Introduction

Deal Highlights

Check out some of EnergyX’s highlights!

- $9.7 million previously raised and $10 million + additional committed capital - With over 1200 investors, EnergyX has built a community of investors committed to a renewable energy future.

- Founder Teague Egan has been compared to Elon Musk (founder of Tesla) by the BBC and others.

- World class team (former CFO of Tesla Energy & Former Global Director of Innovation at Rio Tinto) and international partners (SUEZ & University of Texas) with over 100+ years of experience in materials for energy and water technologies.

- EnergyX already has agreements with 4 of the top 10 lithium producers in the world and an energy major (customers). Our technology improves lithium recovery rates from 30% to 90%.

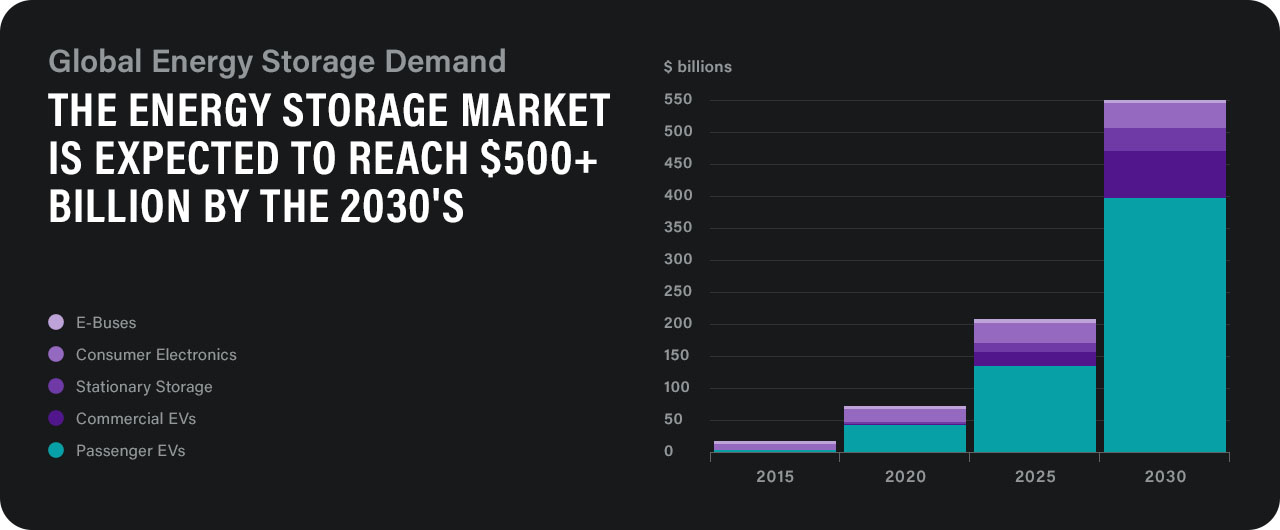

- The annual battery market is $112 billion and is expected to reach $546 billion by 2035. EnergyX is building a robust patent portfolio with 23 patents to date.

- Governments of countries around the world are imposing strict policies on fossil fuels such as oil, gas, and coal, and moving to renewable technologies that require lithium batteries.

- If we achieve our vision, we believe EnergyX has the potential to become one of the most valuable and transformative technologies of all time.

Pitch Deck

Executive Team & Advisors

The team is one of the most important factors when considering an investment. This incredible team combines an entrepreneur (Teague Egan, CEO), with a seasoned accounting veteran with renewables and utility experience (Mike Eberhardt, CFO), a very serious expert in mining technology (Dr. Amit Patwardhan, VP of Tech), and a world-renowned professor and scientist (Dr. Benny Freeman) who is also personally invested in the company.

Teague Egan is a serial entrepreneur who has built a highly experienced team of scientists, engineers, and renewable energy experts at EnergyX. He is responsible for all aspects of the company's growth including its LiTAS™ direct lithium extraction program, and SoLiS™, its solid state battery program. Egan invested in Tesla in 2013 at $9 per share and made a small fortune, which he has used to start and fund the majority of EnergyX to date. He is the leading investor and shareholder in the company.

