Professor of Medicine at Harvard University and leads the Developmental Therapeutics research program at the Dana-Farber/Harvard Cancer Center.

Dr. Benes currently serves as the Director of Oncology Bioinformatics at the Genomics Institute of the Novartis Research Foundation. He was previously a professor at Harvard Medical School and was the former Head of the Center for Molecular Therapeutics at the Massachusetts General Hospital Cancer Center.

Use of Proceeds

If the offering's maximum Reg CF allocation of $1,070,000 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| R&D Pilot phase (Evotec) | $325,000 | 30.4% |

| R&D HTS (Evotec) | $325,000 | 30.4% |

| MGH Patent | $60,000 | 5.6% |

| New Patents | $20,000 | 1.9% |

| CEO/Legal | $80,000 | 7.5% |

| CSO | $65,000 | 6.1% |

| Outsourced CFO | $50,000 | 4.7% |

| Marketing & BD Expenses | $50,000 | 4.7% |

| Operating Expenses (IT) | $42,570 | 4.0% |

| Intermediary fees | $52,430 | 4.9% |

If the offering's maximum amount of $3,250,000 across Reg. CF and Reg. D is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| R&D Pilot phase (Evotec) | $1,045,375 | 32.2% |

| R&D HTS (Evotec) | $1,045,375 | 32.2% |

| MGH Patent | $200,000 | 6.2% |

| New Patents | $50,000 | 1.5% |

| CEO/Legal | $350,000 | 10.8% |

| CSO | $250,000 | 7.7% |

| Outsourced CFO | $50,000 | 1.5% |

| Marketing & BD Expenses | $50,000 | 1.5% |

| Operating Expenses (IT) | $50,000 | 1.5% |

| Intermediary fees | $159,250 | 4.9% |

Terms

This is a side-by-side offering of Common Units, under registration exemptions 4(a)(6) and 506(c), in C-REVEAL THERAPEUTICS LLC, doing business as C-Reveal Therapeutics. Up to $1,070,000 may be raised under the 4(a)(6) exemption. Netcapital will determine which exemption applies to your investment and notify you before you complete your investment.

The amount raised under the two exemptions must total at least $10,000 by May 1, 2021 at 12:59am ET. If the total doesn’t reach its target, then your money will be refunded. C-Reveal Therapeutics may issue additional securities to raise up to $3,250,000, the offering’s maximum.

If the side-by-side offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

C-Reveal Therapeutics’ official name is C-REVEAL THERAPEUTICS LLC, so that’s the name that appears in the statements below.

These financial statements have been reviewed by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemptions 4(a)(6) and 506(c) of the Securities Act of 1933. Similar information is sometimes offered in a Private Placement Memorandum for 506(c) offerings.

We’re also required to share links to each of the SEC filings related to this side-by-side offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jul 7, 2023Dear NetCapital Investors. Please see the...

- Jul 7, 2022Dear C-Reveal Investors, I am excited to share...

- Jan 14, 2022Dear Investors and Supporters of C-Reveal...

- May 1, 2021Primary offering finalized, selling units

- Feb 4, 2021C-Reveal is excited to announce that Renato...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.