Mike is responsible for all economic modelling, operations, and partnerships at EnergyX. His former roles include CFO of Venture Global LNG, a liquid natural gas company (completed $7.3 billion of project infrastructure financing), and 17 years Partner at PricewaterhouseCoopers (PwC) conducting financial audits, tax consulting and IT implementation across the U.S on various energy related projects. His career includes 30+ years of financial experience in the utility and renewable energy sector conducting financial and tax structuring, investment economics, and extensive experience with SEC and regulatory filing requirements.

Dr. Amit Patwardhan heads all technology development at EnergyX including both the LiTAS™ program and the SoLiS™ solid state battery program. Prior to joining EnergyX, Dr. Patwardhan held senior leadership roles at Rio Tinto, a global Fortune 500 company with over $40 billion in revenue, in their Industrial Minerals business group and corporate technology group. He received his BS degree in Chemical Engineering as well as his MS, PhD and MBA degrees.

Most of the EnergyX lithium membrane extraction technology to-date has come from Dr. Freeman’s lab and his group’s research. A professor of Chemical Engineering at The University of Texas at Austin, Dr. Freeman has been a faculty member for 29 years, and is described in 433 publications and 27 patents / patent applications. He is currently the director of Materials for Water and Energy Solutions (M-WET), a US Department of Energy-funded research center.

Bob Galyen, an energy storage technology executive, was the founding CTO of CATL (Contemporary Amperex Technology Limited), the world’s largest battery manufacturer. With 38 years of experience in battery technology, Gaylen specializes in clean technology, lithium ion battery systems used in electric vehicles, and high efficiency storage systems. He currently serves as the Chairman of SAE International Battery Standards Steering Committee.

John brings over 25 years of experience in leading growing companies including working hand in hand with Elon Musk on Solar Roof, Powerwall, Powerpack and all Tesla Energy products, operations, and finance. Prior to working at Tesla, John was a senior executive at Dell for 15 years as their VP of Finance in Global Value Creation & Innovation Group working closely with Michael Dell in taking the company private. Mr. Madden has also worked at Applied Materials as General Manager/CFO of their Non-Standard Orders Unit. Additionally, John served as a U.S. Army officer from 1990-1995 in the 82nd Airborne Division and 2nd Infantry Division as an Infantry and Military Intelligence Captain. He is an Ironman athlete and six sigma blackbelt.

Key Partnership

Problem

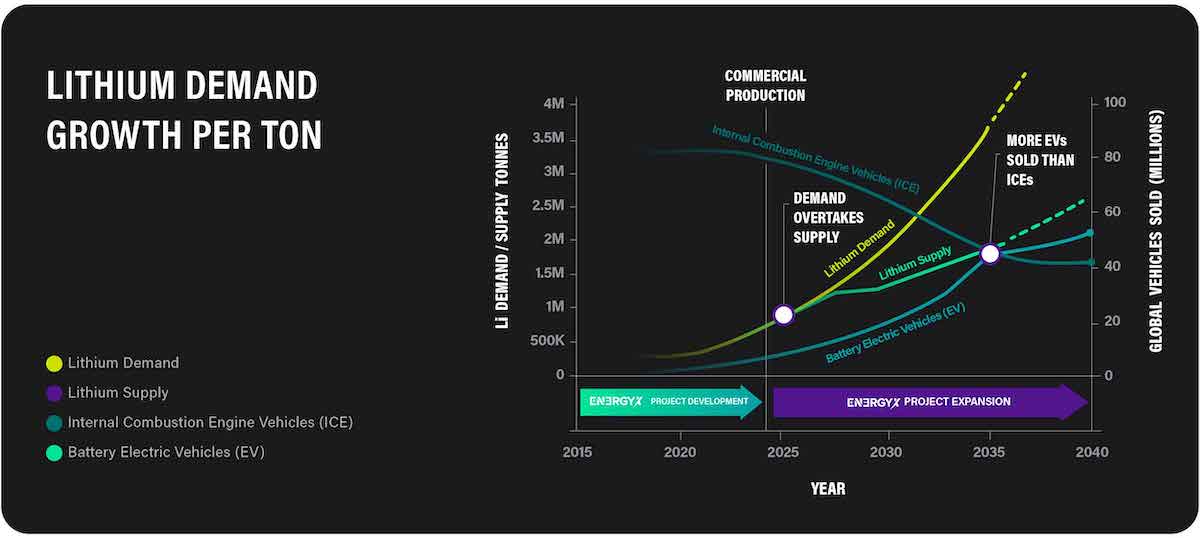

Currently there is a huge lithium supply / demand imbalance.

Lithium is the most important element of a battery. High concentrations of lithium can be found in salt brines, which are extremely salty waters. However, the technology used to extract lithium from the water is outdated and inefficient.

Lithium is currently produced using massive evaporation ponds, like the one shown below. Using evaporation ponds to extract lithium creates several major issues:

- Production takes a long time, 18 months on average

- Extracts as little as 30% of total lithium from the salt brine

- High operational and labor expenses

- Harmful to surrounding environment and indigenous communities

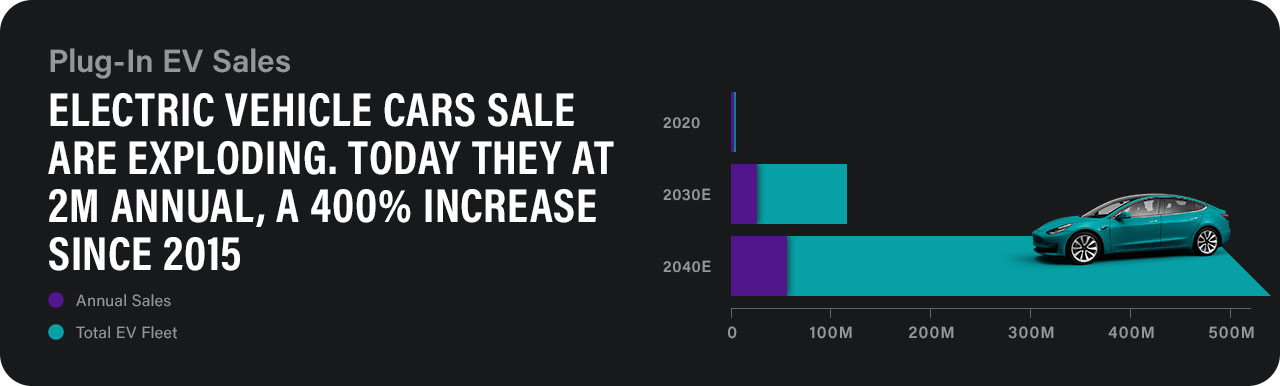

At the same time, global demand for lithium is growing fast, as governments, companies, and people around the world adopt renewable technologies that require lithium ion batteries, like electric vehicles (EV’s). Currently, 2 million EV’s are sold annually. By 2040, 56 million EV’s will be sold per year, a 2800% increase. In fact, total demand for lithium will increase by over 500% in the coming years (World Bank).

Solution

EnergyX built LiTAS™ to answer that demand.

LiTAS™ stand for “Lithium-ion Transport and Separation”

The LiTAS™ system is a form of Direct Lithium Extraction (DLE) technology that recovers up to 90% or 3x the amount of lithium as traditional evaporation ponds. Our technology also reduces production time to a matter of days and cuts costs. By creating a more cost-effective method of lithium production, we can reduce the cost of rechargeable batteries, electric vehicles, and other clean technologies.

Our LiTAS™ technology leverages a proprietary filtration system that is compatible with existing lithium producers and can hit recovery rates of 90%. We are also working on a Generation 2 that will completely replace existing technology, helping the world reach a more sustainable and efficient future.

Last, EnergyX is working on next generation battery technology with Dr. John Goodenough, the Nobel-winning inventor of the lithium-ion battery, that will someday potentially be able to charge a phone for over a week, or make a car last over 1000 miles.

Market

THE LITHIUM AND BATTERY MARKET IS VERY, VERY BIG.

Our technology addresses the $112 Bn annual battery market. In 15 years, the market is projected to reach $546 Bn. Currently, lithium-ion batteries dominate the sector, accounting for 70% of the global market. Additionally, electric vehicles are expected to have a large jump in popularity with 56 million per year, a 2800% increase in demand, by 2040. We expect that our technology could be instrumental in helping companies around the world meet the growing demand for lithium.

Business Model

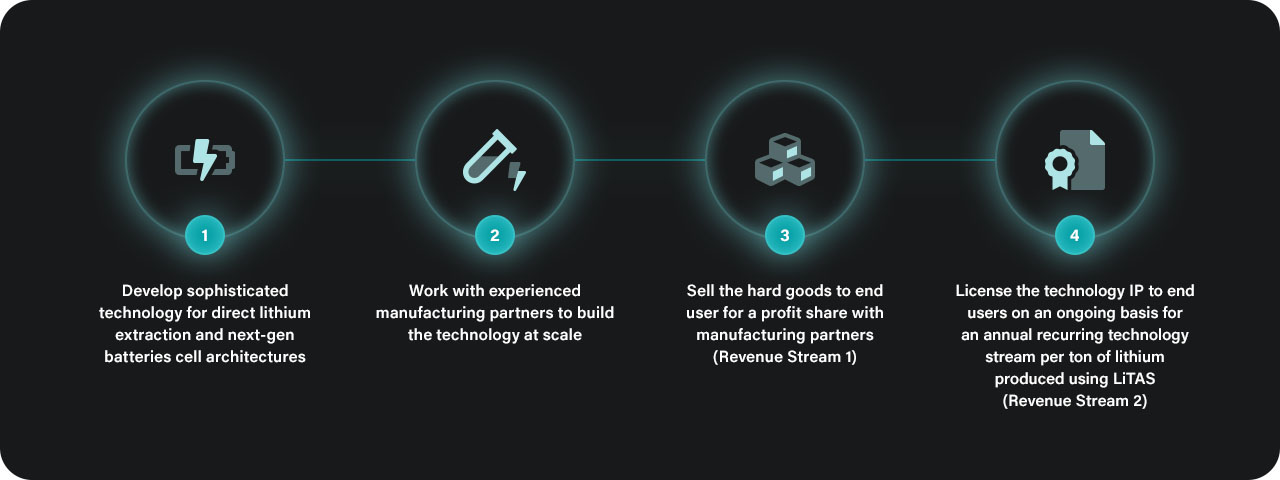

EnergyX is fundamentally a technology company that plans to generate revenue in two ways.

- Technology Licensing Fee for LiTAS™ (Annual Recurring Revenue)

- Product Sales and Initial Implementation (One Time Purchase Fee)

Our business model is to make money from every ton of lithium produced using our LiTAS™ technology. We plan to make up to $1000 for every ton. The reason we are able to command this is because we save our customers so much money. An easy way to think about it is this: If we save our customers $2000 of cost per ton of lithium they produce, we ask that they pay us 50% of that, or $1000 per ton of lithium.

To put this in perspective, by 2025 it is expected the global lithium demand will be 1.5 million. If we capture only 10% of the market and 150,000 tons of production uses our technology, that equates to $150 million in annual revenue if we receive $1000 per ton.

Success to Date

The company has made major progress in the following areas:

- Product development: Achieved all technical milestones, and engineering of LiTAS™ has been scaled to pilot plant stage. Three pilots have been fabricated and we plan to deploy multiple units into the field during 2021.

- Go-To Market: Identified the quickest path to market and implemented a licensing model to work with existing producers as opposed to reinventing the wheel.

- Customer Traction: Several of the top 10 lithium producers have engaged with EnergyX in testing agreements.

- Great Partnerships: Top tier university and industry partners with 100+ years of experience in the field. Partnerships extend internationally.

- Intellectual property: The company has developed a robust portfolio of patents and patent applications, which currently sits at 23 patents to date.

- Growth Plans: We have created short term and long terms goals including a 10 Year Master Plan. At the end of the day, we will become an extremely valuable company by creating technologies that move the renewable energy transition forward.

Product Development

Breakthrough Technology. EnergyX’s LiTAS™ membrane technology, developed by a world leading scientist at the University of Texas Austin and Monash University in Melbourne, is a true technological breakthrough. This is the first membrane that can separate lithium from magnesium, calcium and other impurities with which it is normally found. We plan to deploy multiple pilot plants into the field in 2021.

Go-To Market

Smart Go-To-Market Strategy. We are looking to generate profit as quickly as possible. Lithium production is a massive, capital intensive industry with tens of billions in sunk costs. EnergyX doesn’t try to replace that at one go. Instead, our lithium separation technology can be integrated into existing lithium production locations, increasing the amount of lithium recovered, while lowering costs. Eventually it may replace lithium extraction as we know it today. In the short term, it’s a low-cost add-on, that increases lithium production at low cost.

Customer Traction

Early Customer Engagement. EnergyX has agreements to share actual lithium brines (the extremely salty water from which lithium is extracted) with some of the largest lithium companies in the world, including announcement Orocobre and several of the other top 10. We have processed that water and produced that lithium at lab scale. These customers represent the very largest lithium companies on earth, and are also working with major oil & gas companies looking to diversify and extract lithium.

Great Partnerships

Partnerships With Global Companies. EnergyX is deeply engaged with partner companies including Membrane Technology Research and a multi-billion-dollar water processing giant ($18B revenue / year), who can actually manufacture these membranes and the systems they go into at scale. These partners have agreed to, and are actively working on the manufacturing processes that EnergyX has designed.

Intellectual Property

Large Patent Portfolio. EnergyX is an energy technology company, so we take our patents and intellectual property very seriously. We already control and continue to grow a robust portfolio of intellectual property and patents / patent applications that currently sits at 23. We have a strategy to increase our patents around lithium separation methods and battery components into the hundreds in the near future.

Growth Plans

We project significant growth along the rising demand of lithium both through existing producers and the development of new lithium miners. Current and future initiatives include:

- We plan to deploy 2-4 pilot plants into the field with partner customers in 2021.

- Commercialization for the burgeoning lithium market by the end of 2022 or early 2023.

- The ongoing improvement and optimization of our LiTAS™ technology to continue eliminating steps from the conventional production process, as well as decreasing operating expenses.

- The introduction of future planned generations of LiTAS™ technology.

- Exploration of SoLiS™ solid state battery technology program.

- An innovative, stand-alone laboratory to undertake research and development into alternative, renewable energy technologies.

To read EnergyX’s full 10-Year Master Plan go here.

Why Invest

If you believe that the world is transitioning to a sustainable energy future, then join us and be part of the movement.

- Tesla is now more valuable than nearly every single auto manufacturer combined. The electric vehicles age is upon us.

- With millions of electric vehicles, comes billions of batteries, and tens of billions of pounds of lithium and other battery raw materials.

Invest to help us further develop our promising technology. The time is now.

FAQs

General FAQs

Energy Exploration Technologies, also known as EnergyX, is a renewable energy technology company focused on two things.

- More efficient access to sustainable lithium production using direct extraction technology.

- Technology enabling solid state battery electrolytes.

The company is changing the way humanity is powering our world and storing clean energy with breakthrough lithium-ion technology and energy storage solutions.

EnergyX was founded in late 2017, and incorporated in 2018 in San Juan, Puerto Rico.

Humanity is going through a critical tipping point right now with global temperatures at an all time high. Most of this is caused by human CO2 emissions. Humans are emitting over 30 billion tons of CO2 into the atmosphere every year. This is compared to 650 million of the natural earth’s cycle of volcanic mechanisms. If we don’t correct this trend immediately, a terrible outcome lies in our future. We need to transition the world’s energy supply to sustainable forms with vast energy storage systems to avoid CO2 emissions and global warming.

We currently have between 10-15 team members and our group is quickly growing. Check out our Careers Opportunities Section if you are interested in working at EnergyX.

Our main laboratory is in the Silicon Valley Area right by San Francisco and Palo Alto, California. We also have ongoing research and development at the M-WET laboratory at the University of Texas at Austin. Our corporate headquarters is in San Juan, Puerto Rico, and we have back offices in Ft. Lauderdale, Florida. Get in Touch!

EnergyX has both research partners and commercialization partners. We secured the exclusive worldwide rights to a portfolio of technology from a tri-institutional collaborative effort between Monash University, CSIRO (the Australian National Laboratory), and The University of Texas at Austin (UT). The work was also backed by a $10.75m U.S. Department of Energy grant.

Aside from the $10.75m DOE grant supporting the University of Texas research, EnergyX has raised in the millions of dollars, and is a privately funded company with substantial financial backing.

EnergyX is not a lithium producer. We develop and distribute technology to help lithium producers more efficiently and cost effectively produce their battery grade lithium. Read below for more on our proprietary technology.

Direct Lithium Extraction

We invented a novel form of membrane to separate lithium ions out of the complex salt mixture in salt brines. Think of it like a soup with carrots, potatoes, broccoli and peas. You put the whole soup through a size sieve, where only the water and the peas fit through. In simple terms, this is how we separate the lithium from the rest of the ion such as potassium, magnesium, calcium, sulfate, and others, which are larger than lithium and have a different charge.

We had to create our own novel membrane to complete this process, which is patent protected. No membrane to date could target and separate specific ions in high salinity solutions. Other technology such as Nanofiltration work in low salinities, however LiTAS™ is a combination of a new class of materials called Metal Organic Frameworks (MOF) combined with polymers for stability, allowing robust mechanical features.

The lithium enriched brine sources pass through the LiTAS™ membrane a series of times to separate, extract, and refine the lithium to the appropriate level. This takes a matter of hours to days depending on a few factors. In some scenarios LiTAS™ may be complementary to conventional pond methods, however in comparison those take an average of 18 months to yield final product.

We use a cost effective electrodialysis mode of operation that minimizes electricity usage versus new competing technologies. Versus conventional technology that uses solar driven evaporation ponds, LiTAS™ energy usage will be marginally higher but a significantly smaller facility footprint makes it a much more environmentally friendly solution overall.

The first option is to use local sources of energy, hopefully provided by sustainable means such as solar or wind energy.

Lithium & Safety

The main sources of sustainable energy generation are solar, wind, and hydro power. Once the energy has been created from these sources, it is typically distributed through the grid and used immediately. Batteries come into play if we want to store this energy and use it at a later time.

Lithium, in its pure form, is the lightest metal in the world, hence why its energy density is so high. It is atomic #3 on the periodic table, and is the element that is used in the majority of the world’s rechargeable batteries.

Lithium is a natural resource that comes from the earth. Humans mine lithium from a few different sources. There are two main places are 1) From typical hard rock mining from a pit excavated in the ground, 2) From salt brines, which are very salty waters (>30%) which have high concentrations of lithium (think a salt lake). Most of the high lithium concentration salt brines are in South America in a place known as the lithium triangle.

Lithium is the main, non-replaceable, material in rechargeable batteries. Today the demand for batteries is growing exponentially in order to build electric vehicles, and to store renewable energy generated from solar and wind sources.

Timing & Costs

EnergyX is in the technology development and scaling stage right now. We must go through a series of in-field pilot plants before commercial facilities can be deployed. Our best estimate is that EnergyX LiTAS™ technology will be in the market within 3-4 years’ time. Solid-state battery technology could be implemented in the mid-2020's.

Press

EnergyX has been covered in the press over 100 times and featured by Forbes, BBC, Bloomberg, Chemical Engineer, Financial Times, and many more.

Use of Proceeds

If the offering's maximum amount of $3,934,064 is raised:

| Use | Value | % of Proceeds |

|---|---|---|

| Pilot Plants | $1,970,000 | 50.1% |

| Intellectual Property | $410,000 | 10.4% |

| Battery Design | $450,000 | 11.4% |

| Payroll | $710,000 | 18.0% |

| Legal | $90,000 | 2.3% |

| Accounting/Admin | $36,000 | 0.9% |

| Marketing | $75,295 | 1.9% |

| Intermediary fees | $192,769 | 4.9% |

Terms

This number includes all funds raised by the Company in this round on Netcapital. This is an offering of Common Stock, under registration exemption 4(a)(6), in Energy Exploration Technologies, Inc. dba EnergyX. This offering must reach its target of at least $10,000 by its offering deadline of August 20, 2021 at 11:59pm ET. If this offering does not reach its target by the offering deadline, then your money will be refunded.

If the offering is successful at raising the maximum amount, then the company’s implied valuation after the offering (sometimes called its post-money valuation) will be:

Financials

EnergyX’s official name is Energy Exploration Technologies, Inc., so that’s the name that appears in the statements below.

These financial statements have been audited by an independent Certified Public Accountant.

SEC Filings

The Offering Statement is a formal description of the company and this transaction. It’s filed with the SEC to comply with the requirements of exemption 4(a)(6) of the Securities Act of 1933.

We’re also required to share links to each of the SEC filings related to this offering with investors.

Understand the Risks

Be sure to understand the risks of this type of investment. No regulatory body (not the SEC, not any state regulator) has passed upon the merits of or given its approval to the securities, the terms of the offering, or the accuracy or completeness of any offering materials or information posted herein. That’s typical for Regulation CF offerings like this one.

Neither Netcapital nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or to future financial performance, and involve known and unknown risks, uncertainties, and other factors, that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will, materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

More Info

Updates

- Jan 17, 2024Q4 2023 Quarterly Investor Email has been sent...

- Jul 21, 2023IN CASE YOU MISSED IT: The latest quarterly...

- Jun 13, 2023IN CASE YOU MISSED IT: The latest quarterly...

- Aug 21, 2021Primary offering finalized, selling shares

- Aug 19, 2021HOT OFF THE PRESS: EnergyX was Featured today...

- Aug 16, 2021Also joining the EnergyX team is Angelo Kirchon...

- Aug 16, 2021EnergyX recently added two key hires to its...

- Aug 9, 2021The international journal Nature Materials...

- Jul 26, 2021EnergyX is relocating to Austin, Texas. The...

- Jun 27, 2021Had a great article come out about the EnergyX...

- May 14, 2021In case you missed my Q&A yesterday.

- May 12, 2021Hi Guys - I’m doing an live AMA (ask me...

- May 5, 2021Earlier this week we announced our latest...

- Apr 21, 2021Today we got thrown into the mix with one of...

- Mar 4, 2021Primary offering finalized, selling shares

- Jan 18, 2021Hi Everyone - We are very close to selling out...

- Dec 28, 2020Check out my latest interview with Native...

- Dec 27, 2020Hey this is Teague from EnergyX. Over the...

Ask a Question

Proofread your comment before submitting: once it's posted, you can’t edit or delete it. Investors are advised to review our Discussion Board Policy before submitting a comment. For the fastest help with the web site, email help@netcapital.com instead of commenting.